Yesterday we had a rally based on the strong earnings that were posted during the day. Today that bullish feeling disappeared, important stocks such as Netflix (NFLX) posted losses. There was a lot of hype a few months ago when Bill Ackman bought $1.1 billion of NFLX stock, I have read estimates where his average price per stock was around $360 to $390. Today NFLX closed at 226.19, a loss of -35.12% compared to yesterday's price. That's probably a loss of around $400 to $500 millions for Pershing Square's investors.

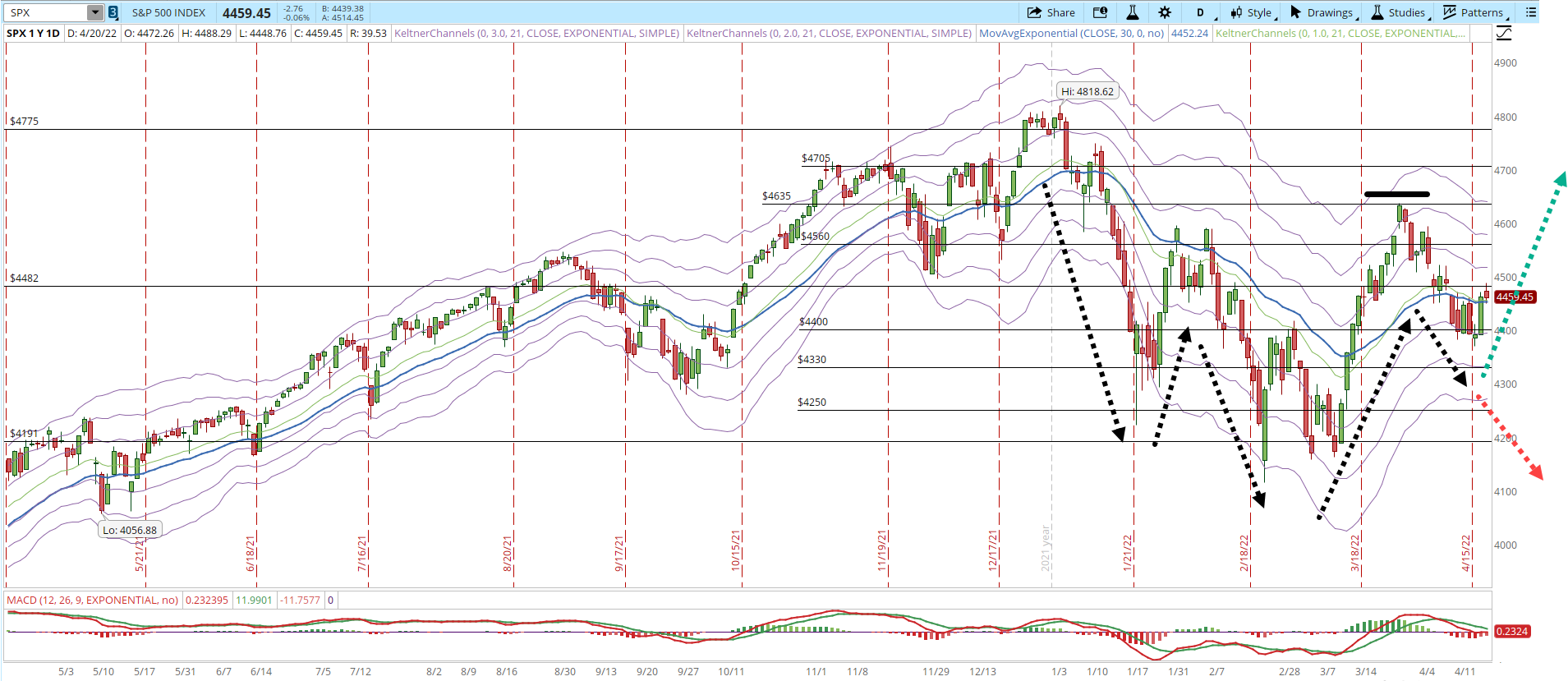

Reviewing the S&P 500, the First Higher Low pattern is still intact and has the chance to continue the rally. Still far from the previous high at 4,637 (solid horizontal black line).

