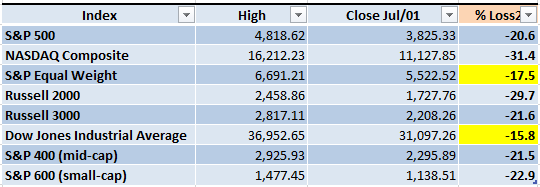

In the abbreviated trading week we are about to start it's important to remember that we are still in a Bear Market. The only two indexes that aren't officially in Bear Market territory (20% loss or more from the previous high) are the S&P Equal Weight Index (SPXEW) and the Dow Jones Industrial Average (DJI). However, there are some signals that the Market could be bottoming, at least temporarily.

Market Overview

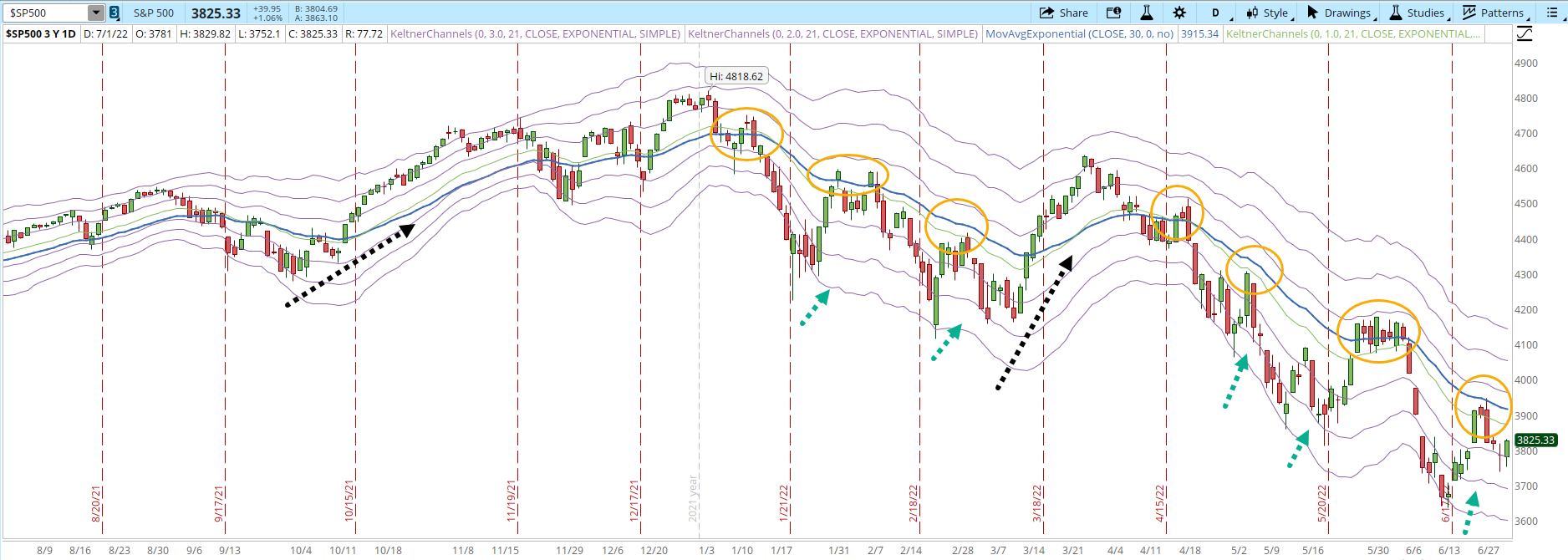

Last weekend I was describing the consistent behaviors that the S&P 500 has had during 2022. During the last trading week, those behaviors were reinforced. The first one of them is that there have been only two rallies that have lasted more than four days since October/2021 (black dotted arrows), any other rally has been killed by the Bears in four days or less.

Another behavior that the index has displayed during 2022 is that when the price level reaches oversold levels (-3 Keltner Channel or below), there's at least a minor rally (green dotted arrows). Finally, the last consistent behavior is that the 30-day EMA (blue line) has been acting as a resistance (orange circled areas). Once the S&P 500 reaches the 30-day EMA, almost every time it has pulled back.

