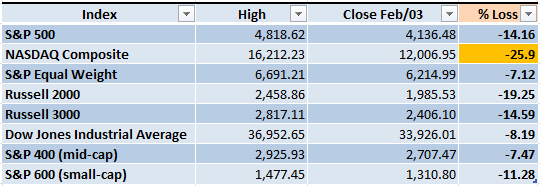

Of the most important indexes, the Nasdaq Composite was the one with the worst decline during the 2022 Bear Market. At its bottom in Oct/2022, the losses were 37.8%. If we review the latest numbers, it's the only important index that is still in Bear Market territory.

The interesting part is that the Bulls are gaining strength, if we change the perspective and analyze how much the same indexes have rallied, four of the indexes are already in a Bull Market, and the Nasdaq is just about to get in that zone.

Market Overview

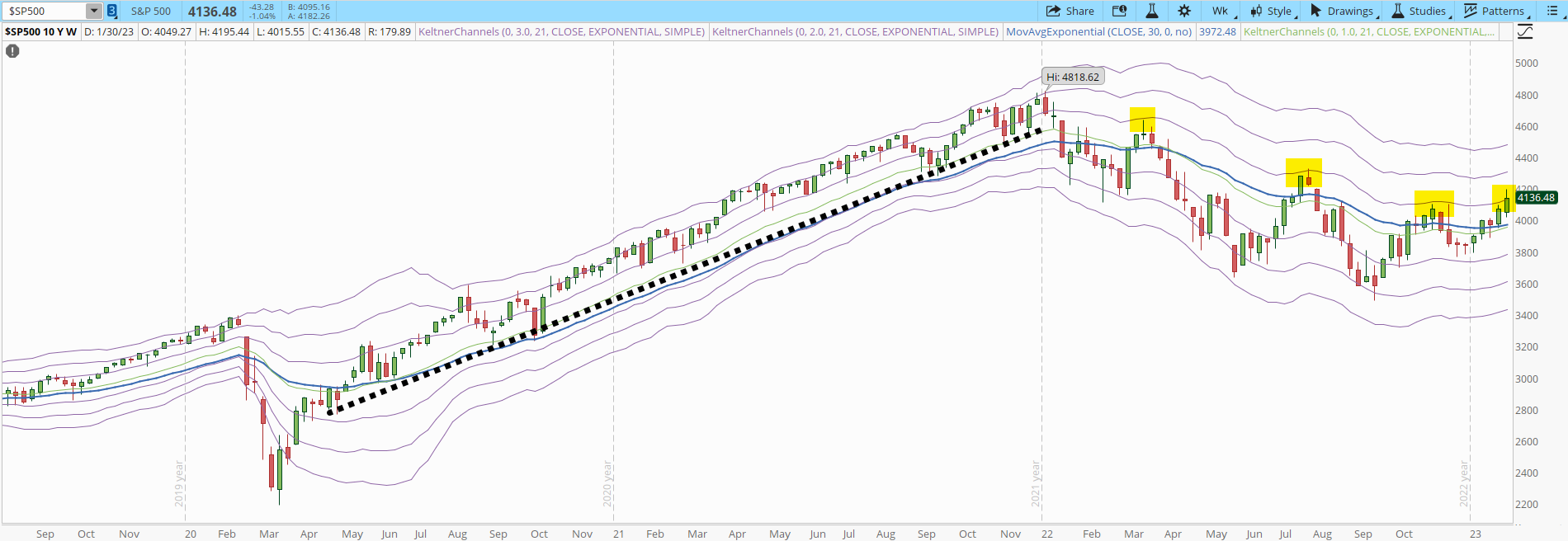

I have mentioned during my past articles that I closely monitor two milestones in the S&P 500. The first one is 4,150 and the other one 4,350. We did see a rally during the trading week of Jan/30, but once the index got close to 4,200 the selling pressure increased and a decline started.

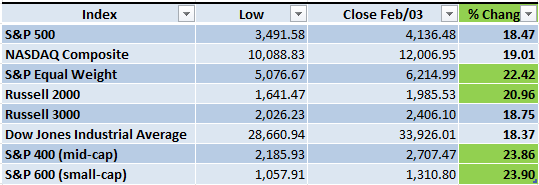

In the weekly chart displayed below, we see that the Bulls keep fighting to gain control back. The +1 Keltner Channel (KC) is still acting as a resistance. Every time the S&P 500 gets to that level, the index pulls back. Compare that to the powerful rally of 2020 and 2021 (black dotted line) where the index kept oscillating between the +2 and +3 KC, not even going below the 30-week EMA (blue line). That is what bullish power looks like.

When the Bulls are finally able to break the pattern and close above the +1 KC, some interesting things can happen when trading on the long side.

Volume by Price charts are another way of identifying supports and resistances, the levels of 4,150 and 4,350 are the next resistances that will be harder to break where there is a higher concentration of volume. It will be a significant event if those resistances are broken and turn into supports.

