The S&P keeps moving sideways after it gapped down on Feb/03. There isn't yet a good clue about the direction that the Market could take in the future. However, the selling pressure that entered the Market on Jan/13 is much less powerful now that it was back then. It could potentially signal that the Correction is starting to trace a bottom rather than continue towards becoming a Bear Market.

All the main indexes ended with marginal movements today, some of them with a positive movement like the small-cap S&P 600 with a +0.09% advance or the large-cap S&P 500 with a loss of -0.37%. Reviewing the 39-min chart of the S&P 500 the sideway movement just continues. There is a temporary balance in the force of Bulls and Bears with less volatility than in the past few weeks.

In a short-term view it will be interesting to see if the S&P moves and holds above the resistance level of 4,560 (green circle) or declines and stays below 4,400 (red circle). Right now the S&P is just oscillating around the 4,482 line for the past three days, eventually something will make it react and go in either direction, start testing new levels and that's when we can see if it rejects or not the new levels.

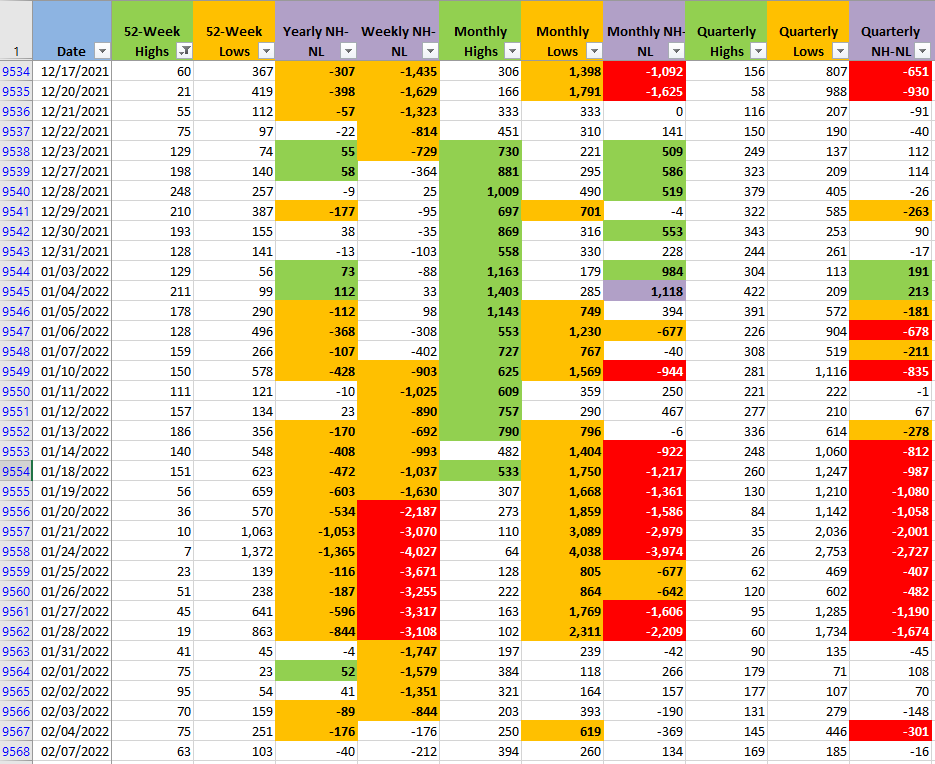

The New Highs and New Lows (NH-NL) displayed an improvement in the New Lows numbers, the Monthly columns are the fastest timeframe that I track, those are the very first numbers that will alert of important Market movements other than the price and the volume. If the Monthly Lows start to increase rapidly and they hold those levels (i.e. see the numbers for Jan/13 - 28), it will be a reflection of the selling pressure dominating the Market.