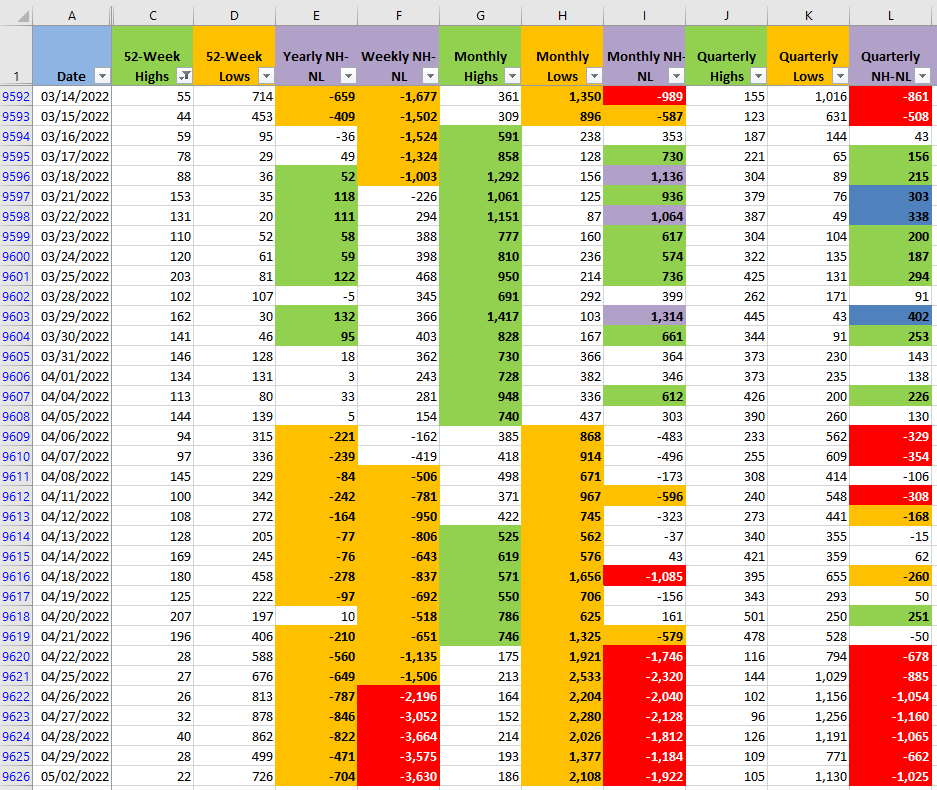

Some people might see some hope after the last minute rally we saw today in the main indexes. Unfortunately, I'm not one of them, certainly the lower prices were rejected but one of the things I have kept mentioning all last week is that the New High and New Lows (NH-NL) numbers aren't improving. If we check the fastest timeframe, which can be seen in the Monthly columns (G, H and I), the numbers improved on Friday slightly and now they are back above 2,000 New Monthly Lows.

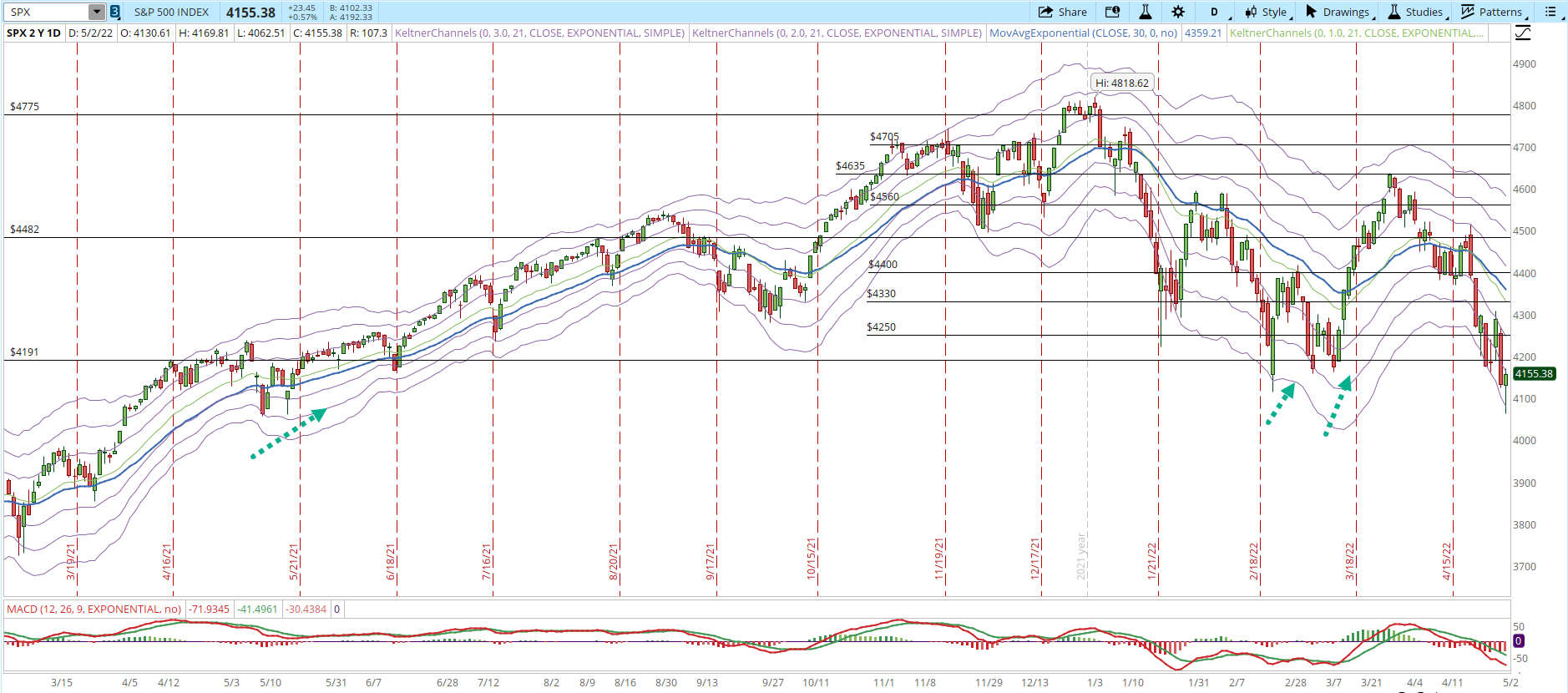

That's a huge number of stocks making new Lows on the last month with only 186 making new Highs. There won't be an important multi-day rally with the New Lows that elevated. There can be some reaction rallies, that's normal, but even that isn't happening. We are at oversold conditions (-3 Keltner Channel in the daily S&P 500 chart) and the index just won't have an important rally that takes it at least to the +1 KC.

I would be extra careful at evaluating that last minute rally. On May 3 and 4 the Fed will hold its next meeting and that could also add to the volatility that we already see because of the earnings season, the war, the inflation and the virus.

The 4,191 weekly support still has a chance to continue being called a support, in order for that to happen the NH-NL numbers need to improve, especially the Monthly New Lows need to decrease significantly and fast. The S&P 500 needs to rally above 4,200 and hold that level. If it continues testing lower levels around 4,050 and the Monthly NH-NL numbers continue as bearish as the past few days, then lower prices are likely to be on the cards in the near future.