Happy New Year, wishing you a happy, healthy and prosperous 2022. Monday will be the first trading day of the year. I'm excited to see what opportunities are waiting for me in 2022. Certainly several warnings about the weekly uptrend have been discussed in past posts, when the trend ends, and some day it will, a Market correction or a bear market could eventually open a world of opportunities if we have the proper risk management in place to protect our accounts.

Market Overview

One important thing to notice is that I calculate the weekly support/resistance based on the data from Stockcharts.com using a 'Volume by Price' indicator. The idea is that the support/resistance lines are set around the areas where there are important congestion zones. The FAQ section of the blog discusses in detail the parameters I use for the calculation. Everybody has different parameters and indicators, use whatever you trust and understand.

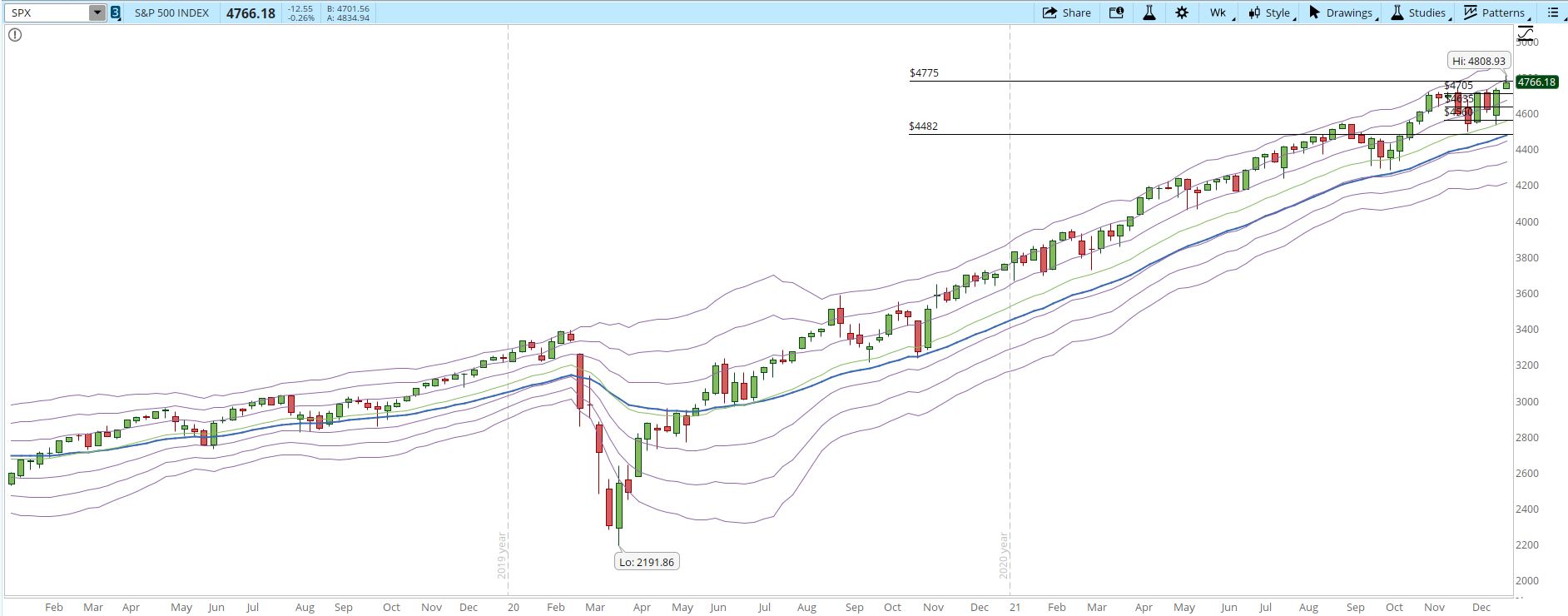

The new weekly support/resistance lines for the S&P are 4,482 / 4,775 respectively. I have added a few short-term support/resistance lines in between in order to better understand the daily action, the lines are set at 4,560 / 4,635 / 4,705. In the 39-min chart below (you can click on the image in order to zoom in) it is possible to see that after the rally that started on Dec/20 the S&P has been unable to get past 4,800, it has tested and rejected that level.

