I still haven't seen enough evidence that we are near the Market top of this powerful trend that started after the 2008 crash reached a bottom. Definitely, the Bulls are showing a lot of weakness, Bears are in control, but I don't see things turning around on the weekly chart yet.

Market Overview

I usually start the post with a 39-min or daily chart, and then look at the bigger picture in the weekly or monthly charts. This time I'll start with the Monthly chart and then zoom in to other timeframes.

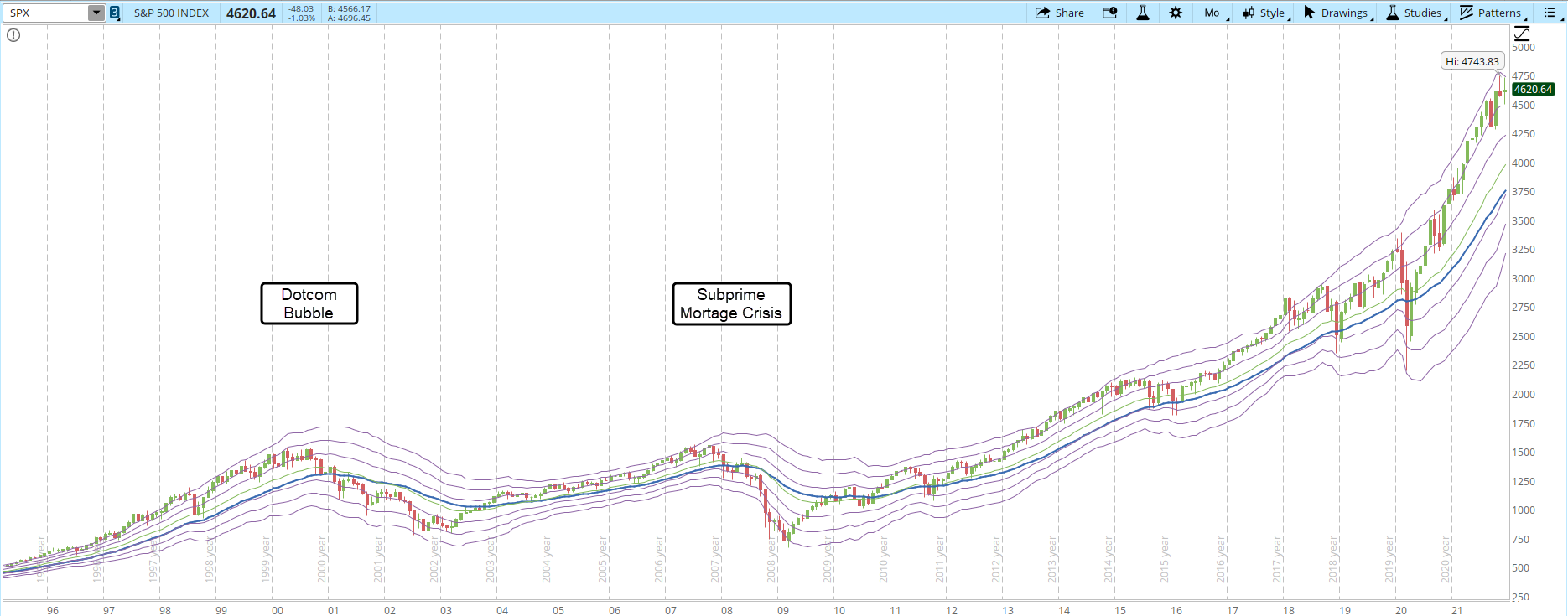

Taking one of the accepted definitions, a Bear Market is when there is a fall of 20% or more from the Market top. What I want to show in this post is that even the most recent powerful Bear Markets gave some technical signals before collapsing. It wasn't something similar to what happened during the Black Monday on 1987.

Looking at the Monthly chart the last two months the Bulls are showing diminishing force, however the monthly trend is still intact. The +3 Keltner Channel (KC) is a territory where we can consider the index to be in overbought territory, so far the S&P 500 has been in that band most of 2021 and hasn't collapsed yet.

