If you are a day trader or trading on the short side of this market then last week probably was a lot of fun for you. If, however, you are siding with the bulls as I am (for now), then welcome to the sidelines, the safest place to be while there are real signs of recovery.

Overview

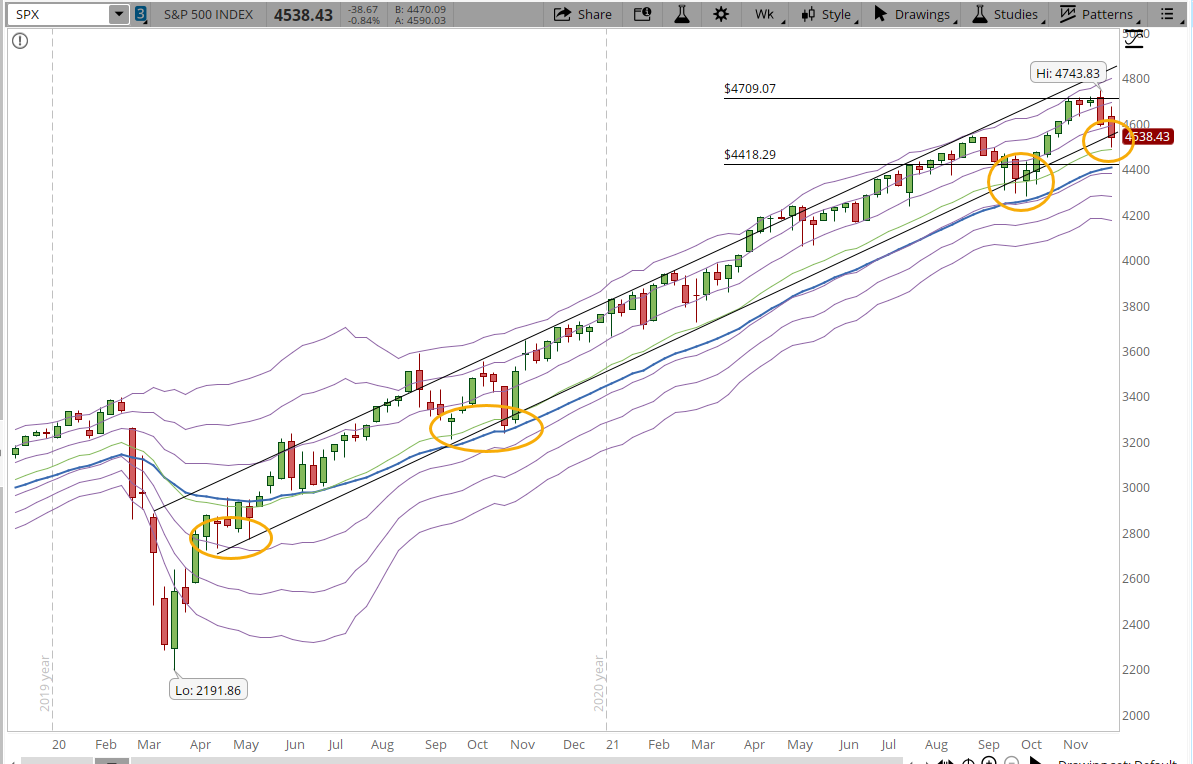

The weekly trend is still intact and is testing the trend line. In the screenshot below, I highlight the points where other tests have occured since this powerful rally started after the March 2020 bear market (you can click on the image to zoom in).

The weekly support and resistance stay the same than last week. The resistance at 4,709 and the support 4,418 (the FAQ section describes how I set all my indicators).

In the next few days, I'll be watching for warning signals, if they happen it will be time to seriously evaluate closing my long positions or tighten my stops at the very least:

- If the S&P manages to close next week below the trend line (currently at 4,500)

- If the price closes the week below the 30-week EMA line (currently at 4,400) that's another signal that the trend could be compromised and even the possibility of the trend to be reaching a top

