Another disappointing week for the Bulls, there were some signals that maybe this week the Market could rally, but nothing happened. The powerful decline also stopped, at least temporarily, but there are some concerning signals that the Bears could regain their force. Let's review the charts to see what conclusions can be drawn before the next trading week starts.

Market Overview

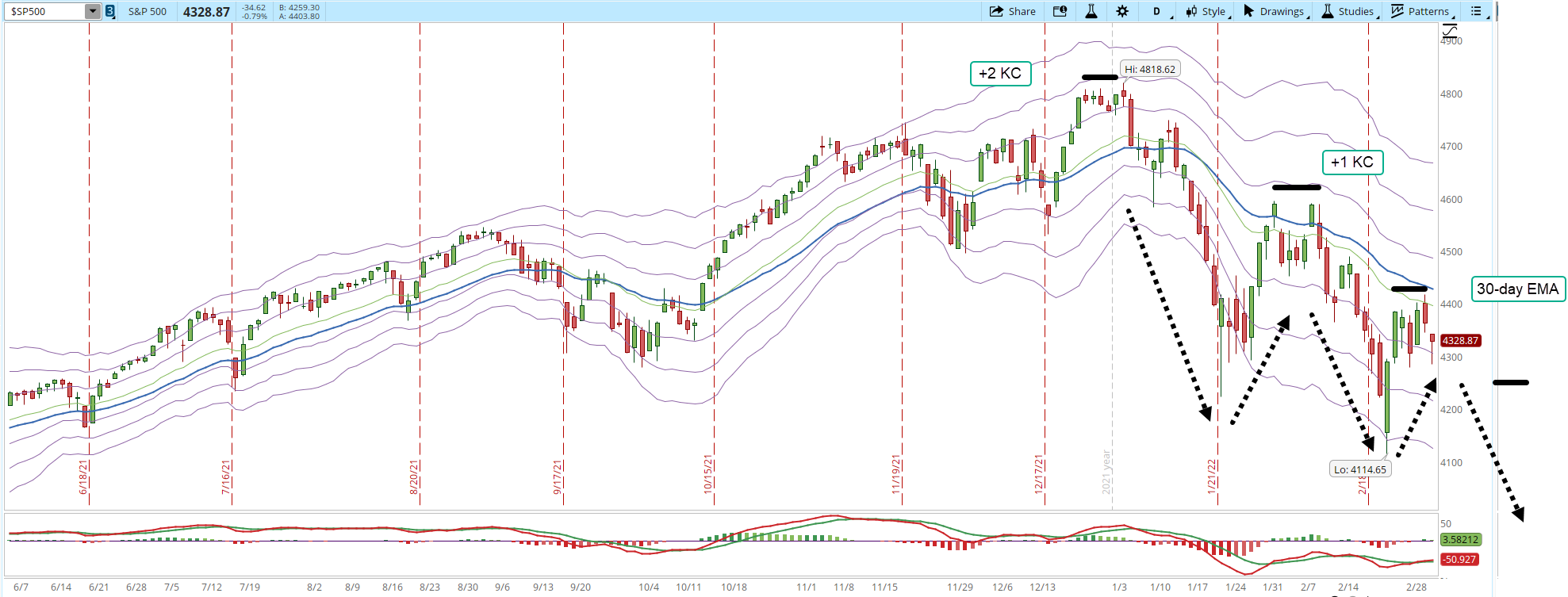

Reviewing the 39-min chart of the S&P 500 we can see that there is a lot of congestion in the zone around 4,250 - 4,400. The S&P was there in Jan/24 (orange circled areas), and eventually lead to a four-day rally that ended in Feb/02. The story keeps repeating week after week. The same news are the catalyst of the same pullbacks, the same resistance and support levels get tested, the same short rallies (none of them lasting more than four days since Nov/05/2021). The important part of the 39-min chart is how weak the Bulls are, the 4,400 resistance is being tested but not with much strength.

From the daily chart of the S&P 500 there are signals that definitely make it clear how weak the Bulls are. The reason I thought there could be a rally (not necessarily an important rally, but at least get to 4,500) was that there is a daily bullish MACD-H divergence in place. The selling pressure diminished the NH-NL numbers were improving for the Bulls. The price action didn't confirm any of these signals, the S&P rallied for two days on Feb/24 and then it was over. No rally has lasted more than four days since Nov/05/2021 and this time was no different.

There is a potential scenario where this daily chart looks more and more like a daily downtrend, lower lows and lower highs. I illustrated the hypothetical scenario with the black arrows, if the S&P can't get past 4,400 it will only take some selling pressure for the S&P to start declining again, testing or even breaking the 4,191 support.

