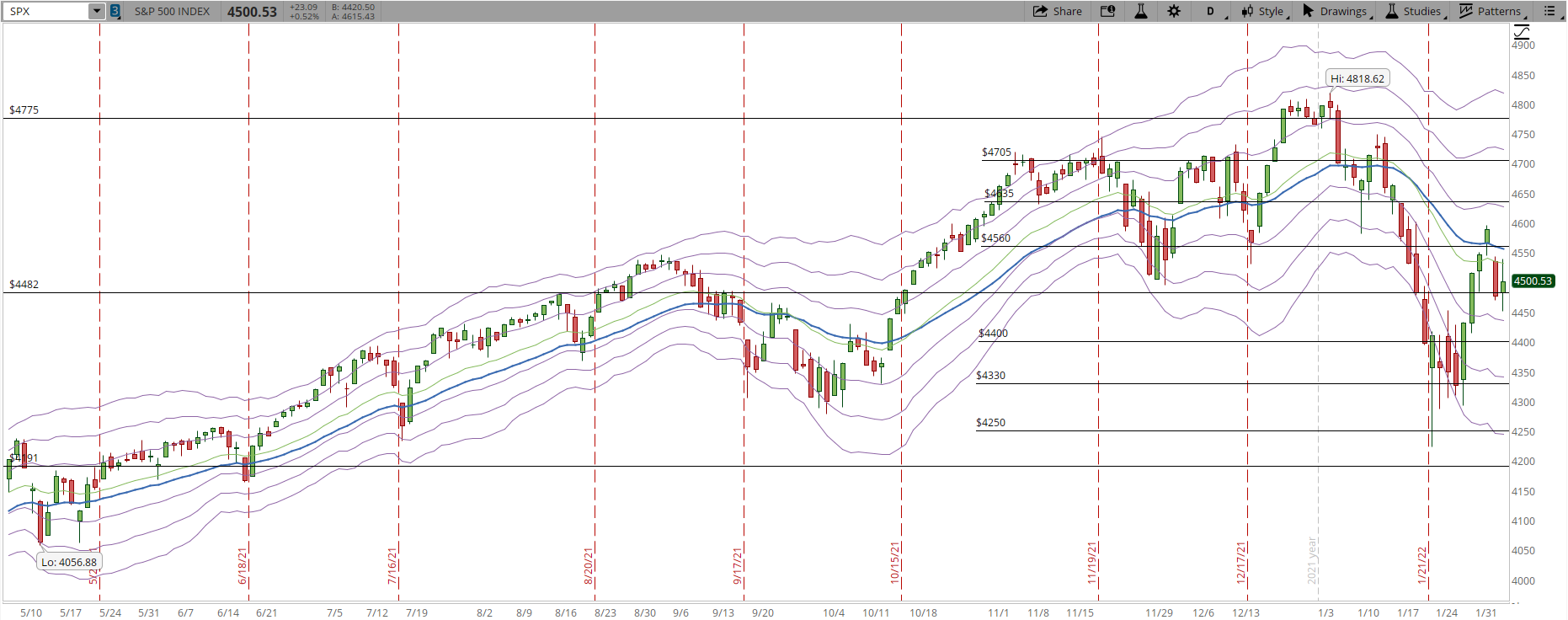

Supports and resistances are great tools that allow us to study the price action in depth. The S&P rallied from Jan/28 until Feb/02, that's four Market sessions (black dashed arrow in the screenshot below). On Jan/31, the second day of the rally I posted that 4,500 was going to be a psychological barrier that would be broken if the S&P had some real force behind the rally, you can see the full post in the link below. What we see today is again weakness, the S&P closed the week right at that level.

Jan/31 - A Spark of Strength in the MarketMarket Overview

The four days that the S&P rallied gave the illusion or hope that things could be changing, that the Bears would be losing the control and the selling pressure would diminish. That possibility still exists, however the last two trading sessions made clear that the Bears still have force and the Bulls are still weak.

Feb/02 was the only day where the S&P was able to stay above the 4,560 short-term resistance. It would seem that the S&P is moving, at least for now, in a trading range between 4,482 and 4,560. The Bears don't have the power displayed in Jan/13, but they are still being able to kill every rally in 4 days or less.

