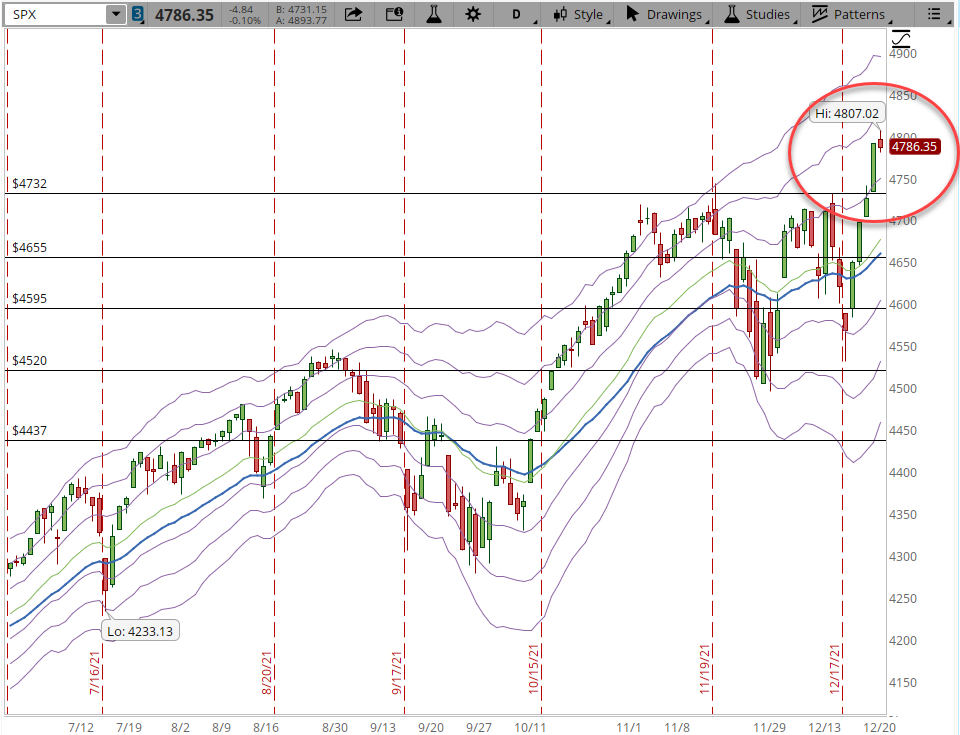

After four days of the S&P rallying to all-time highs today the party might be over, the next few days will tell if this is only a pause in the rally or a correction that test or breaks the support level.

During the weekend I'll recalculate the weekly support/resistance levels but for now the 4,732 line is the new support. It will definitely change as I get my data from Stockcharts.com based on a 'Volume by Price' indicator and the price has changed and will change every time the S&P reaches a new high (the FAQ section of the blog displays the parameters that I use for the calculation).

One captivating idea is that someone can predict what the Market will do and give us the certainty and comfort that trading lacks. I haven't found anyone that can actually do it on consistent basis. We all have an opinion of what could happen next and sometimes we will be right, but the Markets are full of surprises, so rather than trading my opinion or someone else's opinion I trade the charts.

Today I was ready to open three new positions when I saw that the S&P rallied at the beginning of the session. Then the rally lost its power and never recovered, none of my orders was filled. In the 39-min chart below it's hard to appreciate what I don't like about the movement, it seems as only a pause on the trend. (click on the image in order to magnify it)

Unfortunately, on the daily chart (screenshot below) today's action seems like a false breakout. That means the S&P rather than continue it's way up now is showing weakness after the higher price was rejected and could move sideways or down in order to test the support line.

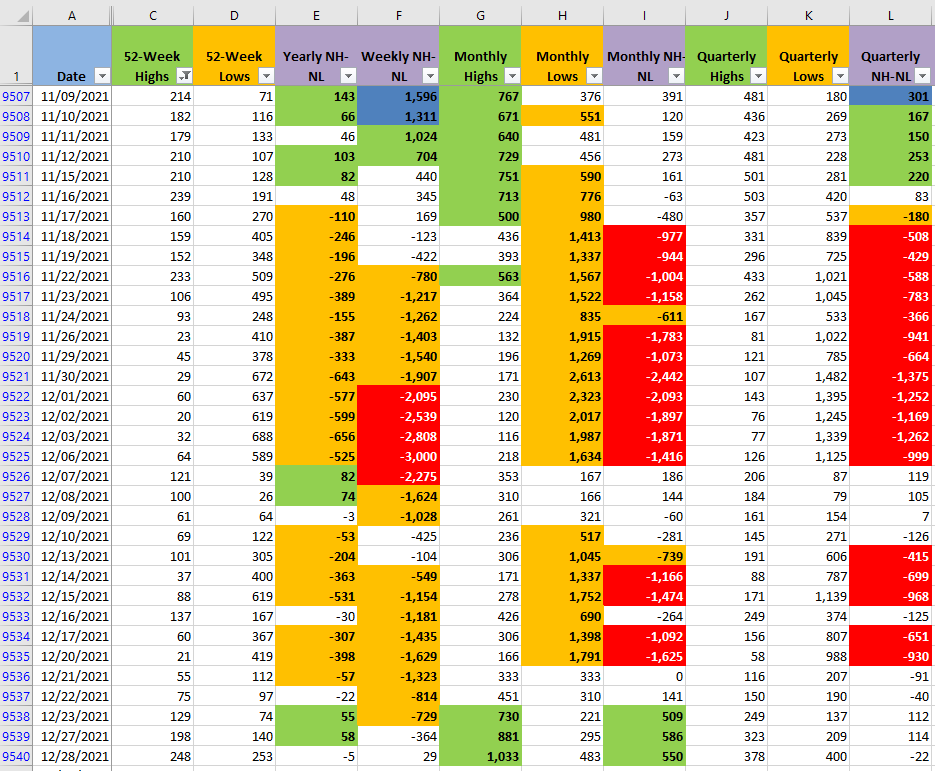

The New Monthly Highs and Lows are giving additional warnings about the fragility of the S&P rally. In the image below in all the timeframes, the New Lows increased significantly. In the slowest timeframes (columns E and L) the balance between New Highs and Lows even went negative.

Tomorrow's price action will give hints about what is the most likely scenario.

- Scenario #1: If the S&P will continue its way up then the Monthly Lows need to stay at the current level or decrease. The rally needs to hold above the support line and if the selling pressure doesn't increase the uptrend will be able to continue. If the uptrend resumes I'll start opening new long positions based on my strategy trading the weekly charts.

- Scenario #2: If the S&P starts to trend sideways then I'll stay on the sidelines until the price action and the indicators confirm a direction in the Market trend.

- Scenario #3: If the New Lows keep increasing then the selling pressure will eventually take the S&P down until it finds support. The first support will be 4,732 and if the selling pressure doesn't diminish we will be back below that line. In this scenario, I'll also stay on the sidelines for my particular way of trading.

As a summary, I was ready to open new long positions because I was bullish after the four bullish days the Market had but things didn't work out as planned. The price action today and the amount of New Lows in all the timeframes show that the fragility that the Market displayed during all the weeks it couldn't get past the 4,732 resistance line is still an issue.