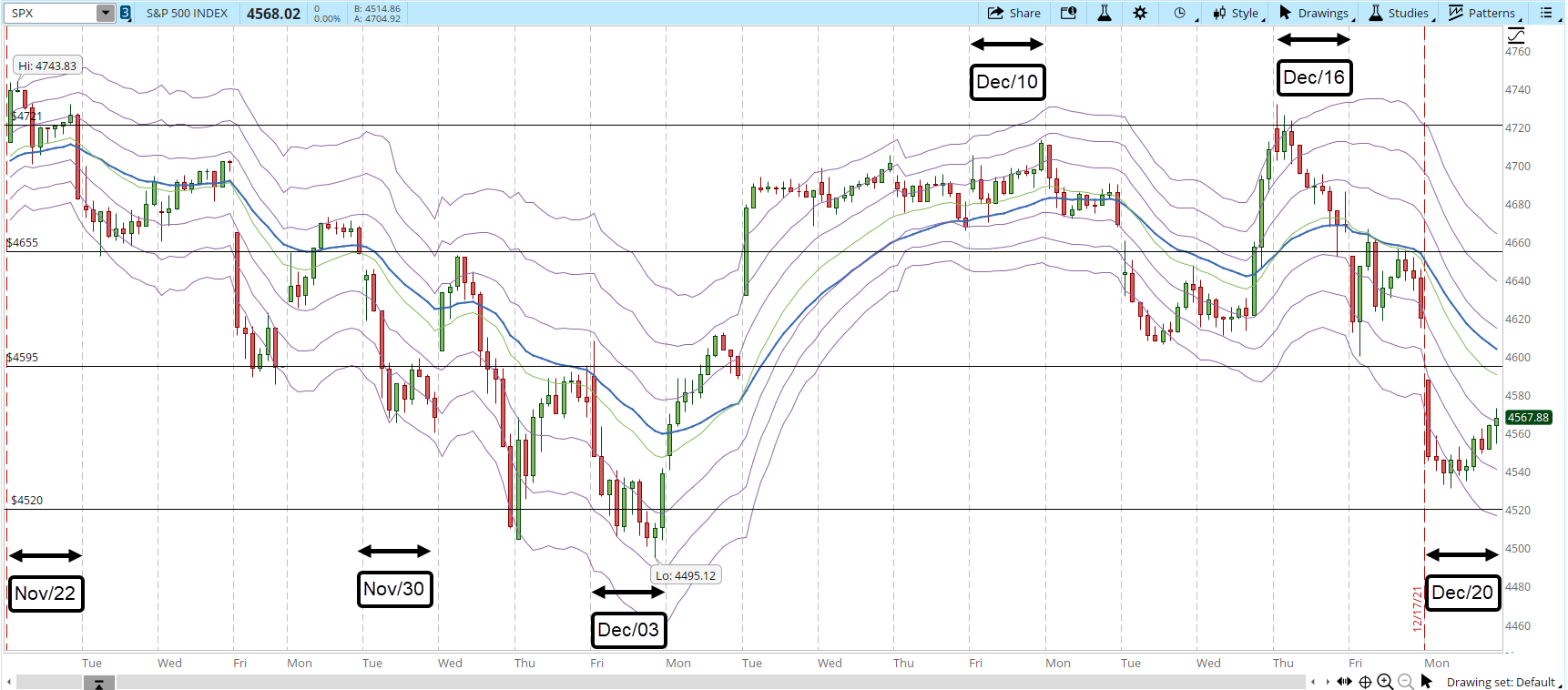

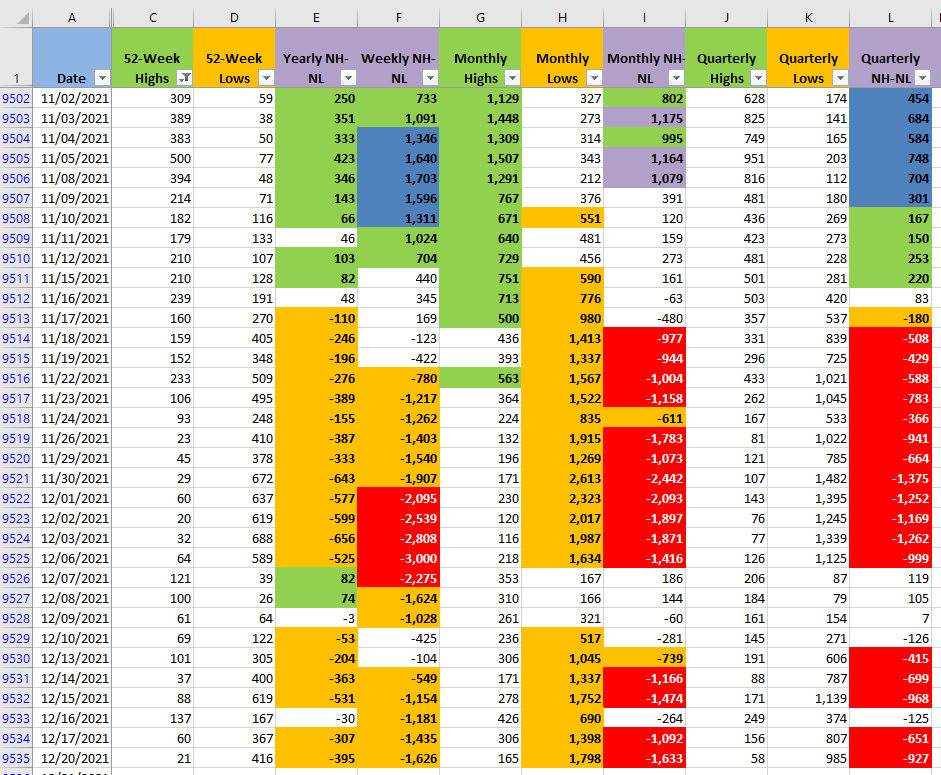

The few relief rallies that attempt to regain control of the weekly uptrend haven't been strong enough to take over the control that Bears have right now. The balance of Monthly New Highs vs Lows is again so big (screenshot below, columns G, H - click on the image to zoom in) that I see a couple of scenarios happening for the session of Dec/21/2021:

- Scenario #1: Bears keep control of the Market, if they are strong enough maybe they break the 4,520 short term support. After that, the next support is the weekly 4,426 support where I would monitor if the weekly uptrend would still be intact. This scenario would be confirmed if the balance between Monthly New Highs vs Lows would stay as it is now, very few Highs and a huge number of Lows.

- Scenario #2: The S&P 500 stays oscillating between 4,595 and 4,520, testing those resistance/support lines. The gap between Monthly New Highs vs Lows gets reduced or at least the New Lows stop increasing.

- Scenario #3: A relief rally that could open the door to something stronger next week (remember this is an abbreviated trading week). The number of Monthly New Lows is drastically reduced as it happened in Dec/07, the S&P manages to close above 4,595 and there is some hope that the weekly uptrend will stay intact and eventually reach a new historical high.

In all of these scenarios for my particular way of trading which happens on the weekly charts, I'll stay on the sidelines. Even in the bullish scenario there are just two trading days left this week, unless the rally is incredibly powerful I don't see how the Bulls can show so much power with the amount of New Lows that just keep increasing.

In terms of the 39-min chart is just a confirmation of the NH vs NL numbers, a support was broken and a new support will let us know if it will be strong enough to hold or the selling pressure will continue, which is in my opinion the most likely scenario.