Another signal of weakness is that when the historical high of 4,818 was reached on Jan/04, the S&P was hitting almost the +2 Keltner Channel (KC), on Feb/02 the S&P couldn't even get to the +1 KC. On the current rally that we saw on Feb/25 the S&P couldn't even get to the 30-day EMA (blue line). If there isn't a reaction from the Bulls soon then the Correction could easily resume.

A signal of improvement would be that the 30-day EMA (blue line) would at least flatten. Ideally, a multi-day rally could make it turn upward.

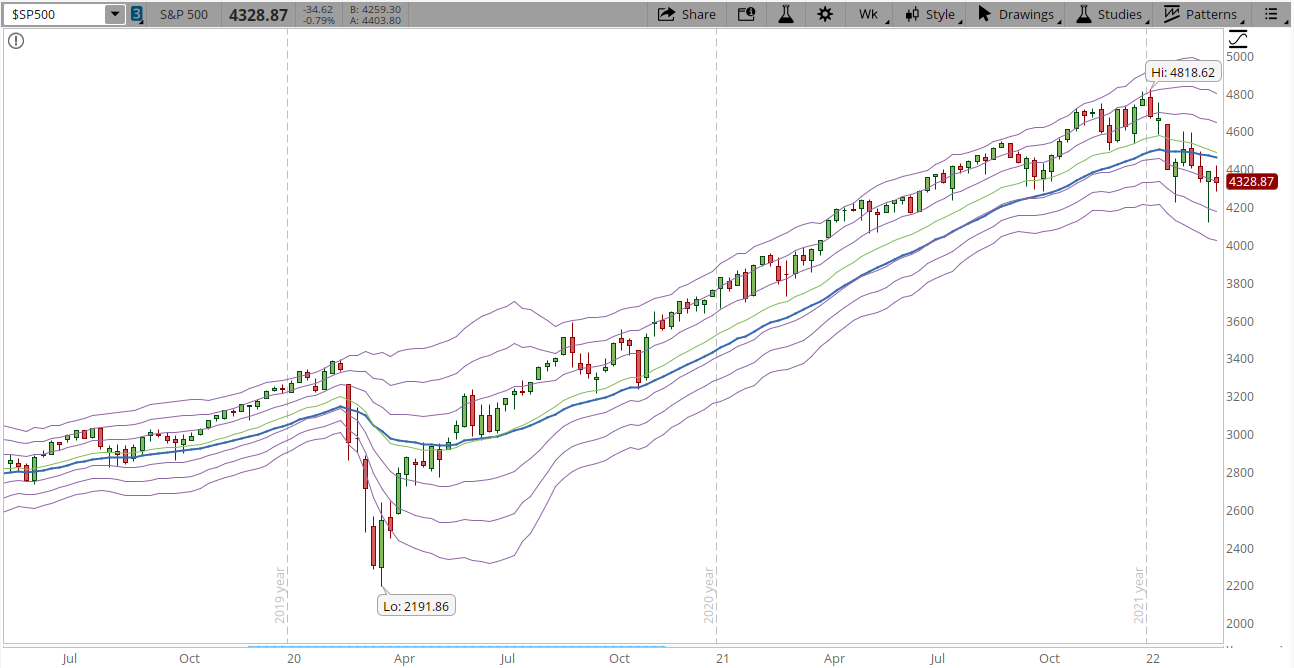

The weekly chart doesn't give that much information that could give some clues about the direction that the Market could take. The S&P 500 is still holding on the weekly above the -1 KC, which is still a normal range of movement without getting to oversold levels. The 30-week EMA is moving more every week from flat to pointing down.