I still maintain my position from last week in which I mention that a limited pullback is coming. Based on the daily chart of the S&P 500, the times where the index got to overbought conditions (+3 KC or above) a sharp decline followed (highlighted in yellow).

I now have eleven long positions open. For two of them I already increased my position. Five of them, I already moved the stop to the entry price, so unless there is a gap, there's no way I can lose money. The rest of them are still pilot trades where I could lose 5-6%. If a pullback comes, it will be great to see which positions crash and which ones will recover fast. There is no point in keeping the losers in a portfolio.

Industries

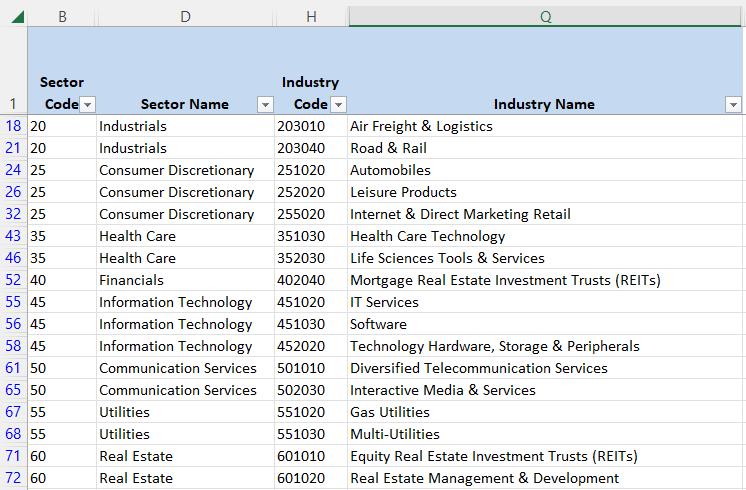

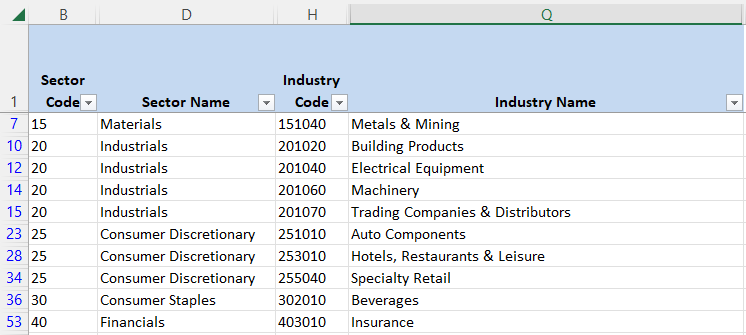

From the perspective of the Global Industry Classification Standard (GICS), I see only see 17 Industries out of 68, with a clear weekly downtrend (screenshot below). I'm only trading on the long side at this point, and I won't consider any company classified within those Industries for my pilot trades.

Companies that fueled the previous Bull Market, such as the Tech Mega-caps (Google, Microsoft, Facebook, etc.) they fall within those Industries. My open long positions are in completely different Industries.

Scenarios

Scenario #1: From my point of view, I'm still confident that a pullback is coming, it's even expected at this point. Not that I like the idea, I have eleven long positions that are using around 65% of my available trading funds. However, when I see a stock that falls within the technical pattern that I'm looking for and has the characteristics that fit my trading plan, then it's time to pull the trigger. I don't trade indexes through ETFs, whether an index goes up or down is just a reference of the overall Market direction. I trade individual stocks and follow a trading plan, my personal point of view or the indexes are irrelevant.

If the pullback does happen during the next trading week, as long as it doesn't go too far below 3,950 it will still be a healthy decline. If the selling pressure spikes, the next strong support would be at around 3,800.

Scenario #2: Bulls are finally giving some signals of strength. Maybe next week they will surprise us with some strong demand and the rally can continue even at overbought conditions. The news about the strong jobs numbers that caused the losses on Friday Jan/03 are still a concern, more aggressive rate hikes might be on their way. If there is a rally despite the negative news, that would be another signal of bullish power.

Scenario #3: The least likely scenario is something similar to what happened from mid-November to mid-December 2022. The Market didn't find a direction and just kept moving sideways during that month. With the earnings season, I don't think the Market will avoid some volatility.

Summary

The S&P 500 and the rest of the most important indexes are close to be in Bull Market territory, some of them already are. I still don't have full confidence that this is a sustainable rally that can turn into a strong uptrend. Some Industries are displaying some interesting uptrend movements that could eventually turn them into the leaders of a multi-month Bull Market.

If you try to consider all the factors around the stock Market, so much information will just turn into noise. I trade only the stocks that fall within my trading plan and ignore the rest. It's a boring and slow way of navigating the Markets, but strict risk management has kept me alive so far. Preserve your capital or you could be out this game pretty quickly.