Today despite the positive economic data published about the employment, didn't help much, once the Fed's minutes were published the Markets sold-off. The new policy was seen as more hawkish than expected, that means the Fed is likely to increase sooner and faster the interest rates in order to keep inflation under control.

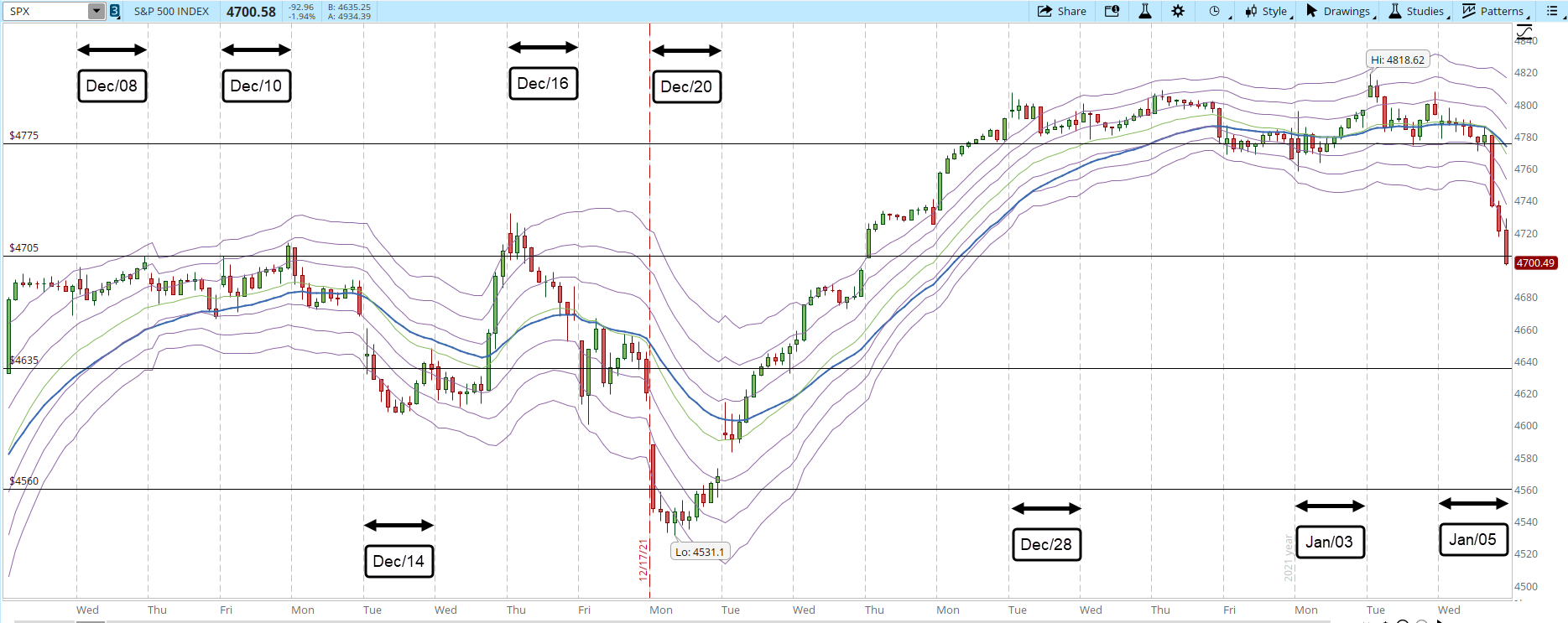

Moving away from the news, the 39-min chart shows the force of the selling pressure. It broke the weekly resistance that was consolidating as a support and it's about to break one of the short-term support levels I add for illustration purposes at 4,705 (you can click the image in order to zoom in). I have been stressing in my latest posts the weakness in the Markets, tomorrow it will be important to see if the S&P can hold above 4,705 or not. If the selling pressure keeps increasing the Market will keep going down until it finds a support that can't break, the next one is 4,635.

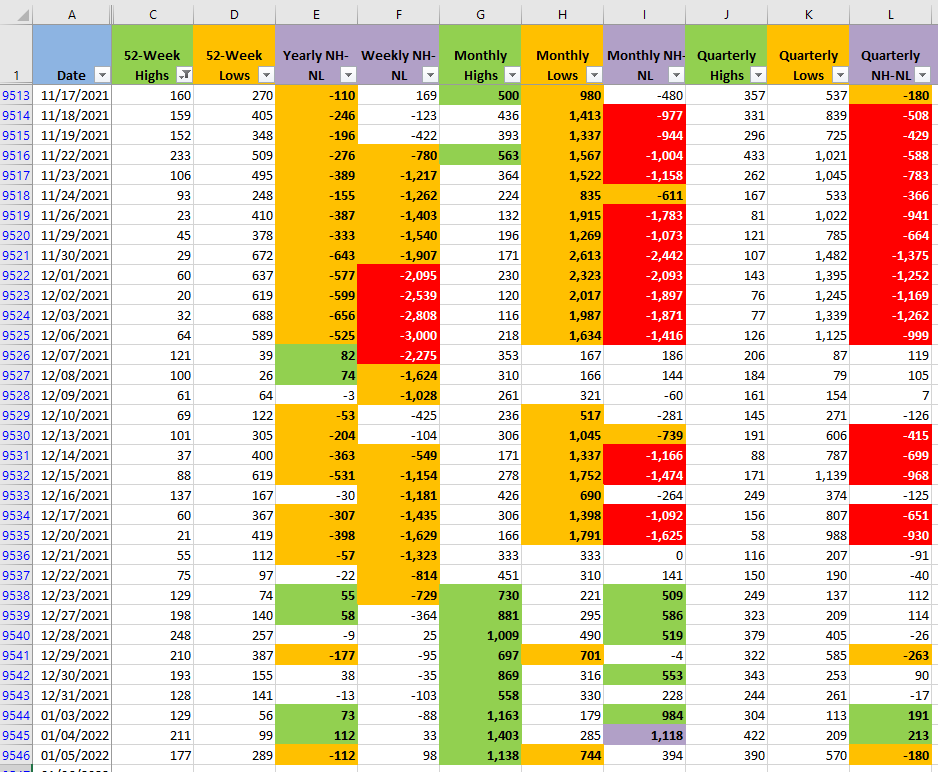

The Monthly Highs vs Lows (NH-NL) confirm the weakness, the amount of Lows more than doubled. I was expecting that the Monthly Highs collapsed under the circumstances, but they are still holding, maybe tomorrow the numbers will confirm the sell-off.

Despite what might look as attractive prices after the sell-off the selling pressure might continue, I'm staying on the sidelines until the scenario improves. For me that means holding the 4,705 support, eventually rallying above 4,775 and finally crossing the 4,800 level. That could sound as something far away, but today, the S&P got to 4,818 before collapsing. Whatever is your trading strategy evaluate if you have the proper risk management in place in case the S&P continues it's way down.