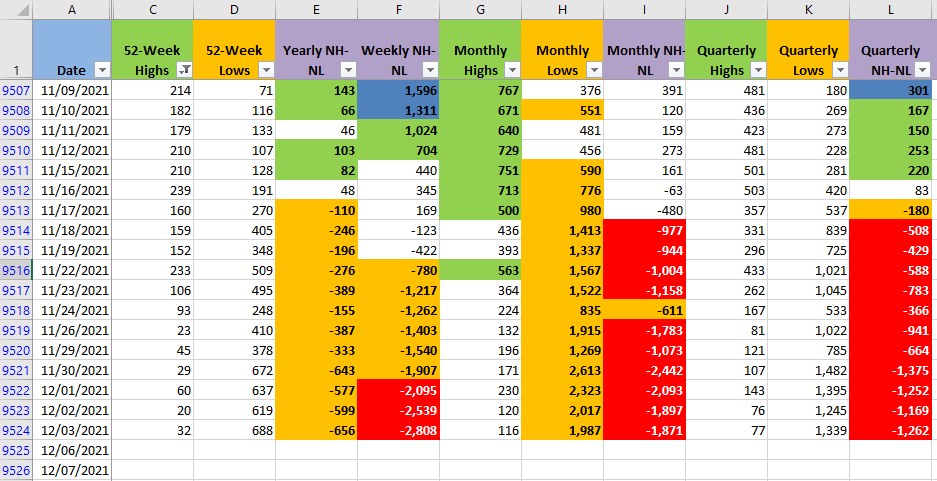

In terms of the Monthly New Highs and Lows there aren't big news, even during the relief rallies that happened during last week, the amount of New Lows stayed pretty elevated (columns G and H, click the image in order to zoom in).

One of the people I admire is Peter Lynch, in one of his books, "One Up on Wall Street" he has a quote that became famous and applies perfectly to the current situation:

"Bottom fishing is a popular investor pastime, but it’s usually the fisherman who gets hooked. Trying to catch the bottom on a falling stock is like trying to catch a falling knife. It’s normally a good idea to wait until the knife hits the ground and sticks, then vibrates for a while and settles down before you try to grab it. Grabbing a rapidly falling stock results in painful surprises, because inevitably you grab it in the wrong place."

Peter Lynch

Trying to anticipate a change in direction can have big rewards if you are right. But if you are wrong the mistake will be very costly. It's time to stick to your plan, trading only when your method triggers a signal and always manage the risk.

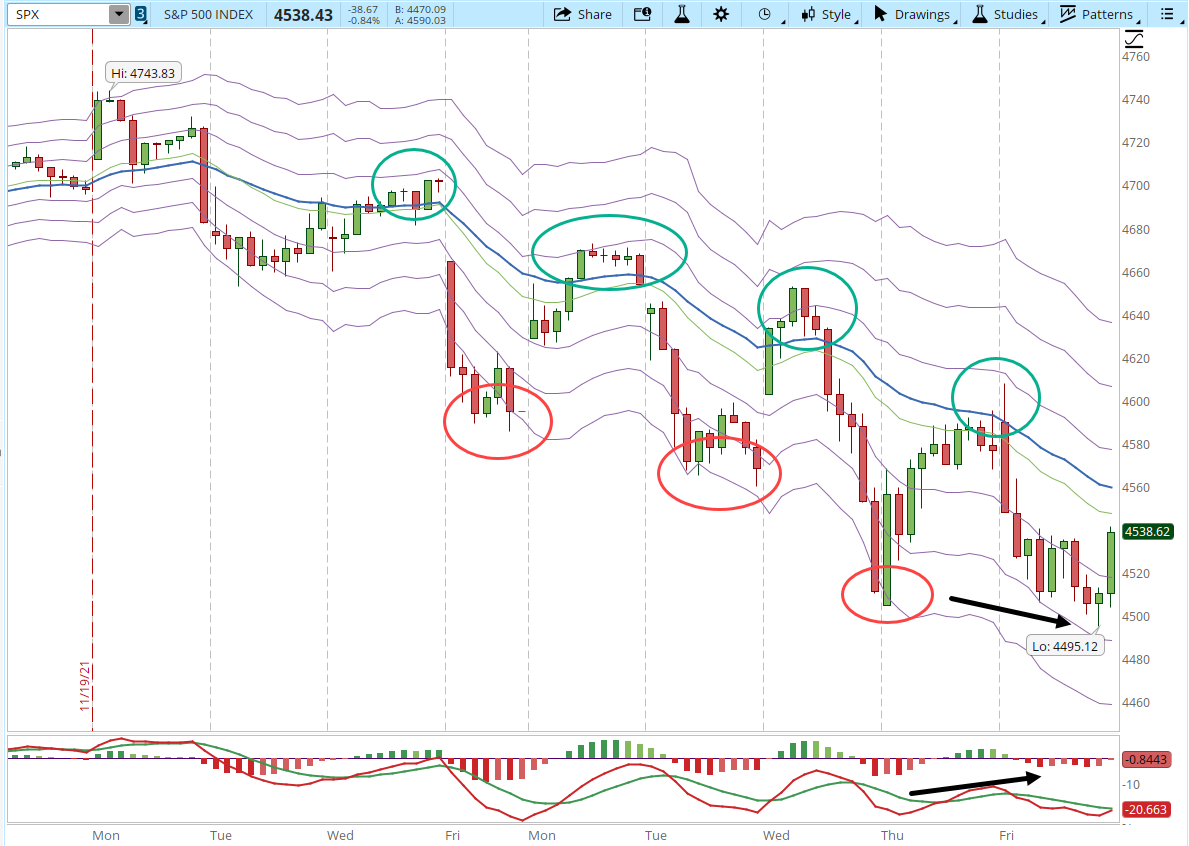

The 39-min chart that I have been mentioning during the mid-week Market updates keeps having a predictive pattern, and several points of interest:

