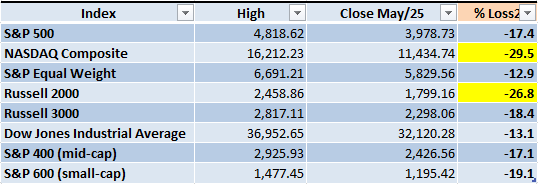

The main indexes finally got a break courtesy of the Fed, the May 3-4 FOMC minutes were released today and they hint that the Fed won't necessarily need to turn more hawkish in order to fight inflation. In the screenshot below you can see the current losses of the Correction/Bear Market. The ones highlighted in yellow are already in confirmed Bear Market territory (a loss of 20% or more from the previous high).

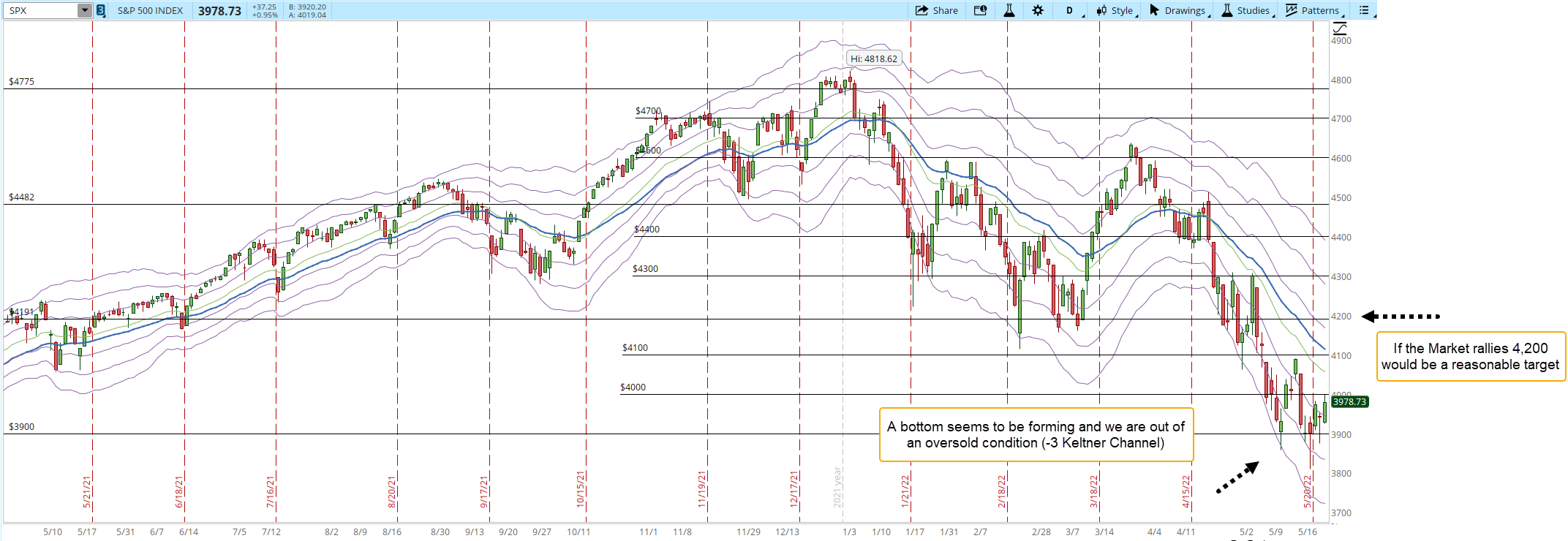

A rally at this point wouldn't be something crazy, with the current scenario I still think it would only be a reaction rally that would reach a level between 4,100-4,200. Tomorrow it will be a new day in the Markets, the Fed good news will not last forever, something else will need to fuel this rally during the last two trading days of the week.

If we do get a rally, it's important to distinguish between a reaction rally and a real change in the Market direction. A reaction rally is just part of the natural oscillations that any chart in the Market displays. Even in a downtrend there will be up and downs along the decline, no chart will move in a straight line forever. A change in the Market direction would imply that the Bears are losing control and the Market will be ready to move significantly up, something we haven't seen this year. The most powerful rallies of 2022 got to 4,600 before getting crushed by the Bears and now the S&P 500 is struggling to stay above 4,000, way below the 4,818 we had in January, so the Market direction in 2022 isn't up definitely.

