Yesterday we saw the S&P 500 pullback and today it recovered to a level a little bit higher than Tuesday. It would seem as if there is uncertainty about the 4,500 resistance and the price action keeps testing that level, some days it stays above it and others below, until there is a strong enough catalyst that decides whether the rally continues, stalls or experiences another pullback.

The rally is not necessarily over yet, but it's not really doing much progress anymore, today it just recovered the points that it lost yesterday. It's part of the argument I made yesterday, eventually there is a pullback and I would expect it to keep the close price above the -1 Keltner Channel (KC).

The only thing now is to wait the Market's decision. Is it going to move sideways? (black arrow). Maybe it will pullback, in that case I would expect it to stay above the -1 KC, if it goes below that level then there is too much selling pressure already (currently the -1 KC is at 4,290, orange arrow). Finally, but less likely, the rally could continue on its way up without much of a pullback (green arrow).

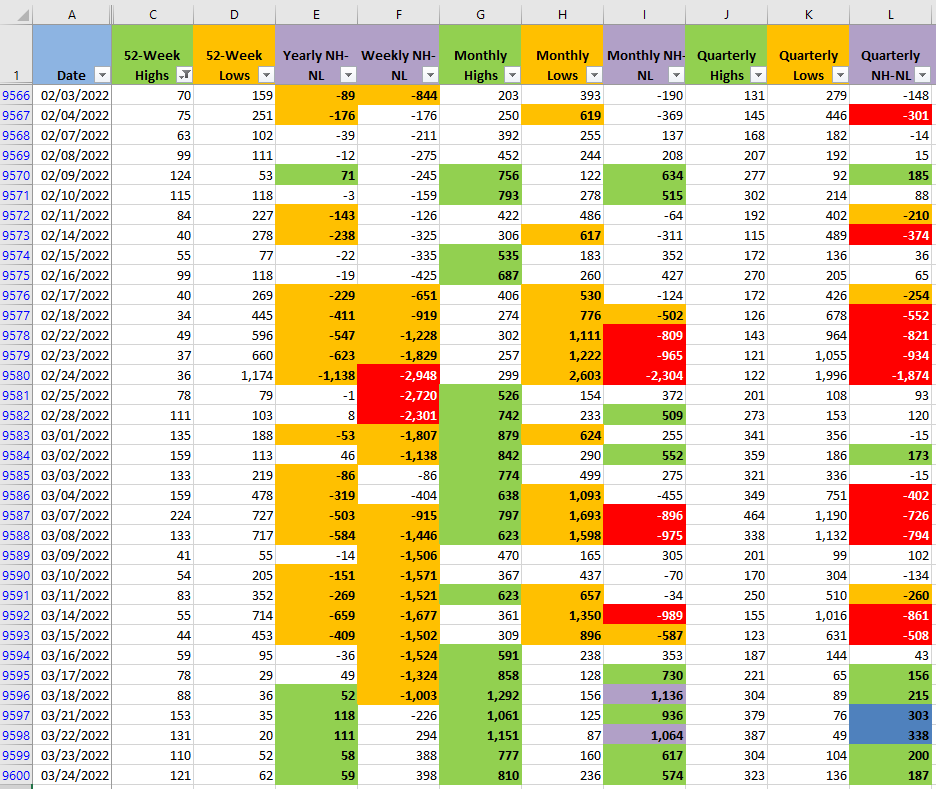

The New Highs and New Lows numbers don't reflect yet a significant increase in the selling pressure. Let's see what clues we can extract from the last trading day of the week. At this point, I can only see a rally that started on Mar/15 that seems to be topping but with a controlled amount of supply in the Market.