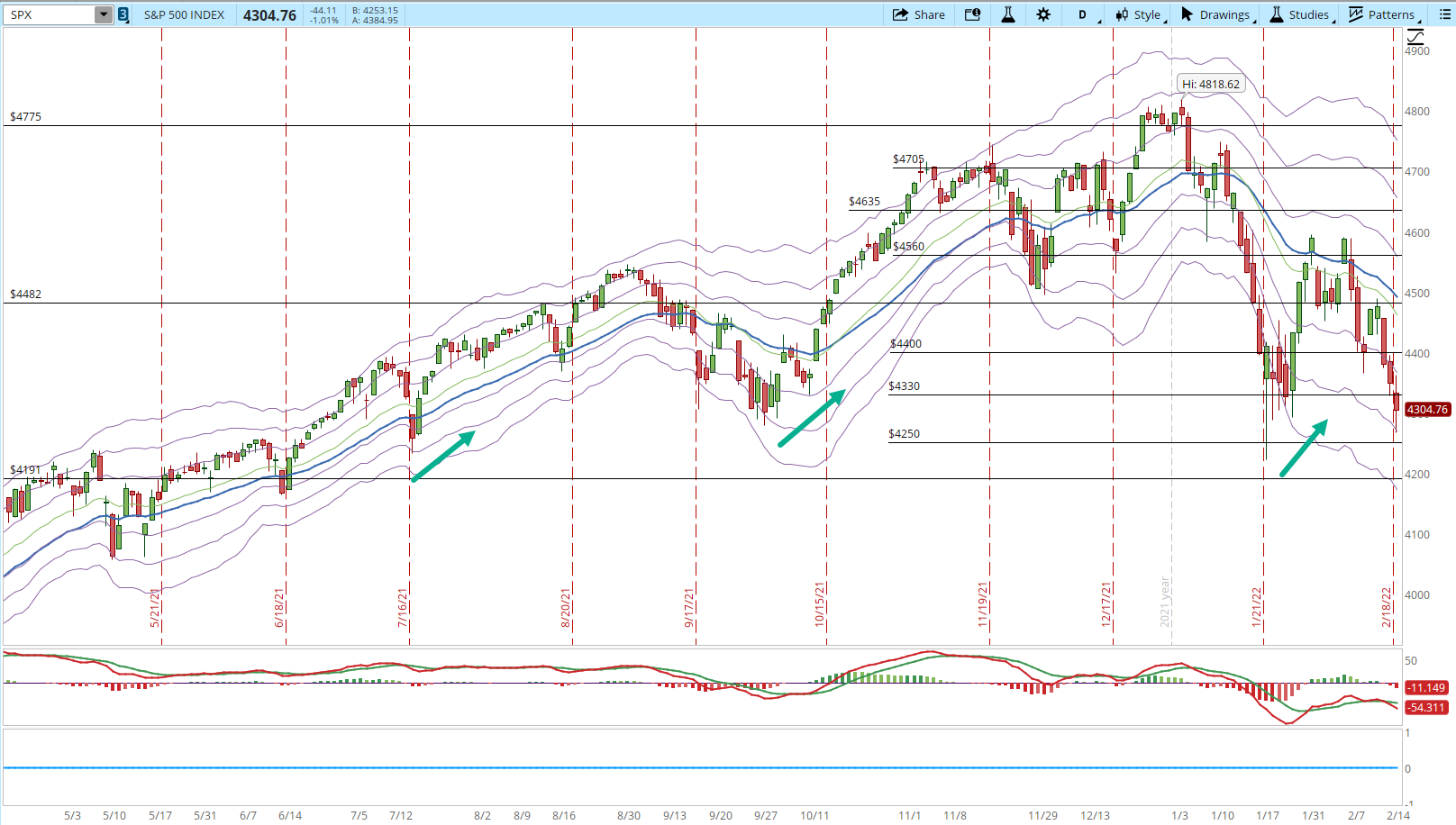

As Russia started to send troops to separatist regions in Ukraine, the tensions escalated and the sanctions from USA and its allies started to move the indexes down. The selling pressure increased and now the next support is 4,250. There aren't signs yet, that the selling pressure is over.

