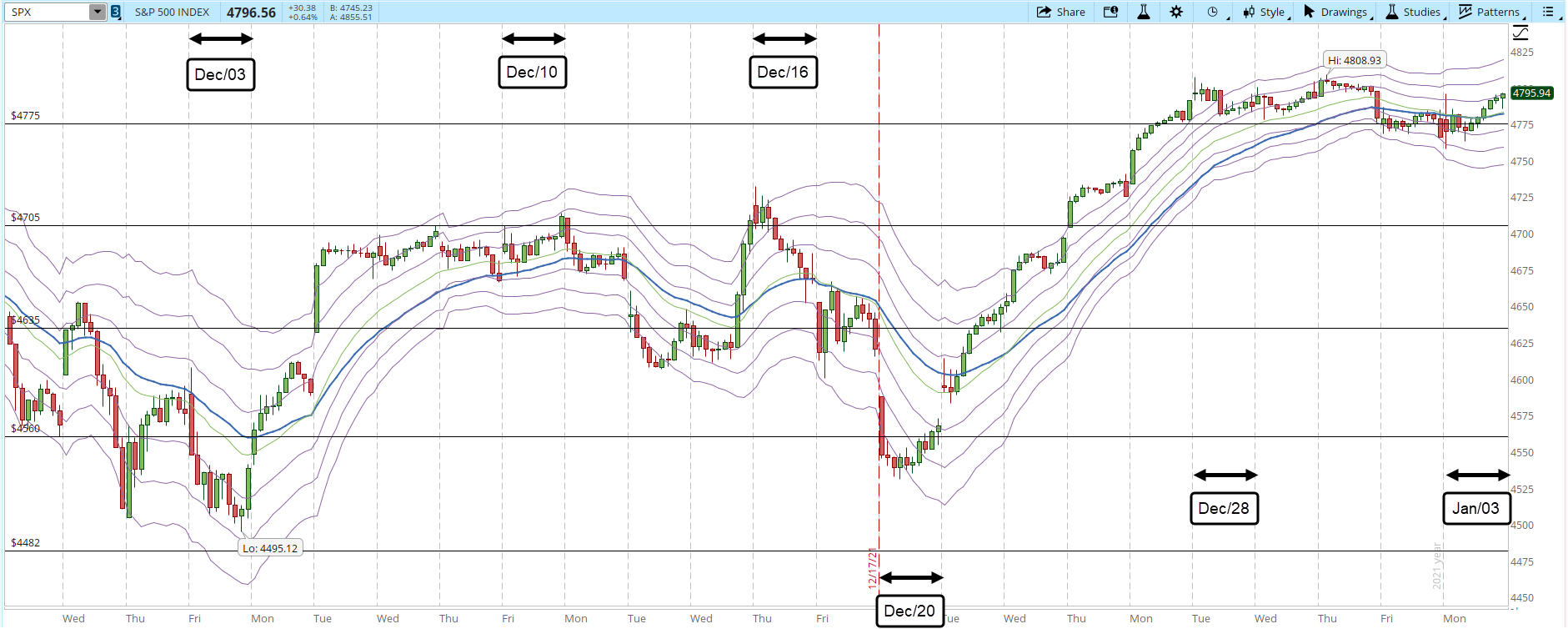

It's almost impossible to get certainties when trading the Markets, today there was another rally, not as powerful as the one that broke the resistance level at 4,775 but still a rally towards the end of today's session. The importance is that the S&P rejected the prices below the weekly resistance line. With this lack of direction tomorrow anything could happen, another rally, a correction breaking the resistance line, which is becoming a support, or nothing, just sideways movement. We have to be ready for any possible scenario and act accordingly.

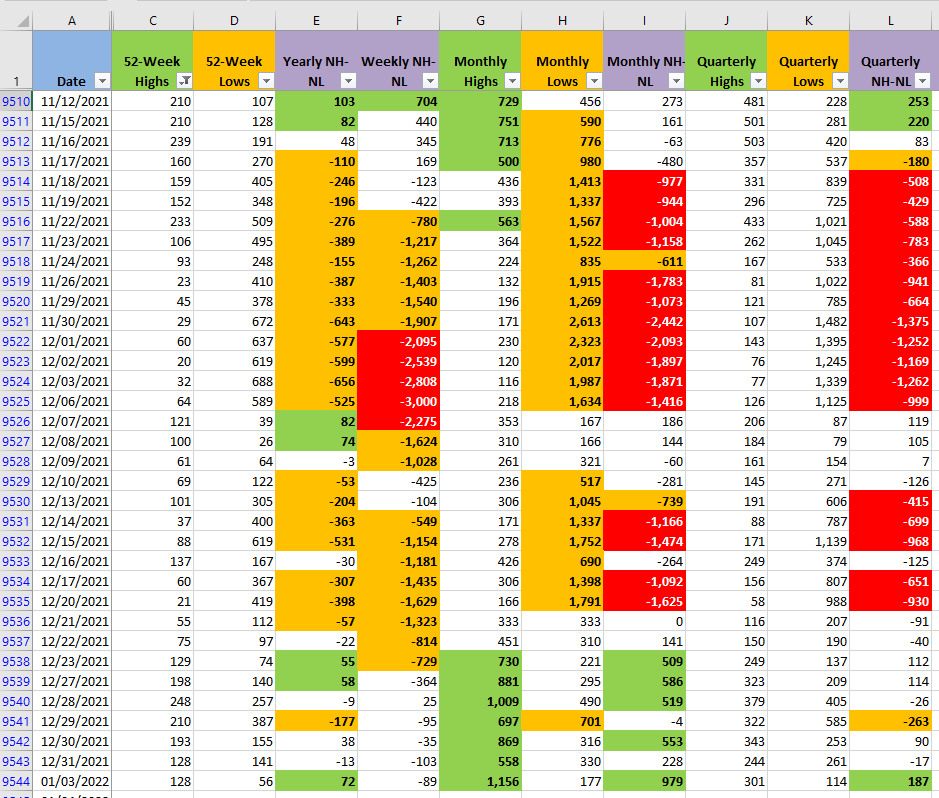

In terms of the New Highs and Lows things turned bullish quickly. All the timeframes are now showing strength so I opened three new positions. There is the risk that I get stopped out if tomorrow the 4,775 level gets tested and never actually becomes a strong support where the rally can resume.

In my last Weekend Market Overview post I mentioned several scenarios, in one of them I was going to open new long positions in the others I would stay on the sideslines (link below), additionally I mentioned that I was considering trading the First Higher Low strategy (1-HL) which I also ended doing today.

Jan/02/2022 - Weekend Market Overview - Happy New Year - 2022With Stan Weinstein's strategy, I traded Constellation Brands (STZ) and for the 1-HL I traded Xilinx (XLNX) and Advanced Micro Devices (AMD). All the three positions on the long side. The next step will be to see if the Market can rally with force again or it will keep testing the 4,775 level.