Today's session wasn't that surprising, I had discussed this scenario in yesterday's post. There is no force from the Bulls, a series of bad news acting as catalyst, increasing the selling pressure. The interesting part will be whether the S&P 500 will make a lower low or it will start to move sideways or maybe even rally.

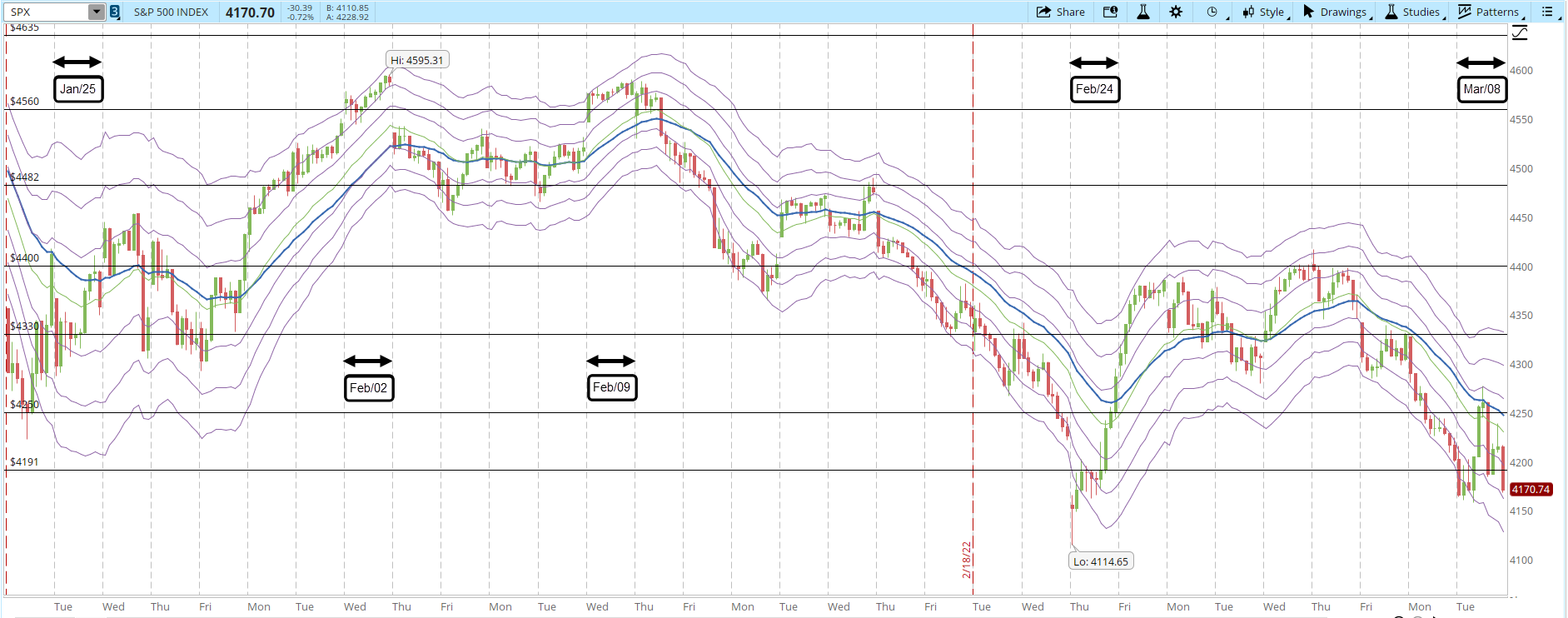

There are some concerning aspects in the charts, starting with the 39-min chart, the S&P tried to rally in today's session, but once it hit the 4,250 resistance it went down closing near its lows of the day. It's very close from testing the 4,114 level, which is the previous low.

