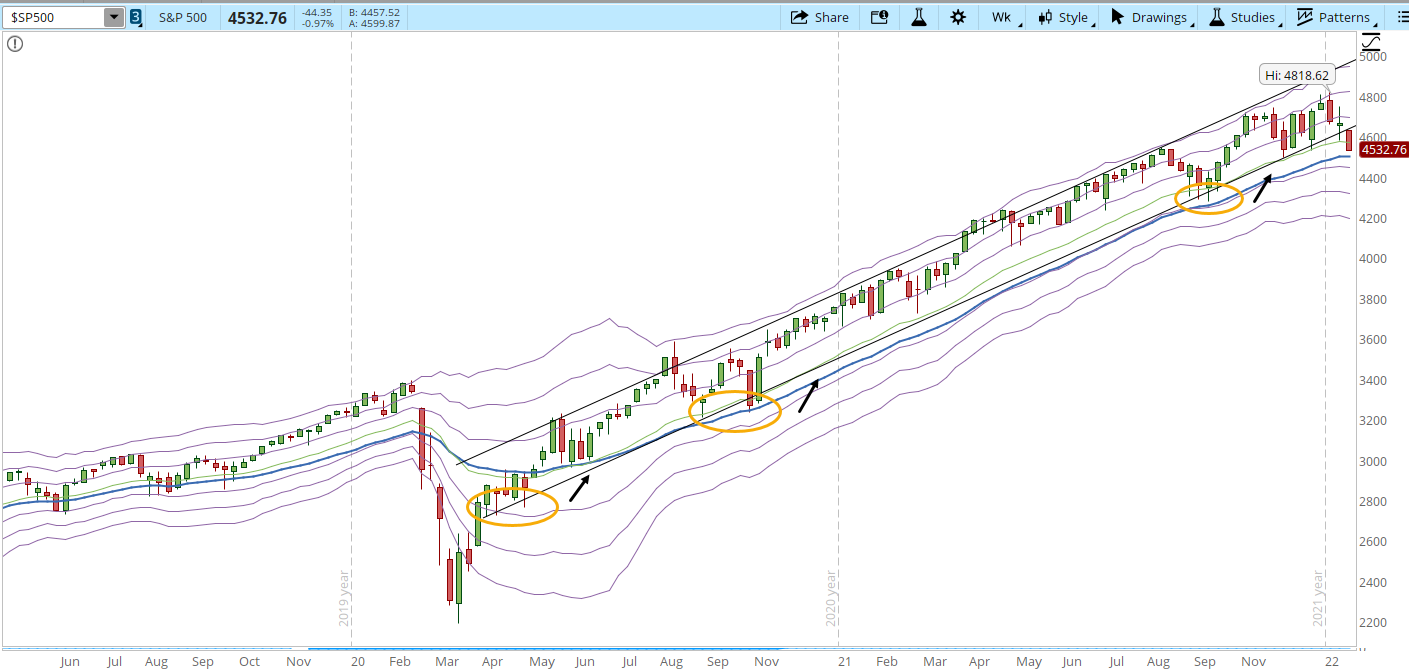

Eventually there will be a relief rally, however if it's not in the next couple of days (which seems unlikely) the latest bar of the weekly chart will close below the lower trendline damaging the trend structure.

