The Markets continue to be very susceptible to the same old news we have been reading about for the past few months. This time the New York Fed President John Williams made some hawkish comments about raising aggressively interest rates in order to control inflation and the Markets posted moderate losses. The abbreviated trading week is over and now it's time to prepare for whatever is coming next week.

Market Overview

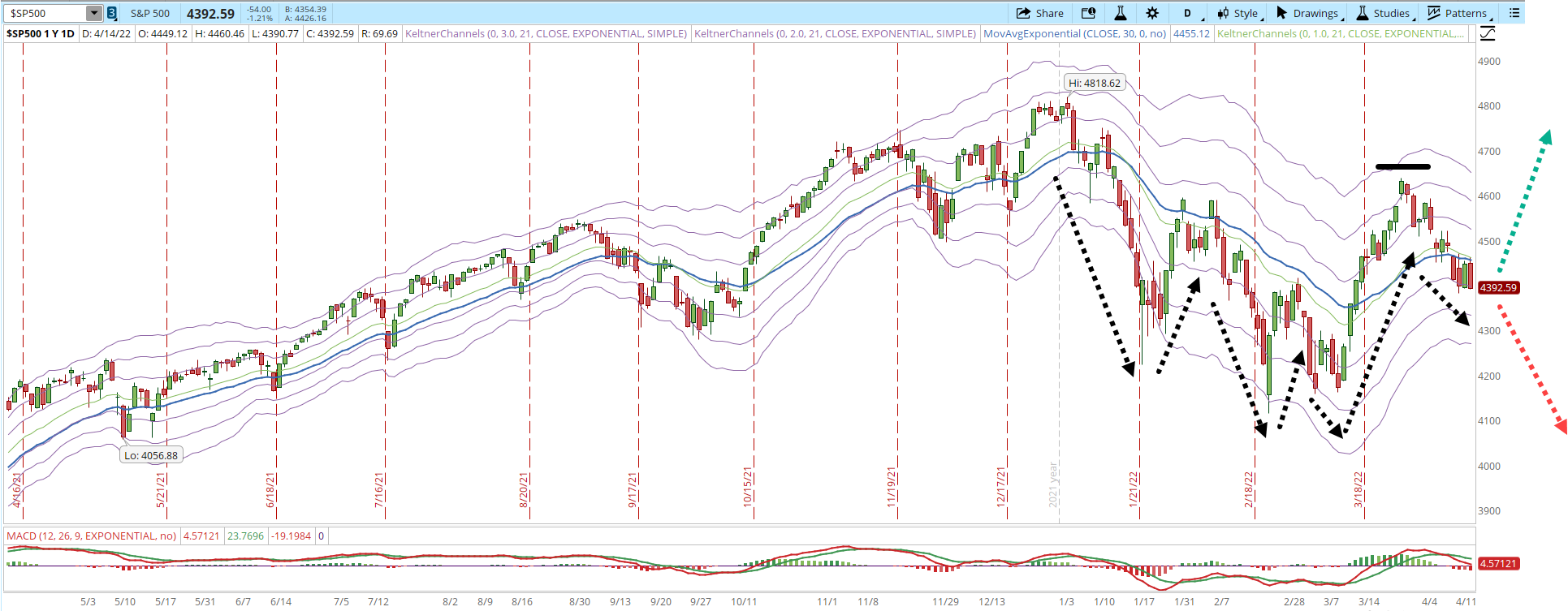

I was expecting a rally on Thursday, it didn't happen, however the structure of the First Higher Low is still intact. What is important from my point of view is the price action that will follow next week and I can summarize it in the following way:

- If the S&P 500 daily chart keeps holding above the -1 Keltner Channel (KC, currently at 4,396) then there's still a chance for the rally to happen.

- If the S&P 500 daily chart closes below the -1 KC in a significant way (red dotted arrow), the pattern could be damaged or completely broken.

- If there's another false breakout and a rally (green dotted arrow) then I'll likely open at least one new long position, knowing that there is a risk that the rally might not exceed the previous high at 4,637 (horizontal solid black line).

