During the Holidays period there weren't powerful catalysts that generated important movements. Only during last Friday Jan/06, there was a movement that looked like the beginning of a reaction rally. Before that, the previous eleven days, the S&P 500 was just moving sideways, the longest period since Nov/2021 without important ups or downs.

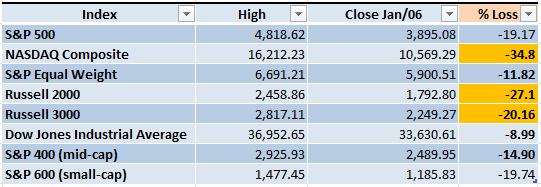

With the gains from Friday Jan/06, some important indexes officially left Bear Market territory (a loss of 20% or more from the previous high). I still keep my estimate from last week, if the rally continues the S&P 500 will probably go to a level around 3,950.

Market Overview

It has been a year now, since the Market started tracing a clear weekly downtrend (lower lows and lower highs, highlighted by black horizontal lines in the screenshot below). The pattern, as I have described it in previous articles, is easy to follow. When the index reaches the -3 KC in the weekly chat of the S&P 500, there is a rally (green arrows). When the index reaches the +1 KC (yellow highlighted areas) there is a sharp decline.

It's impossible to predict when the pattern will stop, but at this point it's intact. In order to show some force, the rally should close above 4,150. The downtrend structure will be severely damaged at 4,350.

The levels of 4,150 and 4,350 are unlikely to get hit during the next trading week. During 2022 only three times the S&P 500 was able to get to the +3 KC on the daily chart (yellow highlighted areas). The rest of the times it stopped at the +1 KC or below. In order to show some force, the Bulls need to get to the green dotted line, and in order to seriously damage the weekly downtrend structure, the rally must reach the level of the blue dotted line. It hasn't happened a single time, since Nov/2021 that the index is able to cross past the +3 daily KC. Those are highly overbought levels. If that happens then some serious demand is starting to enter the Market.

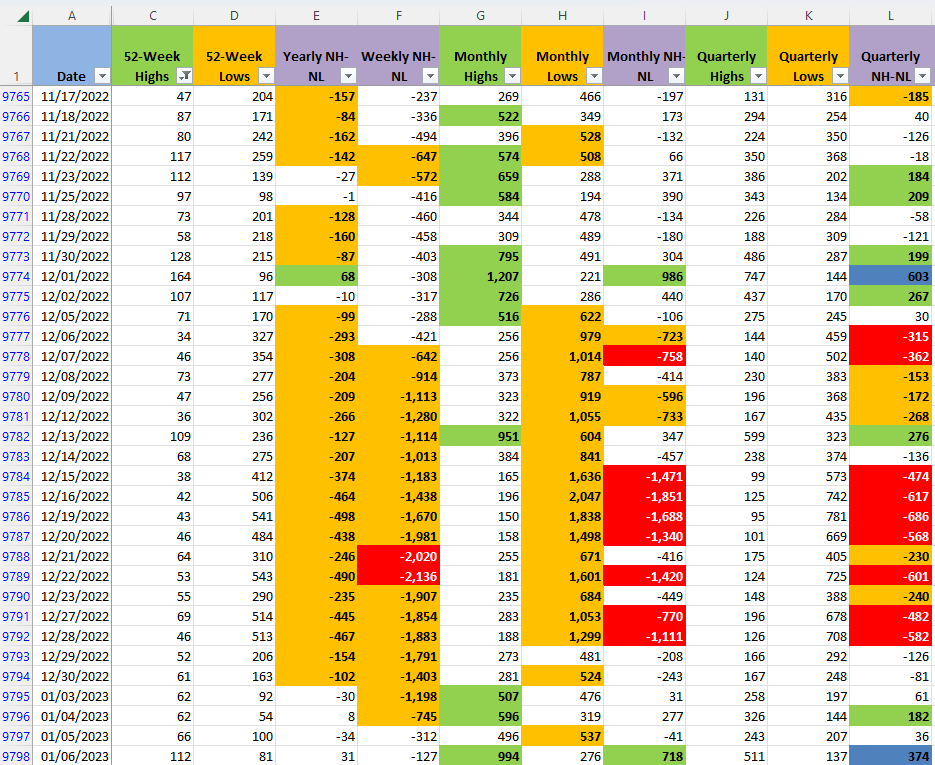

The New Highs and New Lows (NH-NL) numbers barely confirm the bullish force. Only Friday Jan/06 was really bullish, unfortunately a single day of strong demand doesn't mean much.

Industries

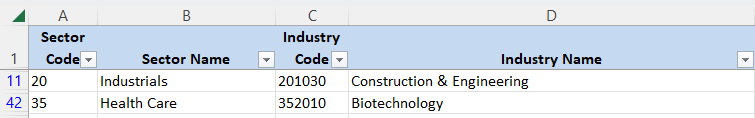

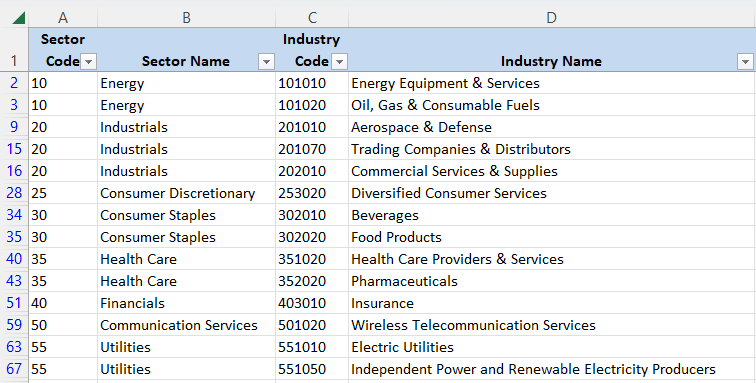

There isn't much change in this section. The Bears seem to be losing some of their power. From the 68 Industries that compose the Global Industry Classification Standard (GICS), 26 have had their weekly downtrend structure damaged. Another 26 are still in a clear weekly downtrend. The 'Construction & Engineering' Industry ($SP1500#201030) and Biotechnology ($SP1500#352010) continue to be the ones that could start a strong uptrend.

