The purpose of using indicators when trading the Markets is to have a reasonably good perspective of the probability that an instrument moves in the direction that you expect. The S&P has been unable to break past the 4,800 barrier and to make things worse the indicators that I use are giving unreliable signals that are useless when trying to determine the chances of the Market to resume its uptrend.

Does that mean it's time to change indicators? Definitely not, there are thousands of indicators out there, at some point all of them will give mixed signals. I stick to the indicators that I trust and understand, they will eventually start to provide useful information. It's only natural that this happens from time to time, the Markets are chaotic environments where, at some point in time, have a display of order that allows us to trade.

Market Overview

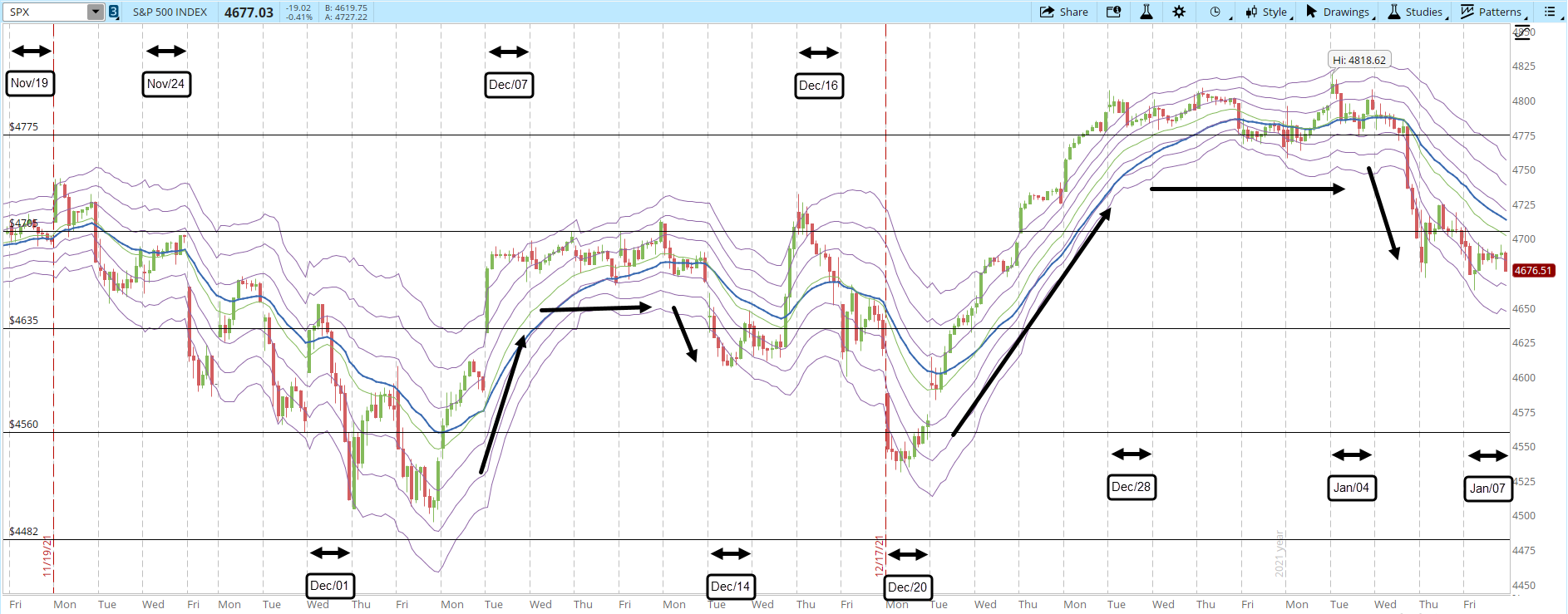

I kept the weekly support/resistance levels at 4,482 and 4,775 respectively; they didn't change from last week. The short-term support/resistance lines that I add for illustration purposes are 4,560 / 4,635 /4,705 same than last week.

The concern right now is whether the S&P will be able to recover the 4,700 level or not. If the selling pressure continues, it will likely test the 4,635 support. The outlook isn't very encouraging for the Bulls (I'm still bullish until the weekly uptrend is broken). Analyzing the 39-min chart below there have been two significant rallies, one lasted two days, the other four days, they are highlighted with the black arrows in the screenshot. Both of them ended with a consolidation and then a sell-off. I'm not saying that the number of days is an indicator that could be used to trade, but it suggests a lot of weakness from the Bulls.

