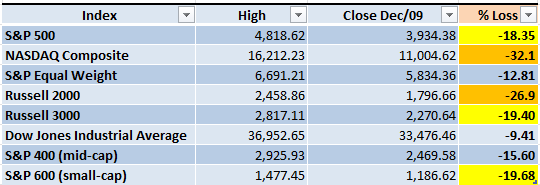

The Markets are chaotic places that from time to time let us see some glimpses of order. During 2022 the S&P 500 weekly chart has been displaying a downtrend pattern (lower highs and lower lows), and it seems that the Bears are determined to keep that pattern alive. Last week, most of the most important indexes were out of Bear Market territory (a loss of 20% or more from the previous high). Now we have two indexes with losses above 20% and three others close to that number. Will the downtrend pattern continue?

Market Overview

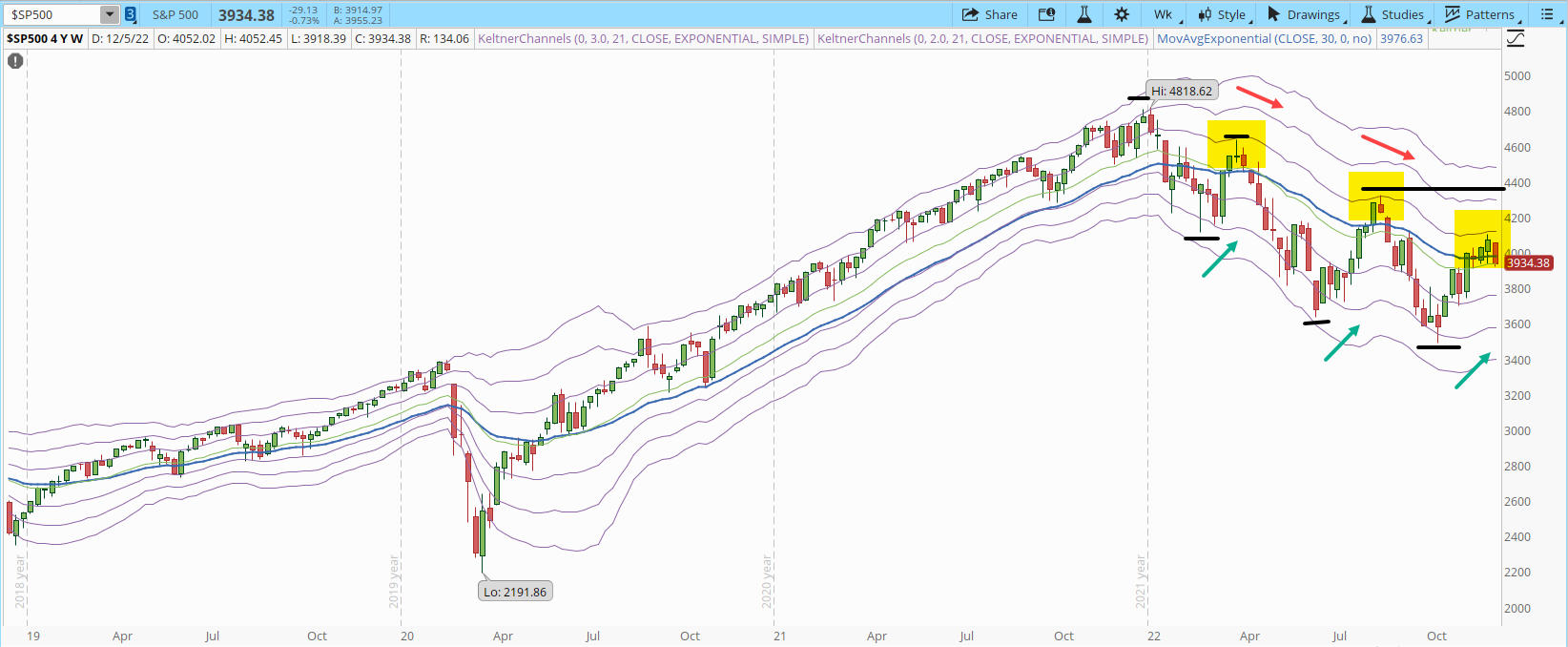

The weekend downtrend is still dominating the Market action during 2022. There isn't enough demand yet, to get the S&P 500 past the +1 Keltner Channel (KC, yellow highlighted areas). The last two times we saw very sharp declines that took the index to the -3 KC. Historically December has been one of the best performing months for the Markets, if the Bulls are planning to do something that actually damages the downtrend structure, the next three weeks are a great chance to do it.

