The consistent behaviors that the Market displayed from January to mid-July 2022 are changing. We need new references in order to understand what the Market is doing. Last week I mentioned that the most likely scenario was a rally with a maximum realistic target of 4,150 and that's what ended happening. What can we expect for the next trading week?

Market Overview

Last week we just saw the Market rally for three consecutive days closing at its highs, for some people that triggers what's called the hot-hand fallacy. The term comes from the athletic world where someone that repeatedly scores causes people to believe that they are on a streak, and they will continue to score. It's the belief that what happened in the past will continue to happen in the future. A three-day rally is still too early to consider that the Market is already turning or that a Bull Market is ready to start.

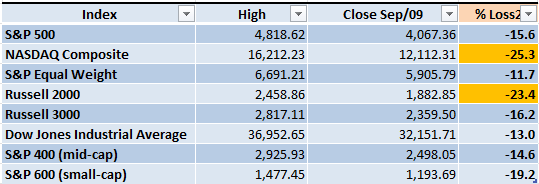

Reviewing the progress of the Market with a different perspective we can see that we are still not that far from going back to Bear Market territory (a decline of 20% or more from the previous high). I don't have a crystal ball to see if this is really the beginning of a powerful uptrend or not. However, there isn't enough evidence yet to prove that Bulls are getting the control of the Market.

I would set two important milestones at this point and see what happens during the next trading week. The first one is an area of high volume around 4,150 and see if the Market can get past that strong resistance. And the other one would be 4,300 where the last multi-week rally failed and started a sharp decline. If the Bulls can really break those two barriers, then there might be real force behind the movement.

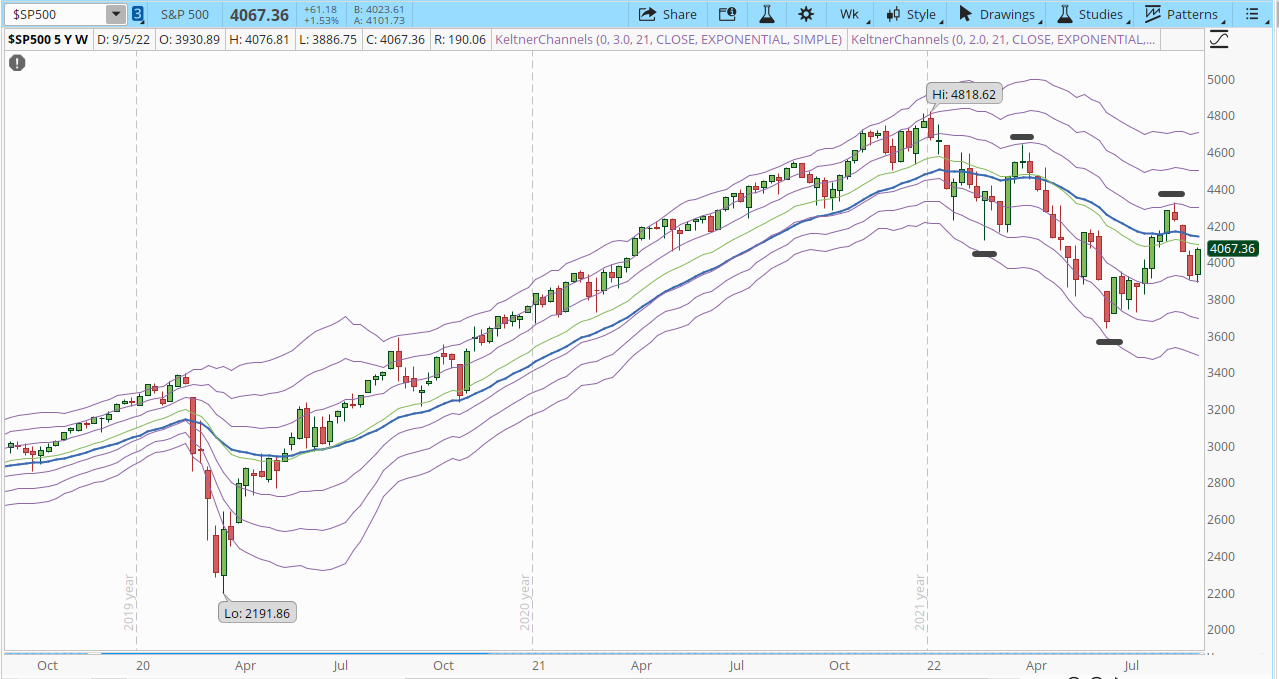

Another confirming reference that gives great insight into the short-term developments is the weekly chart of the S&P 500. Since Jan/2022 when the downtrend started (lower highs and lower lows highlighted by the horizontal solid black lines) we have seen the normal oscillations of the Market, it never goes in a straight line. However, we are 751 points below the historical high from Jan/2022.

Another interesting fact is that on the weekly chart, the +1 Keltner Channel (KC) is acting as a resistance. Two important declines started when the index reached that level. Eventually the Bulls will be able to break the barrier of 4,150 and 4,300 it will be important to monitor those attempts but there are additional levels that could give important clues, in this case the +1 KC on the weekly chart.

I don't see that many relevant discussion points regarding the daily chart of the S&P 500. I just highlighted in the screenshot below the levels that I'll be monitoring. If the rally continues it will face an increasing selling pressure at 4,150 and if it manages to get past that level it will be important to see how it behaves around 4,300. Additionally, if it manages to get that far it will get to overbought territory (+3 KC channel or above) which would set the conditions for a pullback.

