After months of inflation and hawkish comments from the Fed, it seems that the Market hasn't finished discounting the same old news. Today all the important indexes plunged more than 2.5%. The First Higher Low pattern that had formed in the daily S&P 500 and S&P 400 (mid-cap) has completely been broken. The Market is not that far from testing again the February lows at around 4,100.

Market Overview

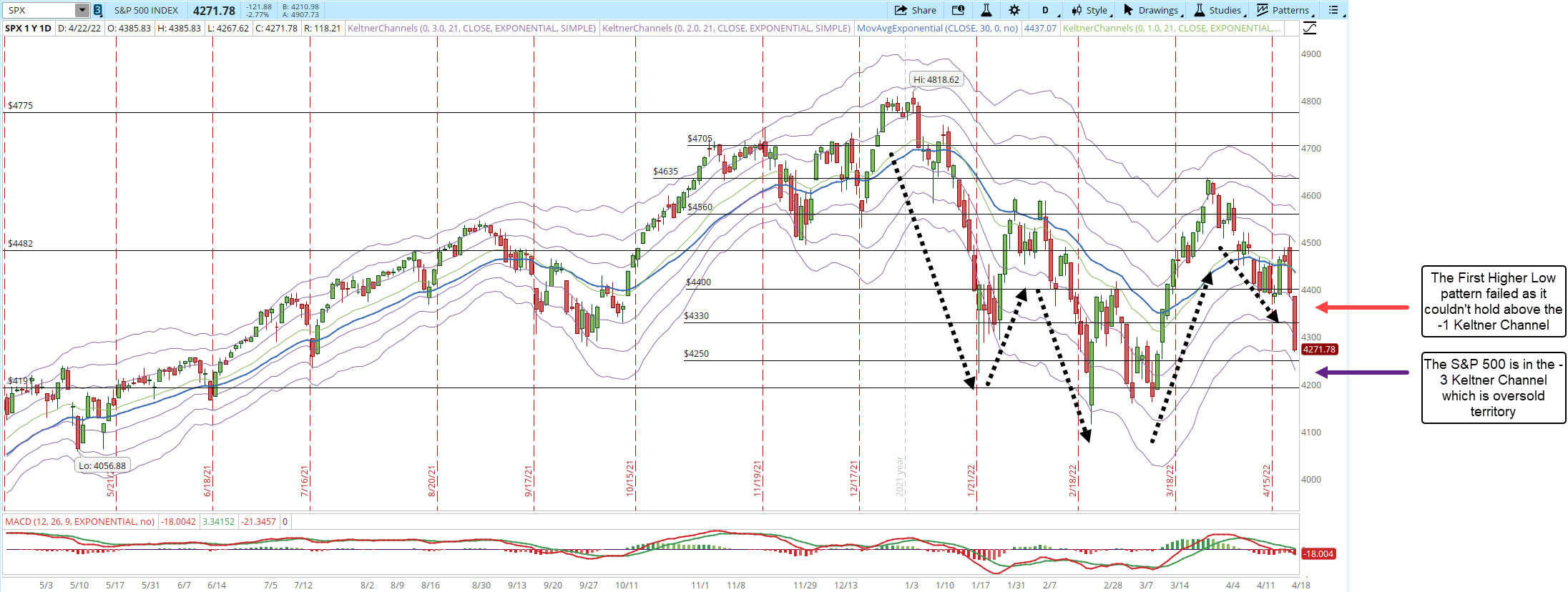

Officially, the First Higher Low pattern that formed during the week and triggered a buy signal is completely broken in both the daily charts of the S&P 500 and S&P 400. If we review first the S&P 500 chart, now the price level is in the -3 Keltner Channel (KC), that's oversold territory. The next short-term support to watch is 4,250 and after that, the weekly support at 4,191. They have both been strong supports in the past, eventually generating at least a reaction rally.