When the rally ran out of fuel there was a pause of three days where the index was moving sideways, however, on the last trading day of 2021 it closed below the resistance line of 4,775.

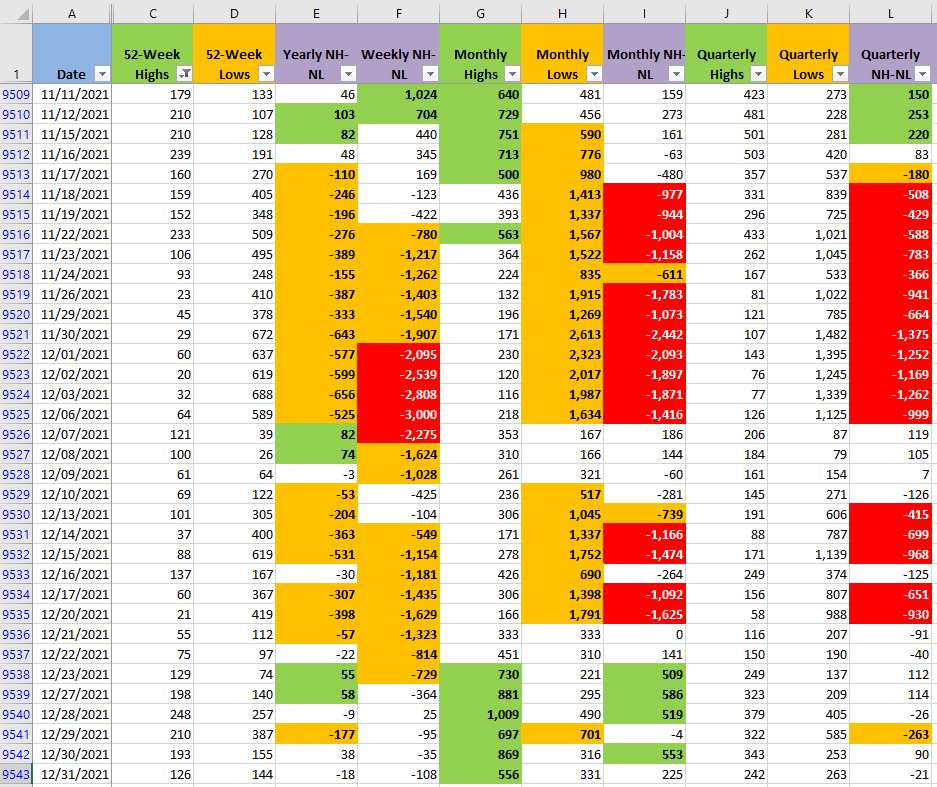

In terms of the New Highs vs New Lows (NH-NL) in all its timeframes there is no clear winner in any of them. The power that at some point Bears and Bulls were displaying for now it's gone.

On the daily chart (screenshot below) there is also a bearish warning. Back at the first few days of November, the S&P the index was able to get past and stay for several days around the +3 Keltner Channel band (green arrow). During the latest rally a divergence was created, that means that there is a higher price with an indicator reaching a lower level, the KC on the latest rally barely got to the +2 KC band (red arrow). The bearish divergence is highlighted through the black arrow.

A bearish divergence could be a warning of a potential correction, the index won't necessarily collapse into a Bear Market, however, when the index is unable to reach a similar level in the KC band while getting to a new historical high is definitely a signal of weakness.

In terms of the weekly trend is still intact (screenshot below). It will be important, at least for my particular way of trading the Markets, to see how the S&P behaves after a consolidation of several weeks. Was it just a pause in the weekly uptrend? Was it a distribution phase where the index is topping and eventually will go down? During the next few weeks clues will be given and it's key to pay attention to them.