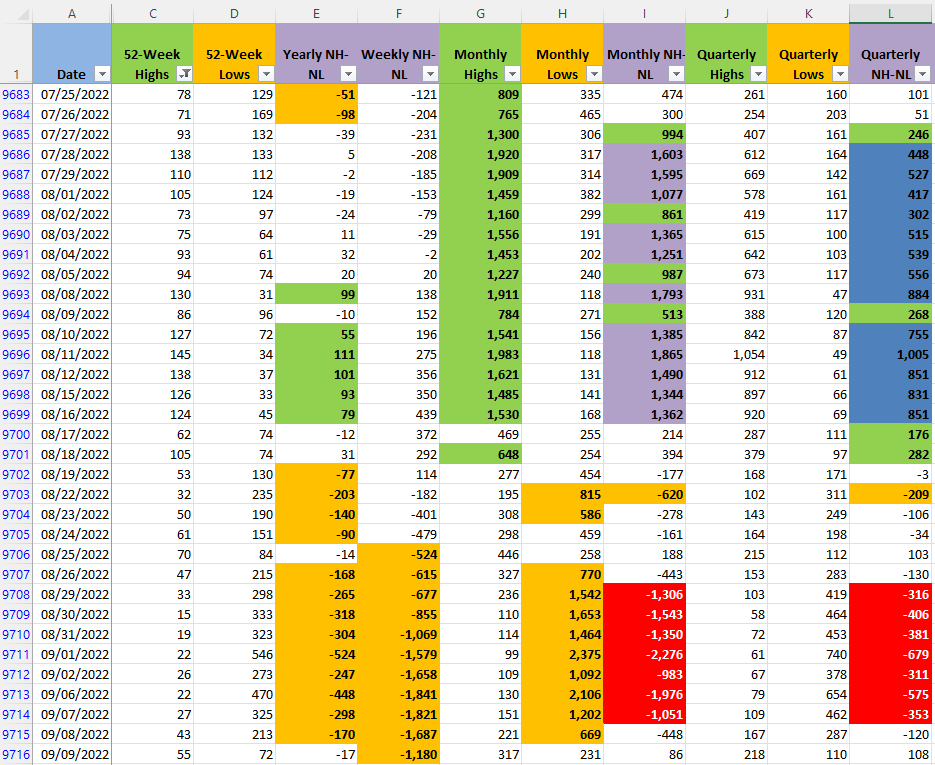

The New Highs and New Lows indicator (NH-NL) doesn't have a clear winner in terms of the balance of power for the Monthly timeframe, which is the fastest from the ones displayed (columns G, H and I). The NH-NL is a leading indicator, it's important to pay attention when the Monthly timeframe changes in order to get clues about a potential direction for the Market.

Industries

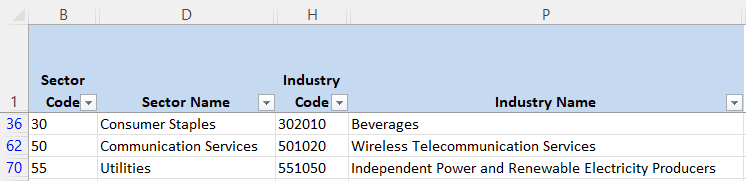

The Industries that from my point of view are still strong remain unchanged from last week. From the 68 Industries that compose the Global Classification Standard (GICS) there are only three that still seem to have some force on them. Two of them are on defensive sectors ('Consumer Staples' and Utilities Sectors) which doesn't signal much of an aggressive demand yet.

Eventually there will be news regarding the strong Industries, even before the beginning of a Bull Market, some Industries can lead the way and rally weeks or months ahead of the rest. That's the importance of monitoring this section.

Scenarios

Scenario #1: No one has really been able to consistently predict the future in the Markets, there's just too much chaos. However, there are scenarios that are more likely than others and the way you manage a trade, including the risk management, can make all the difference in the world without the need to forecast the future.

The scenario that I see more likely for the next trading week is that the rally will begin to stall. We are in September, which is a month with a bad track of Market performance. The environment hasn't turned into something incredibly bullish where greed is the dominating the Market sentiment. In fact, the underlying problems that could have contributed to the Bear Market are still unsolved (inflation and potential recession, Ukraine war, supply chain crisis, China tensions). Reaction rallies are natural and even expected, until there's strong evidence that this rally is something other than that, I'll keep waiting on the sidelines.

Scenario #2: The second most likely scenario would be a pullback. Besides the different catalysts that have been around for months we are also in the earnings season. There can be surprises, both positive and negative, however the fragility that the Market has displayed makes me believe that the impact of the positive news will be much less than the effect of the negative news.

Scenario #3: Anything can happen in the Markets, I don't see this very likely, but the rally could continue. It could potentially break the 4,150 and 4,300 milestones mentioned in the article. That would require something surprising and strong enough to fuel the rally at least 2 or 3 more days. If the rally does break the 4,300 resistance I'll definitely consider start opening some new pilot trades, otherwise I'll stay in cash.

Summary

The last three weeks haven't been as exciting and full of adrenaline as some people would like. This isn't a movie, and we can't really slow down or speed up the Market timing. For a trend trader like me this is a period where I need to work on finding potential trades, read books, try to find my weaknesses, automate tasks, etc. Eventually a new powerful Bull Market will emerge and I'll be ready for it.

It's a very risky business try to predict the bottom of a Bear Market. Even if you are extremely lucky and manage to catch that bottom, nothing guarantees that the Market will immediately rally, the Market could keep tracing that bottom for weeks or months. Even now there's always the risk that the Bear Market resumes its decline.

Whatever happens the Market has the final decision and we need to be prepared for any scenario or run the risk of blowing up our Market account. The opportunities of keeping a healthy risk management strategy are exciting, preserving capital will allow a trader to take advantage of the beginning of the next Bull Market at great prices.