The S&P which rallied from Dec 21-27 has either entered a trading range, or we are about to see a correction. At least those seem the two most likely scenarios, of course the rally could resume but right now the Market is giving signals of weakness.

If we review the 39-min chart below the S&P is basically rejecting prices above 4,800, every time it gets past that level it just goes back to the trading range above 4,770 (you can click the image to zoom in).

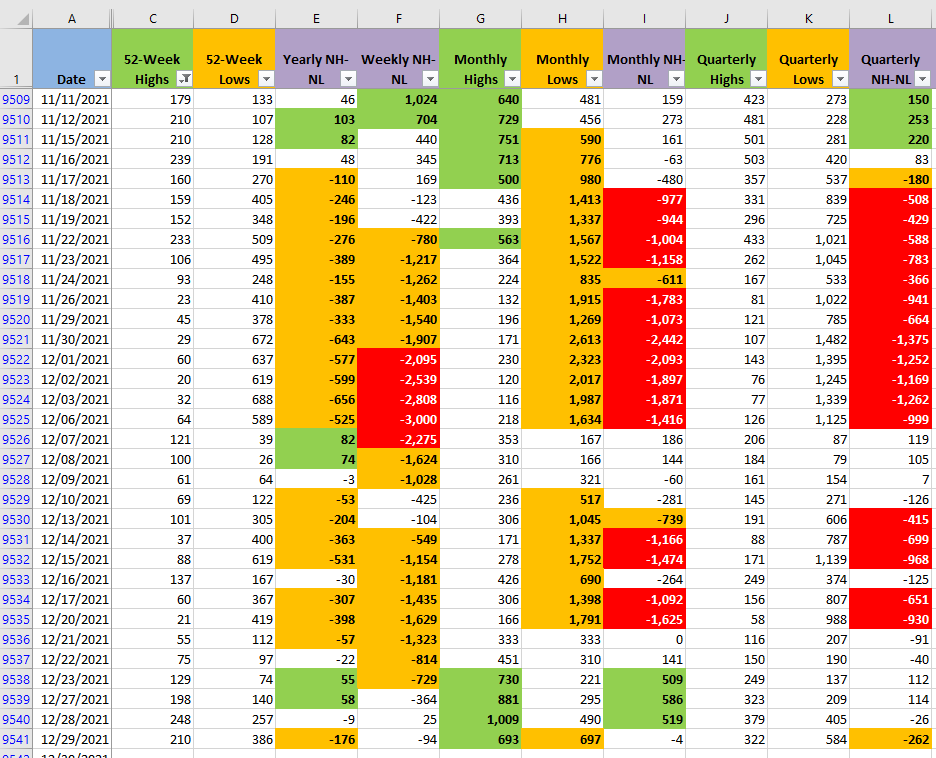

The most concerning part is the New Highs vs New Lows, the indicator keeps deteriorating. In all of the timeframes the balance between the two is negative (columns E, H, L). In order for the rally to resume, the selling pressure has to decrease. I color the spreadsheet cells in orange and red depending of the amount of Lows there are for that particular timeframe, see how long the Bears dominated te Market. Bulls started a four day rally and now all I see is weakness.

I was ready to start opening new long positions if the rally resumed, some alerts of several stocks I monitor triggered early in the day and late in the second half of the trading session. I didn't even capture any orders, until the Bulls show force rather than weakness I'll continue on the sidelines.

It's a matter of developing the patience to wait for the right time to open the trades that fit your plan. There is a quote by Charlie Munger that applies perfectly to the current situation:

"The big money is not in the buying or selling, but in the waiting."

Charlie Munger