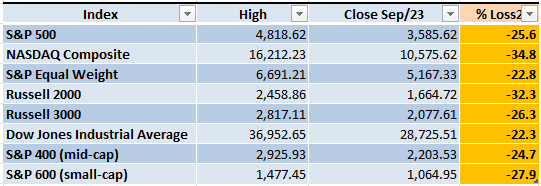

It's an exciting time at the Markets, the low that we saw in June/17 has been breached and if there isn't a quick recovery above 3,600 panic is likely to take over the Market. Every single important index is now officially in Bear Market territory (a loss of 20% or more from the previous low). The exciting part of all this situation is to find out if the Bear Market will continue or not and the opportunities that it will open in the future if you want to trade on the long side.

Market Overview

The weekly chart is the scary part of the sharp decline, the downtrend (lower highs and lower lows, highlighted by horizontal solid black lines) is more evident every week. Right now, the S&P 500 is still in that limit where there are only a few points of difference between the previous low of 3,636 and the new low of 3,584. If the Bears manage to take the decline to 3,500 or below that level the structure of the trend will be strengthened.

It's nice to have a few references in the charts that can give perspective to the chaotic Markets. For the weekly chart, the +1 Keltner Channel (KC) has been acting as a resistance for the last two sharp declines. For the Bulls the -3 KC has been acting as a level where there is the possibility of at least a feeble reaction rally. The -3 KC or below that level is considered as oversold Market conditions. the inability to take the index above the +1 KC indicates a lack of strong demand.

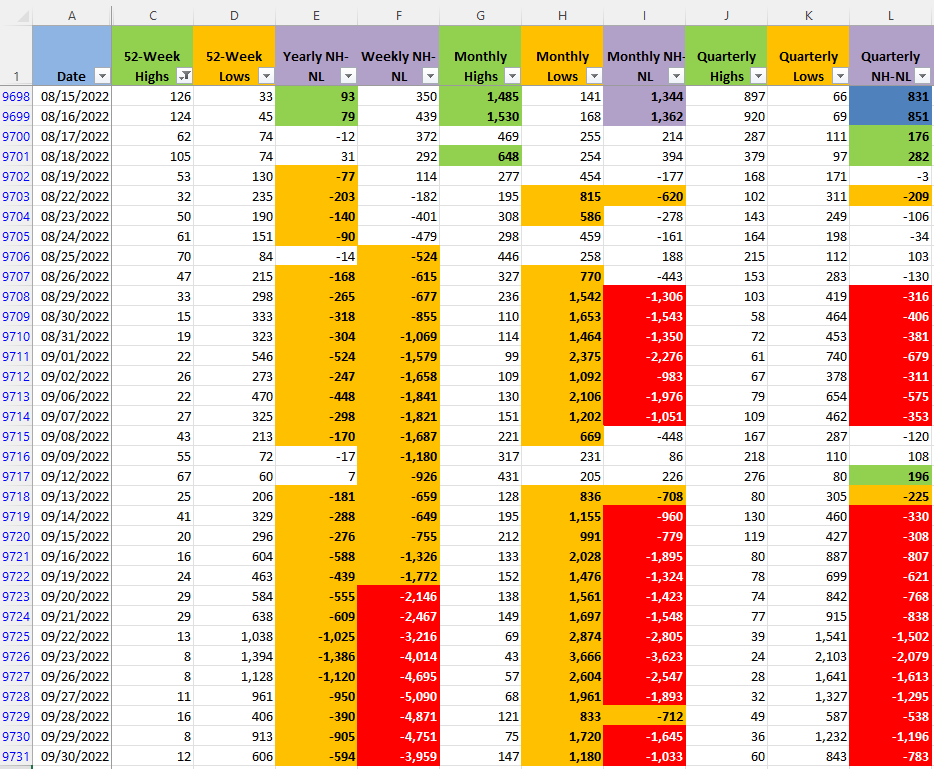

There's no question that the Bears are dominating the Market direction, however, there's a slight indication that their strength could be diminishing, at least temporarily. If we take a look at the New Highs and New Lows numbers (NH-NL) the selling pressure reached an extreme around Sept/23. On last Friday, Sept/30, the selling pressure is still pretty high but not anywhere near the levels that we saw the previous week.

