The Market rallied today and I keep mentioning in my posts I'm still bullish while trading my strategy in the weekly charts. However, my bullish belief about the Market is being seriously tested with today's action. The Market did rally but there are warning signals that just don't go away.

One reason I just keep ignoring news is that they are, from my point of view, very unreliable. You need an incredible skill to try to interpret how the Market is going to discount whatever event happens during the day and then have a strategy in place to profit from that potential reaction.

Today the Fed was supposed to be the catalyst of the day, but the news they gave weren't really great and the Market still had a rally towards the end of the session lead by Big Tech. Basically the Fed is optimistic about keeping inflation under control and they are stopping earlier than expected the financial stimulus and projecting three hike rates next year.

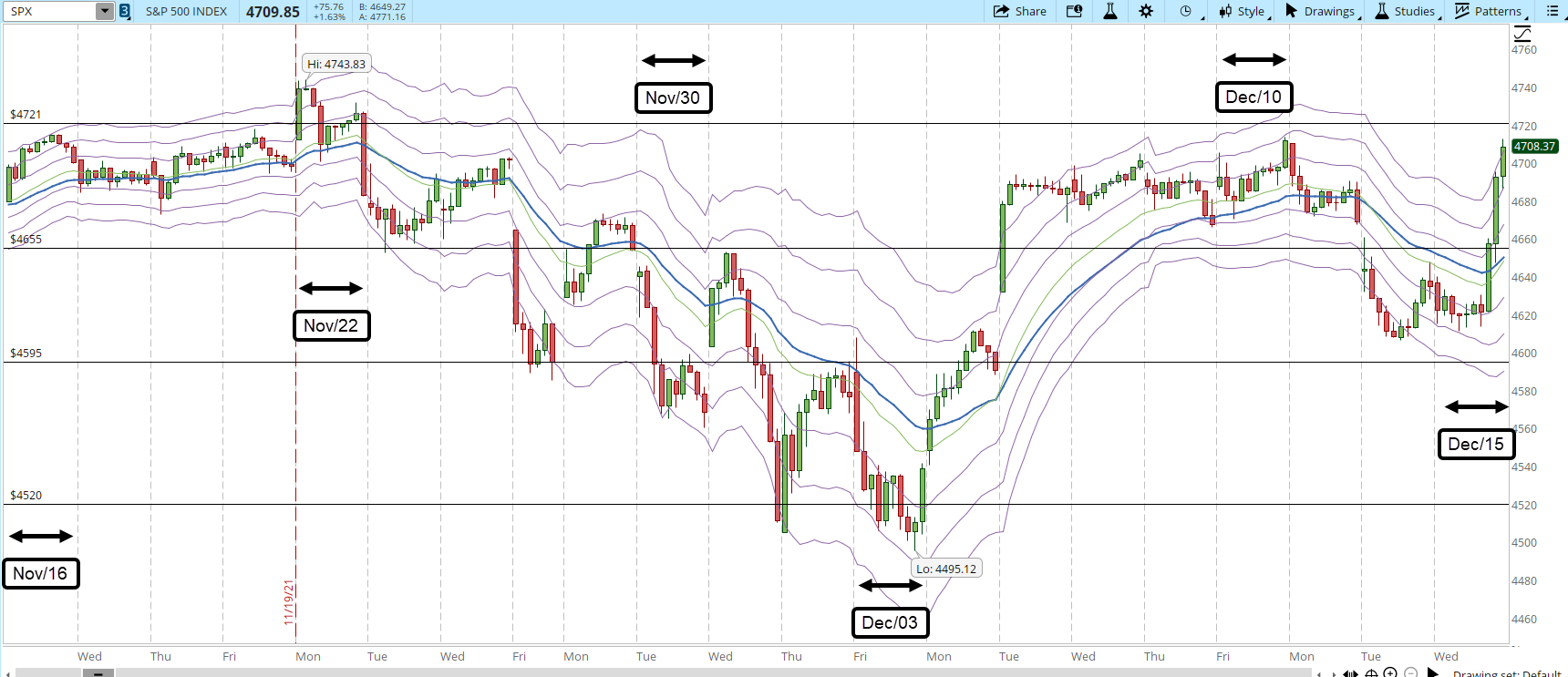

For me it's easier just to forget about all those news and see what happened in the charts, starting with the 39-min chart the Market is looking for a direction. After breaking the 4,655 support line yesterday today is back where it started, unable to break past the 4,721 resistance. Monitoring the important areas where the price action is happening makes more sense to me than trying to forecast what are the important news and how the Market will react to them.

