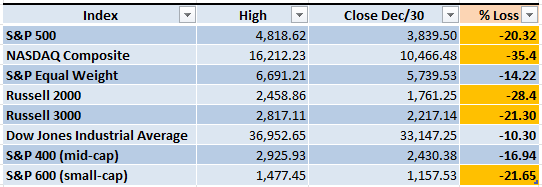

The year 2022 had a couple of promising rallies that couldn't change the Market direction, the Bears dominated most of the year and almost all of the most important indexes closed in Bear Market territory (a loss of 20% or more from the previous high):

We begin 2023 with a lot of uncertainty, about the inflation and potential recession, the Ukraine war, COVID, the supply chain crisis and the tensions with China. By the time the news hit the conventional media, it's usually too late to make a trade. The analysis of charts can give some clues about what could happen next in the Markets.

Market Overview

January 2023 will be a test to see if the current weekly downtrend continues or not (a downtrend is a series of lower highs and lower lows, highlighted by horizontal black lines in the screenshot below). Keeping track of the pattern is very easy, every time the index gets to the +1 Keltner Channel (KC, highlighted by the yellow areas) the index has an important pullback. When it gets to oversold levels (-3 KC or below, green arrows) the index rallies again. At some point the pattern will break and we will need to understand in which direction the Market will move next.

If the S&P 500 has a decline to a level around 3,400 then the downtrend structure will continue intact. If, however, the index rallies and is able to close above 4,350 that would seriously damage the pattern.

The daily chart isn't very encouraging, the pattern is also obvious. During 2022 the S&P 500 only got to the +3 KC three times (highlighted by green circles). After reaching that overbought level, the index started a decline (red arrows). The rest of the year, the index could barely get to the +1 KC, sometimes not even to that level (orange highlighted areas).

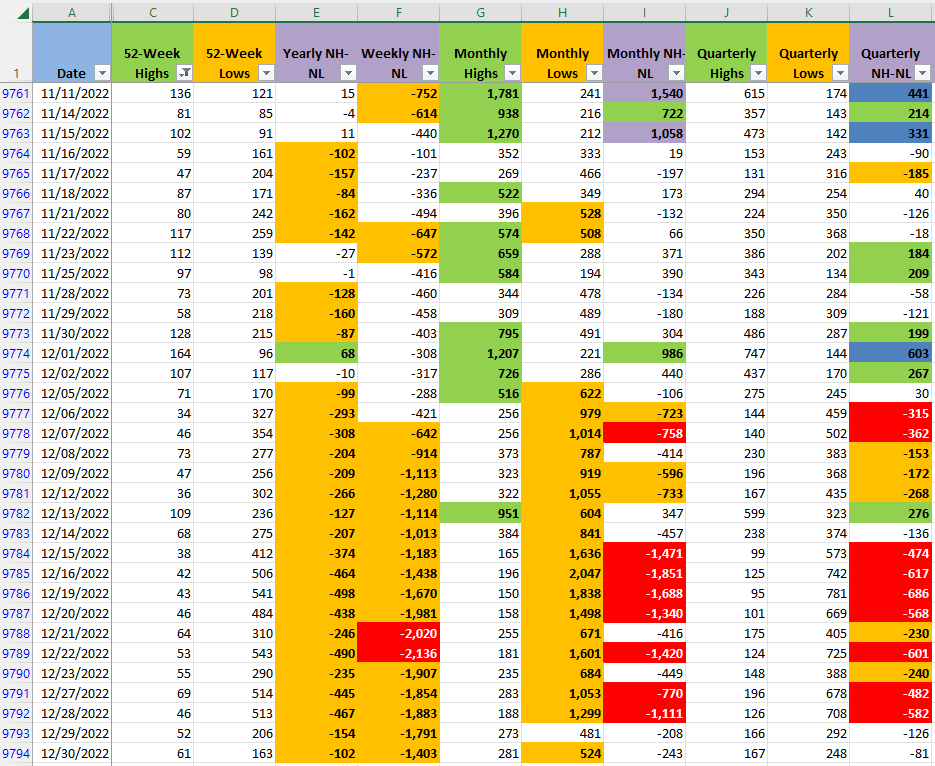

The selling pressure started to decrease in the last couple of days of 2022. We can see that through the New Highs and New Lows numbers (NH-NL). The Monthly timeframe is the one that moves faster than the other two. If the Monthly NH start to increase, and the NL decrease there is a chance for a reaction rally to occur early in the first week of the year.