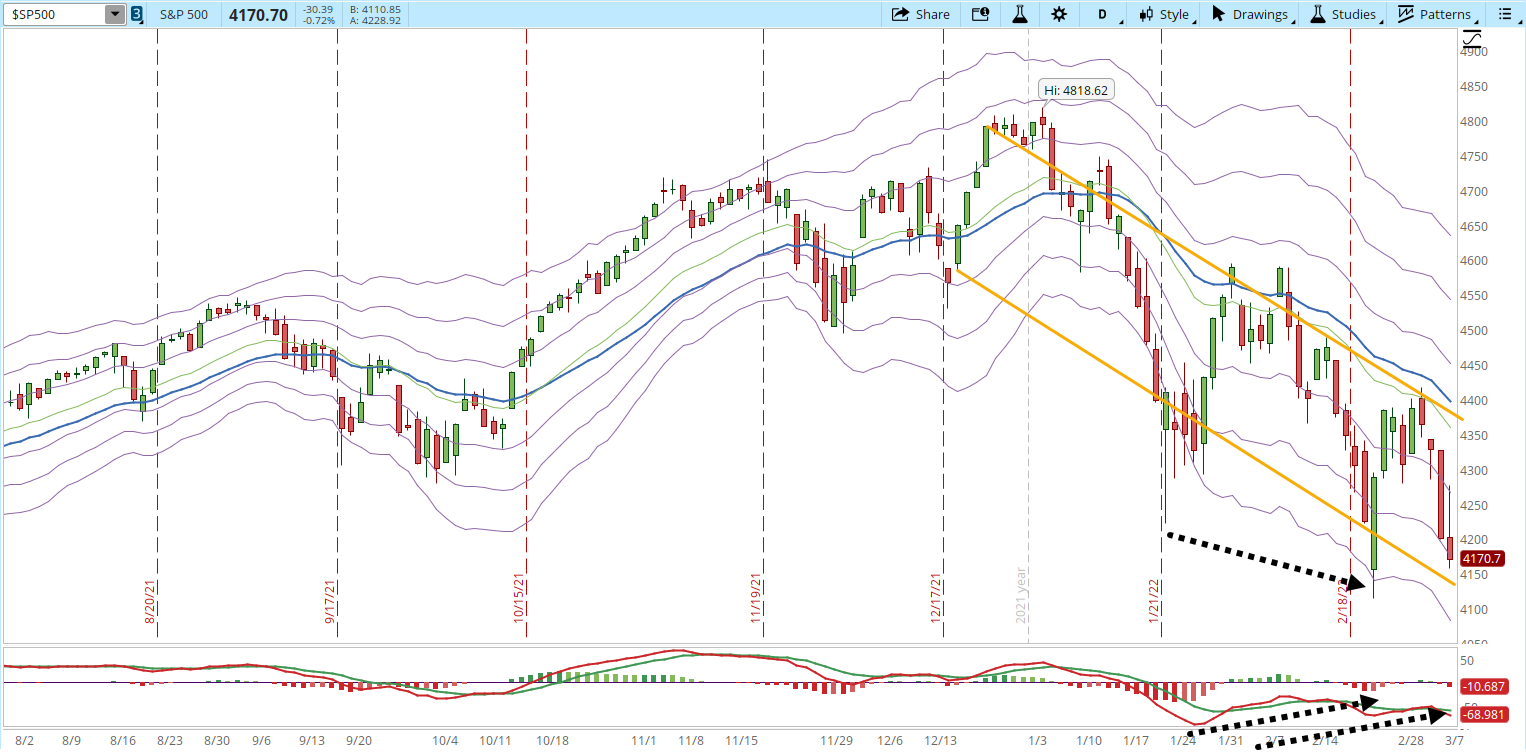

The daily chart has bad and good news. The bad news is that this looks more every day like a downtrend. I have added the orange lines in order to make it easier to recognize it. The good news is that there is a potential bullish MACD-H divergence that could trigger a rally (not necessarily an important rally). That possibility was there on Feb/24, but the rally was killed after two days. Another bullish divergence could develop and see if there is more demand that pushes the prices up (black dotted arrows).