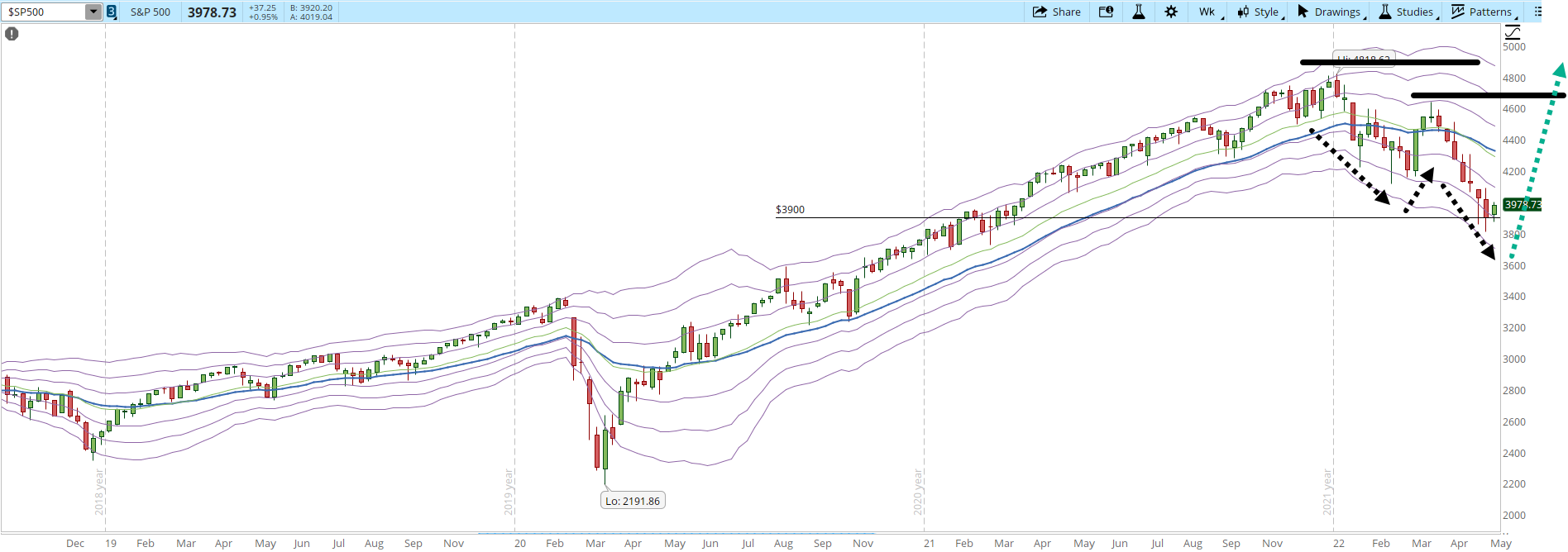

Short-term doesn't really matter much, we can extract some clues and try to guess where the Market might be going tomorrow or next week but anything can happen. My main concern is in the weekly chart, a pattern of lower highs and lower lows is forming (horizontal solid lines) and if whenever an important rally happens doesn't break and hold above 4,650 (green dotted arrow) it will only draw a potential downtrend more clearly.

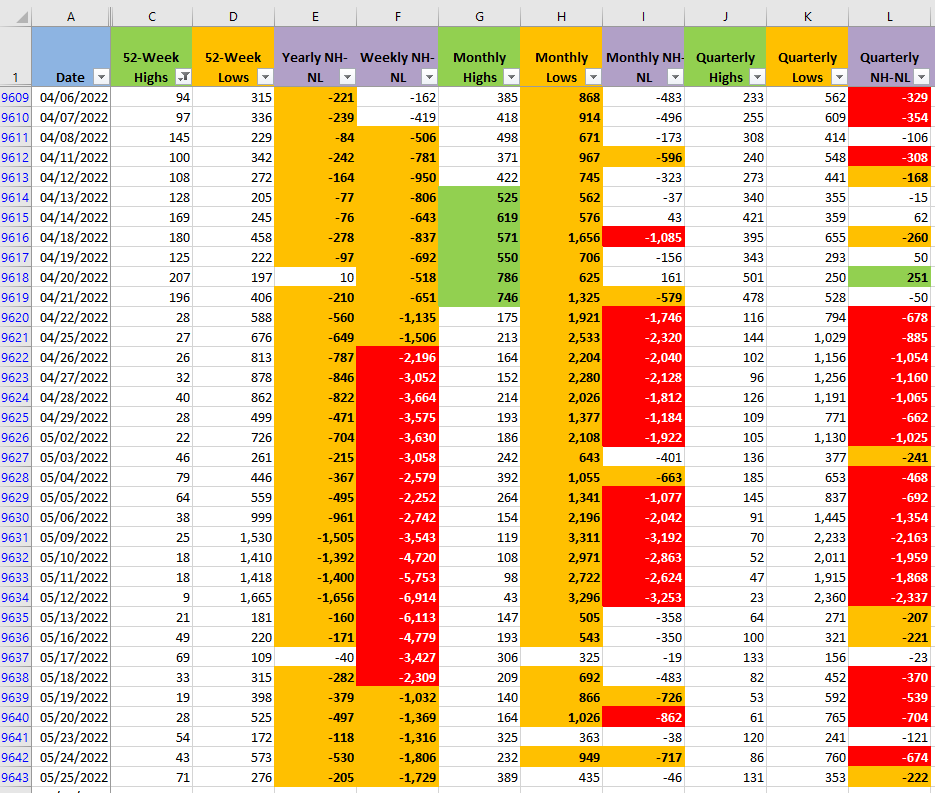

The New Highs and New Lows numbers (NH-NL) improved, especially the New Lows decreased significantly. That's a good sign, eventually it needs to be validated with the price action, that means the New Lows keep decreasing, the New Highs start to increase and the price moves up in alignment with those numbers.

We are living a more relaxed trading week than I thought we would have. A potential bottom with some hope of a reaction rally. My point of view hasn't changed yet, I don't think we already saw the end of the Correction/Bear Market. I wouldn't relax just yet. Observing all the action from the sidelines keeps my perspective a little bit more objective, I'm not losing any money if the decline resumes, it will just open more opportunities in the future.