The main indexes haven't moved much during this abbreviated trading week. The discussion continues around how far is the inflation from peaking and the risk of a recession due to the measures that try to control that inflation. The FOMC minutes were released today and there weren't big surprises, the Fed maintains its commitment to tame inflation even if that will impact directly the economy's growth.

I'm finding some good setups in Biotechnology ($SP1500#352010) and Pharmaceuticals ($SP1500#352020). The positions that I still keep open have modest gains, and for a couple of other positions I was already stopped out.

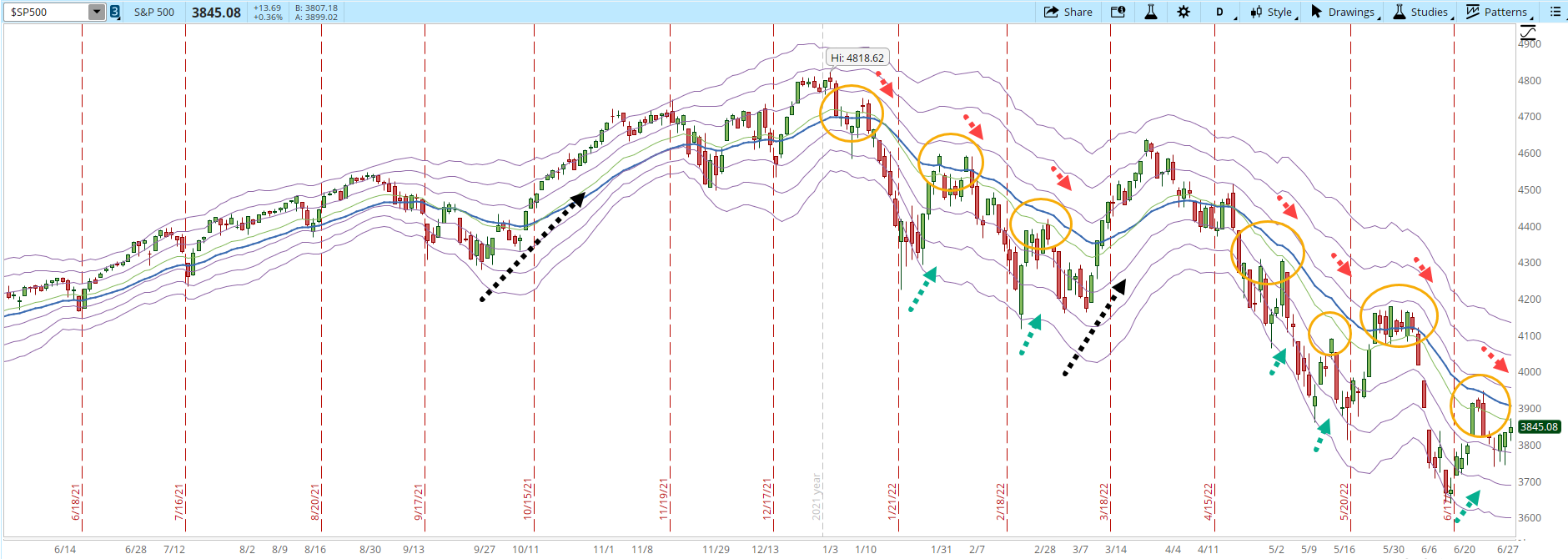

I'm waiting to see a strong reaction from the Bulls, at least a descent rally that can take the S&P 500 to 4,000. The daily chart is still behaving consistently. The 30-day EMA is still serving as a resistance (orange circled areas). There have been only two rallies since Oct/2021 that have lasted more than four days. And when the index gets to oversold levels (-3 Keltner Channel or below) there is at least a modest rally (green dotted arrows).

As I mentioned during my 'Weekend Market Overview' article, I don't think that the Bear Market is over, however a reaction rally wouldn't be a crazy idea at this point, at least a rally that would send the index to a level around 4,000.