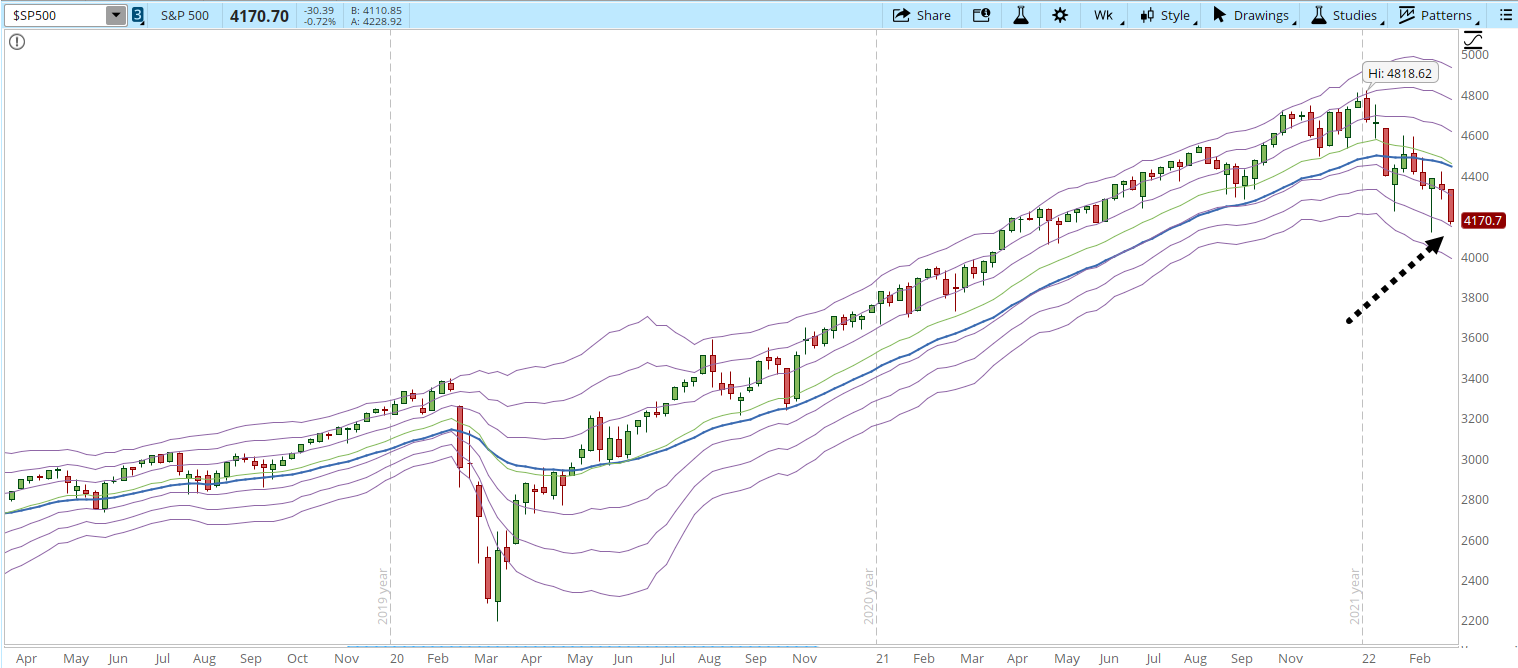

The weekly chart is not very encouraging, if the S&P closes below the -1 Keltner Channel band (KC) that would indicate a strong selling pressure (the normal levels where the price would be oscillating is between -1 and +1 KC). We are near the middle of the week, so the last bar is still not reliable, the S&P could still rally, but if it closes like that and with the 30-week EMA starting to decline the scenario would look very bearish.

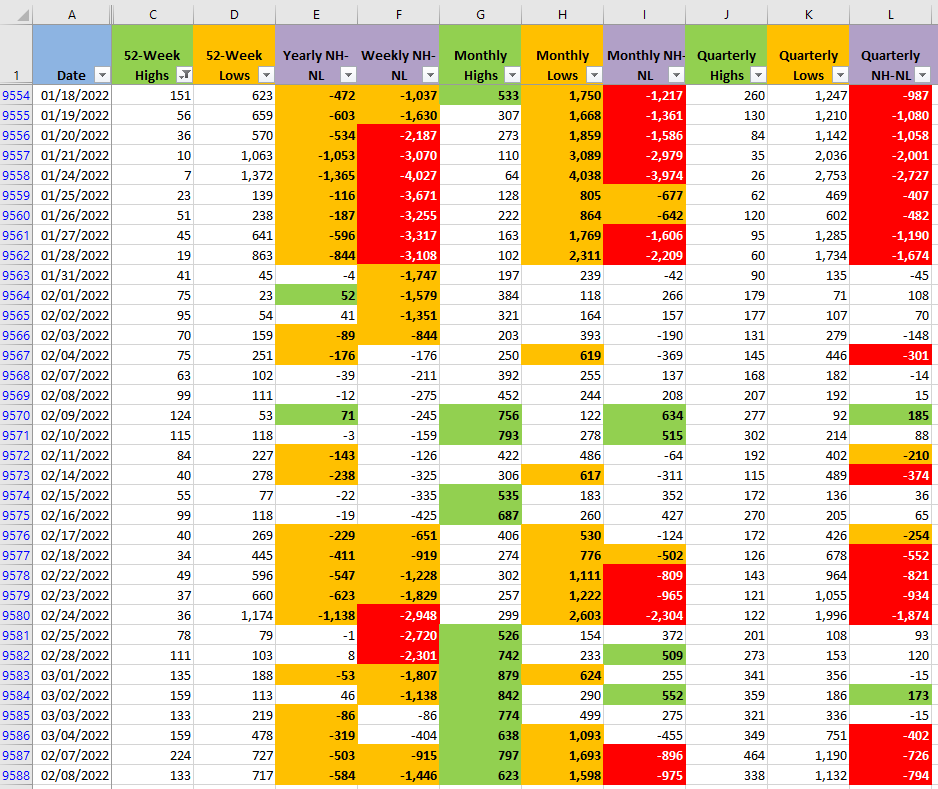

Finally, the numbers of the New Highs and New Lows (NH-NL) only confirm the selling pressure. It's important to monitor them as it will be an important clue once there is a recovery in the numbers for the Monthly timeframe (G, H, I).