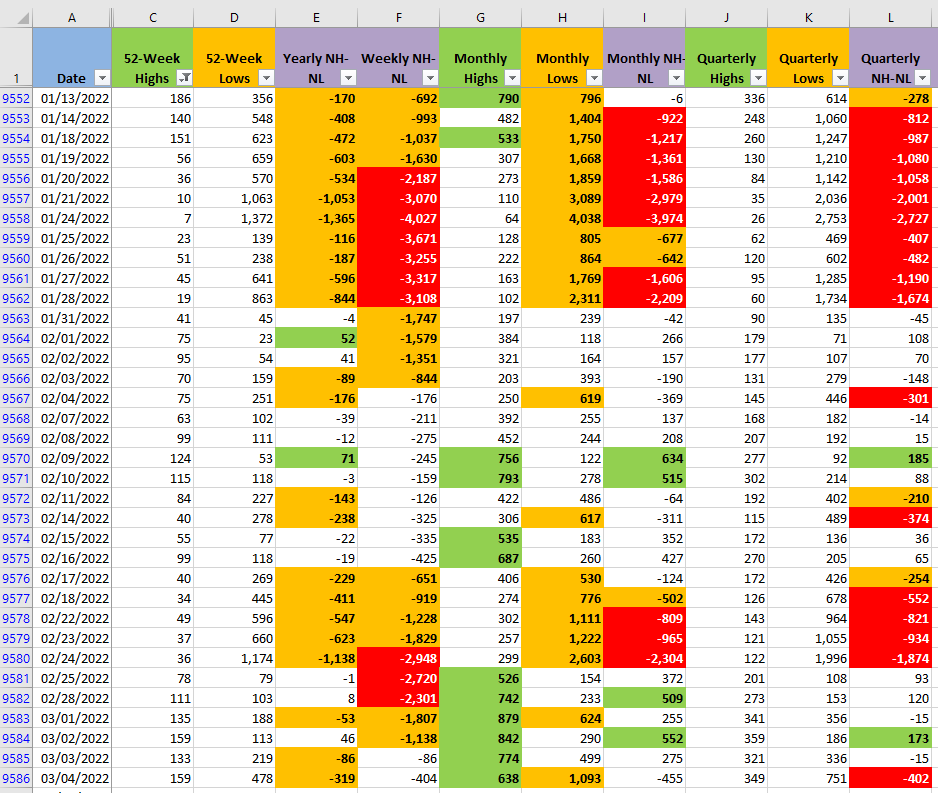

The New Highs and New Lows numbers (NH-NL) that showed some improvement during the week, deteriorated importantly during this Friday Mar/04. The selling pressure started to increase again and it's important to monitor the Monthly NH-NL numbers which are the ones that change faster in all the timeframes displayed below (columns G, H, I).

Industries

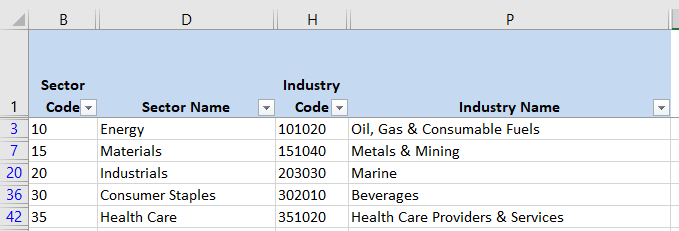

The number of Industries where I see strength hasn't had an important increment in weeks. Last week there were four Industries out of 68 that compose the Global Classification Standard (GICS). This week there are five, which are not enough to start an important movement. Eventually some Industries will get stronger than the rest and could lead to an important rally or long-term uptrend. Those Industries will start trending up maybe even a few months earlier than the rest. The Industries displayed in the screenshot below still seem to be more on the defensive side than the stocks that will eventually lead the Market to an important uptrend.

Scenarios

Scenario #1: The most likely scenario from my point of view is that the S&P 500 will keep oscillating between 4,250 and 4,400, testing those levels until there is some catalyst that will make the Market take a direction. That catalyst not necessarily will occur the next trading week. That type of sideways movement can last for a while. If there is something that triggers a movement out of those levels, I'll evaluate again the situation. If it breaks the 4,250 support I'll just continue on the sidelines, I just have a single position open and it's in Oil. If the S&P breaks the resistance of 4,400 and is able to hold above it with decisive force, I'll think about opening long positions in Oil or in one of the strong Industries that I posted in the previous section of the article. I'll still be reluctant to take more risks while the S&P is unable to break and hold above 4,600.

Scenario #2: I had troubles deciding which was the most likely scenario, not that it matters, the Market is the ultimate judge, but I do like to prioritize and focus the scenarios that I see more likely to happen. Another possibility for next week, is that the selling pressure increases dramatically, there is no shortage of negative news lately, it wouldn't be that hard for that to happen. If the Market resumes the Correction with force and there is no demand that can absorb the supply, the Correction might even get to be a confirmed Bear Market. In order for the S&P to be catalogued as Bear Market it would have to decline to 3,855 (20% lower than the top at 4,818).

Scenario #3: There is a third but unlikely scenario where the Bulls finally rally with force, the rally is able to get past 4,400 and at least get to 4,500. A powerful rally ideally will break past 4,600 which would take at least three or four sessions. I see this scenario unlikely to happen unless some unexpected news hit the Market, it would have to be a positive surprise from the Fed or the resolution of the Ukraine conflict or any other positive news that the Market hasn't discounted yet.

Summary

Another week where the Bears haven't been able to resume the Correction but definitely haven't allowed any important rally. I have outlined the levels which are critical to monitor during next week 4,250 - 4,400. From my point of view, there are more bearish than bullish signals. These are times where it's better to trade carefully, strict risk management can save an account from serious damage.

Staying on the sidelines preserving capital is a conscious decision, and from my point of view is a valid position just like buying or selling. If the current environment isn't ideal to trade your plan, there is no need to force it. Profit isn't generated by trading more but by trading right.