The first milestone would be to close above 4,150 which at this point is above the +1 KC. The next milestone is closing above 4,350 which would damage the structure of the downtrend.

Last week I mentioned that a pullback to 3,900 would be something expected and healthy to happen and we are currently around that level. If that support can't hold, the selling pressure could spike and the index could go all the way down to 3,760 and from there the price action would help determine what is the next likely support to stop the decline.

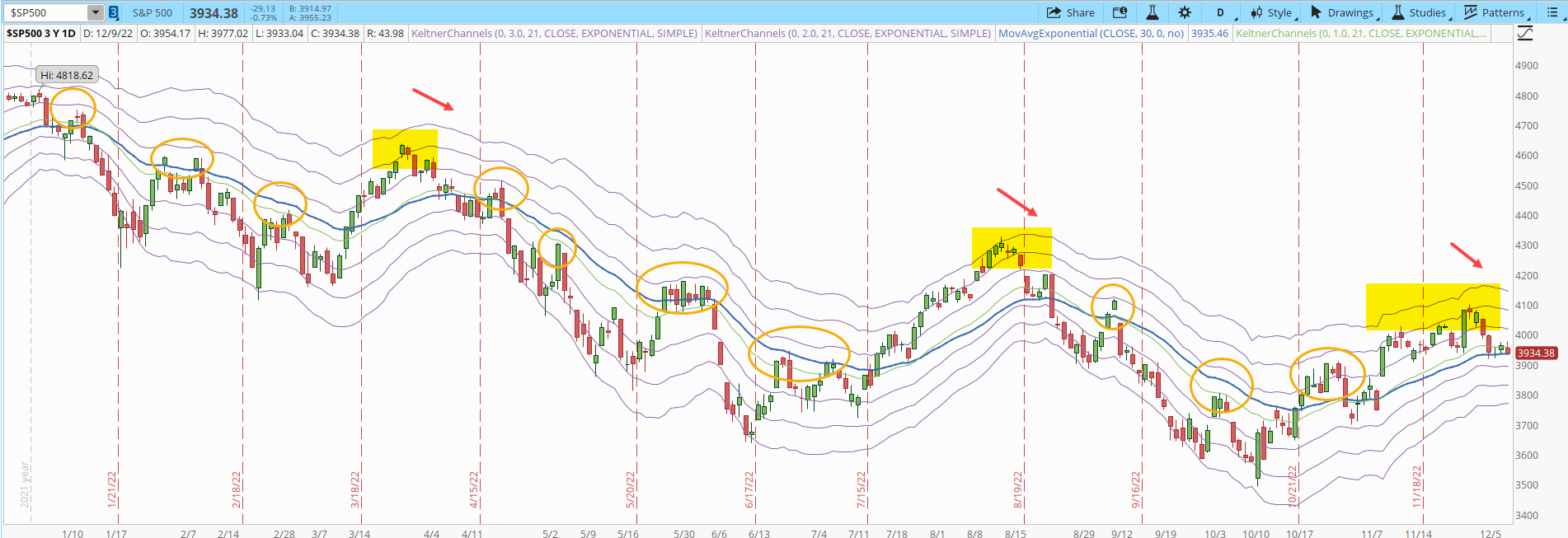

The daily chart of the S&P 500 is also displaying a very consistent pattern. Only three times during 2022 the index reached the +3 KC level (yellow highlighted areas), all the times the index had a decline after that. However, a more frequent behavior was that when the index reached the +1 KC the index had a pullback (orange circled areas). None of these patterns will last forever, in hindsight is easy to judge the Market behavior, at this point it's not that clear what's going to happen next, but this year, the Bears are still the dominant force.

