The Marked rallied today, it looks like it's just a reaction rally. The Market got to a point where it was near an important support and some demand entered the Market.

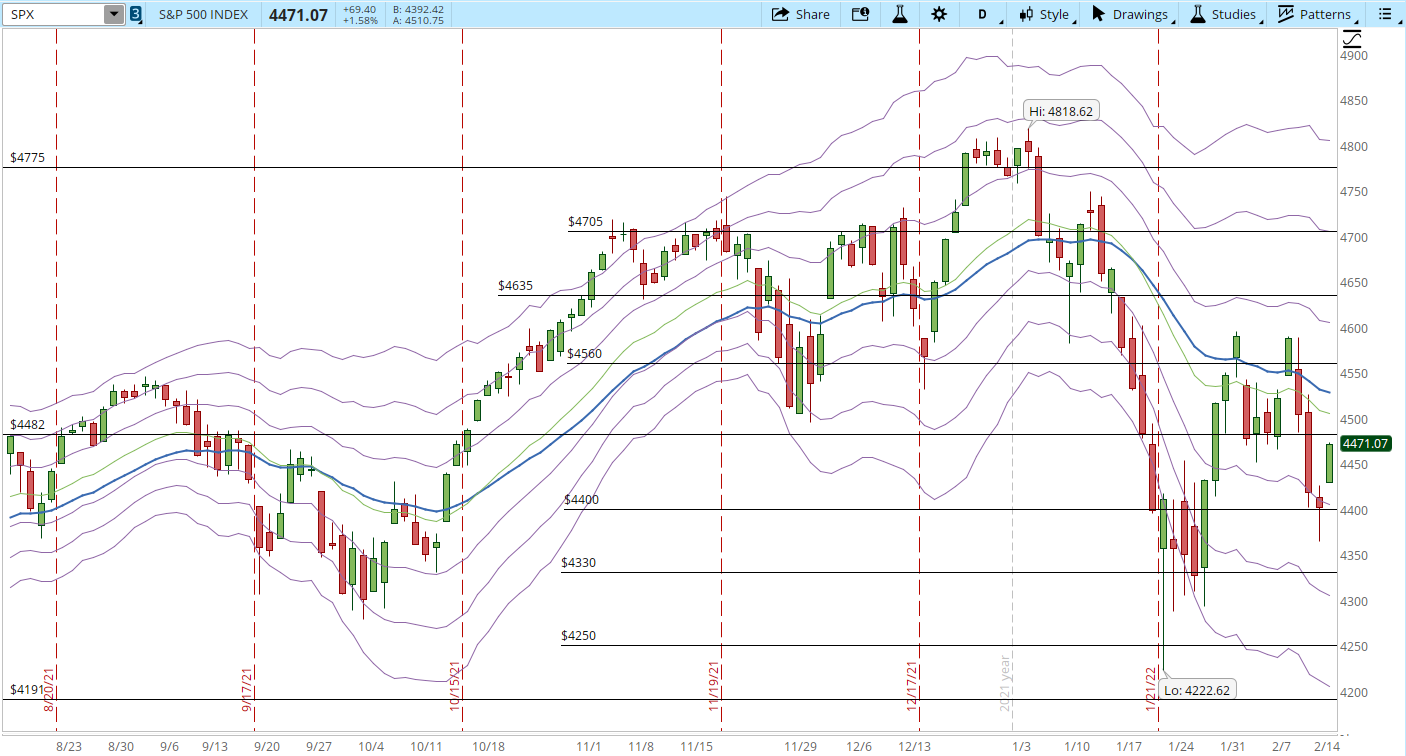

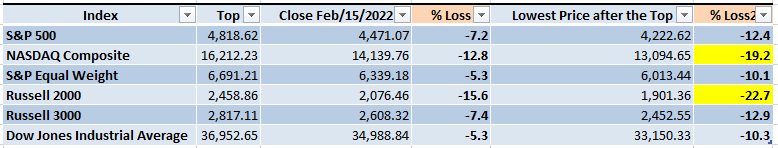

If we review the top price and lowest price for several important indexes, Nasdaq and Russell 2000 were close or at full Bear Market definition. The Correction is still not over, not until there is a significant rally that breaks the trading range where the Market is stuck right now, or the Correction resumes its decline.