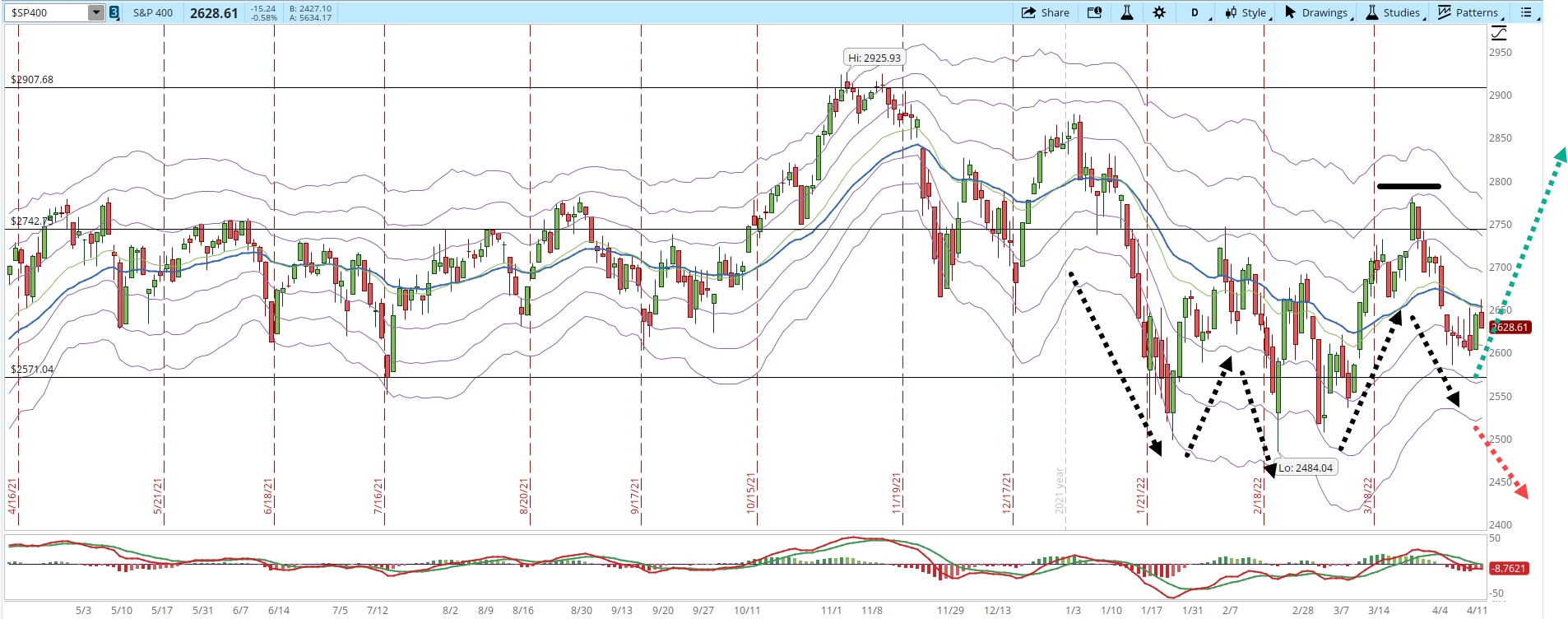

The S&P 400 (mid-cap companies) is in a similar situation than the S&P 500 (large-cap companies). I have highlighted the same areas than in the previous chart and the scenarios described above, also apply for the next chart just adjusting the price levels.

