There aren't guarantees when trading the Markets, however, lately the selling pressure seems to dominate the price action. The same old news that have been hitting the media for months are able to make the main indexes stumble.

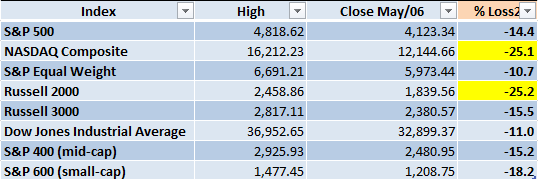

In order to add some perspective, the table below shows the impact of the declines in the main indexes compared to their previous highest level. The ones in yellow are already in confirmed Bear Market territory, some others are pretty close to that level (Bear Market defined as a decline of 20% or more from the highest previous level).

Market Overview

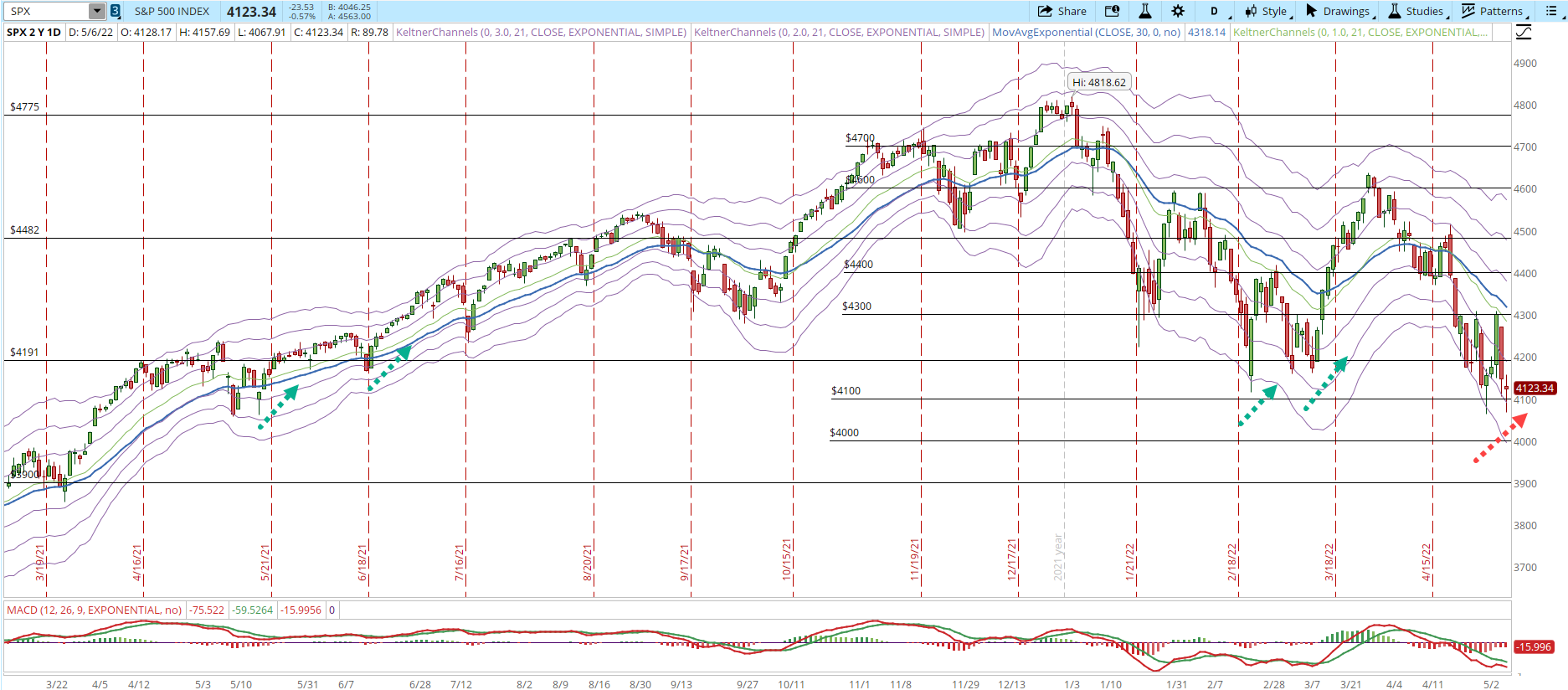

I have removed a few short-term supports from the daily chart of the S&P 500, it was getting too crowded with too many support and resistance lines. The weekly levels (4,775 / 4,482 / 4,191 and the newly added 3,900) are still the same, just the lines in between that I use for reference changed.

The concerning part about the S&P 500 chart is that since April/2021, when the index tested the 4,191 level there was at least a reaction rally that took the index back above the support (green dotted arrows). The current situation is different, even at oversold conditions, the index seems to be more inclined to continue the Correction rather than having at least a small rally that gets it back above 4,200 (red dotted arrow).

The rest of the indexes are also displaying weakness, posting an image of each of them would make the article unnecessarily long and tedious, but I would recommend you to do that exercise on your own as it gives a good feeling of how the selling pressure is affecting the small and mid-cap companies.

Taking a high-level overview of the S&P 500, the monthly chart makes me think that the Correction isn't over yet. Reviewing the screenshot below that shows the monthly behavior of the S&P 500 since the subprime mortgage crisis, it's easy to see that when the index was near or at overbought levels (+3 Keltner Channel) there was an important selling pressure that made the index decline (orange arrows).

Most of the times the index declined to the -2 KC, the only exception was during 2019 with the selloff caused by the Covid virus where the index got to oversold conditions (-3 Keltner Channel) but recovered quickly.