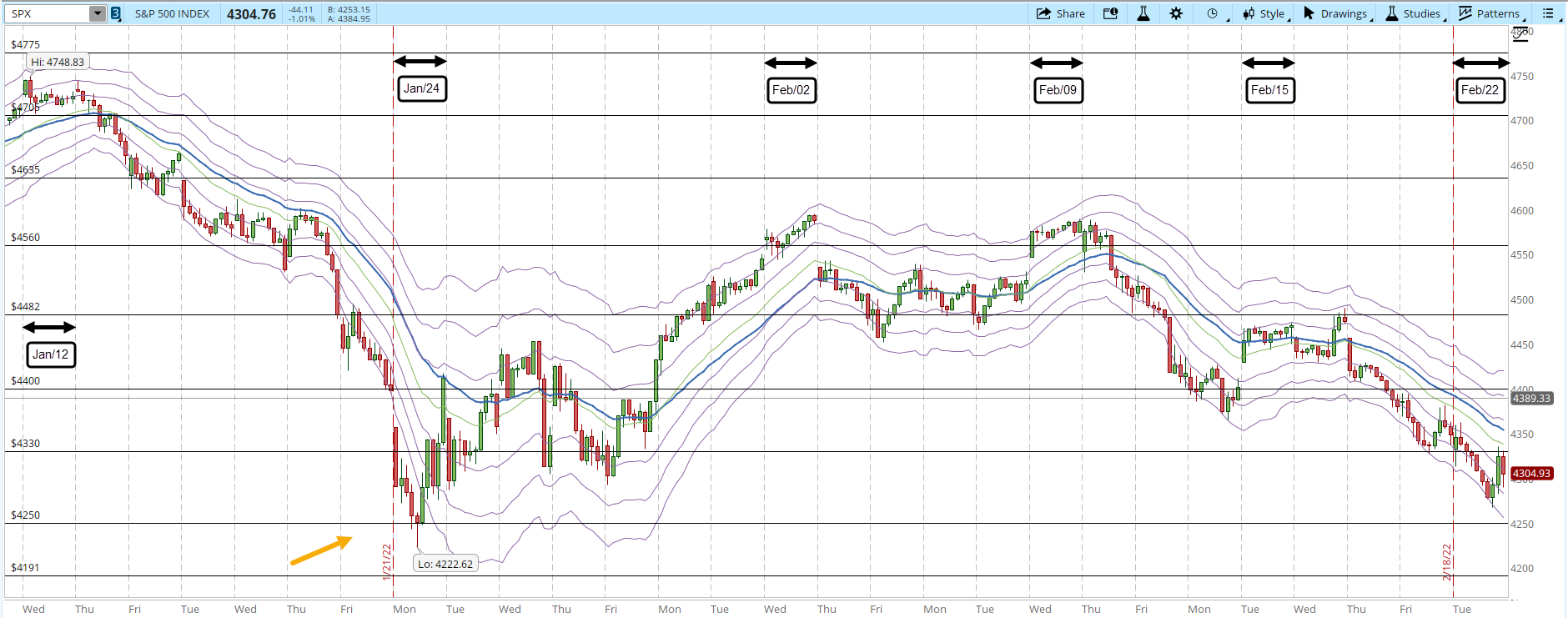

Reviewing the 39-min chart the S&P is testing the January's lows. The last time the S&P was around the current levels, the S&P rallied (orange arrow).

There isn't a law or a written rule in the Markets that whatever happened in the past has to happen again. Nevertheless, studying the past behavior gives us at least some idea of the probabilities we are currently facing. The S&P doesn't have to rally just because it has done that in the past (green arrows), but we can start interpreting the price action that we are about to see during the rest of the week.

If the S&P ends having a rally, even a small one, there is some demand entering at that level and the selling pressure would likely be diminishing. If the S&P breaks the 4,250 level then the Bears are still too strong and they will likely keep breaking through supports until they hit one that is strong enough to stop the fall. If the S&P starts to move sideways, the selling pressure would be diminishing at least until the Market decides in which direction it will go.

There is no need to forecast what is going to happen, it's impossible to do it with consistent accuracy, someone might be lucky a few times but not always. It's much better to interpret the charts and act accordingly.

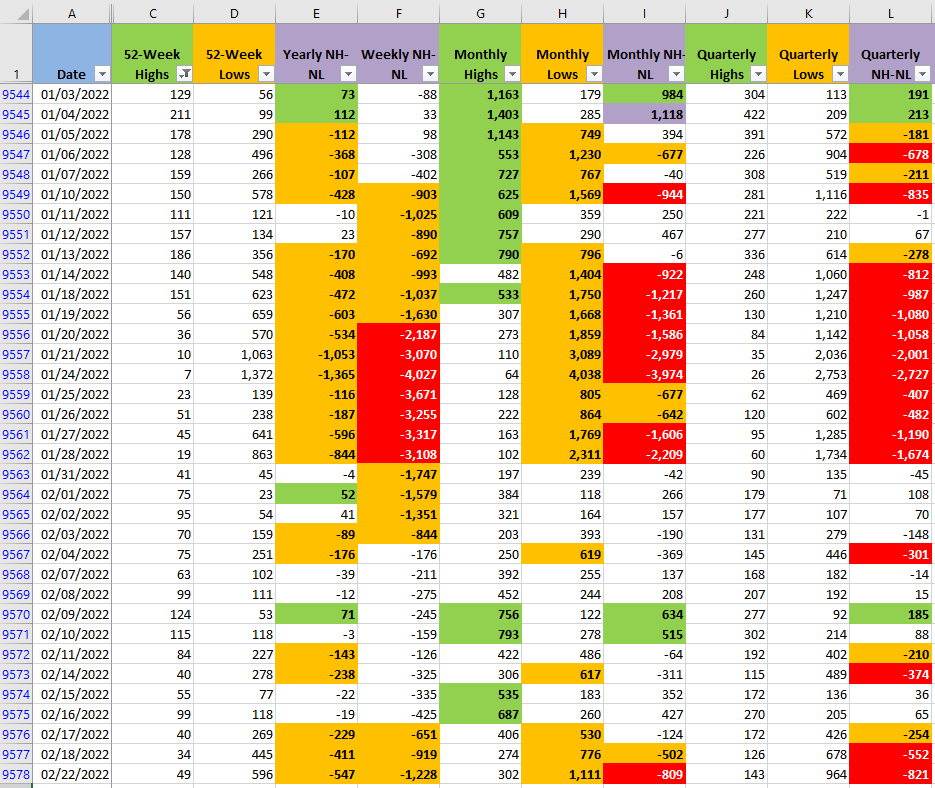

The New High and New Lows numbers also confirm the Bear's dominance, nothing surprising there, but it's important to keep monitoring the Monthly numbers. That's the fastest timeframe, and when things start turning more bullish, those are the columns that will move first (columns G, H and I).