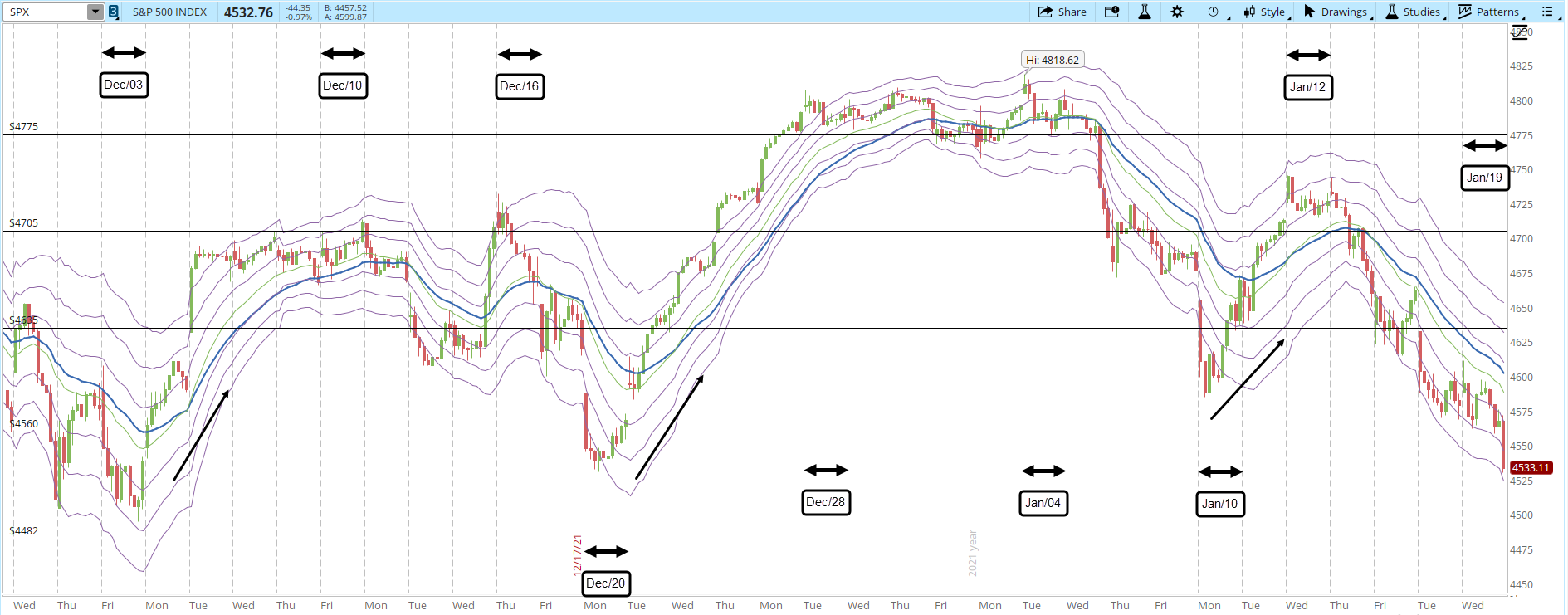

The 39-min chart of the S&P below shows the price action of the day. Another short-term support broken at 4,560. The next chance to stop the downtrend will be the weekly support at 4,482. The S&P has lost around 6% from the top at 4,818.62, still a correction, not a Bear Market.

The S&P was at the current price level in Dec/03 and Dec/20, in both occasions the S&P had a relief rally shortly after reaching a level around 4,530. The difference I see this time, which is a source of big concern for me, is that this time the S&P is just going on its way down. The S&P is not even seriously attempting to get to the EMA line (blue line) or past that line, which in the past it managed to get at least to the EMA line or to the +1 Keltner Channel before continue on its way down.

