Today Jerome Powell's remarks during the meeting with the Senate Banking Committee stopped the Market fall that started a few days back. The idea is that the Fed will do whatever is necessary in order to contain the inflation through raising the interest rates. The Market saw with positive eyes that despite those actions the Fed will consider the Market reactions that could derive from the Fed's plans.

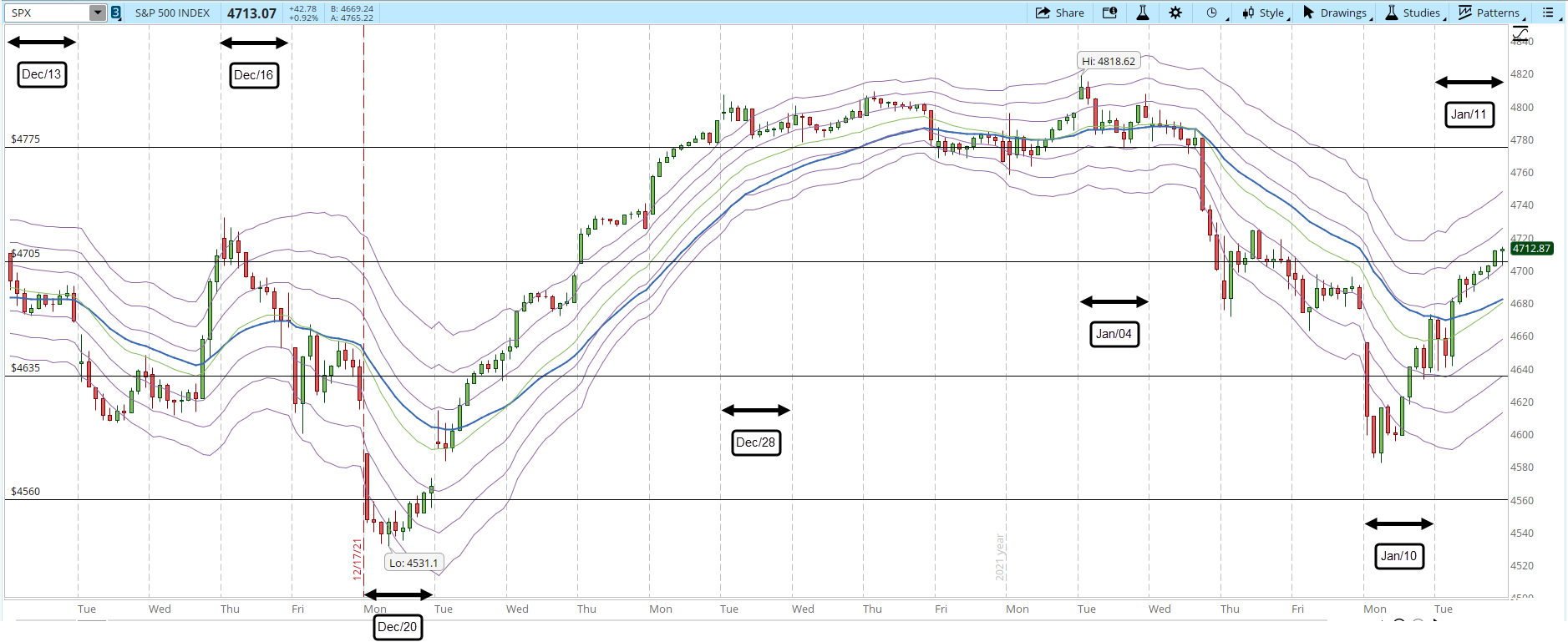

Yesterday the Market went down but it managed to recover most of the losses. Today is the first day that the Market actually rallies. In the 39-min chart in the screenshot below there was some volatility at the beginning of the session but after that the S&P never looked back until it got past the short-term resistance at 4,705.

One day of strength doesn't change the fact that the S&P 500 has been unable to get past and close above 4,800. However, step-by-step it can get there, for now it needs to hold above 4,700 and show some strength to try to break the 4,775 resistance.

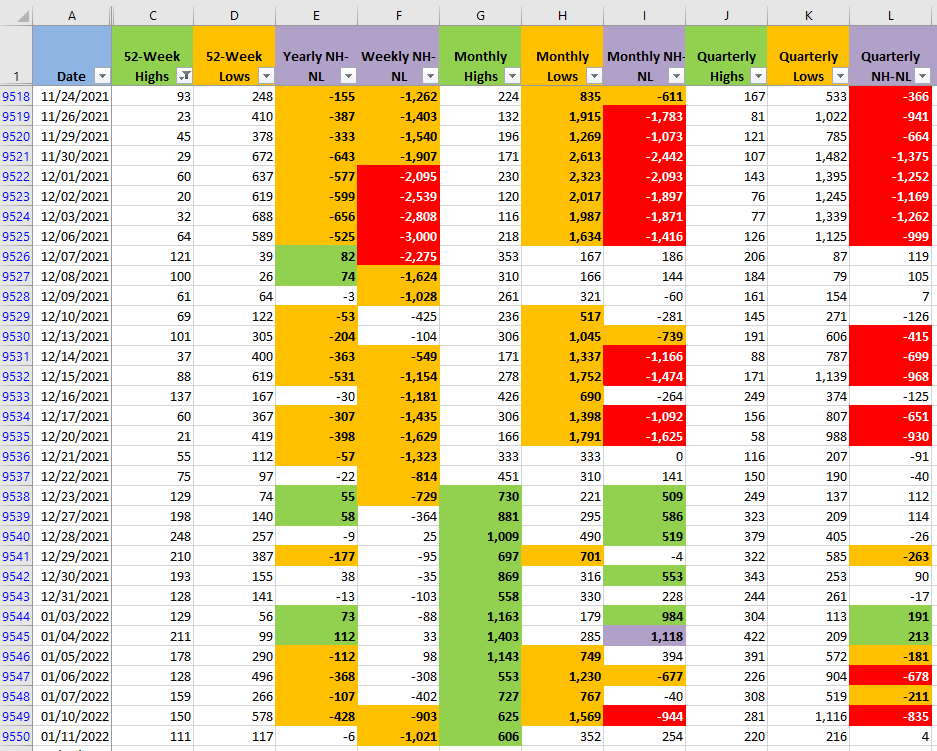

The New Highs and Lows made a drastic change, the Monthly timeframe dramatically switched to a position that would allow the rally to continue (columns G an H).

I might be early to the party but I decided to open four new positions, all of them longs. I traded a 1-HL pattern for three tickers:

- SPY

- Element Solutions (ESI)

- Ashland Global Holdings (ASH)

Today was a busy and strange day that affected my emotional state, which can affect my trading. I should have traded only ESI or ASH, not both since they both belong to the Chemicals Industry.

I had mentioned in previous posts that I was becoming very bullish in the Energy Sector. Today I decided to open a position in Marathon Oil (MRO). The fragility of the Market is a big concern for me, but I trade what I get from the Market, ideal textbook situations are rare. If things don't go as planned I'll just accept the hit to my account and move on to the next opportunity.