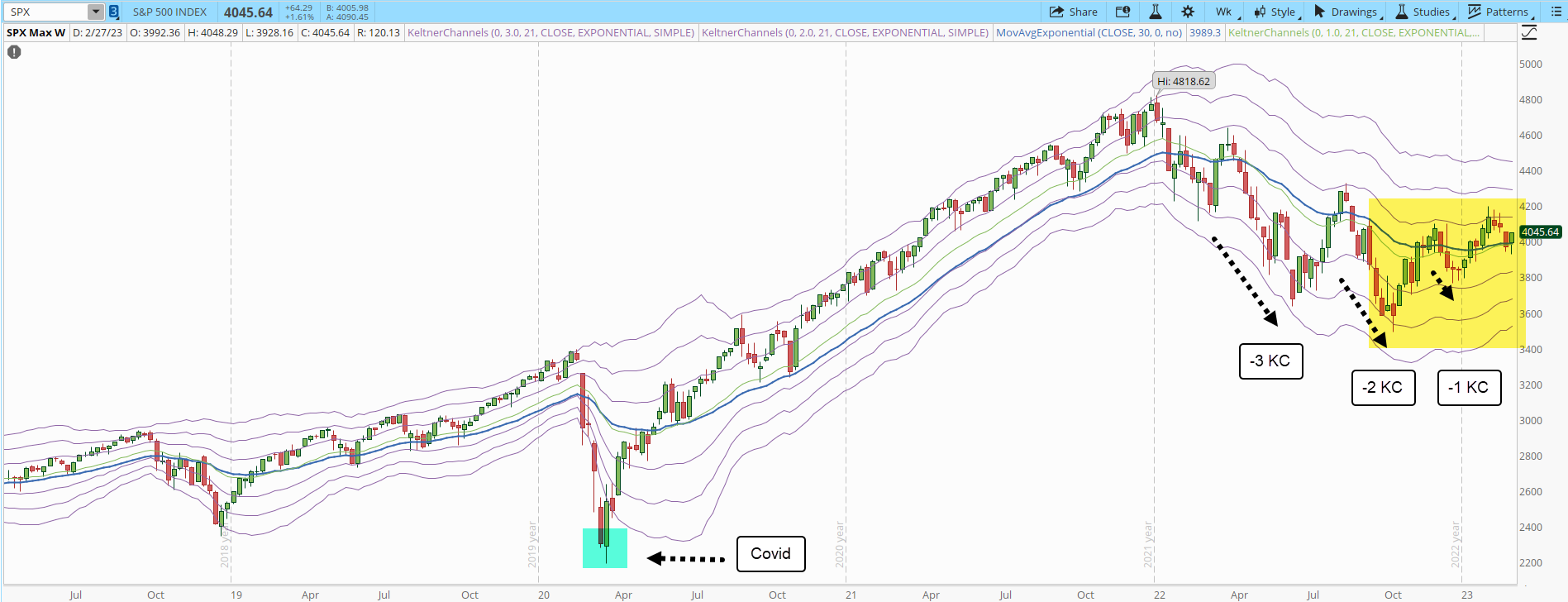

The Bulls managed to stop the Market decline after it reached its current low in Oct/2022. If we review past powerful Bear Markets it would seem that quick V-shaped recoveries were the norm. The current situation is different, low demand and risk appetite, if we are really at the bottom of the Bear Market, the Bulls are failing to create a powerful multi-month rally. Anything could disrupt the fragile bottom that seems to be tracing the weekly chart of the S&P 500.

1980-1983 Recession

This won't be a long and/or boring history lesson, but a similar situation like the one we are currently living happened between 1980-1983. The yellow highlighted area were 6 months of sideways movement before the Bear Market resumed its downward trend. It wasn't until Aug/1982 (blue highlighted area) where a powerful v-shaped recovery took place and started breaking every resistance in its way for almost an entire year. During these years there was a tight monetary policy, in an attempt to fight mounting inflation, which triggered a recession. Sounds familiar?

1987 Black Monday

There isn't a consensus about the severe and unexpected 1987 Market crash. Some say it was a largely overdue correction from a powerful Bull Market, others that it was the tax bill introduced a few days before the crash. Whatever it was, the decline was sharp, quick and it only lasted a few weeks. The recovery started only 7 weeks after the Bear Market reached its bottom and it lasted two years. Another powerful v-shaped recovery.

2000 Dotcom Bubble

The Dotcom Bubble effect lasted a little bit more than two years until the Market finally reached a bottom. This time there wasn't a v-shaped recovery. The Market was moving sideways around 7 months before an important rally took place. The message is that, despite how severe a Bear Market is, it will not always necessarily bounce back in a v-shaped quick recovery.

2007-2010 Subprime Mortgage Crisis

One of the most powerful Market events in modern history is the Subprime Mortgage Crisis. It put the financial system in the verge of collapse, it took the S&P 500 one and a half years to reach a bottom. Despite the severe decline, this is another sample of a v-shaped recovery in a powerful Bear Market.