Currently in the monthly chart, the index is getting to the -1 KC, but the descent has been slow, five months. The levels I will be monitoring are around the -2 KC in the monthly chart, which right now is at 3,820 (this would be already Bear Market territory). If things get really bad the index could end at the -3 KC which right now is at 3,220.

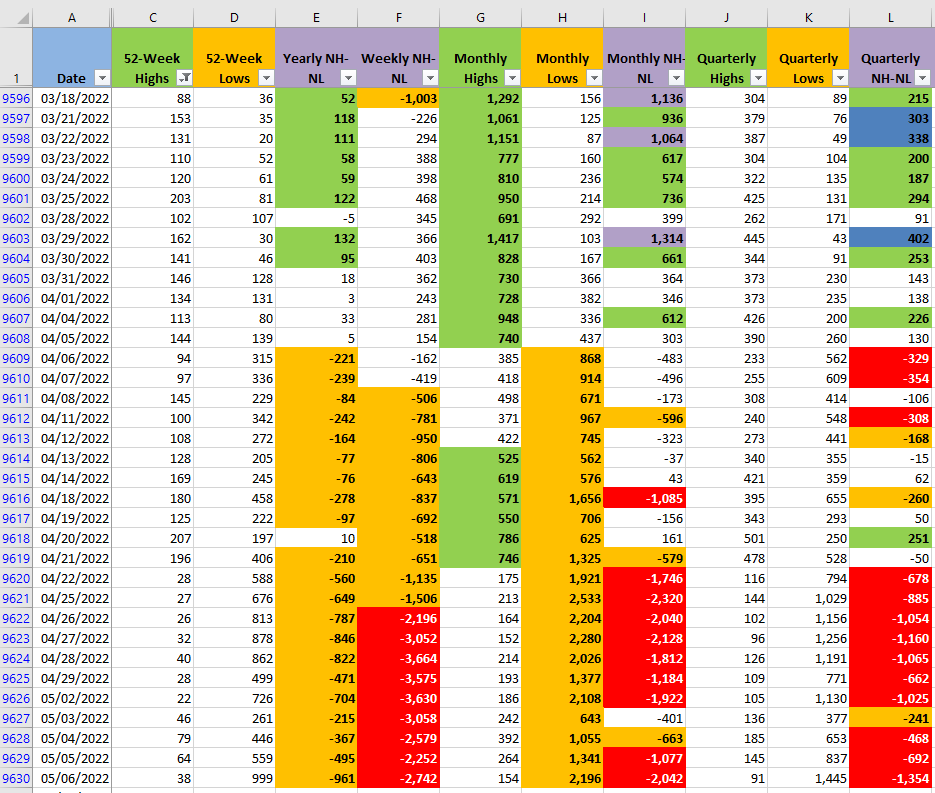

The New Highs and New Lows numbers (NH-NL) confirm the high amount of selling pressure we are experiencing. Since April/06, that's twenty two trading days, the amount of Monthly New Lows has been above 500. That's a high amount of stocks making New Lows for an extended and continuous period of time. If these numbers don't decrease, the likelihood of an important rally is very low.

Industries

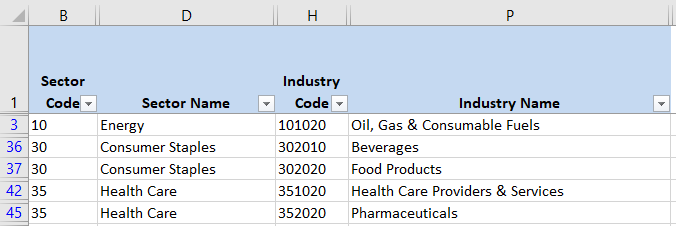

The amount of Industries that from my personal point of view are still strong is also not improving. From the 68 Industries that compose the Global Classification Standard (GICS), only 5, which is less than 10%, are displaying still strength. Two of those are in the Consumer Staples sector, which is considered a defensive Sector.

A single indicator might not have much value by itself. However, when multiple signals keep confirming each other, is time to pay attention to the message that the Market is sending.

Scenarios

Scenario #1: From my point of view, the most likely scenario is that the S&P 500 will keep oscillating between 4,100 and 4,200. There is a chance that finally some catalyst makes the index rally, but even if that happens I think the S&P 500 will have a hard time getting past 4,300. Until there's a powerful movement that takes the index above 4,500 I won't think about opening long positions. At this point, I'm waiting on the sidelines, all cash.

Scenario #2: The second most likely scenario, is that the selling pressure will increase dramatically, so strong that it will keep breaking supports. The next weekly support that could stop that kind of decline is at 3,900. I'm against trying to pick bottoms, so in this scenario I'm not opening any long positions, it's a very risky business. If this scenario is the one that ends happening, I'll just let the Correction continue until it forms a bottom, that could take days or weeks, then I'll think about opening new long positions.

Scenario #3: Since anything can happen in the Markets, a very unlikely scenario, is that we see a powerful rally that takes the S&P 500 above 4,400. At this point, I don't see a catalyst that could move the index for several days to that level despite the current amount of selling pressure. In case this unlikely scenario happens, I would monitor closely the Monthly NH-NL numbers to see if the New Monthly Lows decrease significantly to allow that the rally continues.

Summary

The situation looks complicated at the very least. The indexes are testing or breaking supports that had hold since 2021. The amount of New Lows haven't decreased since the beginning of April. The amount of strong Industries is pretty low. The majority of the catalysts moving the Market in the past few months are negative (i.e. inflation, Covid, Ukraine war, tensions with China, top economies slowing down, etc.).

If this Correction sends all the main indexes to Bear Market territory it will eventually open great opportunities for a new Bull Market. In order to profit from that kind of Bull Market the important thing is to preserve your capital, if you don't survive the Correction/Bear Market, you will eventually miss the next big uptrend.