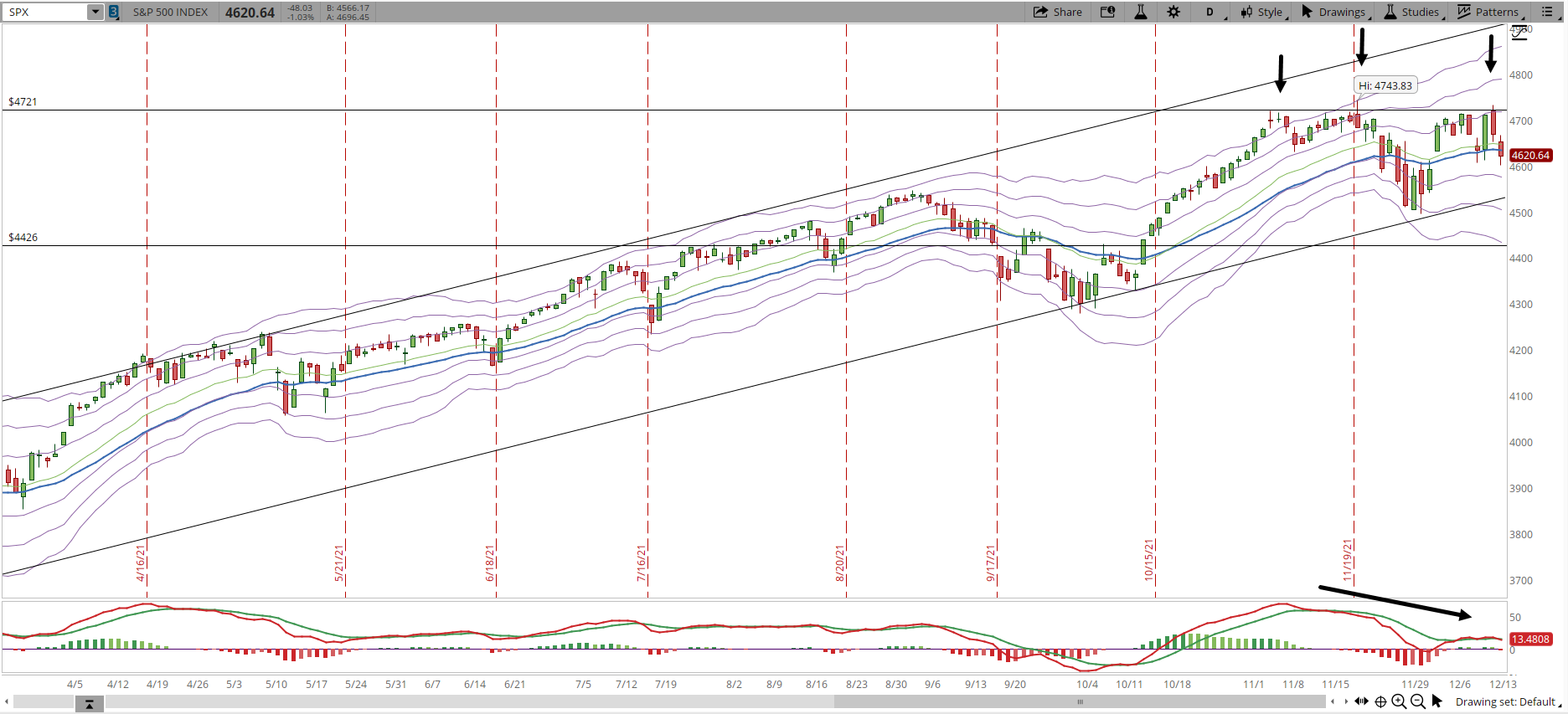

The weekly chart starts to show some concerns in the way the trend is developing. For this week, the weekly resistance and support stay at 4,721 and 4,426. At the weekly level is easier to see with more detail that the trend line and the support line are still holding (screenshot below, you can click the image in order to magnify it).

Analyzing the daily chart, the concerns increase. The S&P has tried three times to get past the 4,721 resistance line. The three times it failed, additionally the MACD-H on the daily is confirming the weakness of the Bulls.

