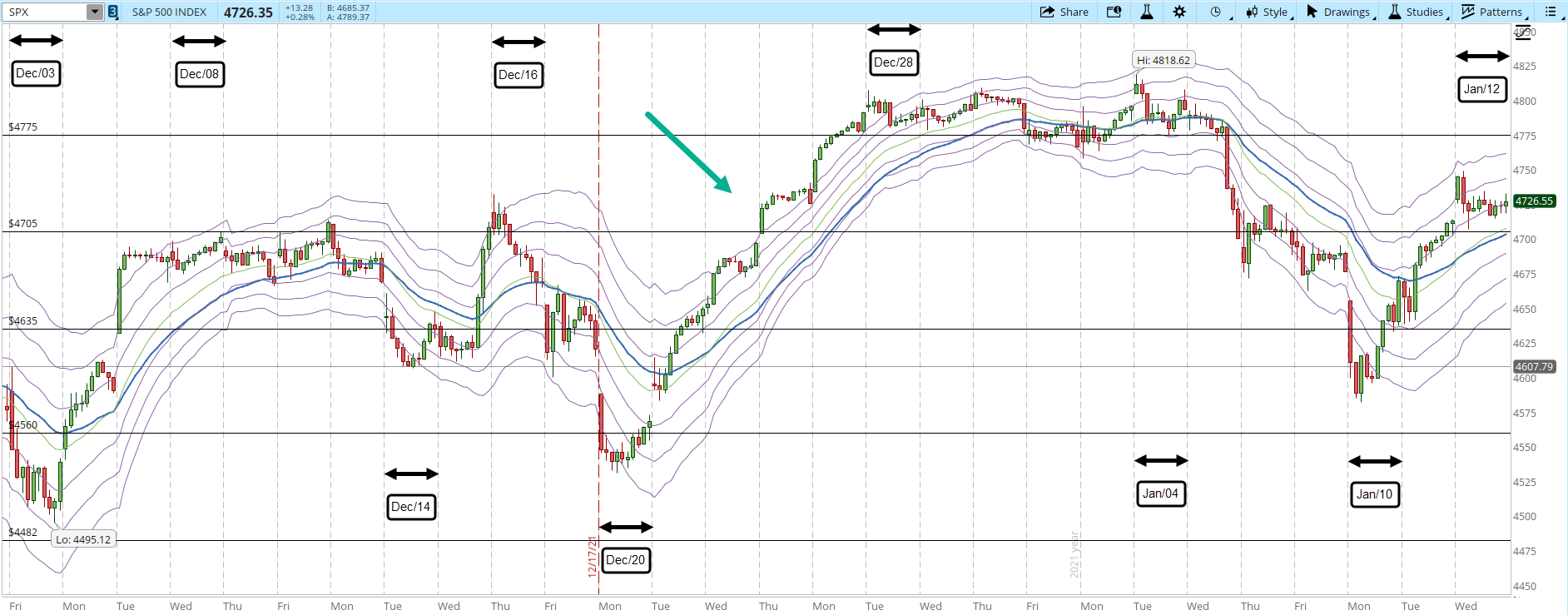

The Market session began with a gap, the attempt to rally just lasted a few minutes, after that, it lost all its power. The S&P still managed to stay above the 4,705 level so there is still a chance that the rest of the week the rally can continue, however, this is more a signal of weakness than strength. On the 39-min chart below it appears that the rally lasted a couple of days, but on Jan/10 what really happened is that the S&P recovered part of the losses from the beginning of the session, there was a rally but not a single point was gained.

If we review the history of the last 30 days, the S&P has just crossed and stayed above the 4,700 level only once (green arrow), the rest of the times it has tested that level but eventually went down. If there is no real force soon it will end happening the same.