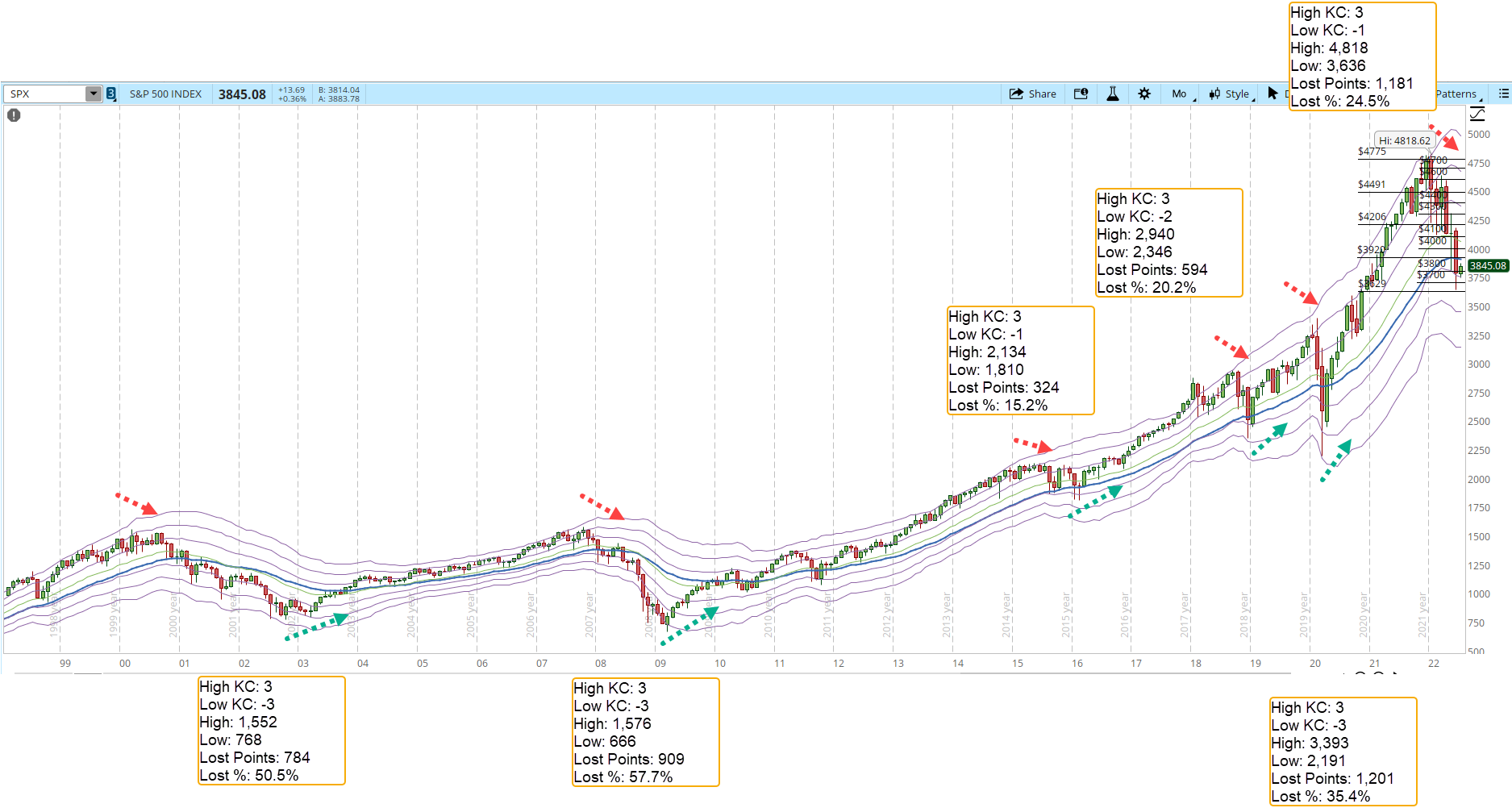

In order to gain some perspective about the declines that the S&P 500 has suffered since 1998 I reviewed the lost points and percentages of the six major declines. They all started when the S&P 500 reached an overbought level (+3 KC or more) in the monthly chart (red dotted arrow). After the decline finally reached a bottom there was always a multi-month powerful rally (green dotted arrows).

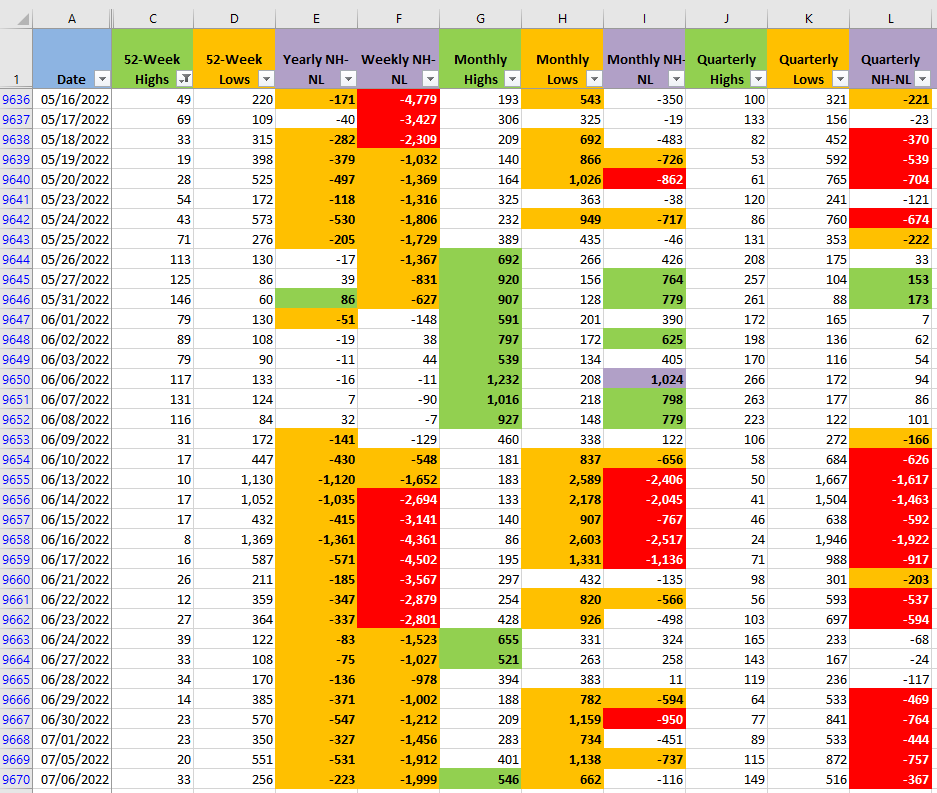

If we review the current numbers for the New Highs and New Lows (NH-NL) indicator in all its timeframes it's possible to see that the selling pressure has been decreasing. Even the Monthly timeframe is showing some increase in the amount of New Highs, it's important to review if the New Highs can keep increasing and the New Lows continue decreasing.

As a summary, we are still in a Bear Market, I still believe that there is a possibility that the S&P 500 can have a rally that takes it to a level around 4,000. I'll continue opening pilot trade positions in order to gain a better feeling of the Market situation, still with a reduced size and tight stops. The underlying problems that have us near a recession (inflation and the Fed, Ukraine war, supply chain crisis, China tensions, etc.) aren't close to be solved, it's very important to keep a strict risk management strategy in order to preserve capital. Any powerful negative catalyst can resume the Bear Market decline. There's no way to continue playing this game if by the time a new Bull Market finally starts you have no capital to invest.