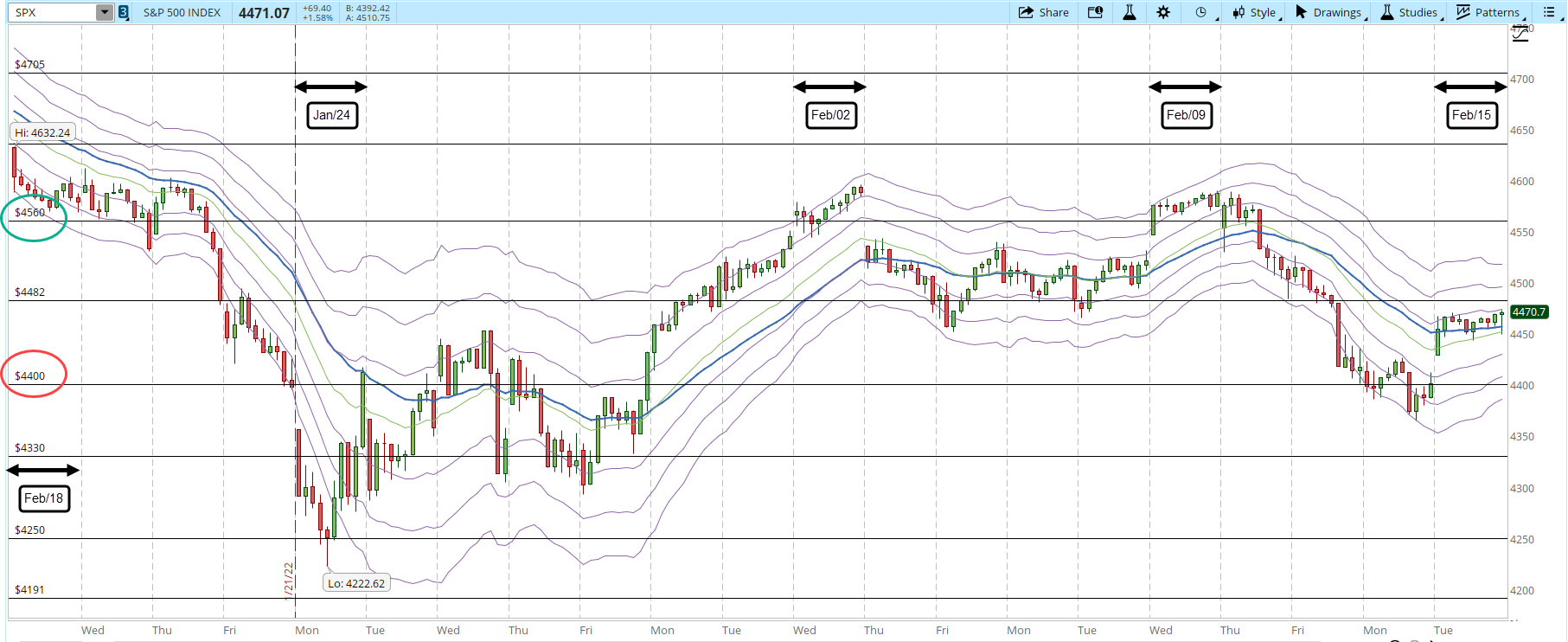

The Market rallied at the beginning of the session and then it couldn't get past the 4,482 level. The scenario will become interesting once the S&P decisively moves below 4,400 or above 4,560 (red and green circles in the screenshot below). At this point is just the price moving inside the trading range testing support and resistance levels.

The daily chart of the S&P also doesn't give much more information yet. The 30-day EMA is still pointing down (blue line in the screenshot below). The rally will become more significant if it can get past 4,560 and it can last more than four days. After Nov/05/2021 no rally has lasted more than four days.