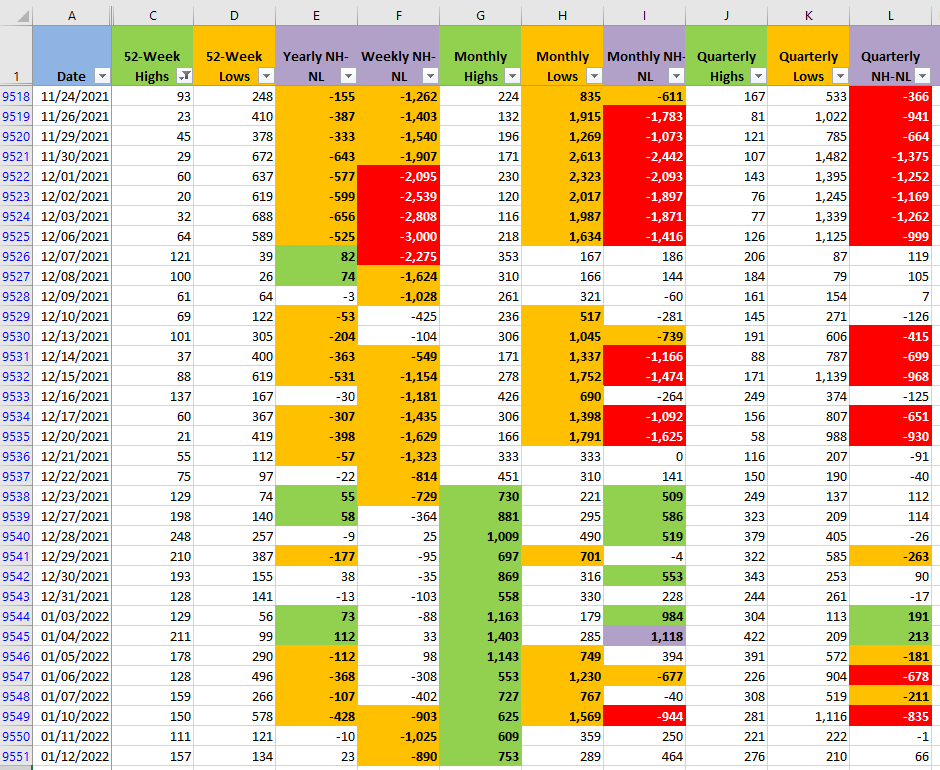

The amount of New Highs and Lows in all the timeframes is something between neutral and a little bit bullish. Once the Bears took control over the Market in mid-November, the Bulls haven't done much except for the rallies on Dec/06 that lasted two days and Dec/20 that lasted four days. The rest have been consolidations and corrections.

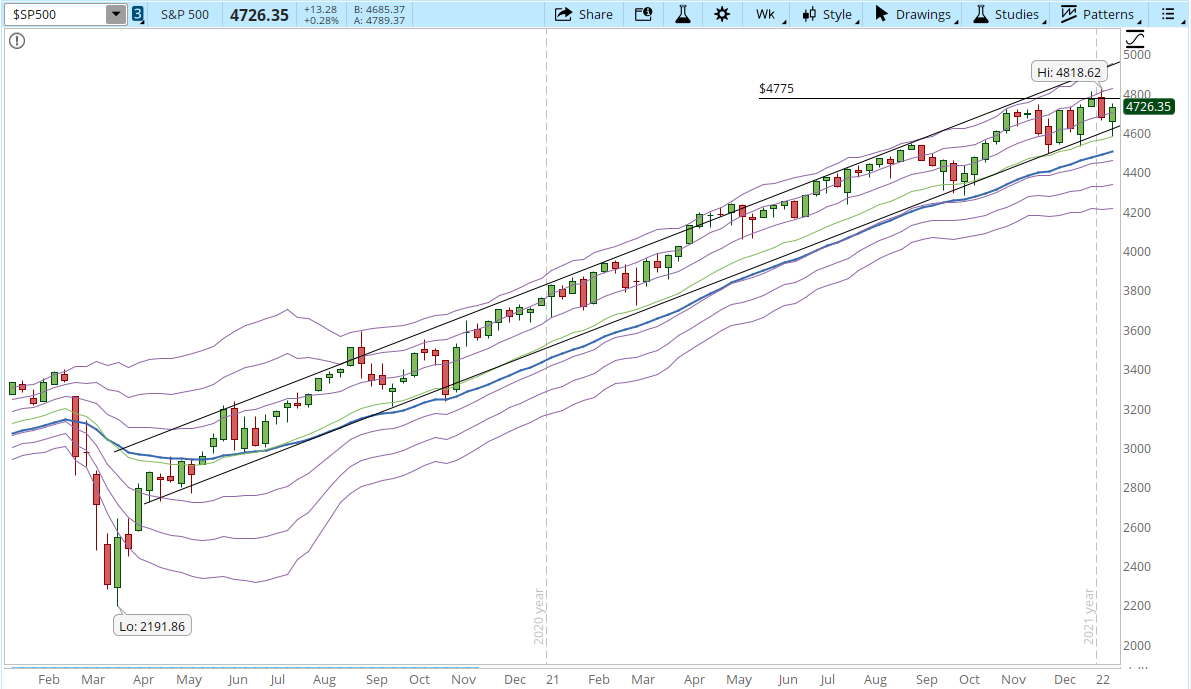

I'm still bullish and I still have 13 long positions open. They all have stops in place, the persistent weakness that started in November makes me wonder if rather than a pause in the weekly uptrend (screenshot below) we are facing a distribution phase right before the Market begins a downtrend. At this point in time no one can tell, we might all have an opinion, but it's a fact that the weekly uptrend is still intact.