These aren't rules set in stone, however, I do monitor these repetitive behaviors in order to gather clues when the Market starts to behave differently. An additional reference is that I had estimated that the rally could get to a level of around 4,100. I ended being too optimistic, the rally didn't even get to 3,950 which signals a weaker Market situation.

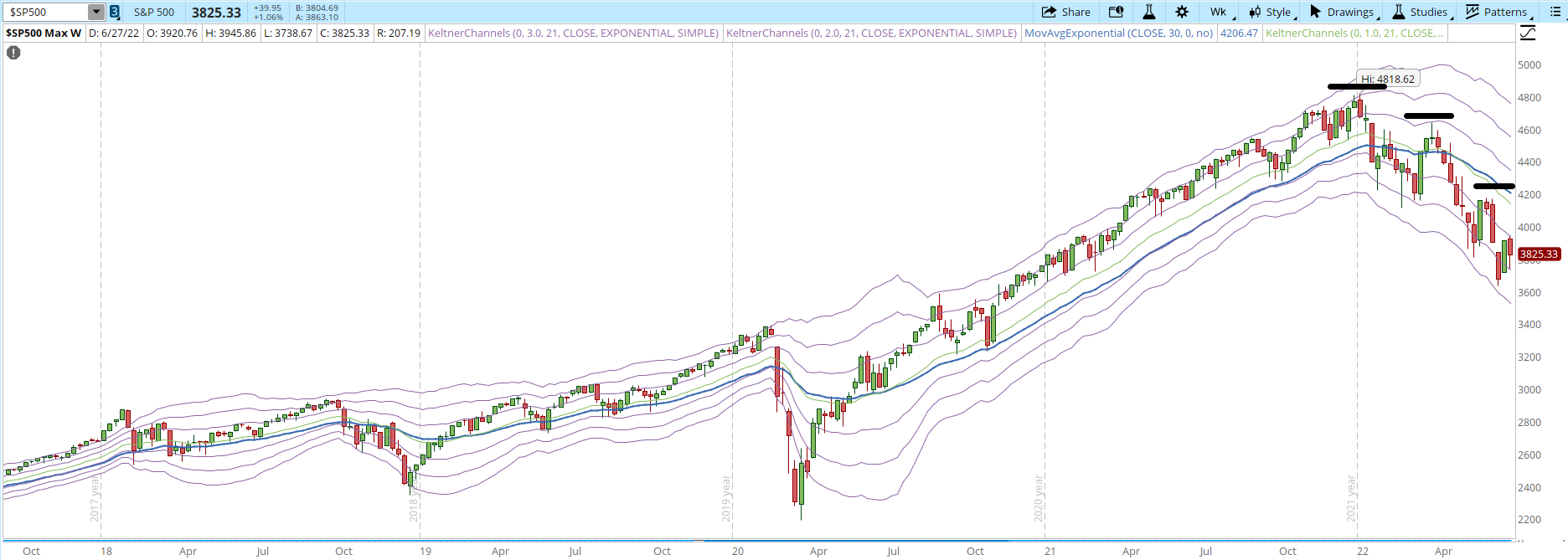

In order to gain more perspective about the current Market situation, the weekly chart lets us see more clearly the downtrend that started back in Jan/2022. The highest point was 4,818 and now we are a thousand points below that level. I have added a few horizontal solid black lines in order to highlight the lower highs and lower lows that are being traced in the chart.