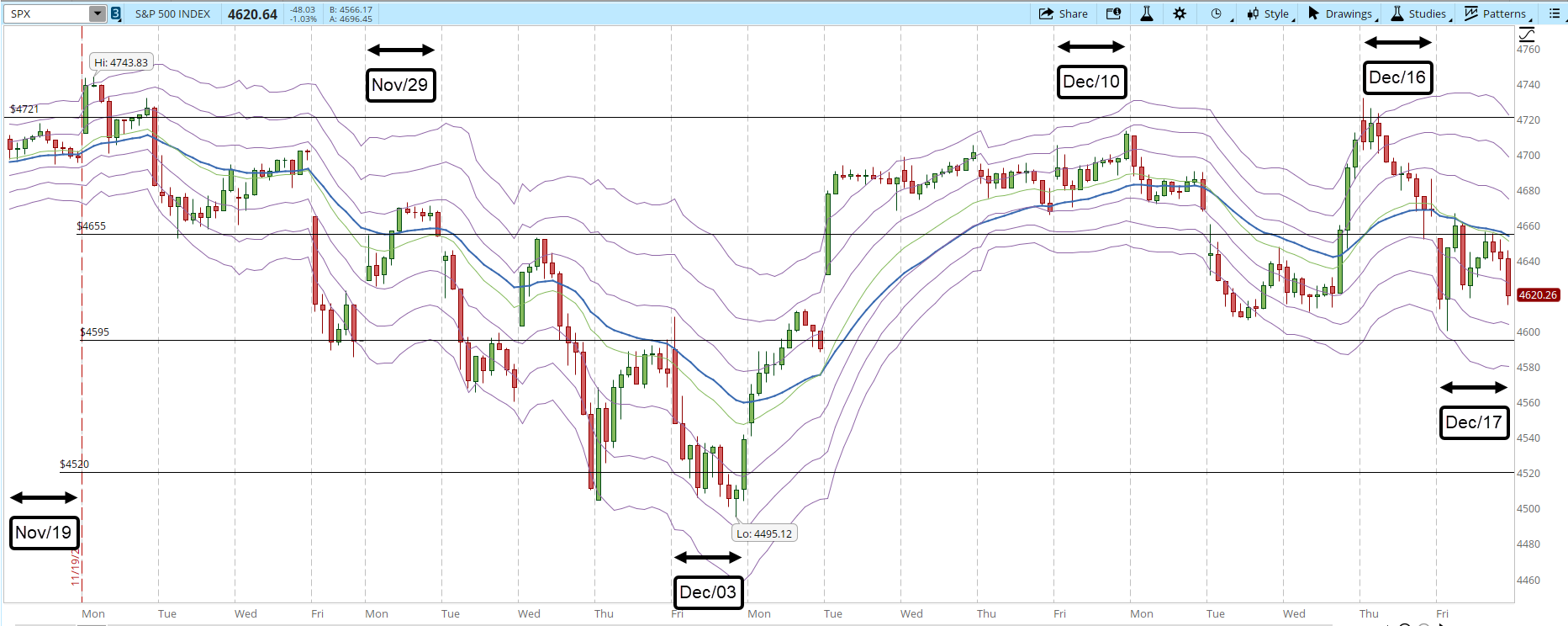

Finally on the 39-min chart is easier to see how the price action is moving between those weekly resistance lines by adding three additional shorter term support/resistance lines at 4,655 - 4,595 - 4,520. Last Friday the S&P broke below the 4,595 support line, the second time in the week this happened.