The rest of the Industries, that could have a potential breakout in the next few weeks are displayed below:

Scenarios

Scenario #1: The most likely scenario for the trading week about to start (Jan 09-13) is that the rally will continue a little bit more before stalling or pulling back. I still consider a realistic target the levels of 3,950 - 4,000. In the unlikely event where the rally manages to reach 4,100 or above, then we would need to understand what's fueling the movement and if it can transform a reaction rally into something stronger.

Scenario #2: If the rally fails to continue, the second most likely scenario is that the decline will resume. If the Bears recover their force, a level around 3,700 for next week would be realistic. During 2022 the negative news dominated most part of the year. Unfortunately, those negative catalysts remain unsolved. The one that will continue to be a key factor to monitor will be the levels of inflation and if the economic measures lead to a recession.

Scenario #3: The least likely scenario is that the sideways movement continues. The holidays are over and eventually the Market will find a direction. We already saw the S&P 500 moving sideways for eleven days. I doubt it will continue this sideways movement for long.

Summary

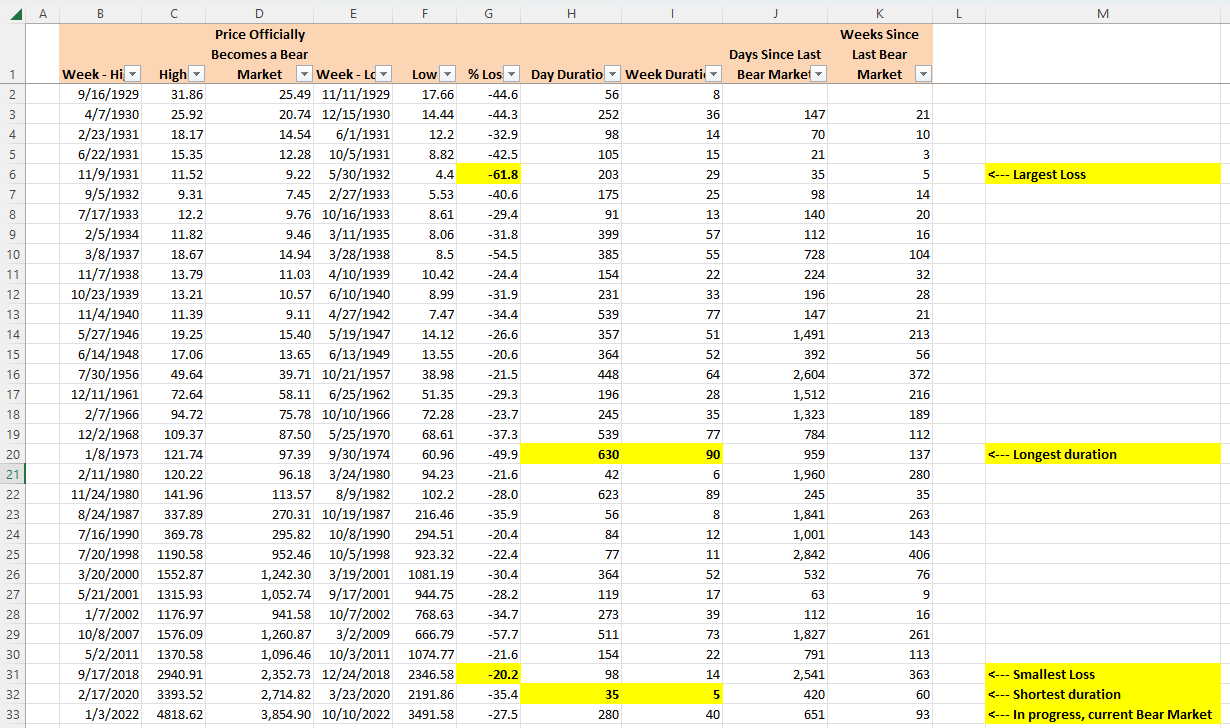

The first trading week of 2023 didn't bring major news. The Bears are still the ones dominating the Market. This Bear Market is testing my patience. A few weeks ago I presented the table below. Column I, displays the duration in weeks from top to bottom of each Bear Market since 1929. The current Bear Market took 40 weeks, while the average duration is 37. The Bear Market that took longer to reach a bottom was the one in 1973, it took 90 weeks. Those numbers are just for reference, there are no guarantees in the Markets.

During times of uncertainty, I try to find some direction in different milestones or references like the one below. Even if history doesn't exactly repeat as in the previous Bear Markets, it's much better to understand if the current Market situation is still in line with the past or this is some kind of outlier and why.

Keep your risk management in place, the Bear Market isn't over, and the major indexes are 1% or less away from going back to Bear Market territory. If you lose your capital, there's no way to continue playing this game.