On Sept/23 in the Monthly timeframe only 43 symbols made a New High (NH) and 3,666 made a New Low (NL). The selling pressure decreased and the latest reading doesn't show a significant increase in the NH, only 147, but the decrease in the NL is very significant 1,180.

The daily chart of the S&P 500 is still at oversold levels, there was a failed attempt to rally on Sept/28, but I still think that there could be a reaction rally. The weakness that the Bulls are displaying isn't very encouraging in terms to give an ambitious target for the potential reaction rally but 3,950 would still be realistic and more than that would be surprising. The reaction rally isn't a change in the Market direction, as I have mentioned in other articles is just a natural oscillation, the Market never moves in a straight line, there are always pullbacks and rallies in the middle.

In order to damage the structure of the weekly downtrend the S&P 500 would need to close above 4,350. In order to get above that level a very strong positive catalyst would be required, one that last at least a couple of weeks. A reaction rally doesn't need that much, I have highlighted with green dotted arrows the levels where there have been rallies when the index gets to oversold levels, most of them just lasted three to four days.

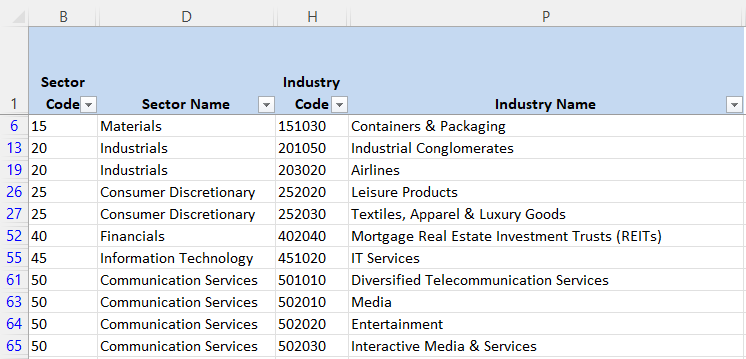

Industries

This week there aren't any Industries from the 68 that compose the Global Classification Standard (GICS) that I would consider strong. The decline has been too sharp and many Industries have been severely punished. A few of the ones that have been affected the most are displayed in the screenshot below.

The most interesting part will be to wait and see which of the Industries can hold the best during the Bear Market and eventually start to rally. Those Industries could be the leaders that start a powerful multi-month Bull Market. There isn't a way to know when that will happen, it could be tomorrow or in a year. That's why it's so important to keep monitoring this section.

Scenarios

Scenario #1: I'm on an optimistic mood and I still think that we will get to see a reaction rally, from my point of view that's the most likely scenario. I don't think that the Market is ready to change direction, a realistic target for the rally, in case it happens, would be 3,950. It will be important in terms of Market sentiment to recover a level above 3,600. The next strong support that might stop the decline is around 3,400 in case that the Bulls fail to rally or at least start a sideways movement.

Scenario #2: The second most likely scenario is that the decline continues. Fear is a very powerful and quick sentiment, if the trading week about to start doesn't have some positive news that can fuel the rally and make the investors forget a little bit about the inflation/recession, the Ukraine War, the China tensions, the supply chain crisis, etc. then the decline will likely continue and during my next article I'll post the new support levels that could stop the decline.

Scenario #3: If the weak Bulls aren't able to capitalize from the oversold levels and start a rally then maybe at least they can stop the decline and start tracing a bottom. I think this is the least likely scenario, we are at very extreme levels that could trigger the reaction rally and if that fails the Bears are displaying consistent strength that could take the indexes even lower.

Summary

The trading week about to start will give important clues about the balance of power between Bulls and Bears. Important levels are being tested and panic could invade the Markets if we don't get to see a reaction rally early in the week. All the Industries suffered important losses in the last three weeks, it's too early to tell which of those Industries will be the leaders that will trigger the next big Bull Market, however eventually it will happen. Some of those Industries will stop declining and will have important rallies and others will follow.

If you have preserved your capital, kept strict risk management then there are great opportunities in the future. Trying to catch the bottom of the Bear Market is a very risky business, "cheap prices" can always get cheaper. Averaging losses is another technique that can blow up your account. Sometimes staying on the sidelines is the best you can do while the storm passes. Whatever your decisions are, hopefully you will have a proven plan that lets you navigate, with low risk, this powerful Bear Market.