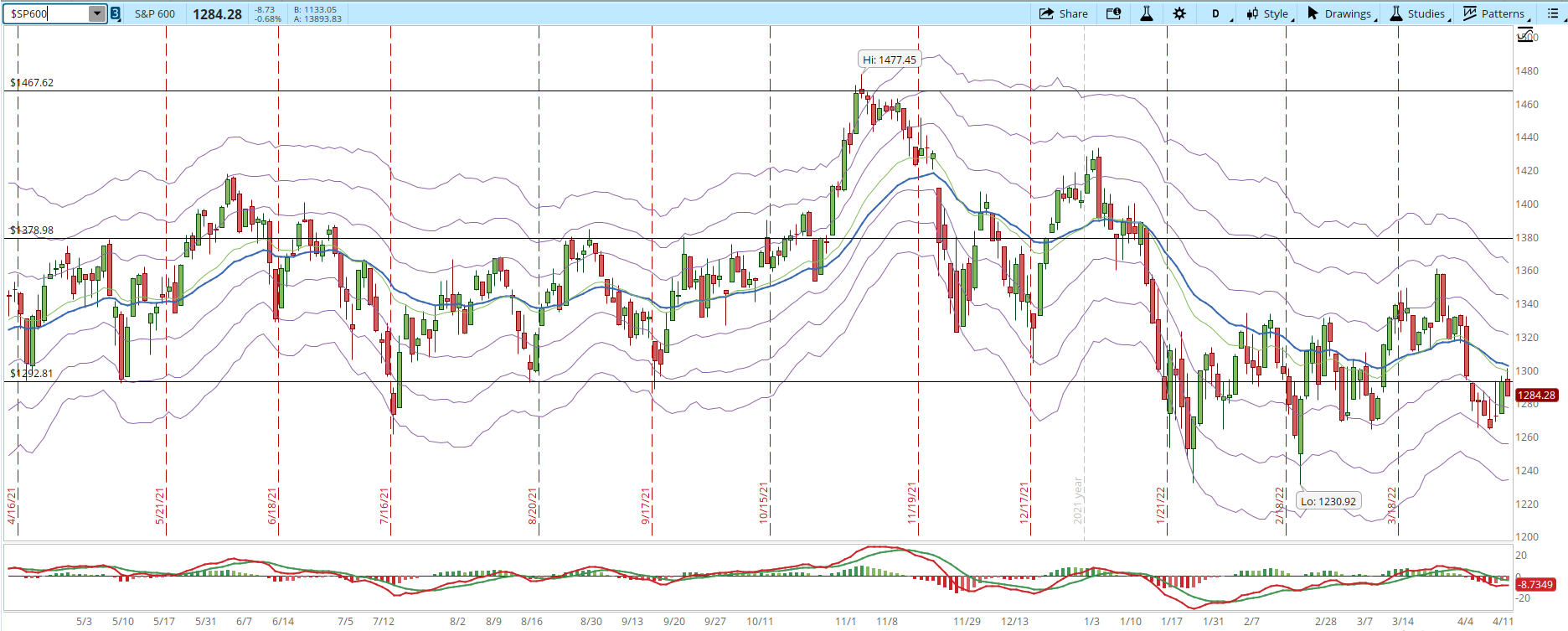

In terms of the S&P 600 (small-cap companies), I keep posting this chart, despite there is no First Higher Low pattern, just to be aware that small-cap companies haven't been doing great in the last year. It's not impossible to pick a small-cap winner but it's harder. At this point, the S&P 600 is still struggling to hold the 1,292 weekly support.