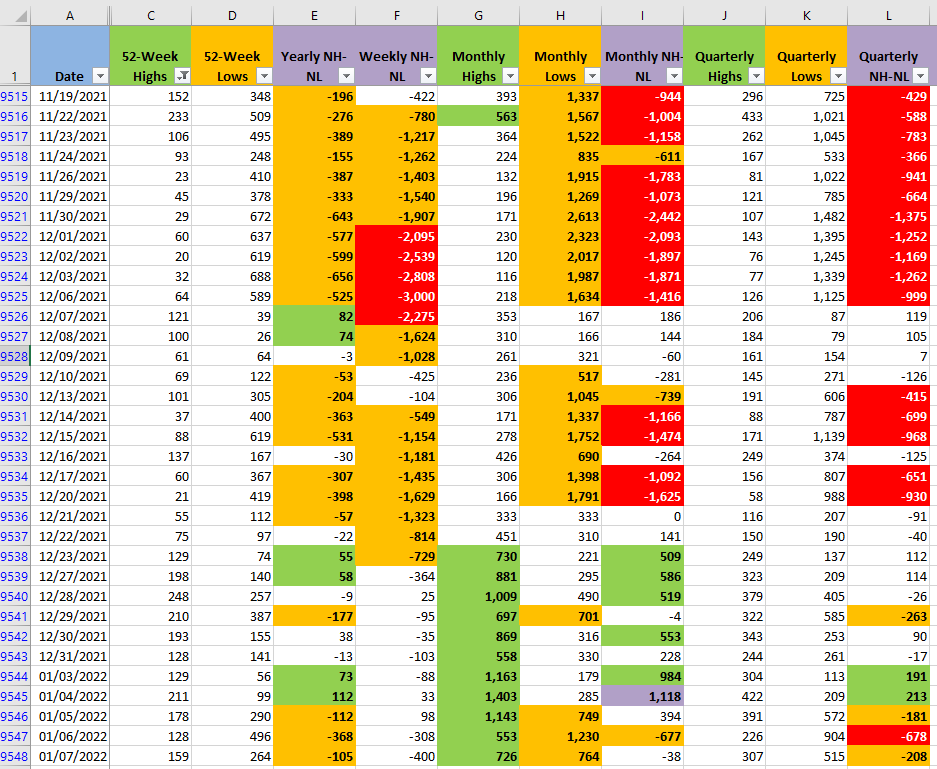

The New Highs and Lows are not being, at least for now, a useful tool to determine who will control the Market in the next few days. The monthly timeframe, which is the fastest one, doesn't have a clear winner dominating the Market direction (columns G and H of the screenshot below, you can click the image in order to zoom in).

Last weekend I highlighted a warning in the daily chart, a bearish divergence (link below), this week the S&P went down, I didn't trade that signal, divergences are a good fit to contrarian traders not trend traders like me.

The point of mentioning this bearish divergence is that is yet another warning of how weak the Bulls have been so far. If there is not even a relief rally soon, eventually the selling pressure could take the S&P all the way down to test the 4,482 weekly support.