Taking a wider view, this time with the daily chart, we can see that there is a lot of price congestion between the weekly lines of 4,482 and 4,775. Since Aug/2021 that range of prices encapsulates around 80% of the price action. In order to get past that level and eventually get past 4,800 it will take several sessions with a lot of demand overcoming whatever supply keeps entering the Market.

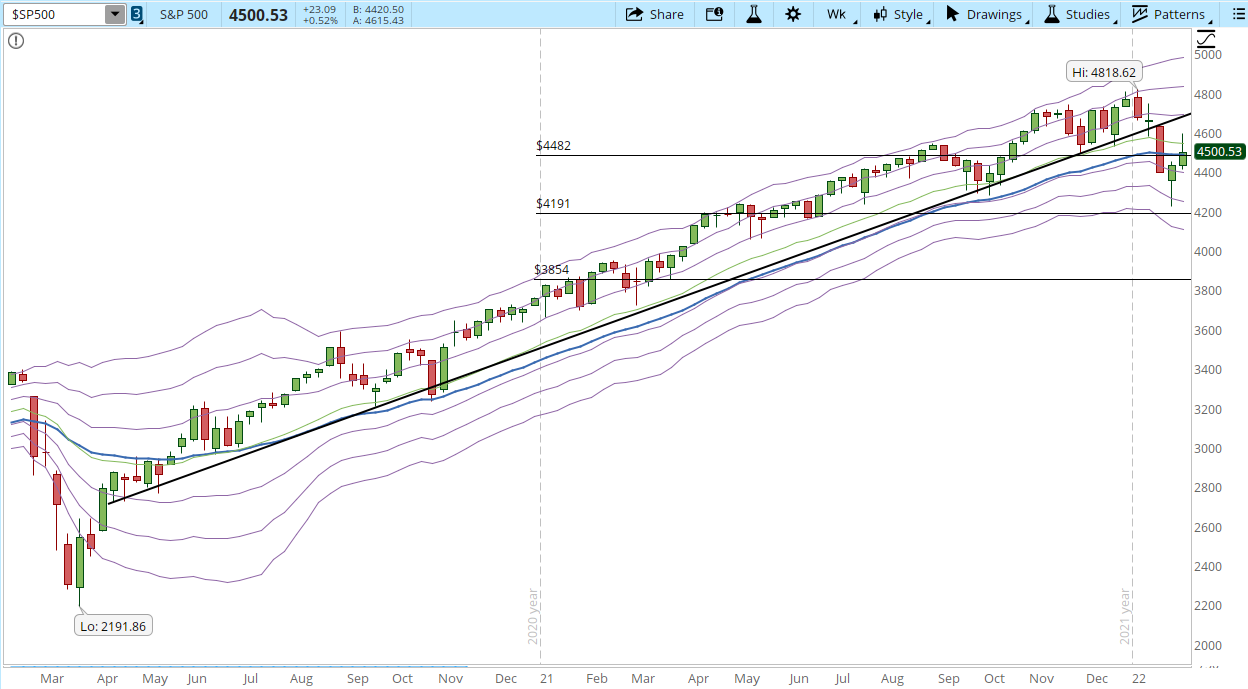

The weekly chart doesn't offer much information this week, it's still a good reminder of where we are and where we could be going next. The weekly uptrend was broken, the 30-week EMA flattened, we could be at the top of this uptrend, and the price is struggling to stay above the weekly level of 4,482 weekly support.

