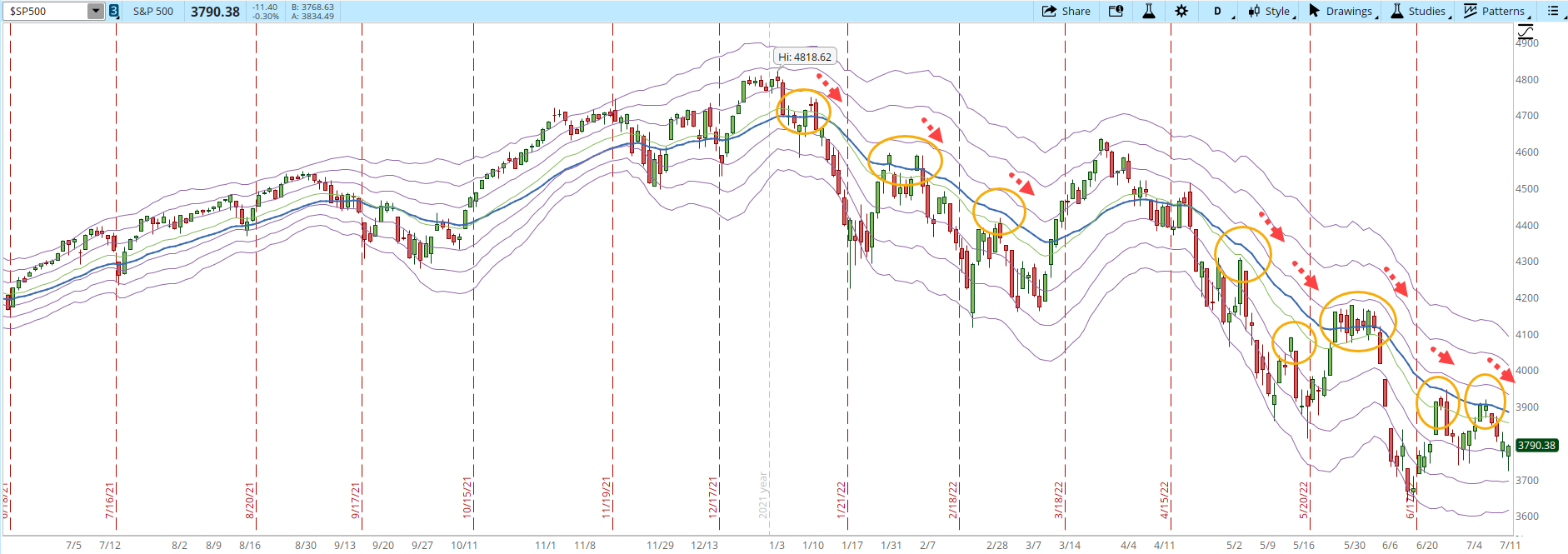

Another trading week is about to end and the 30-day EMA (blue line) has proved to be a strong resistance to beat during 2022. In multiple past articles I have shown how almost every time the S&P 500 is near or at the 30-day EMA there is a pullback (orange circled areas with red arrows). This week wasn't the exception, the only difference is that the S&P 500 seems to be rejecting price levels below 3,700. If the index holds above that level, there could be a chance for a meaningful rally or at least the index could start tracing a bottom.

Eventually there will be a rally, powerful enough to break this recurring behavior. That could be a good signal that the Market is starting to change direction. At this point, the Market is still showing weakness.

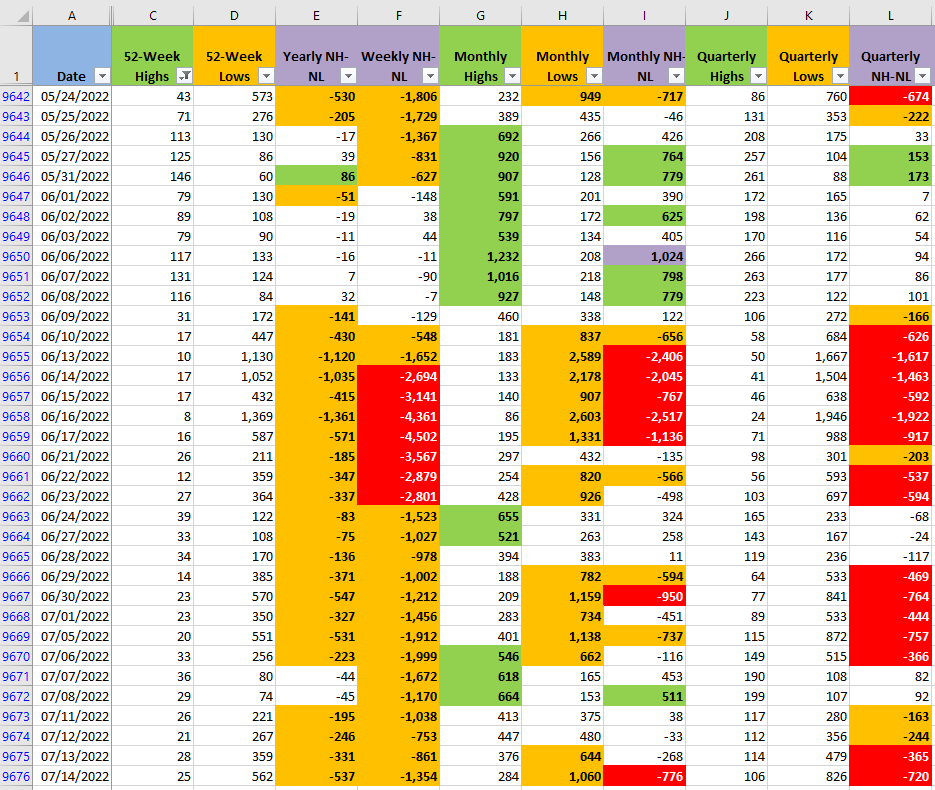

Unfortunately, the probability of a strong closing for the week diminished with today's price action. The selling pressure increased considerably, measured by the New Highs and New Lows (NH-NL) indicators in all the timeframes I track. The Monthly timeframe, is the one that moves faster than the other ones displayed in the screenshot below. The New Highs were starting to expand to bullish levels during last week and now the Bears made it clear that they are still in control.

Anything can happen in the daily chart especially during times when the volatility is elevated. The weekly chart takes longer to modify its direction, unfortunately the weekly chart is tracing a clear downtrend pattern, lower highs and lower lows (solid horizontal black lines). In order to break the pattern, the S&P 500 would at least require to rally and close decisively above 4,000 at the very least.

The negative catalysts continue to affect the Market direction, lately the inflation and the potential recession keep dominating the news. I don't think that the Bear Market is over yet, I was already stopped from most of my pilot trades with limited small losses. It's time to keep a strict risk management in case the Bears are able to resume the decline. There's no strong evidence yet that we have reached a bottom.