Jan/02 - Happy New Year - 2022

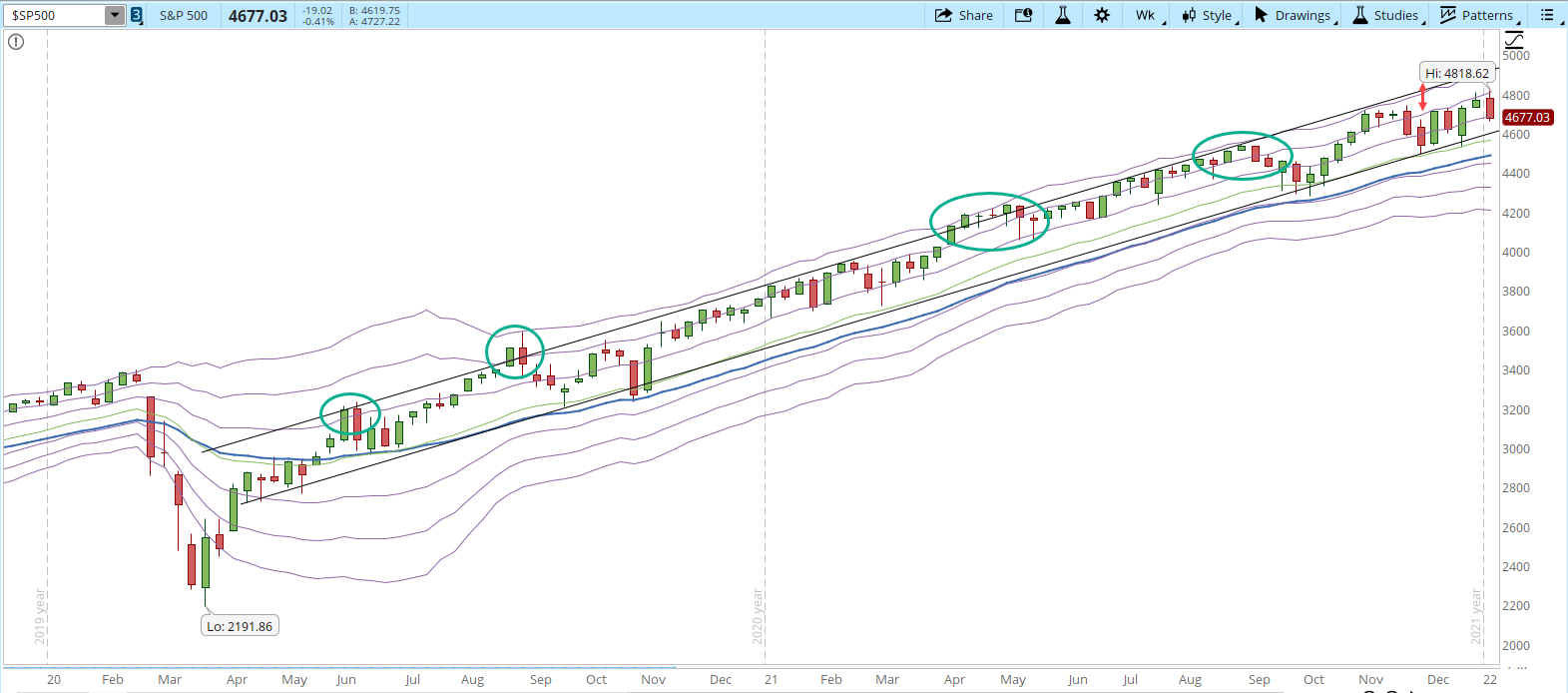

The weekly trend (chart in the screenshot below) is still in place, but I don't particularly like that the distance between the price and the upper trend line is widening (red arrow in the upper right corner). The trend started around the last part of March 2020, the S&P had a strong rally and it got to stay close or above the upper trend line for weeks (green circles).

Industries

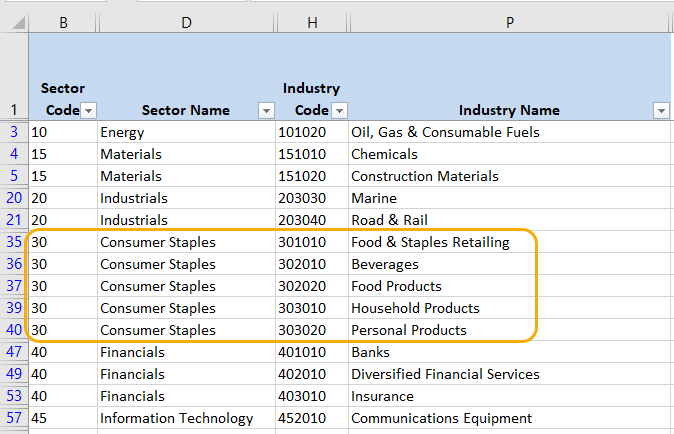

After the sell-off fueled by the Fed, the coronavirus news and the disappointing US Dec nonfarm payroll there was a change in the Industries where I see strength. Five of the Industries belong to the 'Consumer Staples' Sector, which holds stocks that are considered defensive.

I'm following closely a few tickers in the Energy Sector, the situation is a little tricky as the rally might be something temporary fueled by several news. Currently the crude supply is showing some fragility. The riots in Kazakhstan are disrupting the oil production in that country. A political crisis in Libya could also be another factor, extreme cold in Western Canada and decreased production in Russia. The message is still the same, the Energy rally needs to be able to continue despite the news that could change at any time if I'm to open a position in Energy stocks.

Scenarios

- Scenario #1: If the S&P is able to rally it needs to show some real strength, not just a relief rally. First, it needs to close decisively above 4,700. Once that happens it needs to be able to break again the 4,775 resistance. This is unlikely to happen in a single session. The power of that rally, in case it happens, needs to be reflected in the Montly NH-NL numbers, the Lows are excessively elevated at this point. If all this happens, I'll start opening new long positions.

- Scenario #2: If the S&P just keeps moving around the 4,705 line it will be yet another signal that there is still some selling pressure that Bulls haven't been able to overcome. I'll stay in the sidelines in this scenario.

- Scenario #3: If the selling pressure continues, the next level to be tested will be 4,635. If the New Lows increase, the fear in the Markets could accelerate the fall to the 4,560 support. When the Market falls it's a lot faster than when it rallies. The sell-offs are fueled by fear which is an emotion that is fast though not necessarily long lasting. In this scenario I'll let the stops trigger if things get that bad, no new long positions, if there are any attractive shorts I might take them early in the week.

Summary

Unfortunately right now there isn't a clear direction in the Markets, the road ahead is just unknown territory without many clues of what is about to happen. Mixed signals in the indicators, lack of strength from the Bulls but the weekly uptrend still intact, a lot of factors that just generate more confusion.

There is no need to try to forecast what is going to happen, trading is not about having a crystal ball that helps relieve the uncertainty pervading the Markets. Look at the charts, follow your strategy whatever it is. Risk management at this point is essential in case the Bears take over the control again. Trade the probabilities when your system allows it and remember that staying on the sidelines is a perfectly valid option that could help you preserve your capital while better opportunities present in the Market.