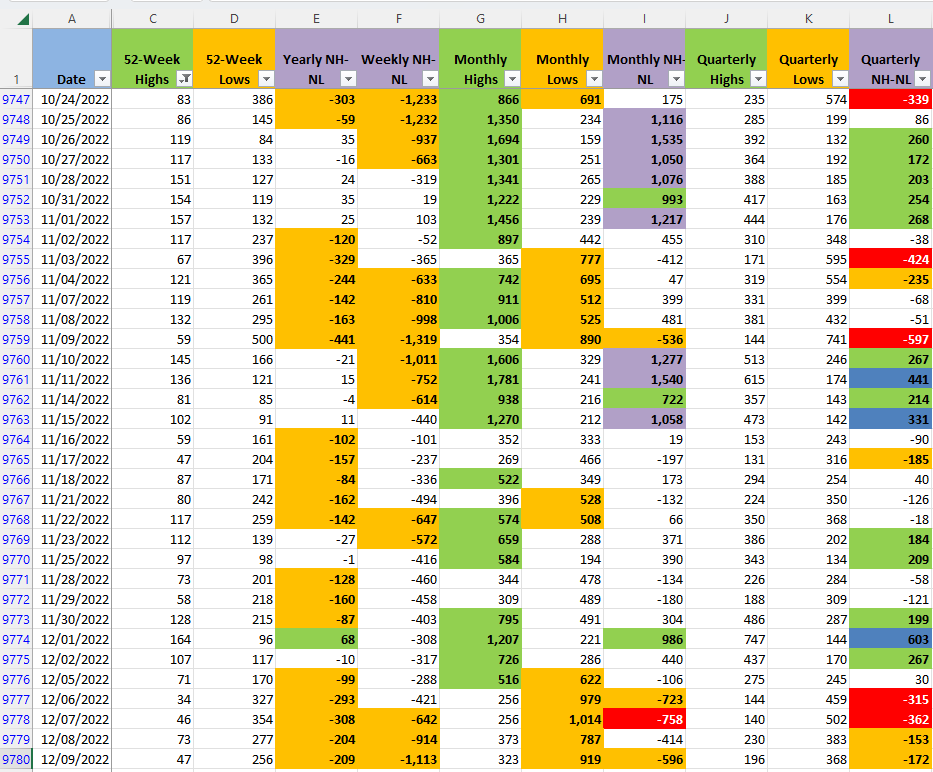

The New High and New Lows numbers (NH-NL) confirm the price action above. Bulls can manage to create rallies that might even run for a month and turn bullish the Monthly NH-NL. However, the Yearly and Weekly NH-NL take much more time to display that change, and the rallies haven't lasted that long. After Nov/15 the NH numbers stalled and now the selling pressure is increasing again.

Industries

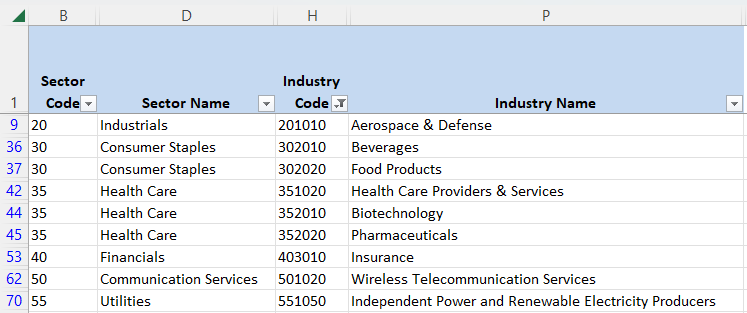

Out of the 68 Industries that compose the Global Industry Classification Standard (GICS), 'Construction & Engineering' Industry ($SP1500#201030) continues to be the only one that I would still qualify with the potential to create a strong weekly uptrend. Below there is a list of additional Industries that have the potential of having interesting breakouts in the next few weeks, unfortunately some of them are part of defensive Sectors. That's not a signal of risk appetite.

If the powerful Tech Mega Caps don't take the Market leadership again, 'Health Care' could be one of the next leaders if some of those Industries start to rally.

Scenarios

Scenario #1: Even if Bulls lost their force and Bears are trying to make a comeback, I don't see a dominant force in the daily chart of the S&P 500. From my point of view, I think that the most likely scenario for next week is that the index will start to move sideways, oscillating between 3,900 and 4,000.

Scenario #2: The second most likely scenario is that the decline will continue. If the 3,900 support doesn't hold the decline could accelerate and could go as low as 3,760. Even with a couple of powerful rallies during 2022, the S&P 500 is still losing 18.35% this year. December is obviously the last month of the year, but it's also one of the months where the Market, historically is more likely to have gains. If Bears kill that last hope, we might not start 2023 with great expectations.

Scenario #3: The least likely scenario is that the rally will resume it's way up. If that happens, something powerful, positive and unexpected needs to appear early in the week. Today, I don't see any evidence of a catalyst that could trigger at least a multi-day rally.

Summary

Independently of the Market action, we need to be prepared for anything the Market throws at us. I still keep opening pilot trades with tight stops, none of them with great results yet. They give a much better feeling of the Market situation. However, not every trading week is full of adrenaline and surprising news, in fact the second half of last week was kind of dull and boring.

Eventually things will change, there is no way to know when or what will trigger that change. The patterns described in this article will break and things will get much more interesting. If the current Market situation isn't conducive for your trading plan, consider staying on the sidelines or opening small size trades to see if they start to work. That will limit the damage to your account if things don't go as planned.