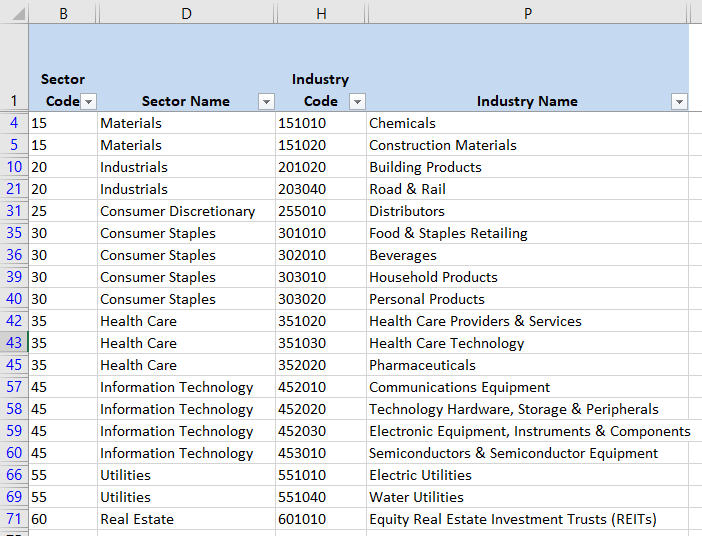

Industries

There are several Industries that look strong, and despite that the number of Industries increased from twelve on my last Weekend Overview post (link below) to nineteen this week, they seem to be increasing around defensive Sectors such as Consumer Staples, Real State and Utilities:

Dec/26 - A Christmas Present to test Resistance Levels

Scenarios

- Scenario #1: If the S&P is able to keep above the 4,775 line and eventually rally while the New Highs increase and the New Lows stay at the current levels or lower then I'll start opening long positions. Several alerts of tickers I follow triggered during the week but I decided not to take any of them because of the repeated weakness alerts discussed in my previous posts.

- Scenario #2: If the S&P keeps moving sideways, testing the 4,775 there is nothing for me to do other than waiting on the sidelines until there is a clear direction.

- Scenario #3: If the S&P is unable to close above the 4,775 level, and the New Monthly Lows start to increase significantly, then the selling pressure will take the index down to test the next support. Some of my stops could trigger on this scenario. I won't add any new long positions and I haven't found any attractive setup to short. On this scenario my plan will also keep me on the sidelines.

First Higher Low

With the increased difficulty to find good trades and the persistent bearish signals, I'm considering to start trading a strategy I successfully used in the past called First Higher Low (1 HL). I learned about it from Kerry Lovvorn when I went to one of his seminars in Alabama in 2018. There is also a lot of material in Spiketrade.com, which is the site that he runs with Dr Elder. I stopped trading it because of the following reasons:

- You can trade the strategy in any timeframe you want but I was trading it on the daily charts. That means I was swing trading (holding the trade for a few days or weeks, not months). Swing trading requires a lot more time in front of the screen, which I didn't have back then.

- When I switched to using Stan Weinsteins methodology I had to pick the new strategy or the 1-HL I was using. If I kept both that meant that the amount of time, scanning and managing, trades doubled.

The concept is actually very simple, a stock that has been going down for the last 30 days still has ups and downs, however every time it goes down it makes a lower low and a lower high. At some point, the stock stops the downtrend, rallies and when it pulls back the low is higher than it previously was. The idea is that the stock could potentially now start an uptrend, or at least a rally where it will be doing higher highs and higher lows (green arrow in the image below). There is always the risk that rather than start going up the downtrend resumes (red arrow), risk management is essential in this strategy, I had a success rate of around 70%, but if I failed to manage the losses, they could eat all the profit and more.

That is just an overview of the strategy, check the resources mentioned above if you are interested in trading it. It's a profitable swing trading strategy if you have the time to make it work and manage it. It took me around three months of losses before I could start to turn things around.

Besides the lack of opportunities trading Stan Weinstein's methodology, swing trading has the advantage that I get to keep the positions open a smaller amount of time, risky situations like quarterly reports can be avoided, and if there is a bearish period I can close the positions a lot faster than trading weekly uptrends.

Since the bearish signals also haven't stopped I might need to start spending more time managing my portfolio in order to avoid a big loss whenever the weekly uptrend is over.

Summary

The warning signals in the Market keep appearing. Whether this is a pause in the uptrend or we are getting close to a top, no one can really be 100% sure. When I trade I don't try to forecast, I follow a plan, if things go my way then I get a profit and if not I manage the loss. Keeping the net balance between profits and losses in my favor is what keeps my equity curve on the right direction. When I enter a trade, I'm fully aware that it could fail, trading is a probability game, there is no crystal ball that will let us know what's going to happen. Learn to fail until it doesn't hurt that much, failing is part of trading, you won't have success until you have learned how to deal with failure.