The Consumer Price Index (CPI) report measures the change in consumer prices based on a representative basket of goods and services over time. With the favorable CPI report released today the news were interpreted as a possible inflation peak which could lead the Fed to limit its rate hike program. I don't trade the news, however it's important at least to have an idea of what are the important catalysts discounted by the Market and most importantly what was the reaction to the news.

In the article that I posted last weekend I mentioned that the most likely scenario for this week was a pullback. I still think that the pullback can happen this week despite the powerful rally. I don't like the way the Market rallied today, that gap that it traced could end getting filled in the next few days. Additionally, the daily chart clearly shows that we are in overbought territory (+3 Keltner Channel or above).

The past two times when the S&P 500 reached the +3 KC, it had sharp declines (orange circled areas). I have also highlighted a resistance around 4,200 with the horizontal black dotted line. That's an area where there is a lot of volume and selling pressure will likely start increasing.

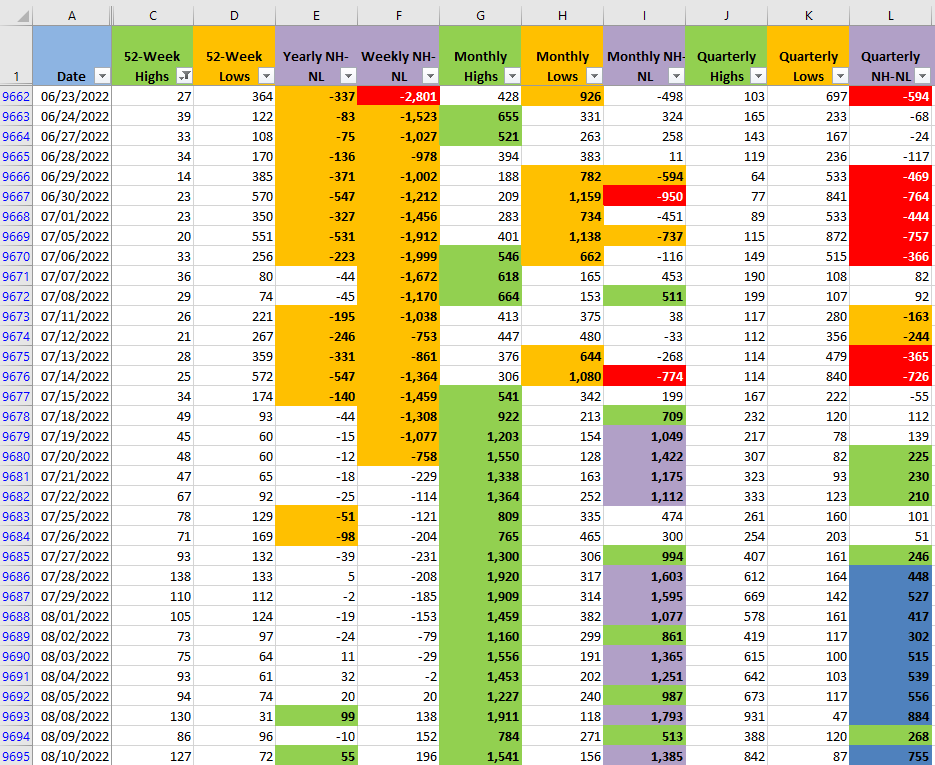

The New Highs and New Lows indicator (NH-NL), in all the timeframes I track has turned bullish. I'll pay special attention to the Monthly timeframe (columns G, H and I), if the supply starts to overcome the demand, those are the columns that will move first.

The rally starts to dissipate the fear that is dominating the Market. The greed and Fear of Missing Out (FOMO) the next big Bull Market, slowly start to become the dominant Market sentiment. I'm being very careful about the current situation, the signals of a pullback are there. Back on Jan/2022 we were at a level of 4,818 we are still 600 points away from getting back to that level. We need a lot more positive catalysts to recover that level.