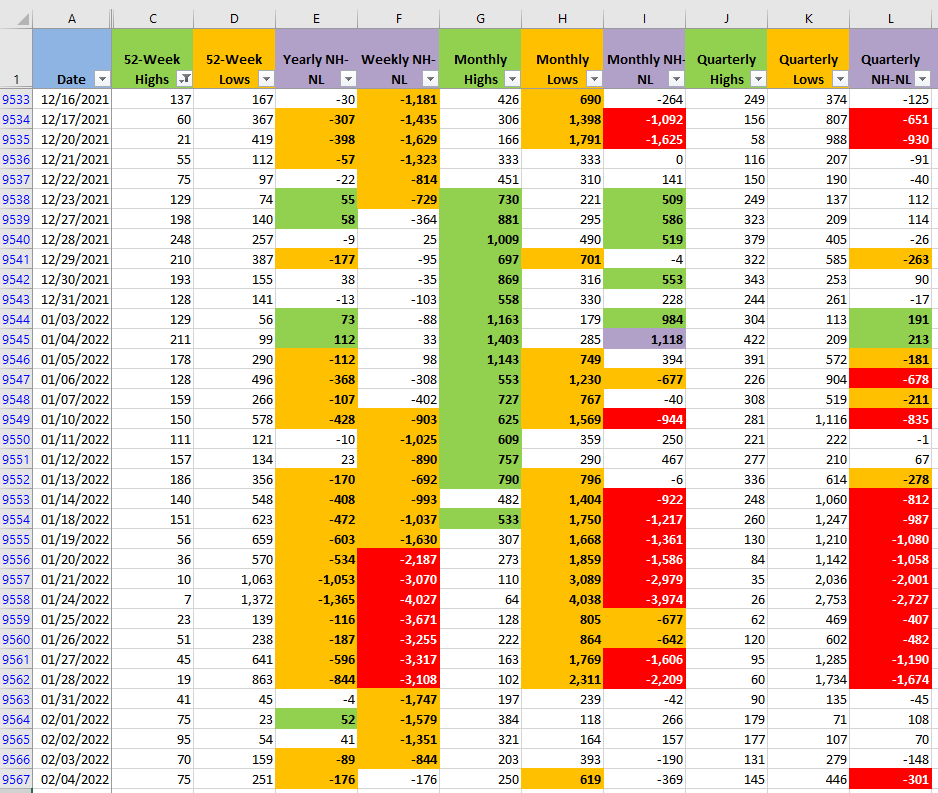

The numbers for the New Highs and New Lows are another important issue in the current Market. As I kept mentioning in previous posts, the New Highs never really went up significantly during the four-day rally that started on Jan/28. On Friday, the New Highs in all the timeframes were practically unchanged but the New Lows increased considerably.

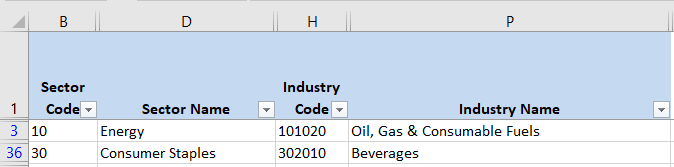

Industries

There isn't much change from last week in terms of strong Industries. Out of the 68 Industries based on the Global Classification Standard (GICS), I could only find strength in two of them, last week there were four. Another warning signal, if the S&P is going to resume the uptrend at some point, that can't be done with only a couple of Industries rallying out of 68.

Scenarios

- Scenario #1: From my particular point of view the most likely scenario is that the selling pressure will continue and during the week it could increase. The earnings season is not being impressive, the Fed's comments have been lately a constant risk that the Market keeps discounting every time, and the negative news about the virus sometimes drive the Market action. In terms of good news, I don't see many, at least not as strong as the negative ones that could take the S&P back at least to 4,700. In this scenario I'll keep on the sidelines with the possibility of tightening the stops I still have in the very few positions I still keep open.

- Scenario #2: Another possibility is that the S&P keeps moving sideways. A balance in the forces of Bulls and Bears until there is a catalyst that let us know in which direction the Market is likely to move. In this scenario I'll also stay on the sidelines, it might still be too soon to call this the bottom of the Correction.

- Scenario #3: Bulls aren't dead yet, if there is enough demand in order to overcome the selling pressure, the rally could resume. I don't see something that would trigger that amount of buying, but anything can happen in the Markets. If this scenario is the one that ends happening, I would only open new long positions if the force of the Bulls makes the S&P move decisively above 4,500 and ideally closer to 4,600.

Summary

The weakness in the price action, the lack of strong numbers in the New Highs but increasing numbers in the New Lows, only a couple of strong Industries and the fragility of the Market when news about the Fed or the virus hit the journals are all in the checklist of how weak the Market still is. From my point of view, the game right now is about capital preservation rather than profit making. Having the stops in place, tight risk management, it will be essential while the Market picks a direction.