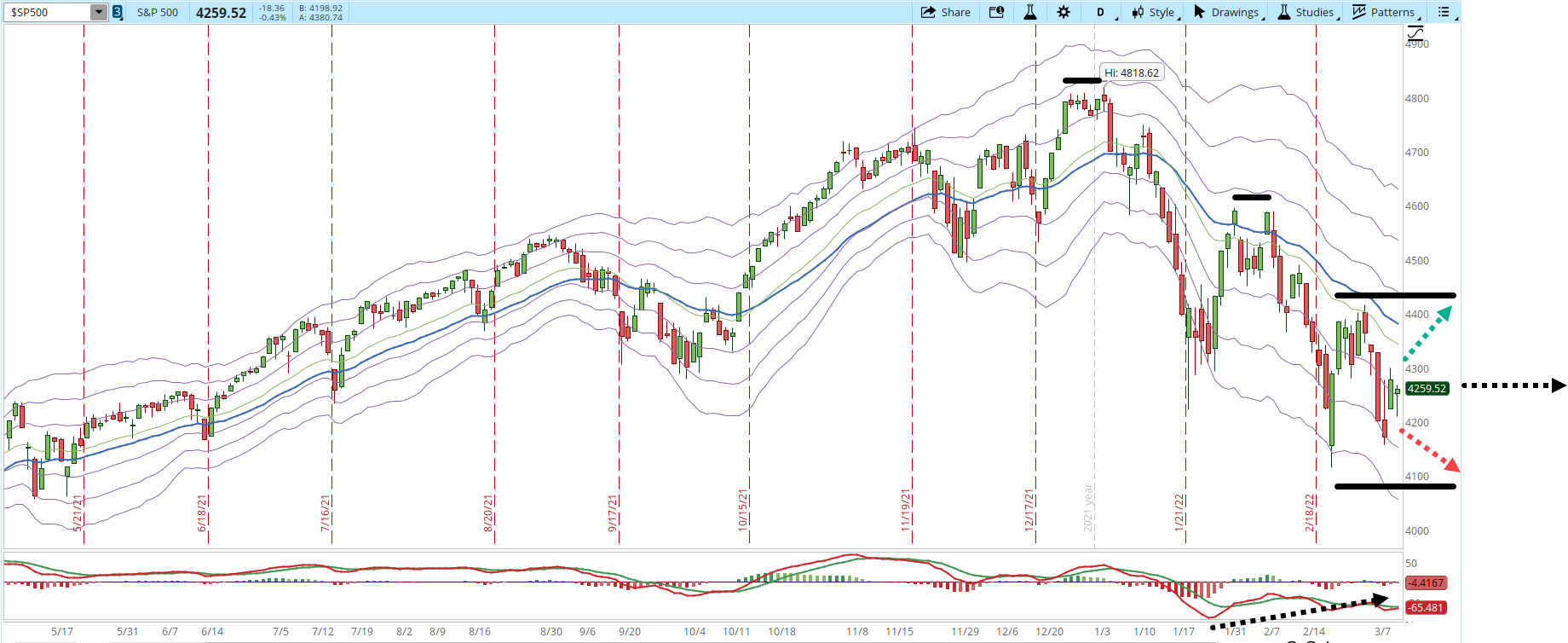

Yesterday we had a powerful movement in all the important indexes, which could have been the beginning of a multi-day rally. It wasn't, remember that no rally has lasted more than 4 days since Nov/05/2021, that's still valid today.

It's obvious that in the Market there are three possible paths, not all of them are equally likely to happen and every time the levels that we need to monitor are different.

Scenario #1: One possible path, which I see the least likely of the three, is that the rally will resume. If that happens, the movement needs to break and hold at least above 4,400 (green arrow). Ideally in order to be really significant it should be a multi-day rally that can get past and hold above 4,600.

