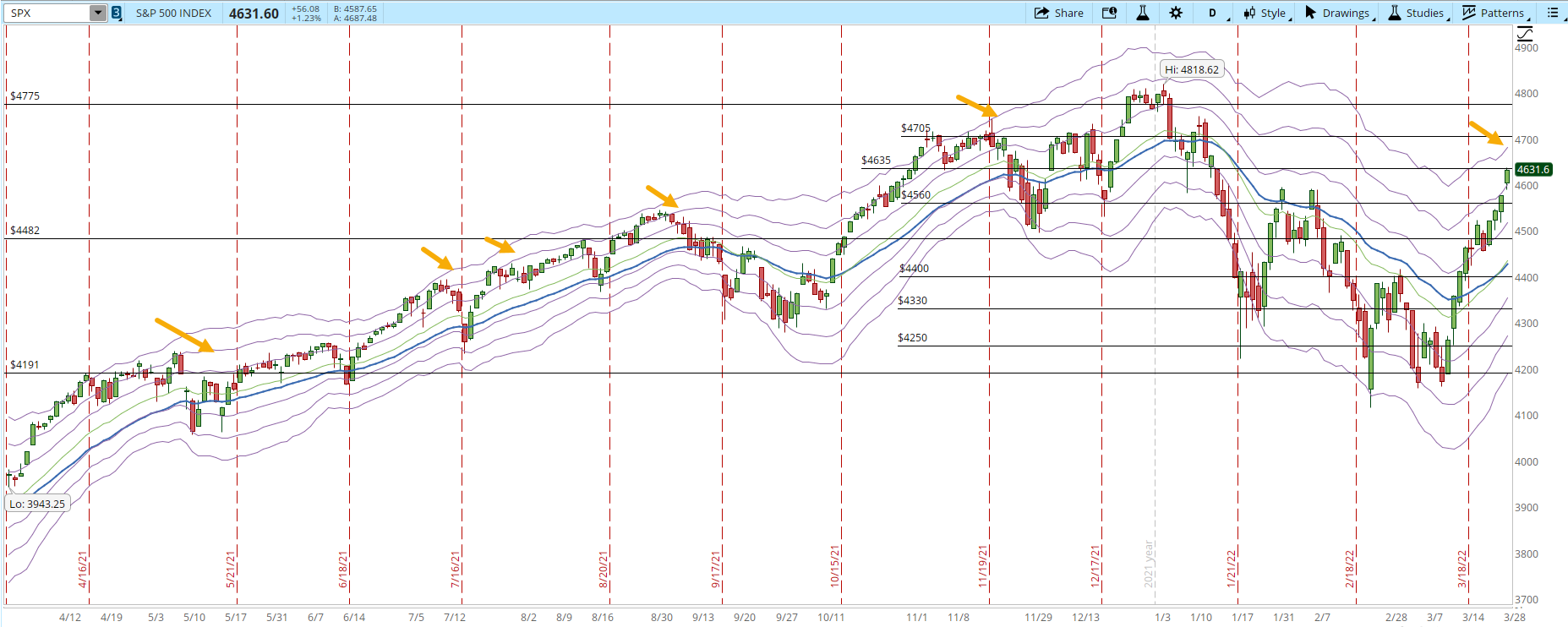

The Market had a powerful move today, there's some hope that the Russia-Ukraine talks might lead to a de-escalation of the war. The rally is getting to overbought conditions, while the price is oscillating between -1 and +1 Keltner Channels the movement is considered normal. Once it gets to the -3 KC, it's considered to be oversold, and the +3 KC means overbought conditions (we are almost there, screenshot below).

If we review the daily chart of the S&P 500 for the past year, the index reached multiple times the +3 KC, and in all of them eventually had a pullback (orange arrows). It's not a guarantee that immediately the index will pullback, but eventually it does.

Why does this behavior keeps repeating? The higher the index goes, the more people that starts to wonder how long will the rally last. Some of the traders will feel that the Market is near the top and will start to take profits, that generates selling pressure in the Markets. If the supply gets absorbed by the current demand, the rally will eventually resume its way up. If the selling pressure takes the index below the -1 KC it's a good moment to question if there is too much supply that it's not just a healthy pullback but something else.

Bear Markets, Corrections and pullbacks they are an essential part of trading. One of their uses is to get a stock you have been tracking at a lower price where you can eventually profit. Another use is to test the Market and a specific stock, if the Market or the stock are really strong, they won't collapse once the selling pressure hits them.