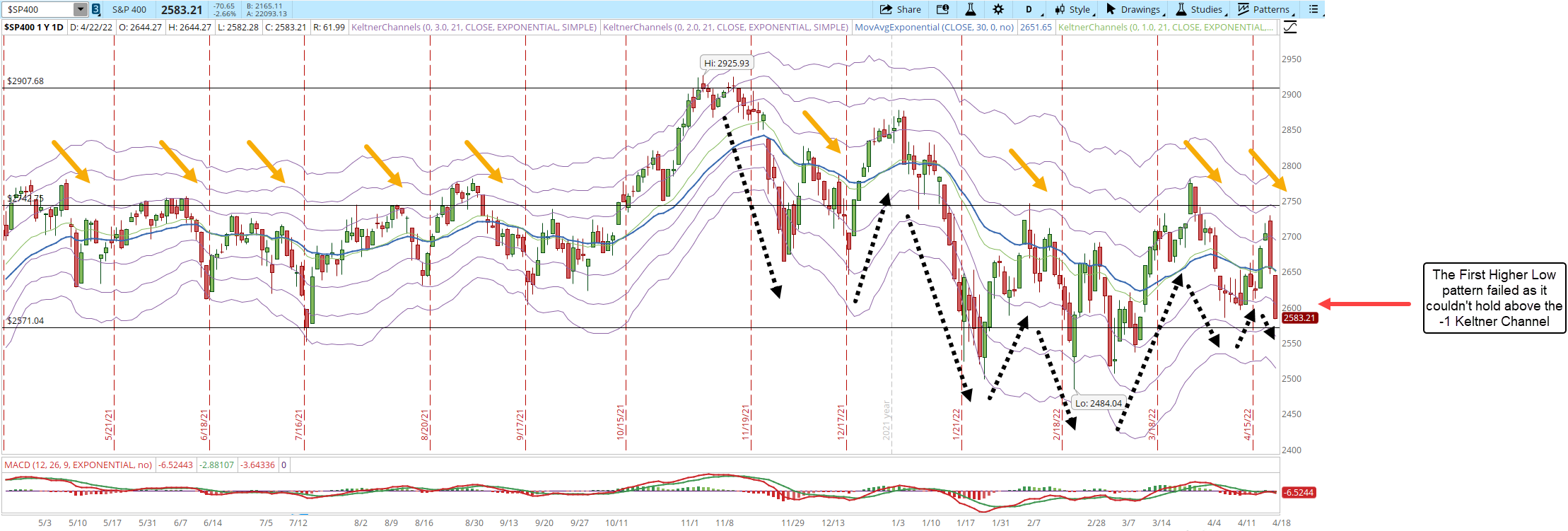

The S&P 400 First Higher Low pattern also was broken completely, the price level isn't yet in oversold conditions but the quality of the pattern is low. The last two bars have been pretty long and closing at their lows. I have drawn the orange arrows several times showing that the S&P 400 has been unable to get past the 2,742 resistance during the past year. The only hope now is that the 2,571 support still holds as it has in the past.

The rest of the indexes are about the same, if they aren't already in the -3 KC, they are pretty close to get there. The amount of supply entering the Market in the last couple of days completely overwhelmed the existing demand. If the selling pressure keeps increasing, we will likely test the February lows.

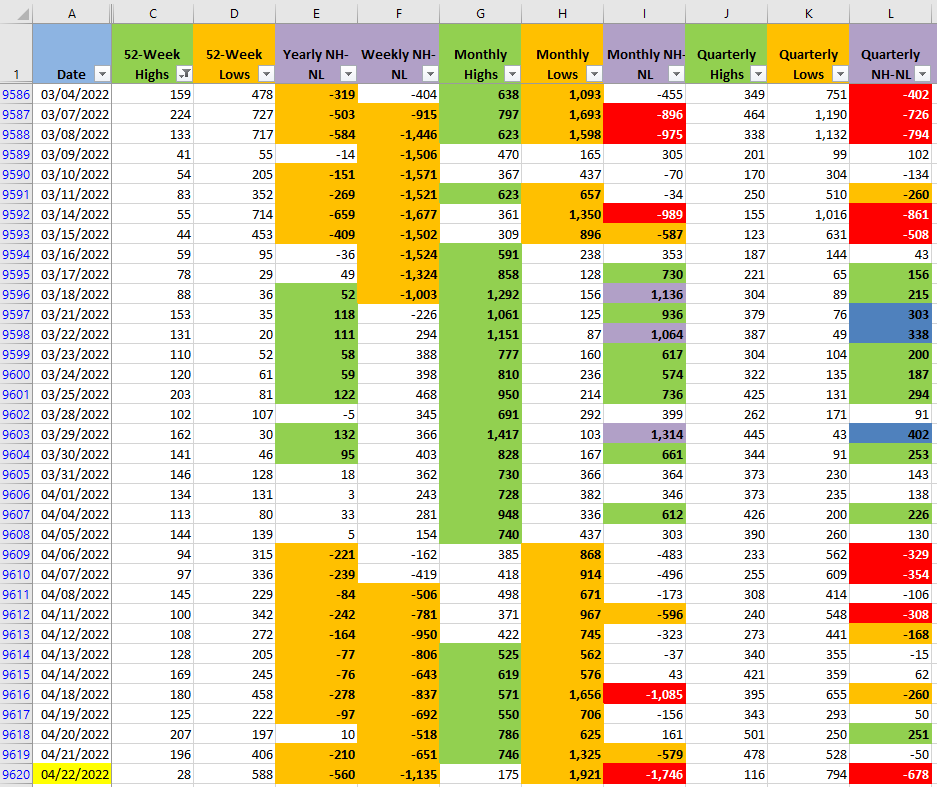

The New Highs and New Lows are confirming the selling pressure. Since the trigger of the buy signal for the First Higher Low patter, in April/19, and also in my last Weekend Market Overview article, I alerted in both that there was a real danger of the pattern failing. The amount of Lows in all the timeframes was increasing rather than decreasing.