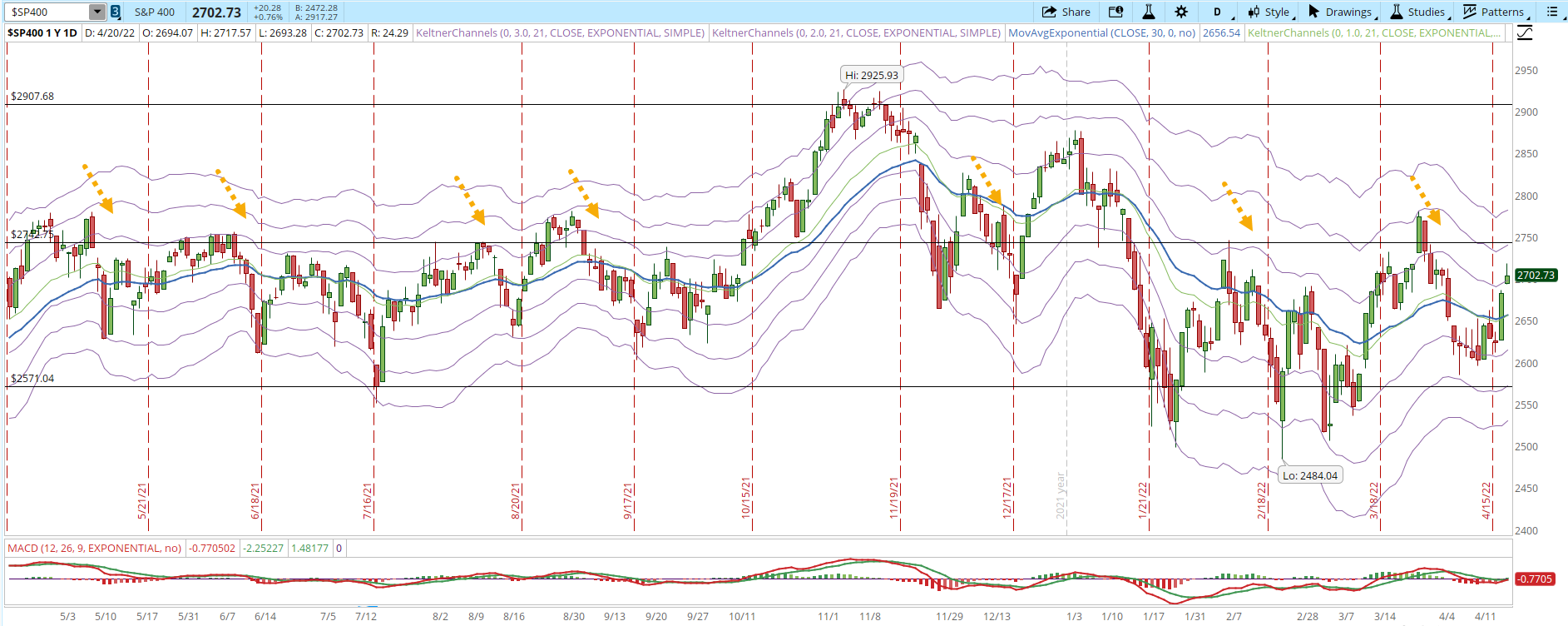

The S&P 400 (mid-caps) performed better today. However, despite having a much better day than the S&P 500, the mid-cap index still hasn't broken the 2,742 resistance where it has consistently failed during the last year (orange arrows).

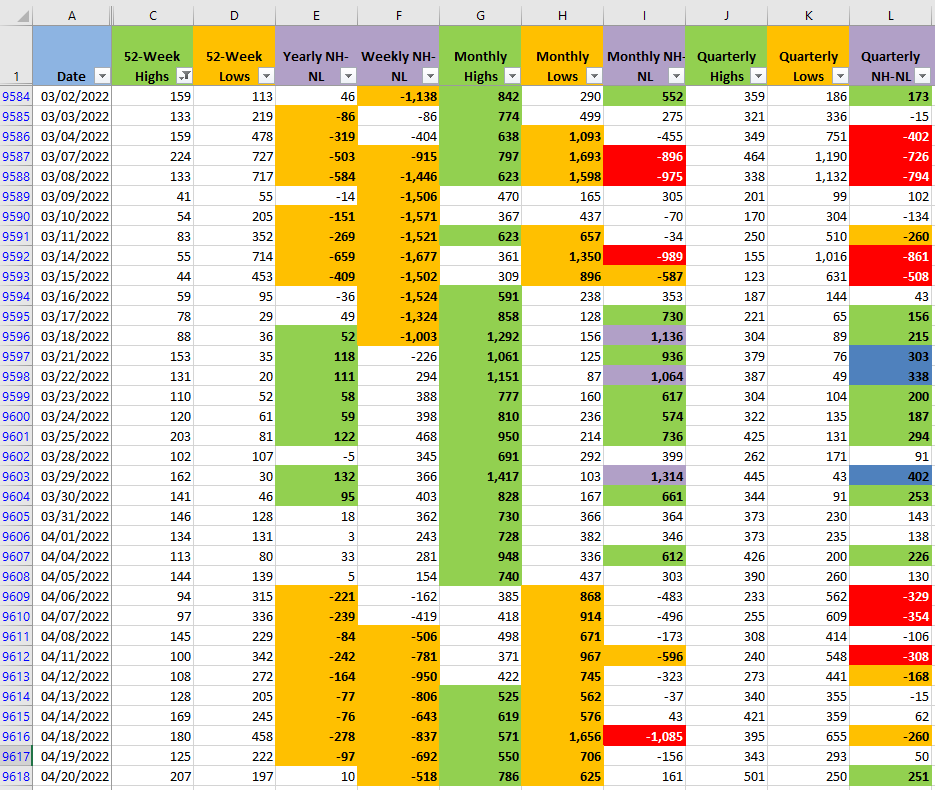

The New Highs and New Lows numbers keep slowly improving. The amount of New Monthly Lows is still elevated. If the rally is to continue, those Lows need to decrease before the end of the week. As I mentioned in yesterday's article, a single rally day doesn't change the entire Market scenario, let's see the behavior in the last two trading days of the week.