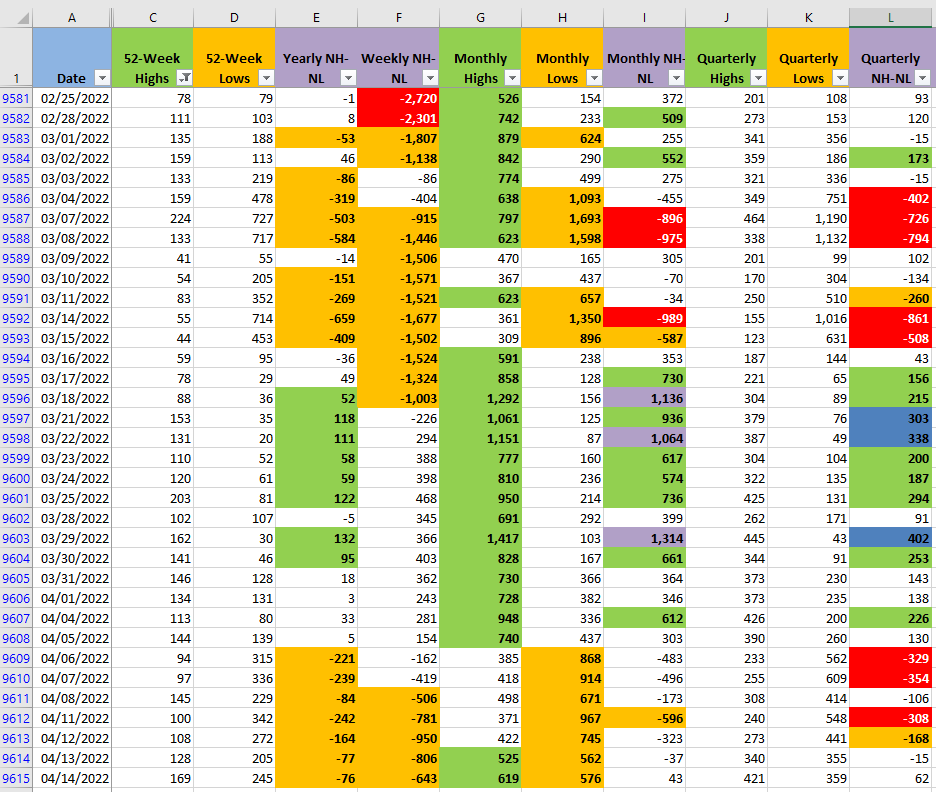

The New Highs and New Lows (NH-NL) numbers have been deteriorating since April/06. There is selling pressure entering the Markets that the demand hasn't been able to absorb. If there is the chance that a rally actually happens, the Monthly numbers (columns G, H, I), which are the ones that change faster of all the timeframes displayed, they need to show an increase in the Monthly Highs and a decrease in the Monthly Lows. That might sound obvious but there are times when the NH-NL start to move ahead of a rally/pullback.

Industries

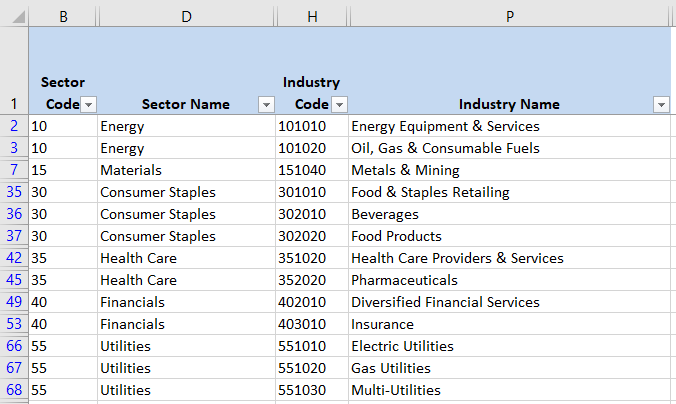

From the 68 Industries that compose the Global Classification Standard (GICS), 13 are the ones that, from my point of view, still show strength. The number and type of Industries that are showing strength, especially when comparing them to past weeks, could also provide some clues about the Market situation. In the screenshot below, 50% of the strong Industries are part of defensive Sectors (Consumer Staples and Utilities). That's not a great indicator of risk appetite.

Scenarios

Scenario #1: Last week I was more on the optimistic side, this week I'm more on the realistic one. The First Higher Low pattern, which could potentially trigger a rally is still there intact. However, I'm trying to factor all the information described above plus the negative news and I see more likely that the First Higher Low pattern fails:

- A very susceptible Market to the same old bad news (the virus, the Ukraine war, inflation and a hawkish Fed, not an awesome earnings season so far). Any tiny new detail about the same old news and the Market declines.

- Half of the strong Industries on the defensive side.

- NH-NL numbers moving between neutral and bearish.

- A lack of display of strength from the Bulls, if there's bullish strength at some point it has to be displayed, like the Bears did when they sent some of the indexes to Bear Market territory and the rest to Correction mode.

After considering those points, This week I think that the most likely scenario is that the First Higher Low pattern will break, causing the price level of the S&P 500 and S&P 400 to go below the -1 Keltner Channel. I only have two long positions opened and one of them I traded it with half of my normal trading size. It's not a big deal if this scenario occurs.

Scenario #2: In the second scenario the First Higher Low actually rallies, in that case I'll open at least a long positions, and if it gets past 4,637 I'll likely open more. The only potential catalyst that I can foresee now that could make this scenario happen is that next week there are some surprising earnings that haven't been discounted yet by the Market.

Scenario #3: If Bulls and Bears keep their forces balanced and there isn't any powerful catalyst that moves the Markets in any direction, then the indexes could move sideways. This scenario is very unlikely, especially during earnings season. However, it's better to start the week ready to act according to our trading plan with whatever the Market throws at us.

Summary

I'm eagerly waiting a significant rally that can break and hold above the 4,800 barrier. That might not happen next week, or this month, maybe not even this year. The only thing for sure is that no matter when, it will eventually happen. Closely monitoring the Markets will eventually pay off. Strict risk management will be even more important to make a few test trades along the way and still be able to preserve capital.