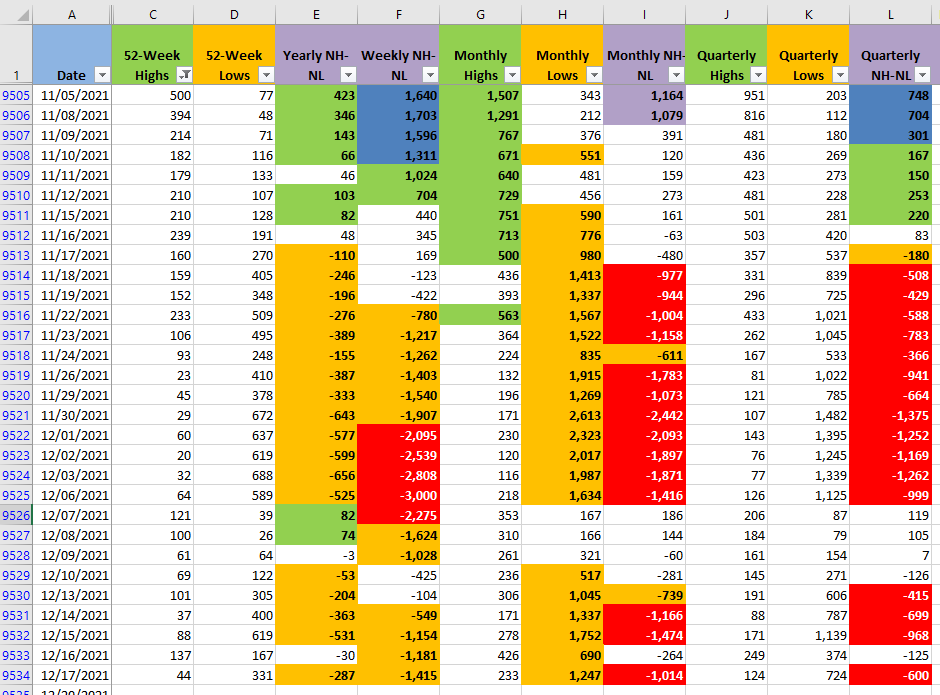

The daily and 39-min charts show warning signals. The signals are unfortunately confirmed when reviewing the New Monthly Highs vs Lows. There were a few days from Dec 07-09 where it looked like the Bulls were gaining force but since mid-November, these NH vs NL numbers have shown clearly that Bears are in control (columns G and H).

On the technical side I'm also concerned that the index of the small and mid-capitalization companies are not showing the same power that the big S&P 500 companies. Even within the S&P 500 the S&P 500 Equal Weight Index is not confirming the power of $SPX. Do you notice any similarity between the four indexes below? None of them has been going anywhere in the past few months.

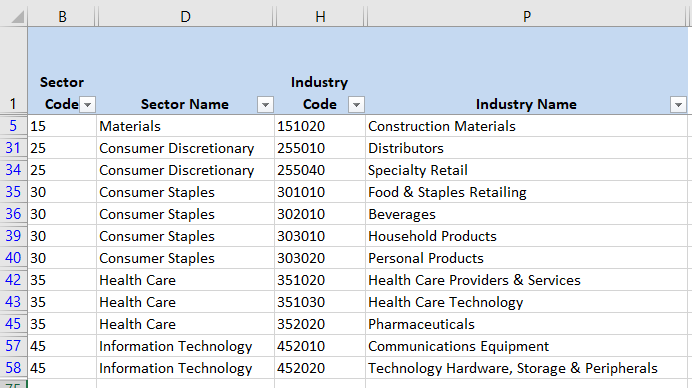

Industries

The main concern in the strong Industries for the week about to start, is that one third of the list is composed by defensive Industries within the Consumer Staples Sector. If the big funds are rebalancing the portfolios towards these Industries the future might not be that bright.

Scenarios

- Scenario #1: As in posts from previous weeks, I like to think about the likelihood of what could happen in the Market and have a plan in place for those scenarios. If the selling pressure keeps increasing and the amount of New Monthly Lows keep confirming the force of the Bears I'll let my stops to trigger if it comes to that. If this bearish scenario persists, the support at 4,520 could also be broken.

- Scenario #2: If the trading range continues, we will still have a few more days or weeks of small corrections and rallies oscillating between the weekly support/resistance lines at 4,721 and 4,426. In this case I'll just wait on the sidelines waiting for a clear Market direction. For swing and day traders this scenario would be more beneficial.

- Scenario #3: In this final scenario there is the chance that finally Bulls do something to take control of the situation and keep the weekly uptrend alive. There can be a few relief rallies coming but those are different than the Bulls moving the S&P above 4,721 and staying above that resistance line.

Summary

We are about to start an abbreviated trading week, on Friday the Markets will be closed and still no hints about the direction that the Market will take. I'm bullish until the weekly trend is broken. The amount of bearish warnings is something that can't be taken lightly, risk control will be essential in the next few weeks in case that Bears get even stronger.