- Every time the price hits the +1 Keltner Channel (green circles) it collapses and drops down to the -3 KC band (red circles)

- In the last occurrence there is a divergence, I learned about them from Dr. Alexander Elder, he has a good book called "The New Trading for a Living" that explains how divergences work. The concept is simple but the execution is hard. The price reaches a new low but the indicators seem to be stronger than before (black arrows). I don't like to trade divergences since they require the mentality of a contrarian trader, I do keep an eye open when they occur since they give me good signals of potential bottoms.

- In the divergence below, the MACD-H doesn't confirm the lower price. The Keltner Channel (KC) also shows a divergence, the previous low went to the -3 KC band, the latest low didn't even reach the -2 KC.

Industries

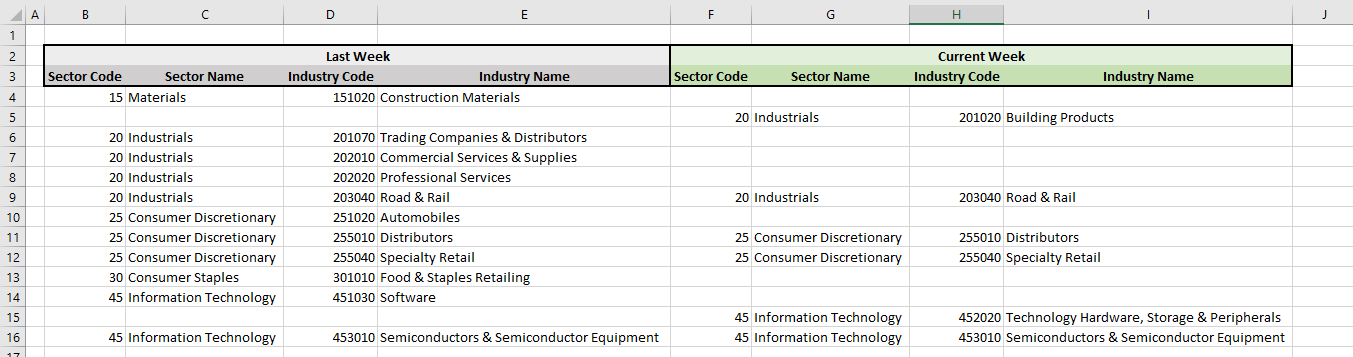

During my last weekend post, I mentioned which are the industries where I still see strength, the list has shortened. Looking into the strong industries, there aren't really many candidates to watch for.

There are only six industries that look strong and the issue with them is that many of the stocks that compose the corresponding index are too expensive to buy.

Scenarios

As mentioned in my post from last weekend, I don't try to forecast the market, I prefer to think about what I'll do in each of the scenarios that I foresee to be the most likely ones to happen:

- Scenario #1: If the New Lows continue to be elevated I'll just watch the correction from the sidelines. When the sell-off started I had seven long positions open, I was stopped out from one of them (Rapid7 - RPD) on Dec/03. If any other stops trigger it will hurt for a while but managing the risk is essential if I want to keep playing this game.

- Scenario #2: The option of a V-shaped recovery isn't discarded yet, but it's very unlikely, the number of New Lows that the bears managed to keep during last week would require a huge amount of power from the bull side to turn things around. Right now there isn't a potential Market catalyst that would cause that behavior. If this V-shaped recovery happens, I'll wait for a few days to see if the rally can hold.

- Scenario #3: If the correction finally finds support, I'll still wait to open new positions unless something really attractive happens. I'm currently tracking 204 symbols, some of them will take months to trigger since I trade the weekly charts, if any of them does trigger it would have to be a great setup to really take the risk.

Summary

Next week could finally show some signals that the S&P is finally finding support. If the Market continues to sink then it will be time to evaluate if the weekly trend is still intact or it's time for a strategy change.

I'll keep monitoring the 39-min chart, a rally in the early part of the week would be expected, it might be even a powerful rally, whether it will hold or not is a different story.