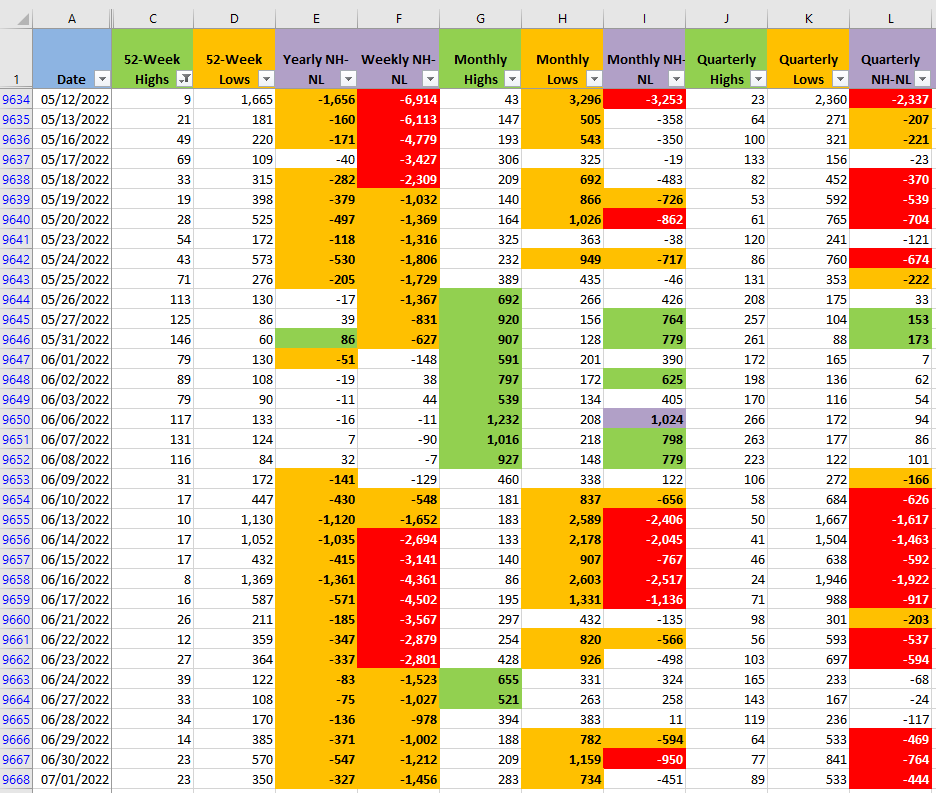

Despite the clear downtrend, I see that the New Highs and New Lows indicators have been displaying a diminishing selling pressure in all the timeframes that I track. This could at least help the Market start tracing a bottom or see how far a reaction rally can get.

Industries

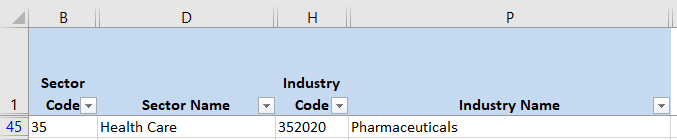

There wasn't any improvement from last week in terms of the number of the Industries that I still see as strong. From the 68 Industries that compose the Global Classification Standard (GICS), it's again the Pharmaceuticals Industry that I see with some force.

It's not very encouraging that a single Industry out of 68 is displaying force. However, it's important to keep monitoring them, eventually some of the Industries will start to recover even before the end of the Bear Market. Those Industries could very well be the leaders of the next Bull Market.

Scenarios

Scenario #1: The trading week we are about to start will be an abbreviated week in observance of Independence Day in USA. The talks about a recession keep increasing and we are still facing the same old issues (inflation, Ukraine war, supply chain crisis, China tensions, etc.). Despite all the bad news, I still think that we can see a rally next week, something that takes the S&P to 4,000. This isn't necessarily a change in direction, just a reaction rally where the index can start testing higher levels and see the amount of demand when it tries to move up.

Scenario #2: The second most likely scenario from my point of view, is that the Bear Market will resume. I have four small long positions that I'm using to test the Market. If the trading week starts with a strong bearish movement, I might close them even if I haven't been stopped out. Anything can happen in the Markets, whatever is the scenario I foresee as the more likely, the Market has the last word. I will act based on the price action, not based on my ideas. With all the negative catalysts, if the Market is unable to rally, fear might again take over the Market sentiment sending the indexes to test lower levels.

Scenario #3: The least likely scenario is that the Market will stall around the current level. I see it as the least likely because there are so many negative powerful catalysts that I doubt that the Market will finally start to stabilize around the current level. During 2022 what we have seen the most is a few feeble attempts from the Bulls to rally and powerful downtrend movements from the Bears. Not that many long periods of the Market moving sideways.

Summary

The Bear Market is still in place. I do think that, in the next few days, we can see another attempt to rally, which I estimate, could get to 4,000. It's still early to discuss the beginning of the next Bull Market but it can be a great time to start looking for the Industries or individual stocks that could be the leaders of that Bull Market.

A reaction rally isn't a signal that the Market direction is necessarily changing. The Bear Market can still resume its decline. Capital preservation is essential if you want to keep playing this game. Rather than thinking how much money you can make if you are lucky enough to pick a bottom, the best way to think about it is how to keep strict risk management that will allow you to trade the next Bull Market even if you don't get to pick the absolute bottom.