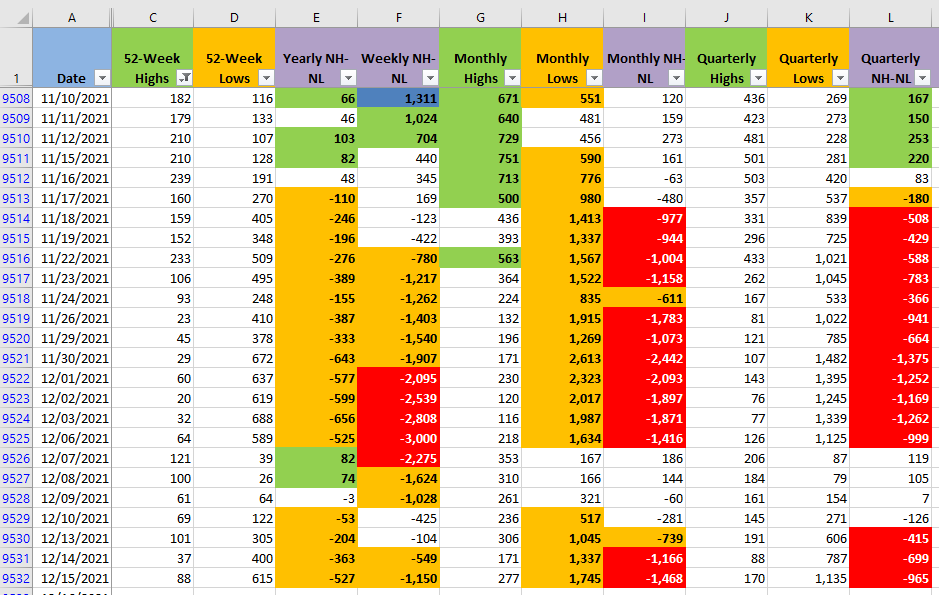

Unfortunately technical analysis can have it's own contradictions, the Market rallied but the number of New Monthly Highs vs Lows (click the image to magnify it) keeps showing that Bears are the ones still in control. Checking columns G and H the number of Highs did increase but the number of Lows increased a lot.

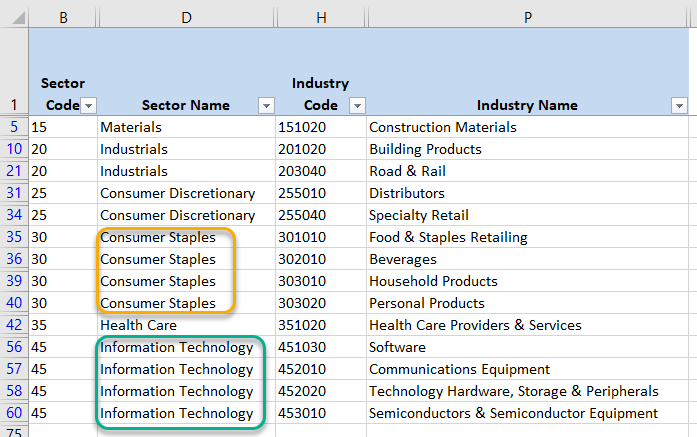

I have a theory about why this could be happening assuming that the data is correct (I get the data from barchart.com). In my latest Weekend Market Overview post I highlight the Industries where I see strength. You can see the entire post using the link below and a screenshot from those Sectors/Industries too:

Uncertain times around Market Resistance

Consumer Staples is considered a Sector with defensive stocks because those stocks produce things that are daily necessities, even when the economy is weak people has to buy those products. Consumer Discretionary is the opposite, people spend in non-essential products when the economy is strong. So what could be going on is that the big portfolios are being rebalanced towards stocks that are considered to be safer if the Market is reaching a top.