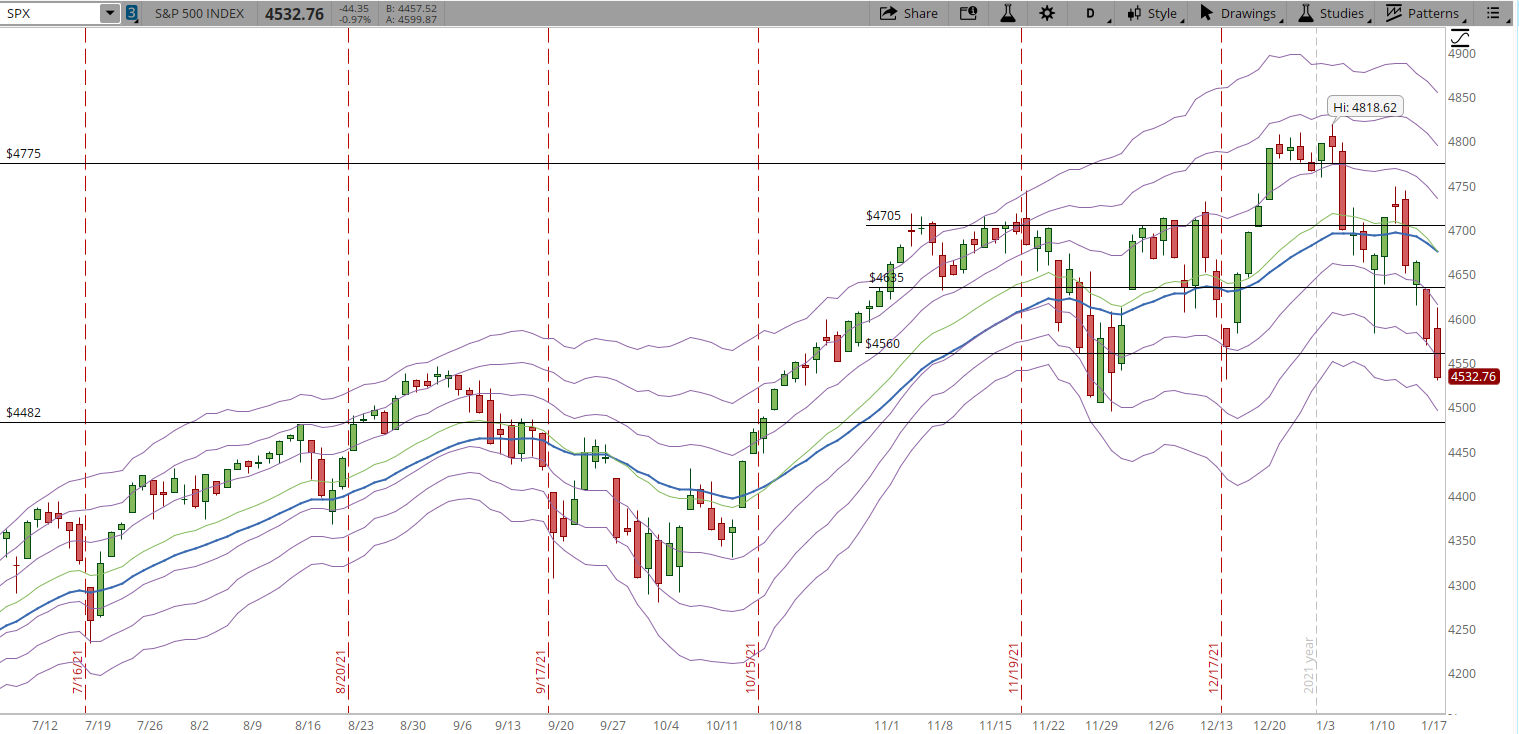

To get some perspective of where the S&P is and the next price level that could provide support the daily chart is a lot more useful and easier to see.

In the weekly chart it's possible to see how the structure of the weekly uptrend could be damaged if the S&P doesn't rally.

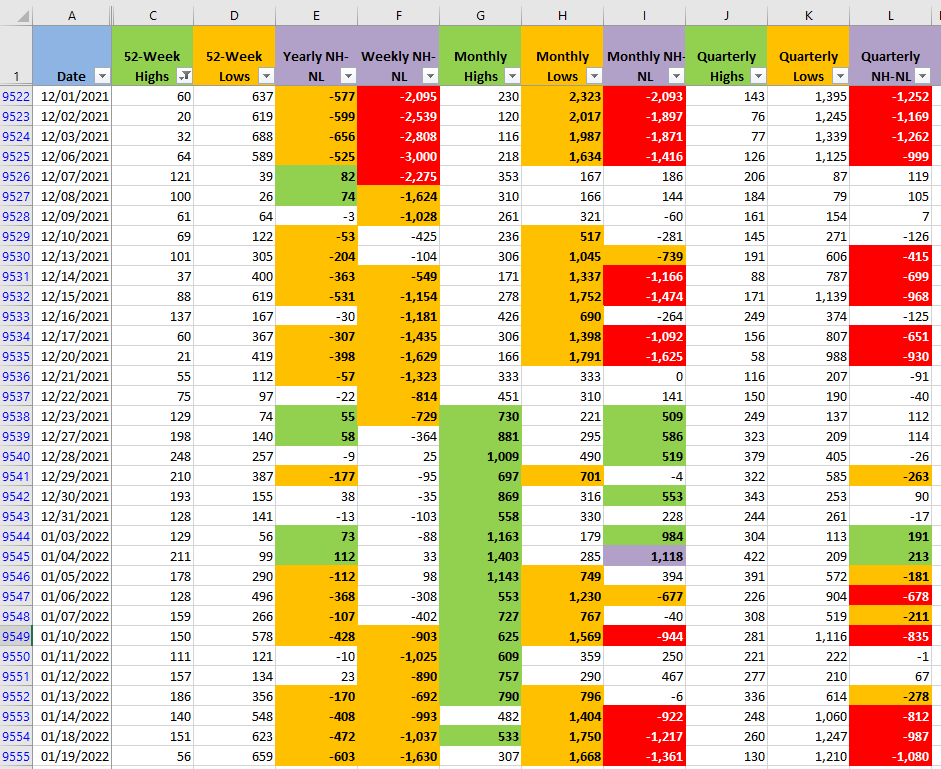

Unfortunately, the New Highs and New Lows numbers in all the timeframes show a complete dominance of the Bears. The amount of New Highs keeps decreasing and it looks very difficult to expect a rally that can challenge the Bear dominance. If the numbers continue deteriorating, we might be near the top of the weekly uptrend or at the top already.