The soaring prices of commodities and oil were the main catalyst for today sell-off at the Markets. The fear is that the high prices will boost inflation and affect the economic growth.

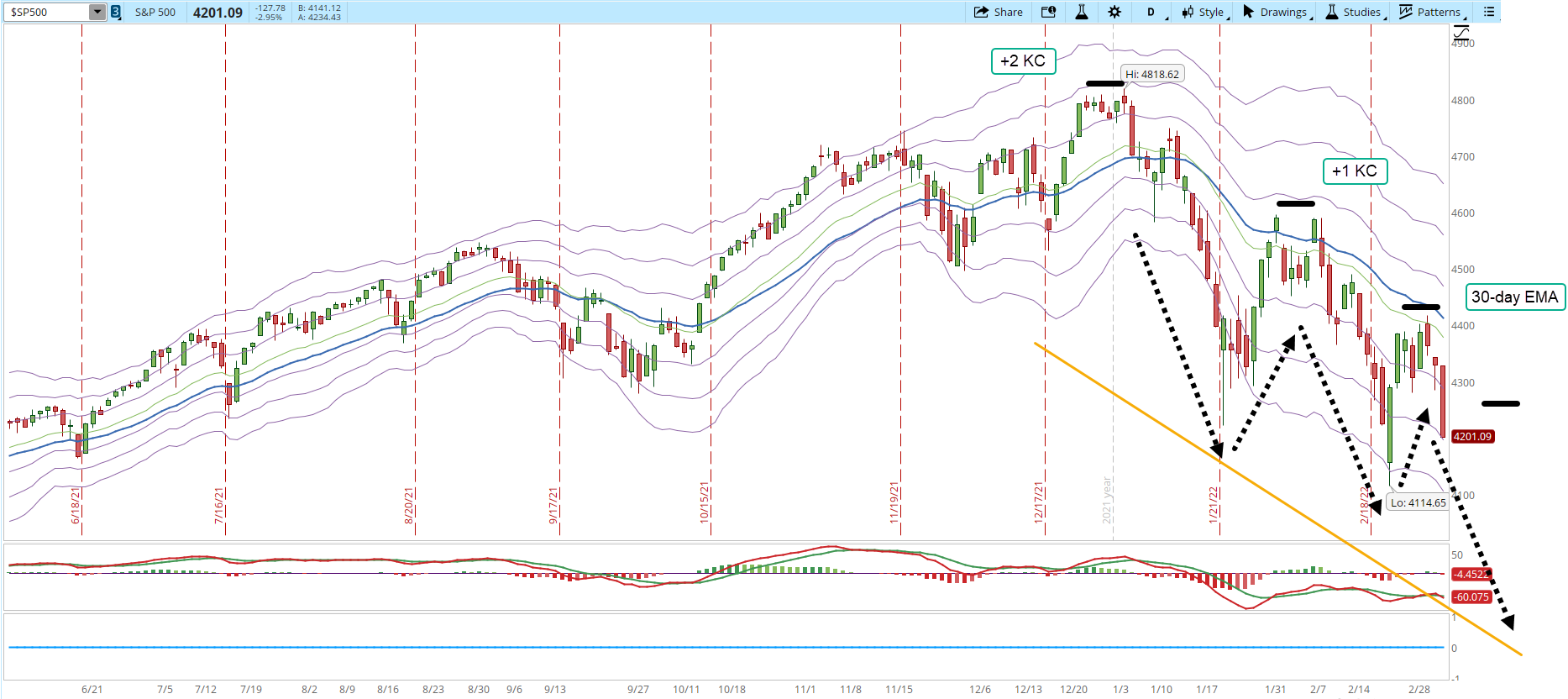

Reviewing the S&P 500 daily chart the scenario that I have described in several previous posts (i.e. in my latest Weekend Market Overview, link below). A downtrend is forming and now it seems to be the most likely course of action (black dotted arrows in the screenshot below):

Weekend Market Overview - Mar/06 - No rally, no force from the BullsIf the S&P gets below the current low at 4,114 then already a downtrend line can be traced (orange line and black dotted arrows). There are two other repeating behaviors that started after the Jan/04. The first one is that once the S&P gets to the -3 Keltner Channel band (KC) it has at least a small reaction rally. The second is that after each rally the S&P is able to get to higher levels, in Jan/04 it got almost to the +2 KC band (horizontal black solid lines), the next rally it couldn't even get close to the +1 KC band, the latest rally we just saw it couldn't even get to the 30-day EMA (blue line).

If there isn't a rally soon, and the selling pressure continues the S&P will be headed to make a new low below 4,114. Unfortunately, the most important news have been around the Ukraine conflict, inflation or the virus. There hasn't been a positive strong catalyst that is able to create a multi-day important rally.

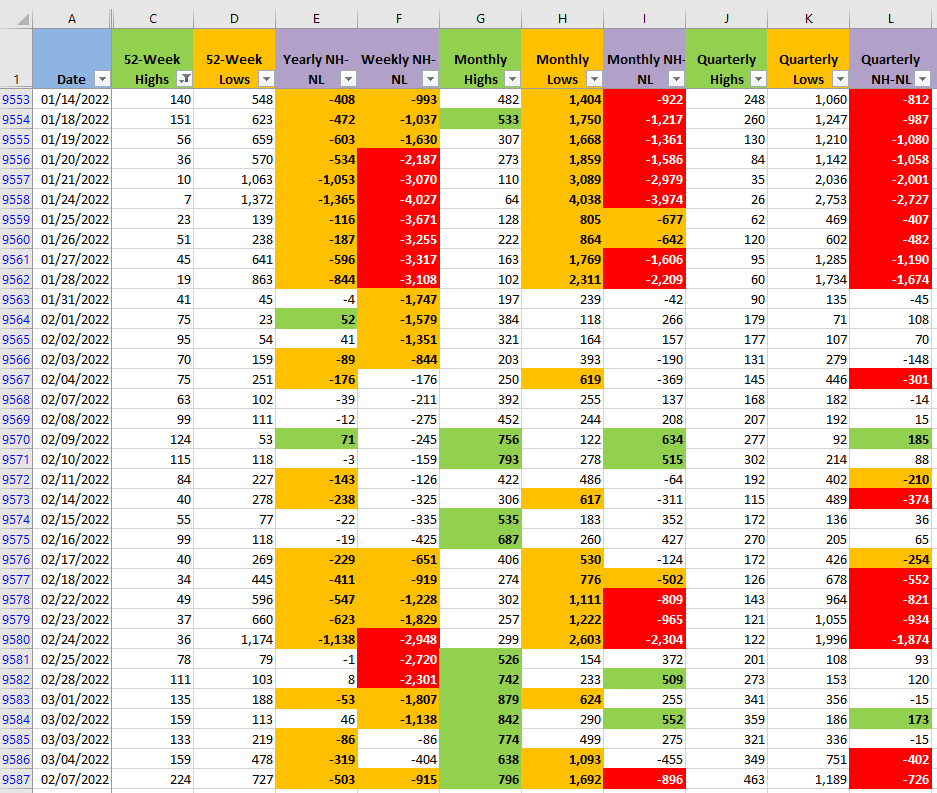

The numbers for the New Highs and New Lows (NH-NL) just confirm the selling pressure entering the Market, a lot stronger than the demand. There is no way to know when the Market will finally turn, it might be tomorrow or in a year, the important part is to keep monitoring the indicators. Other than the price and volume, the NH-NL will start to show a lower selling pressure in the Monthly columns (G, H, I). Eventually a support level will be able to stop the decline, the 30-day EMA will flatten and eventually rally. Unfortunately, right now, Bears are still in control.