In historical terms, the period from November to January has historically been highly bullish when compared to the performance of other months. However, the current situation isn't very encouraging; the S&P 500 reached a peak at 4,600, and if we consider only the top 500 companies by market capitalization, it appears there was a substantial rally of 31.9%, which qualifies as a bull market. If we draw a trendline from the bottom to the current level of the index, we can even see that it hasn't been broken.

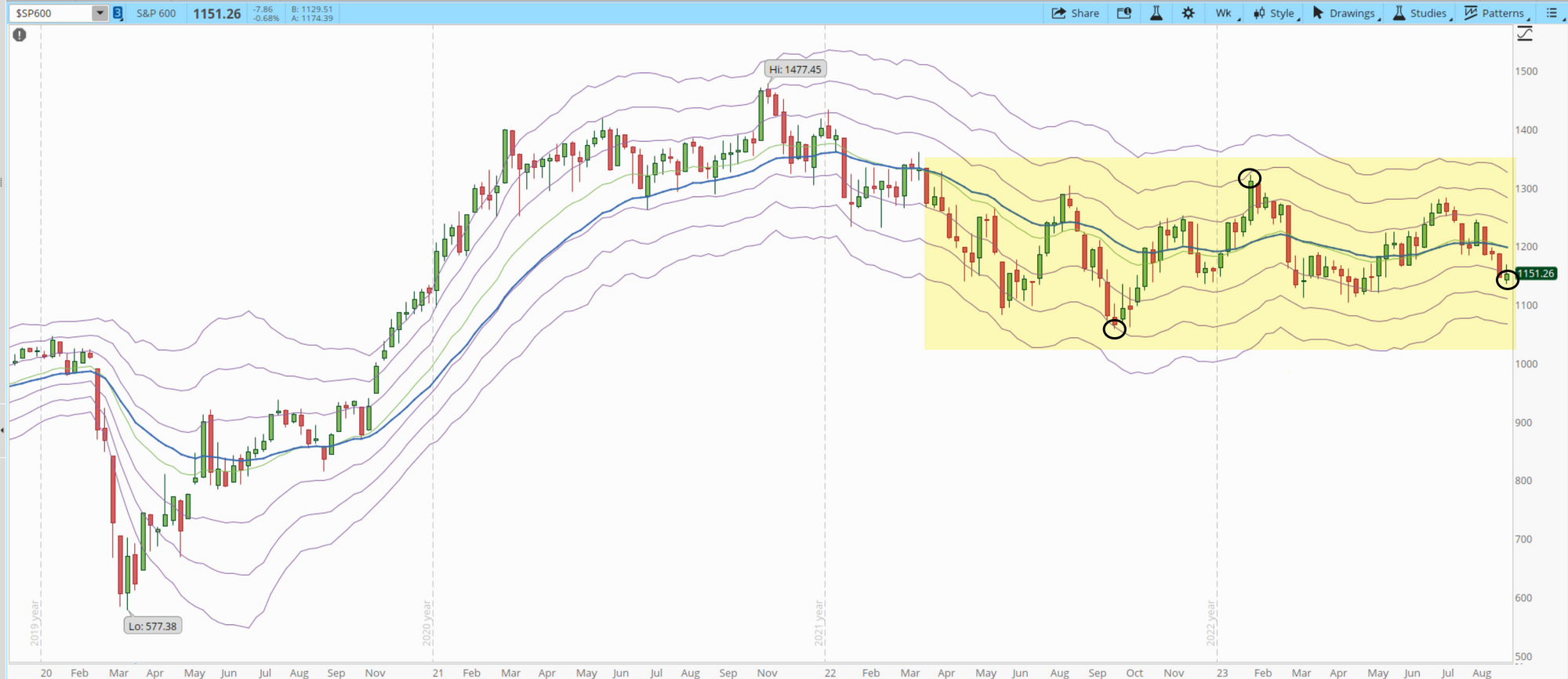

My concern is that the current rally seems to be driven by only a few stocks. If we examine the S&P 600 (small-caps) during the same period, the rally was 24.8%, also qualifying as a bull market, but it didn't hold, and the current price is only 8.8% above the low in September 2022. One year later, it appears to be in a sideways movement. In a bullish scenario, this sideways movement may be forming a base that could support a powerful and sustained multi-month rally.

Taking Profits

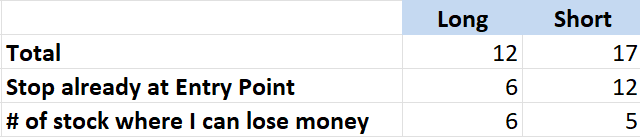

Currently, I hold 12 long positions and 17 short positions. Shorting appears to be working much better than buying, at least for me, with a strategy focused on swing trading and quick profit-taking.

A recent sample trade was with APP (AppLovin Corporation). There was a breakout with high volume on August 10th after the company reported earnings. I opened the position, and my initial criterion for taking profits was that the stock should move up the equivalent of 2 Keltner Channels (KC), which occurred on August 29th. I took profits with another third of the position after the stock moved the size of another KC, which was on August 31st.

After that, a significant amount of supply started to hit the stock, resulting in a substantial pullback. As a result, I closed the last third of the position on September 19th. This strategy is simple, straightforward, and low risk until the market establishes a clear direction. I'm trading in the same manner for both upward and downward movements.

Conclusion

I have reservations about the current rally. Most of the breakouts I've traded in the past couple of months have had a limited advance of 3 KC or less. It's becoming easier to find good short setups than stocks that I can buy. Until I see the S&P 400 and 600 (mid-cap and small-cap, respectively) closing above their +2 KC and breaking the current daily downtrend that began in July 2023, I will keep my trades at a very small size and with very tight stops.

Recession talks are resurfacing in the media, and another earnings season is approaching. Regardless of your trading system, ensure you have robust risk management in place, as volatility is likely to increase in the next few weeks.