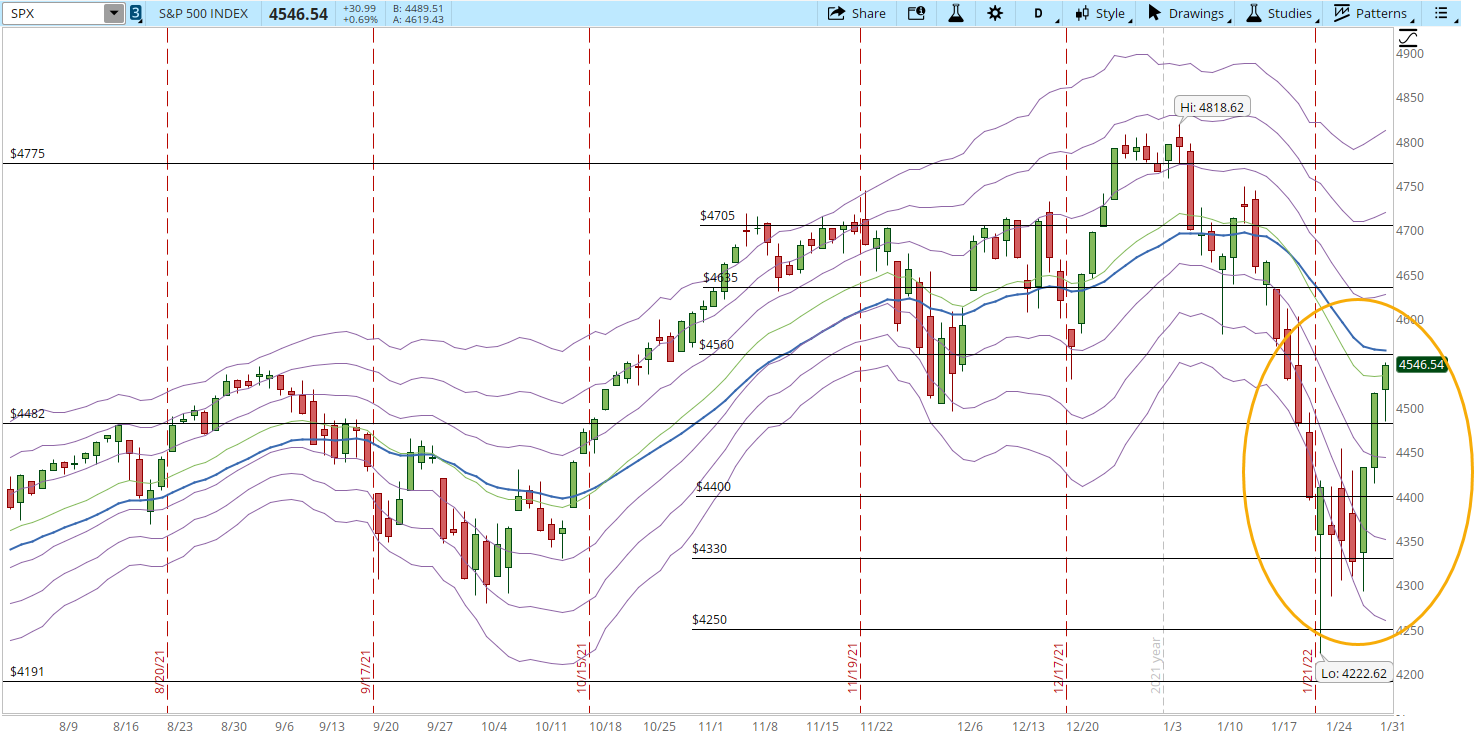

The S&P continues rallying towards the next resistance, which is at 4,560. Today the force of the movement was weaker than the past two days. In fact, most of the day, the S&P was practically flat and towards the end of the session it rallied a little bit.

Analyzing the 39-min chart we can see this behavior more clearly. Most of the gains, so far, come from Jan/28 and Jan/31. Today the rally made little progress and in the next few days, we will be able to see if it continues or not.

Yesterday I mentioned in my post that a pause in the rally was one of the possibilities we could see:

A Spark of Strength in the Market

Today the S&P hold above 4,500, it even rallied a little bit towards the 4,550 level at the end of the session, however the Bull's force seems to be diminishing. Checking the length of the last three bars on the daily chart below, the last one is the shortest of the three, though all of them closed near their highs.

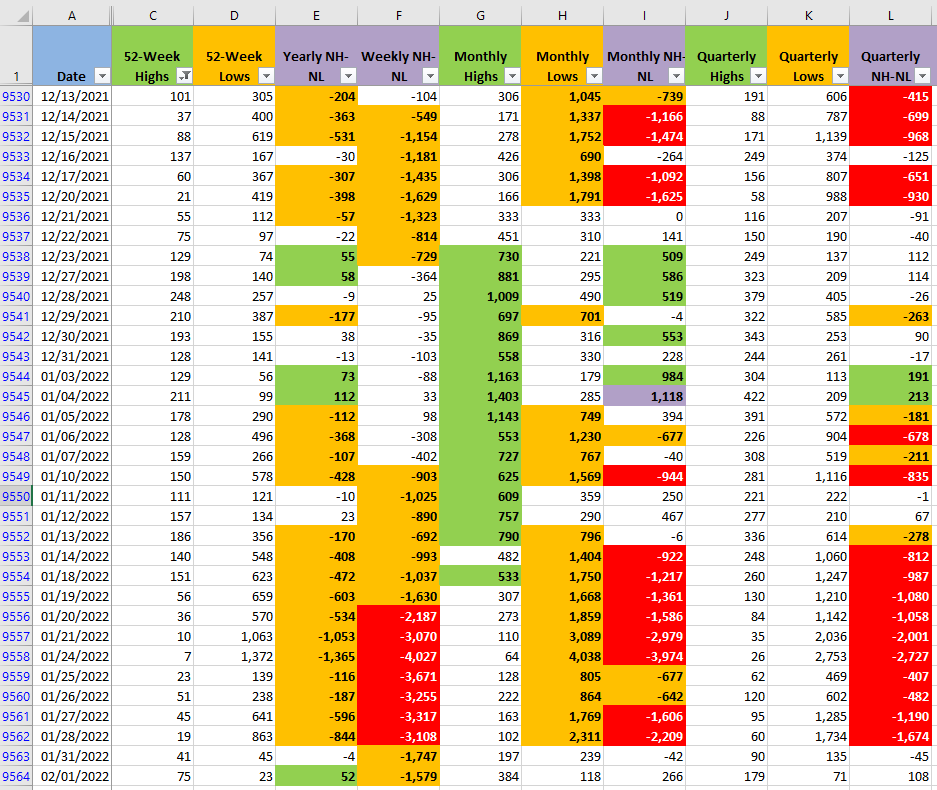

The New Highs and New Lows (NH-NL) didn't change that much. The New Highs increased a little bit in all the timeframes as the New Lows decreased in a similar magnitude.

If the rally is to continue, the S&P will have to hold and break decisively the 4,560 resistance. The NH-NL in its monthly timeframe needs to reflect that the Bulls are gaining force (increasing the Monthly NH) and the Bears don't have the power they displayed after Jan/04 (keeping or decreasing the Monthly NL).

I still haven't opened any new long positions despite several alerts triggered today for symbols that I'm tracking. I want further evidence that the rally is for real and today I didn't see that. Since the Market got to oversold conditions a relief rally was expected, however if the selling pressure is not absorbed in the next few days there is the risk that the Correction resumes.