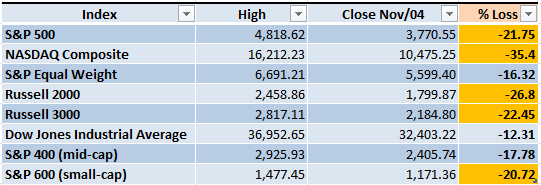

It would be great to have a way to fast-forward the difficult times in the Market, especially when those periods of time can last weeks, months or sometimes even years. The first week of Jan/2022 the S&P 500 was at a historical level of 4,818 and the next week a sharp decline started. So far there hasn't been a recovery, the index is currently at 3,770 a loss of 21.75%. Several indexes are back to Bear Market territory (a loss of 20% or more from the previous high).

Market Overview

From time to time the Market tries to trick us into believing that things are getting better. In March and June 2022 there were a couple of rallies that gave some hope that the Bear Market could be over. However, the weekly downtrend (lower highs and lower lows highlighted with horizontal black lines) is intact and in order to damage its structure there would need to be a rally that takes the S&P 500 above 4,350.

The last few months the pattern on the weekly chart is simple to understand and difficult to predict how long it will last. Every time the index is around the -3 Keltner Channel (KC) there's a rally (green dotted arrows). Every time the index is around the +1 KC there is a pullback (red dotted arrows). During this natural Market oscillations, the index keeps reaching lower highs and lower lows.

Eventually this pattern will break, the Bulls will get some real force and take the index above 4,350 and damage the pattern structure. Never forget the possibility that the Bears can also resume the decline and take the index to even lower levels.

The way the daily chart is behaving is also far from being rocket science. In the screenshot below it's easy to see that almost every time the S&P 500 gets to the +1 KC there is a pullback (red dotted arrows). There were a couple of times during the year that this didn't happen (green circled areas), that's why risk management is essential, it will protect your account from serious damage when these exceptions happen. Nothing works in the Markets 100% of the times.

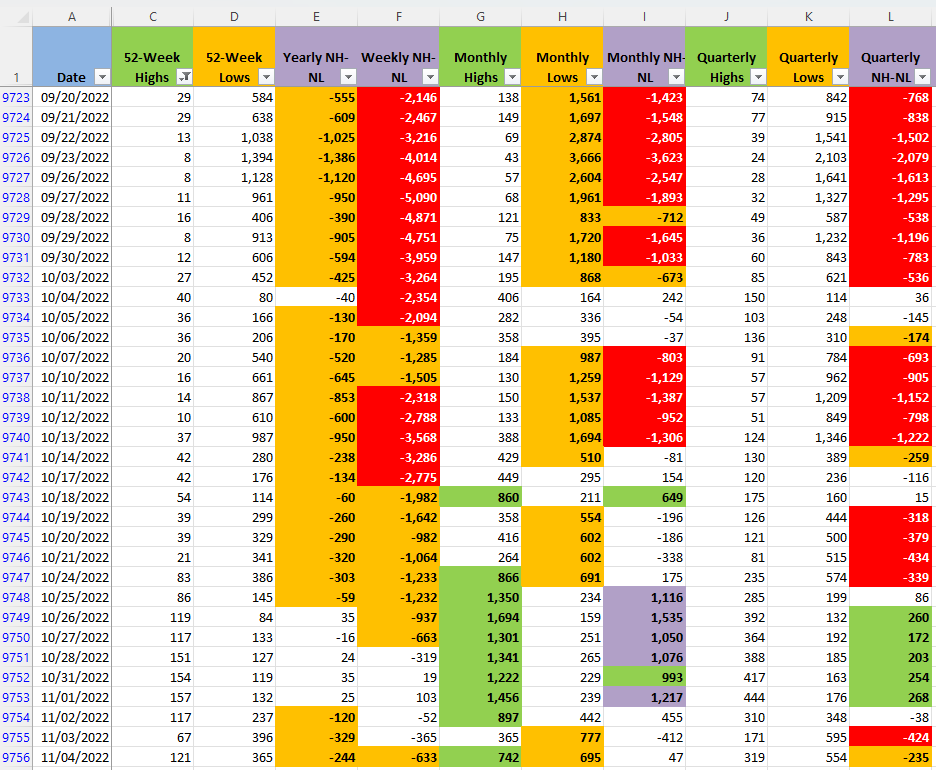

Price action and volume are the main indicators to follow, but from time to time is important to see if the New Highs and New Lows numbers confirm what we see in the charts. The Monthly columns are the ones that move faster from the data displayed below (columns G, H and I). The Bears dominated the Market except for the last part of October. The bullish force that we saw during the last part of October is gone, things are much more even now, not a clear winner yet.