Even the S&P 400 (mid-cap) and S&P 600 (small-cap) had powerful movements today. The S&P 400 daily chart shows how the index got past the weekly resistance of 2,742. If the index manages to close above 2,800 by the end of the week I'll be switching to a more aggressive buying mode.

The S&P 600 is still lagging behind the other indexes, the movement was also powerful but still 30 points away from just reaching the weekly resistance.

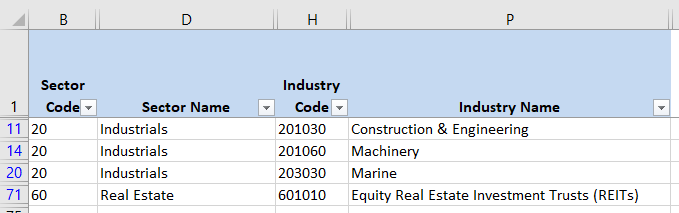

Another positive sign is that the New Highs and New Lows (NH-NL) numbers were showing some weakness yesterday. Today they turned bullish again, that's a good sign since that discrepancy between a strong Market and weak NH-NL numbers was bothering me. Keep a permanent watch on columns G, H and I, those are the Monthly numbers that move faster than any other column in the numbers that I track. That's a way in which we can get alerted of troubles ahead.

It will be key in the next three days to see if the indexes can hold above the levels they just reached. As I have mentioned in this article, a healthy pullback is one that will keep the indexes above the -1 KC. If the Market is still strong it can recover fast from that kind of pullback and then resume it's way up. If the Market keeps going up like crazy eventually there is the chance that it has a big and fast crash like the one that sometimes happens when a chart becomes parabolic.

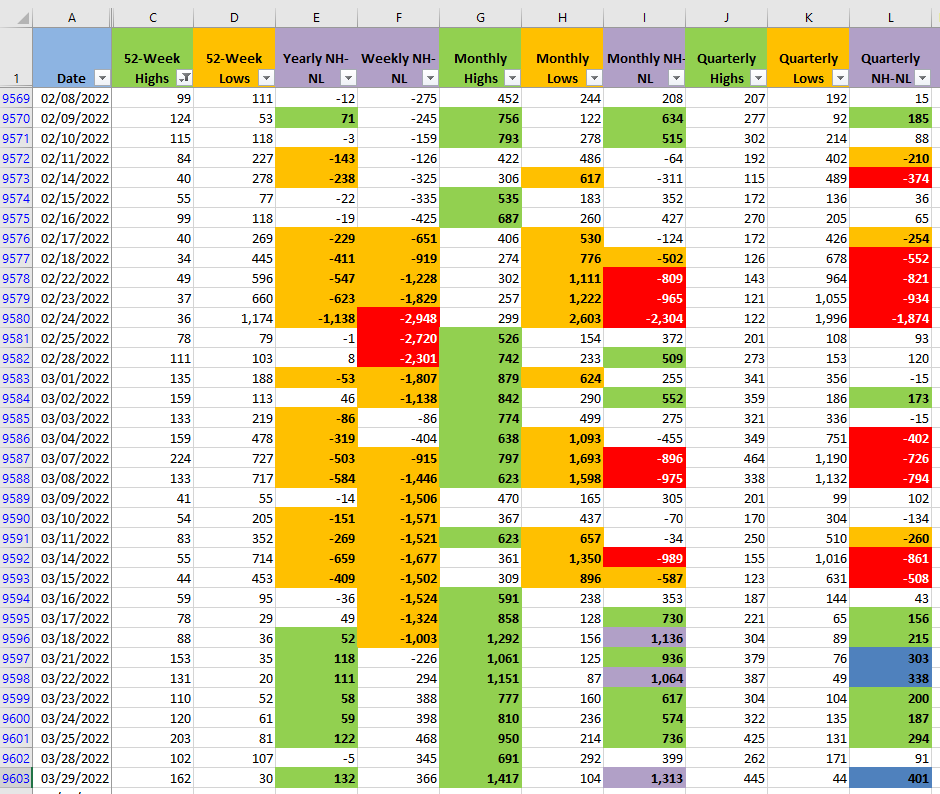

I have a positive balance on the long positions I have open. I got stopped out of IRMD today by a crazy movement, but I saw a good setup that matched my plan in a REIT stock. Below are the Industries where I'm keeping my four long positions open.