Industries

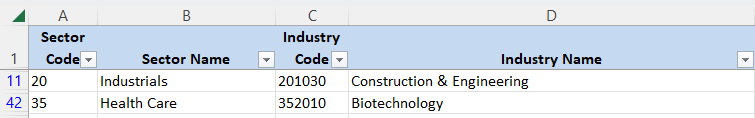

In terms of Industries with potential to trade on the long side there's no change from last week. Out of the 68 Industries that compose the Global Industry Classification Standard (GICS), 'Construction & Engineering' Industry ($SP1500#201030) and Biotechnology ($SP1500#352010) are the ones that could eventually start a strong uptrend.

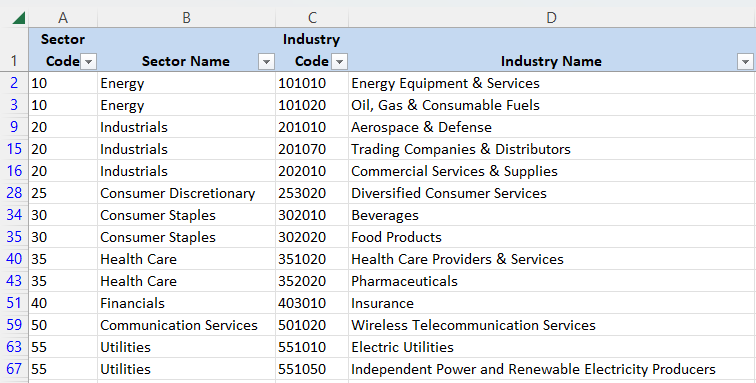

The list of Industries that could potentially breakout in the next few weeks is also unchanged. There was a lot of influence in the last few years from the Tech companies leading the strong uptrend that we experienced the past few years up until 2022. It seems that the leaders of the next Bull Market will be in different Sectors.

Scenarios

Scenario #1: The most likely scenario, from my point of view, is that there is going to be a reaction rally. Something that could take the S&P 500 to a level around 3,950. If this happens, that wouldn't damage the weekly downtrend, it's just part of the ups and downs that the Market experiences when going in any direction. Reaction rallies can be fueled by different factors, ambitious traders that bet on "cheap" stock or fearful traders covering their shorts if they think the index isn't likely to continue the decline. Reaction rallies are short-lived movements, and a few of them can eventually turn into something else.

Scenario #2: If the first scenario doesn't happen, the second most likely scenario is that the decline will continue. Each of the major declines of 2022 took nine to eleven weeks to reach a bottom, Jan/2023 will let us know if the weekly downtrend continues intact. If it does, the S&P 500 could go down to a level around 3,400. The amount of negative news hitting the media is still having more impact than any temporary sign of good news. During January we will have to consider the additional factor of earning reports.

Scenario #3: The least likely scenario is that we start the year in a very relaxed way, with the most important indexes just moving sideways. The last seven trading days the S&P 500 has been moving in a narrow range between 3,780 and 3,880. More interesting things will happen when it moves out of that zone in any direction.

Summary

There is a great movie called 'The Big Short', in a couple of hours it describes separate stories that start to get connected in the years leading to the Subprime Mortgage crisis of 2007. It's an entertaining movie with famous actors like Christian Bale and Brad Pitt. In real life however, we don't get 60 minutes of uncertainty with multi-billion-dollar deals working out perfectly right after that. Unless you are a day-trader, you have to wait days, weeks or months to get an idea if you were actually right or wrong, and in the meantime prepare for next trades. The mind can play tricks during all that waiting time, your trading plan works like a compass that prevents impulsive actions and guides you when things go wrong.

During 2022 if you stayed in cash or shorted positions that would have given you the best chance to profit. It wasn't impossible to profit on the long side, it was just much harder than the last few years. We begin 2023 and the Markets are also living entities, composed of millions of participants. I continue to wait day after day for strong signals that the Market situation is changing. I open a few pilot trades to get a better grasp of the situation, but eventually the idea is to trade aggressively.

I wish you the best for 2023, be ready for whatever the Markets throw at you. As long as you preserve your capital you can continue playing this game. Remember life is a marathon not a sprint. If you have clear objectives, work hard and make some smart adjustments to your strategy along the way, eventually you will get there.