2019 and 2022

When the Covid pandemic hit the planet, there was a quick and powerful Market crash, the recovery was also very powerful, and also had a v-shaped form. If we compare all these powerful declines with the current one, it makes me wonder if we are really at the bottom.

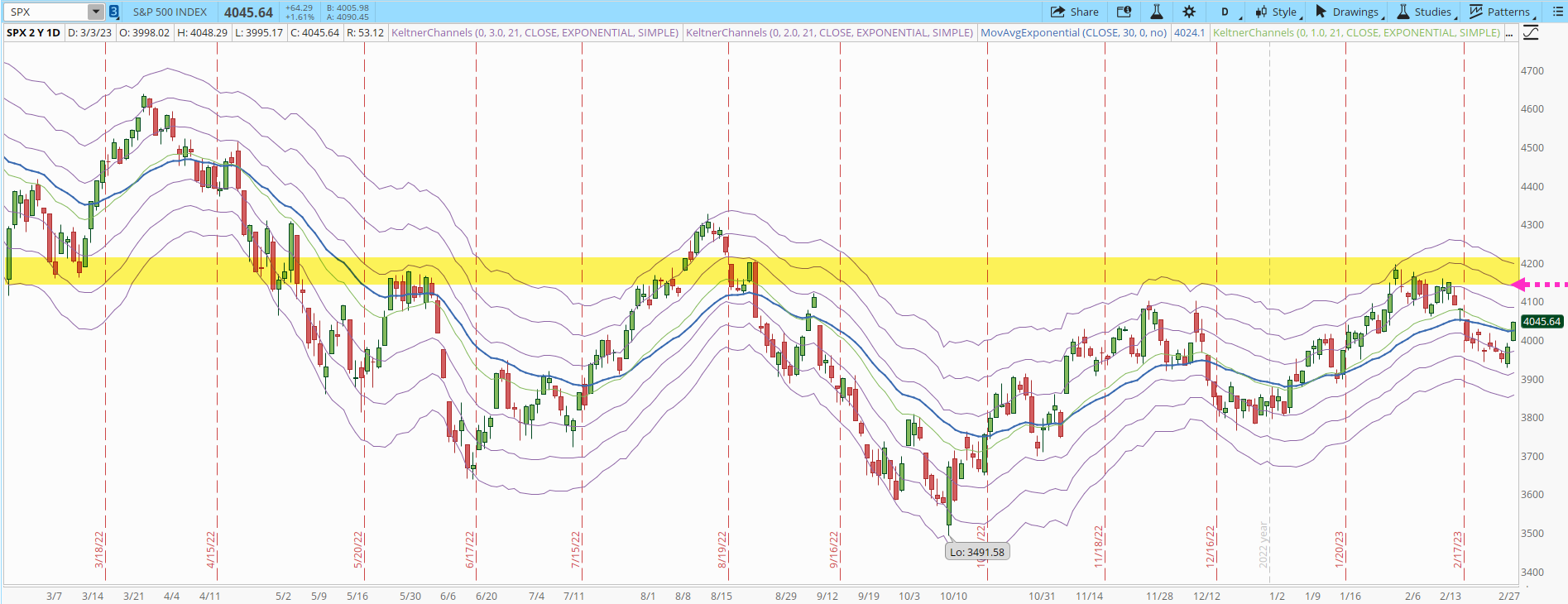

Certainly the Bears have lost some force, as I have explained in past articles, the Keltner Channel (KC) level that the recent declines are reaching is less powerful every time. However the risk appetite is low, the demand isn't exploding, at least not yet. I have mentioned two important milestones to monitor when trading on the long side (4,150 and 4,350).

The Bulls haven't been able to create enough demand to even get past the weekly +1 KC in the S&P 500 chart, it has become an important resistance level since the Bear Market started.

Summary

When reviewing Market charts in hindsight, suddenly everything turns very easy and obvious. Trying to understand the current Market behavior is very complex, especially when there is the possibility of losing money if you take the wrong decision. I have closed most of my long positions, I just keep 4 pilot trades and 1 position that I started pyramiding in Jan/2023.

The pullback that started on Feb/03 seems to have triggered a reaction rally. Those rallies are short-lived and expected. The rally will be significant if it manages to close above 4,150 (pink arrow in the screenshot below, S&P 500 daily chart). I'm not optimistic that is something that can happen during the next trading week. There's too much volume in that zone, it will be a strong resistance to break (yellow highlighted area). But if it happens, then there is hope that an important multi-week rally can start.

Follow your plan, if there are opportunities, you have to pull the trigger and maintain a very strict risk management. At this point it's suicide to just keep mindlessly buying hoping that at some point you will get lucky and the Market will go to the moon. The Bears are temporarily too weak to resume the decline and the Bulls aren't creating any important demand to break the 4,150 resistance. Nothing has been decided yet and the Market has the final say. Ignoring risk management will blow up your trading account, which automatically takes you out of the game. Trade safe and if there's nothing that matches your strategy just wait on the sidelines. Eventually the opportunities will come.