Industries

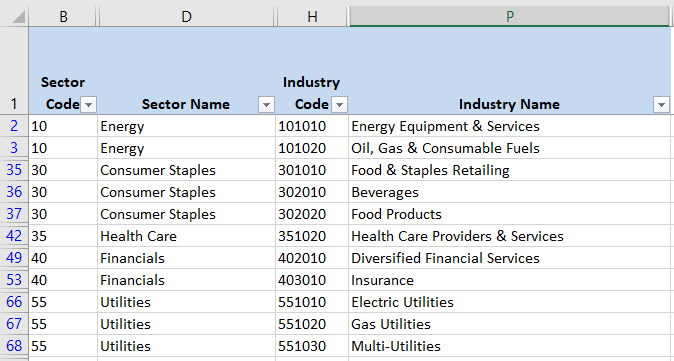

The amount of Industries where I see strength decreased a little bit, from 68 Industries that compose the Global Classification Standard (GICS), 11 are the ones that from my point of view still are strong. However, 6 out of those 11 are in defensive Sectors ('Consumer Staples' and Utilities), which doesn't signal a lot of risk appetite.

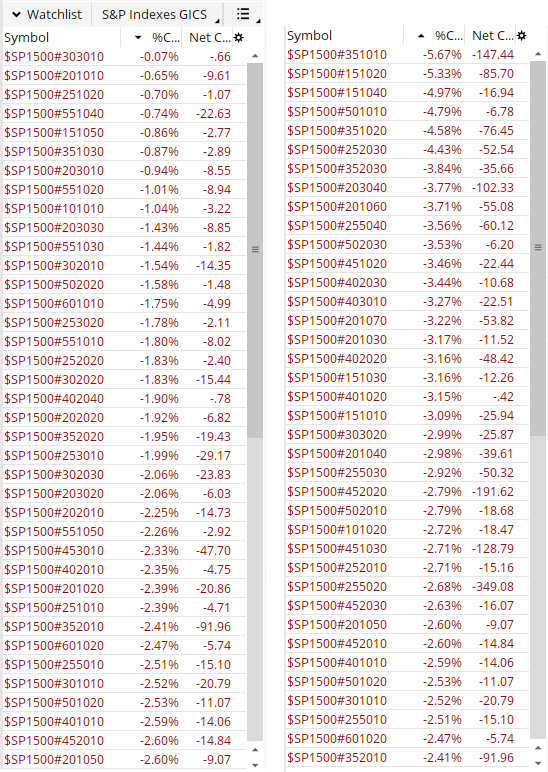

Despite those 11 strong Industries, during the Friday's April/22 plunge not a single one of those 68 Industries Indexes closed in positive territory. Below is a screenshot that shows in the left side 40 of those indexes in ascending order and to the right in descending order. Not a single one of them above 0%.

Scenarios

Scenario #1: The most likely scenario, from my point of view, is that the selling pressure will continue but will find support toward the middle or end of the week. From there, is likely to start moving sideways until there is a new Market catalyst. I still think that the supports discussed in the 'Market Overview' section will be strong enough to hold. For my trading plan this scenario isn't the best to start opening new positions, so if this is the scenario that develops during the week I'll let my few positions open, if a stop triggers that's ok but I wouldn't be opening any new long position under these circumstances.

Scenario #2: The second most likely scenario, would be that the selling pressure keeps increasing and breaks the supports mentioned in the 'Market Overview' section. The Correction resumes or maybe this time it sends all of the important indexes on their way to Bear Market territory. If I see this scenario developing, I'll likely close my remaining long positions even if the stop hasn't triggered yet.

Scenario #3: The final scenario, which I see the less likely to happen, is that some positive catalyst starts a rally that at least gets back the S&P 500 to 4,500. I think that at least a reaction rally could happen during the next trading week, but I don't think it will get that far before being crushed by the Bears. The New Lows numbers are too elevated, negative news easily make the Market decline even if they are the same old news. The Markets haven't been able to break resistance levels. Anything can happen in the Markets, I just see this one as a very unlikely scenario for next week.

Summary

There was some hope that an important uptrend could start to develop after we saw the multi-day rally that started on March/15. Eventually there will be a powerful uptrend that will last for months, but that is unlikely to happen this month.

At this point, I'm only opening long trades that have half or one third of the regular amounts I normally trade. They keep me alert and with a better grasp of the current Market situation without an important damage to my account. At this point, staying on the sidelines waiting for better opportunities seems to be the best option for my type of trading based on Mark Minervini's books.