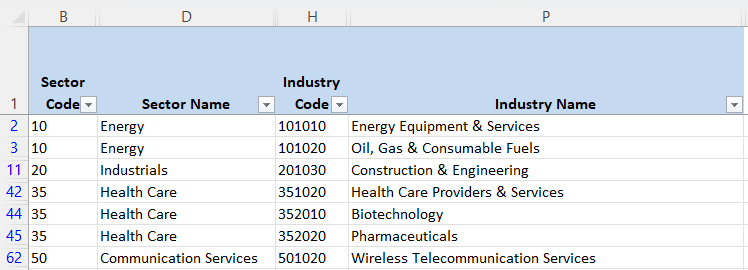

Industries

I still can't find an Industry that I can consider in a strong uptrend. From the 68 Industries that compose the Global Classification Standard (GICS) there are a few that have some interesting potential breakouts. I will monitor them closely during next week, if there are some tickers that have low volatility and start to rally, I might trade them as pilot trades.

At this point those Industries are at levels where in the recent past have failed to breakout, the Fear of Missing Out (FOMO) is something that needs to be controlled. Some of those Industries might actually rally, others will face strong selling pressure and fail again. Trying to forecast what will happen in the Market is a very risky game, I would rather wait and act based on the Market action rather than trying to outsmart the Market and expose my account to serious losses.

Scenarios

Scenario #1: We are still in a Bear Market, Bears are in control if we see the high level picture of the Market. The balance of power between Bulls and Bears in the short-term doesn't have a clear winner. The numbers for the Monthly NH-NL are relatively equal for both sides. Unless there is a strong catalyst during the next trading week, the most likely scenario from my point of view, is that the S&P 500 will keep oscillating in a range of 3,700 to 3,900 while the Market decides in which direction it will continue.

Scenario #2: The second most likely scenario is that the decline resumes. Bulls did manage to gain control for a few days, but the resistance around 3,900 in the S&P 500 is being a difficult challenge for the Bulls to beat. The negative catalysts are still dominating the news. Even the good news aren't that good, the Fed slowing down the rate hikes or the expectation that nuclear weapons won't be used in the Ukraine war are now considered "good news".

Scenario #3: The least likely scenario is that we see another rally, one that actually can get past 3,900 in the S&P 500. Some surprising earnings or unexpected news related to the inflation might be able to fuel a strong rally. Even if we see a rally, most of the rallies during 2022 haven't lasted more than four days.

Summary

There are interesting quotes in the Market Wizards series of books by Jack D. Schwager. One of them comes from Mark Weinstein and applies perfectly to the current Market situation:

“Although the cheetah is the fastest animal in the world and can catch any animal on the plains, it will wait until it is absolutely sure it can catch its prey. It may hide in the bush for a week, waiting for just the right moment. It will wait for a baby antelope, and not just any baby antelope, but preferably one that is also sick or lame. Only then, when there is no chance it can lose its prey, does it attack. That, to me, is the epitome of professional trading.”

After trading for a few years there are some points that are key to be aware of while trading:

- Doing nothing: As we grow up, we are told that doing nothing is a waste of time. Buying and selling gives the impression that we are trying, that we are doing some work in order to make our account grow. What works in our jobs or daily lives doesn't necessarily apply in the Markets. We are in the middle of a hurricane, it's up to you if you try to go through the hurricane but consider that it's also an option to wait on the sidelines. Eventually things will calm down and the opportunities will be easier to spot.

- Adrenaline rush: Trading is a lot more exciting than waiting and being patient. There is people in the Markets that are trading in order to get the same excitement they could easily get from a casino. If they are lucky, they might even make some money and have the fun in the process. If you are serious about the stock market, treat it as a business, this isn't the place to have fun or risk your hard-earned money.

- Fear of Missing Out: When we identify something that could be a potential opportunity to profit from the Markets and we didn't act on time, there will be this emotional strain that could make us deviate from our plan and make us act impulsively. There will always be missed opportunities in the Markets, a broker could easily have more than 10,000 tickers to trade. If you consider Futures, Options, Forex, Crypto, etc. there is no possible way that you won't miss hundreds or thousands of opportunities each day. Focus on your plan and let go the rest.

We are in a Bear Market and the evidence doesn't signal yet a strong recovery. Fear and uncertainty are still the dominating emotions in the Market. Remember that capital preservation is the most important thing while trading, if you lose your money there's no way you can continue in the game. It's key to have a plan that guides your actions during these difficult times. Tracing a bottom after a Bear Market can take time, there's no need to rush, eventually the opportunities will come.