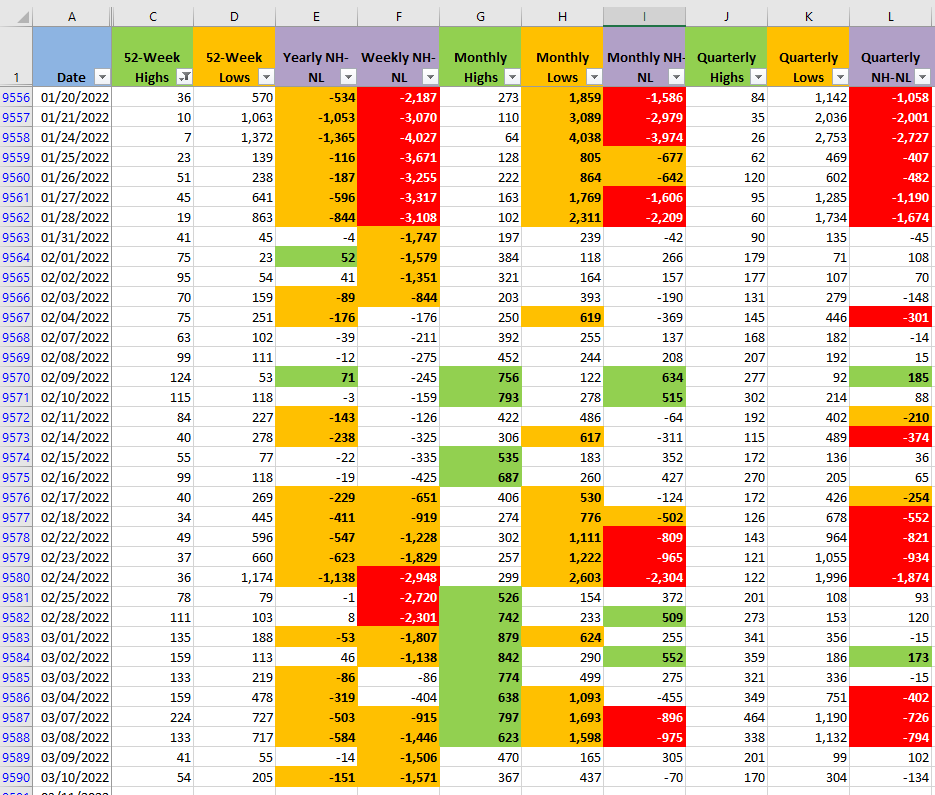

Scenario #2: Another possibility, which is the one I see more likely, is that the S&P starts to move sideways. The balance of power between Bulls and Bears in the NH-NL numbers is more or less the same in all the timeframes. If there is nothing surprising tomorrow (Friday, Mar/11) then the S&P could attempt to trace a bottom moving in a trading range around 4,250 (black arrow).

Scenario #3: The last possibility, which I would personally consider the second most likely to happen, is that the selling pressure increases again dramatically and the decline resumes. After closing all my long positions, I wouldn't mind if this happens, in fact, this scenario gives me the best chances that eventually I can get a few great opportunities when the Correction is over and the Market finally rallies with force. The Market has the final decision, it's not about forecasting, but interpreting the charts and taking actions with strict risk management. I do think that is very realistic that the Market will want to test again the lows at 4,114 (red arrow).

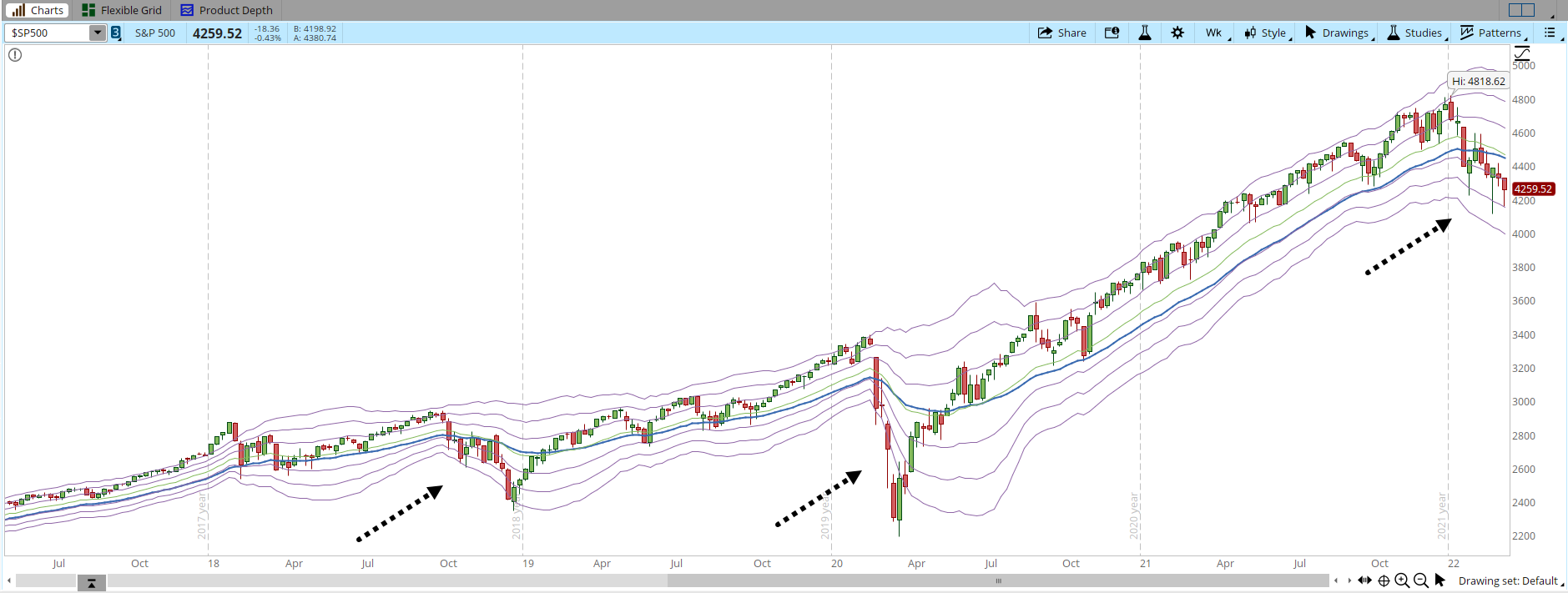

Since May/2017 the weekly chart of the S&P 500 has only closed two times below the -1 Keltner Channel (KC) band. This week, depending on what happens tomorrow, it could be the third time (black dotted arrows). That is a concern because we don't know how much the S&P could still decline. The past two times when the weekly S&P moved below the -1 KC it produced rallies that lasted for months. I'll keep monitoring closely the weekly chart, however nothing guarantees that history will repeat in the Markets.

Finally the numbers for the New Highs and New Lows are more or less balanced for Bulls and Bears, a slight decrease in the Highs and an increase in the Lows but nothing dramatic yet.