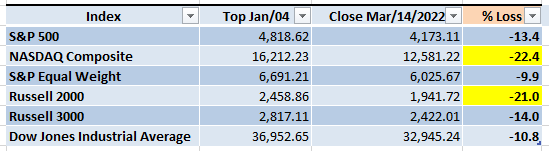

Today we saw the selling pressure increase dramatically. The Nasdaq and Russell 2000 are now officially in Bear Market territory. It will be interesting to see if the 4,191 support of the S&P 500 will hold or not. No rally has lasted more than four days since Nov/05/2021, that statistic is still is valid up until now.

Reviewing the daily chart of the S&P 500 we can see that the 4,919 support level has had a lot of volume in the past year. The support is being tested and it will be important to monitor if the Bears will be able to break it. If the support breaks then we will be facing a downtrend that could take the rest of the indexes into Bear Market territory. Take a look at how the S&P has been reaching lower highs and lower lows, if this continues we could end with the next lower high at 4,300 (horizontal black lines).

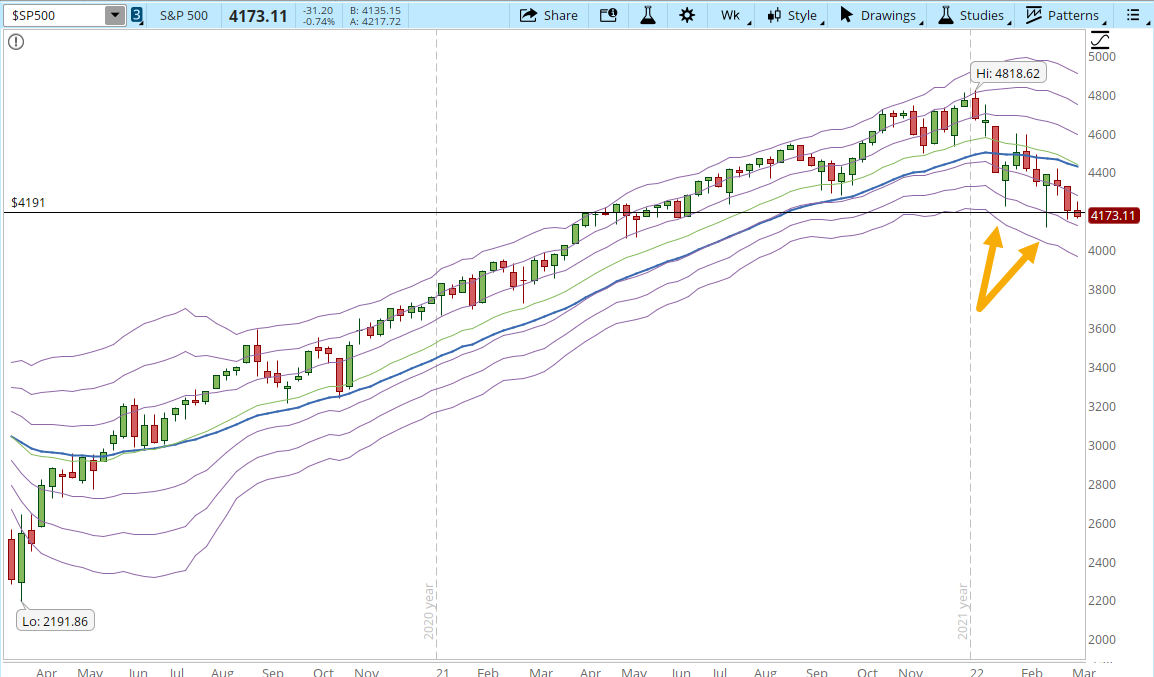

If we review the weekly chart of the S&P 500 we can see that in the recent history, when the index went below the -2 Keltner Channel band (KC) it had at least a small rally that took it back above the -1 KC (orange arrows in the screenshot below). This isn't great, as an important rally would at least take the index back to 4,400 (ideally a multi-day rally that goes above 4,600 would be a much stronger signal of force from the Bulls).

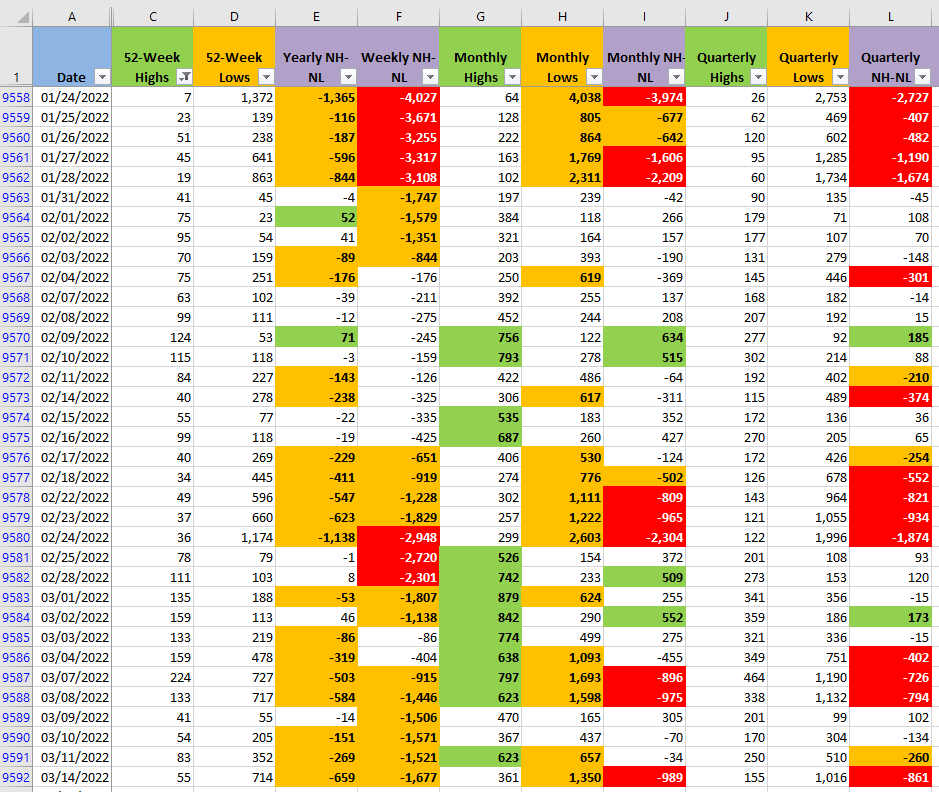

The New Highs and New Lows numbers (NH-NL) confirm the amount of supply entering the Market. I'll keep monitoring them, especially the Monthly columns (G, H, I) which is the fastest timeframe of the ones displayed.

During my Weekend Market Overview, I mentioned that I had already opened a couple of positions in order to start testing the Market with real money. I might be stopped out tomorrow from one of the positions, it looks that I was too early, the Market still seems to be weak and volatile.