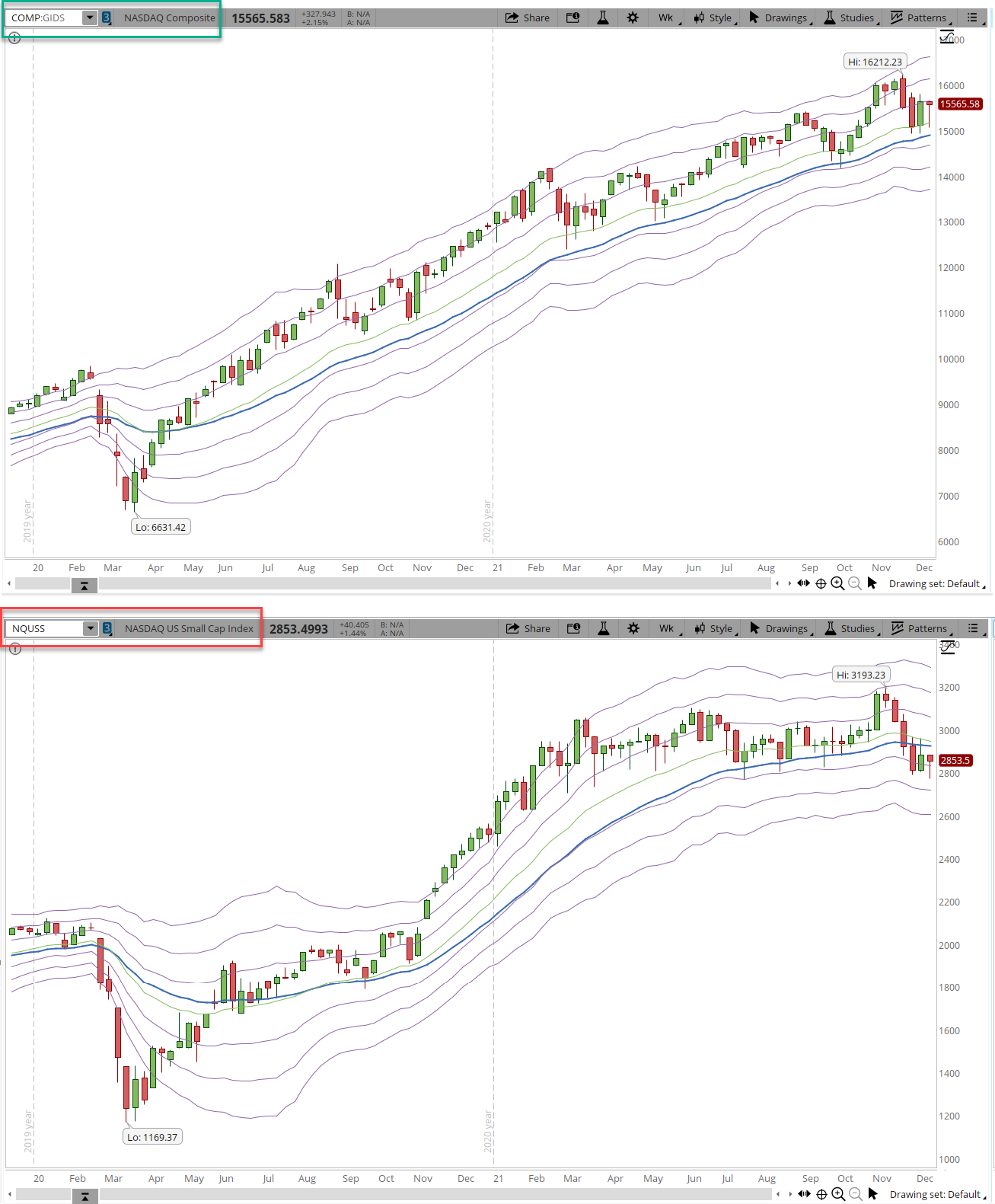

What about Information Technology? What I think that could be happening is that the same big funds are buying IT stocks but not all kind of stocks, only the ones that are considered safe. The NASDAQ Composite rallied today 2.15% leading the Market rally. There is another index the NASDAQ US Small Cap Index (NQUSS) compare the charts below, one is in a clear uptrend, the other one is going nowhere (click the image to zoom in).

So how is all this related to the weird numbers in the New Montly Highs vs Lows? Big Market players could be buying but just high quality stocks. Those are the stocks that are rallying such as AAPL, but the small companies they just keep falling. The risk appetite seems to have disappeared, at least for now.

Today one of the stocks that I monitor triggered an alert, Tower Semiconductor (TSEM). I didn't buy it, I already bought NXP Semiconductors (NXPI) on Nov/06 last year, a position that I still keep open and I didn't see any benefit of adding more risk in the same Industry while conditions keep deteriorating. Until there is more clarity about the Market direction I'll stay on the sidelines, once I see where things are headed I'll start opening new positions.