At some point along our trading path it's very likely that we all have experienced the pain and suffering of a disastrous loss in the Market. Unfortunately when we start trading, if we don't have a mentor that teaches us a profitable way to trade and keeps an eye on us so that we don't deviate from the plan, then eventually greed and fear take over the control of our decisions. Even if it's just for a few minutes that we lose control of our account, that is more than enough time to cause a lot of damage.

Some people can get a tattoo in order to remember something meaningful in their lives. For a trader a disastrous loss is like a tattoo, there might be many trades in our life in the Markets, they will be recorded in our trading journal so that we don't forget about them and just a few trades will stick forever in our minds.

The Asymmetrical Nature of Gains vs Losses

Assuming a hypothetical position of $10,000 USD if it has a gain of 10% then the math is pretty easy, you end with $11,000 USD (taxes and dividends are ignored in order to keep the scenario as simple as possible).

What happens if the same $10,000 USD position instead of a gain it has a loss of 10%, now it's worth $9,000. In order to get even, a gain of 10% won't be enough. Since the value of the position is now smaller a gain of 10% results in $9,900 which in this scenario a loss of $100 is not that bad.

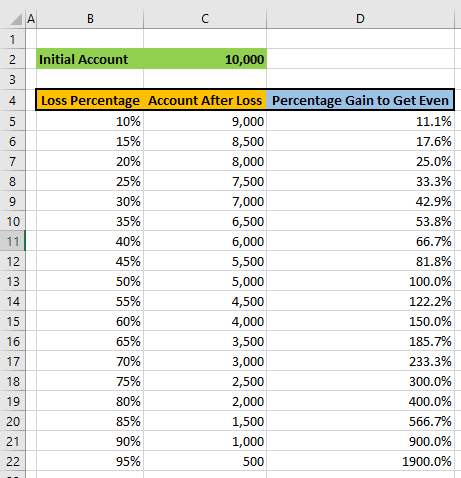

If the loss is more than 10% then things get more complicated quickly. Check the table below in order to understand why big losses can take months or years to recover if they are ever recovered. The table is easy to read, taking cell B11 as a sample, if you lost 40% in a position initially valued at $10,000 you end with $6,000 and in order to get back to $10,000 you need a gain of 66.7%.

In order to realize how complicated these positions are, calculate the percentage that it requires just to get even. After that, do the analysis of how likely is that the stock will rally that percentage and how long you estimate it would take to get there. Anything can happen in the Markets but the purpose of this article is to create awareness that sometimes we hope that some miracle happens and we are able to recover at least part of our losses. Unfortunately if someone is trading based on hope then that account might suffer even more damage.

The Power of Compounding

Usually when the Market or a stock has a significant loss, the price will move a lot faster than when the stock goes up. The reason for that is that losses are based on fear and gains on greed. Greed is a more sustainable emotion than fear, you can stay greedy a longer period of time, but fear is an emotion that is fast and prompts us to act quickly even if it's not in the right way. So the path to get back to even could be a lot slower than the way down, the first step is that the fear has to stop before greed takes over and when that happens now you have a smaller capital that needs to gain a bigger percentage than the one that was lost.

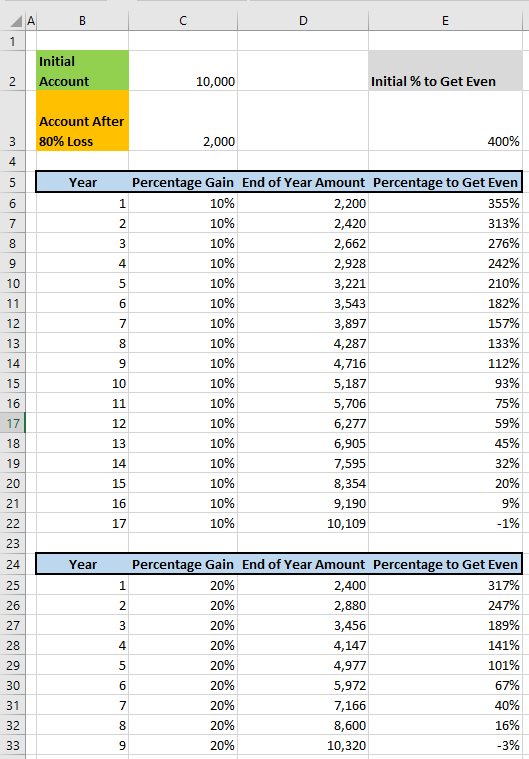

If we had only one stock in our portfolio and that stock suffered a loss of 80% going down from $10,000 to $2,000, then the movement back to $10,000 is very unlikely to happen in a single session. If for whatever reason you decided to keep the stock until it recovers, which is usually a bad idea, but let's assume for a second that the situation improves and the stock stops falling and eventually goes up. The effect of compounding could help along the way.

After the disastrous 80% loss in the position discussed so far assume that it will start recovering at some point at a rate of 10% per year. In that case, it would take 17 years to recover from the loss. If rather than 10% we assume a steady 20% gain per year it would take 9 years. Obviously these scenarios rarely if ever happen, once you had a huge loss you need to do your own analysis and see how likely is that you can recover part of the losses or getting back to even.

One of the reasons we keep those positions open is that we have some hope that eventually things will improve, hope that the stock will stop falling and it will start recovering. In addition, we might hope that the stock can recover as fast as it went down, and if we close the position we lose that chance which implies assuming the big losses. Closing the position doubles the pain, first the pain of the huge loss and then the pain that potentially the stock could recover, which in a few cases it will happen, it could take a long time but for a few lucky people it will recover.

Whatever you decide remember it's always the trader's responsibility whatever happens to his/her account. It's not an easy decision to make but if you don't have a strategy that accounts for these situations then the pain and suffering are destined to be repeated.

Learning from Pain

If you already lived this painful situation, at least learn from the terrible experience. Reviewing our past trades is a great way to find our mistakes. Some common errors:

- There wasn't a stop that would limit the damage.

- There wasn't a plan in place that would tell when to enter/exit, the plan would also outline under which conditions the idea that prompted you to enter the trade was no longer valid and it was time to accept the loss and exit the position.

- Trading based on someone else's idea, this is a tricky factor, sometimes a person can trade based on recommendations, if things go wrong is easier to blame someone else since it wasn't your idea in the first place. However, the reality is that as traders we are accountable for whatever happens to our accounts even if the idea came from an external source.

- It was an emotional trade, we sometimes can fall in love with a stock and the potential profits that might never come.

There could be many factors, only the person that traded the position can figure out what exactly happened and how to fix it.

Mental Capital

The final consideration I want to highlight is hard to measure, but huge losses can have a big impact in how we trade. If the position that suffered the disastrous loss is still open, it might be draining your mental resources, meaning that you might be worried and stressed, the next time you see an opportunity those negative emotions might come into play as you fear that you can lose money again.

If the position was already closed and the losses were assumed, at least do the exercise in order to understand what went wrong, that might help to restore the confidence levels if you find a way to fix your mistakes.

Losses are unavoidable but they can be limited with proper risk management so that whenever you find new opportunities that fit your plan there is no uncertainty about how you should act, you know that there is a plan keeping you safe if things don't go as expected.