The next following days look like they will be full of volatility. Today the S&P opened on a gap down and continued going down during the first three hours of the session. It almost reached the new weekly support at 4,191, losing almost 4% from the close of the previous session. Then it had a powerful rally that took it back to close a little bit higher than yesterday.

Does this mean that the Correction is over? I highly doubt it, it was nice to see some strength after the Bears managed to take down the S&P that much in a single session. A V-shape recovery can't be discarded but the index didn't go up much, it just went back to where it closed yesterday.

My personal point of view is that the volatility will continue at least the rest of the week. Some days the Markets will manage to go up, others they will lose the gains of the previous day. The Correction can still resume and eventually become a Bear Market.

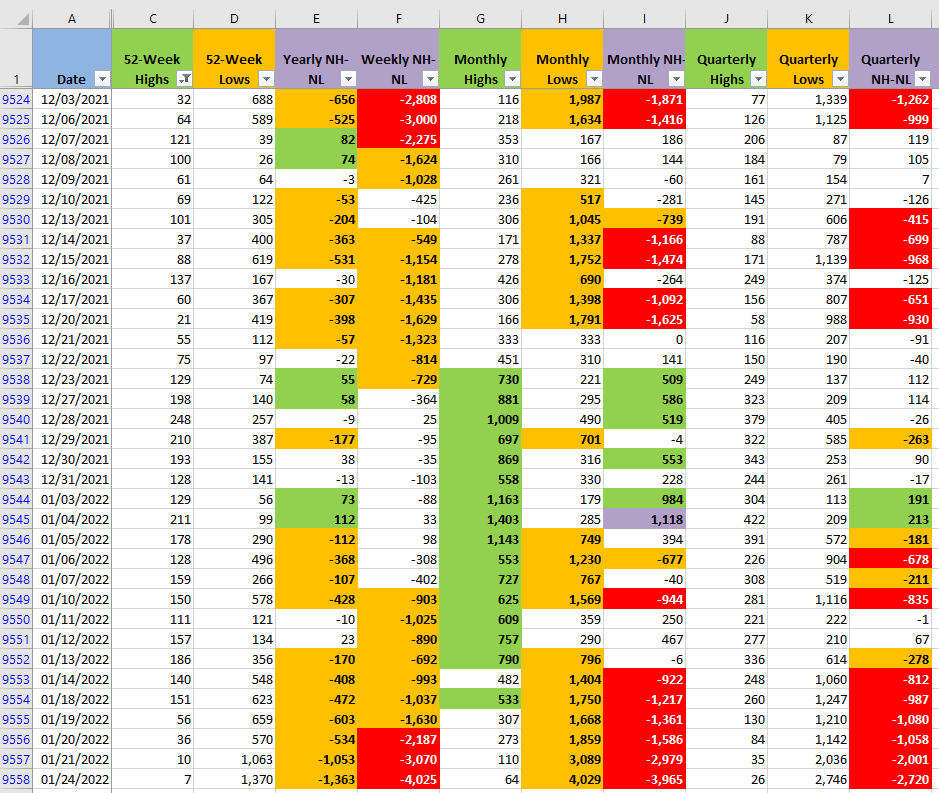

The reason I'm not that optimist yet is confirmed by the New Highs and New Lows in all the timeframes, they are still heavily bearish. It's evident from today's action that some of the selling pressure diminished. That doesn't mean that the Market is ready to start a powerful rally that takes it back at least to 4,700. Review column H, the monthly timeframe is the fastest one of all of the ones I track, the number of New Lows just keeps increasing and the number of New Highs is practically non-existent.

As a summary, there was some force displayed by the Bulls today. They are still alive and could eventually take back the control of the Market. As of today, the scenario still looks bearish, some selling pressure was absorbed, the lower prices were rejected and all those are good signals. But at this point I still see more likely that the Correction will resume rather than the Market is ready to have a powerful rally that takes it back to the levels where the S&P was in Jan/04.

Today I was stopped out from two long positions, on Friday I was stopped out from two other long positions. This is a critical time to have your stops updated, risk management will become even more important as more volatility starts to shake the Markets.

There is a quote I like, attributed to Victor Sperandeo that summarizes what I think is important in times like these:

The key to building wealth is to preserve capital and wait patiently for the right opportunity to make the extraordinary gains.

Victor Sperandeo