I wasn't expecting a movement like the one we saw today, however the strong corporate earnings were today's catalyst. From the 48 companies of the S&P 500 that have reported earnings, 79% have beaten the estimates.

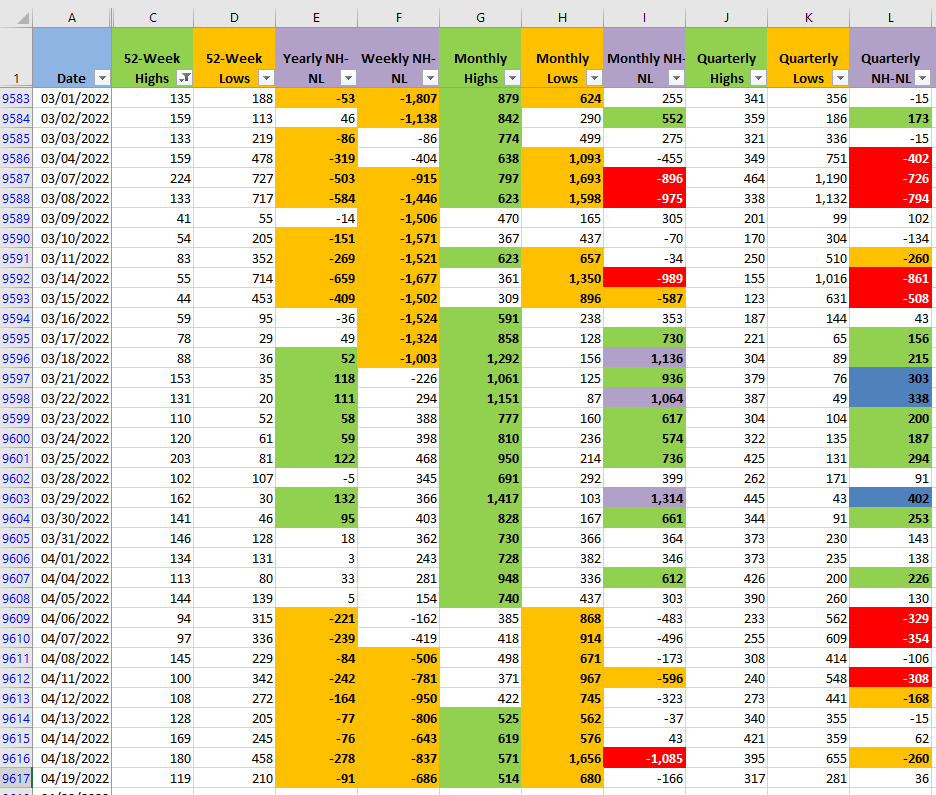

Today the New High and New Low numbers turned significantly less bearish, the Monthly New Lows are still elevated, it will be important to see how those Monthly numbers move during the rest of the week. If the rally is to continue, the Monthly Lows need to decrease in the next couple of days.

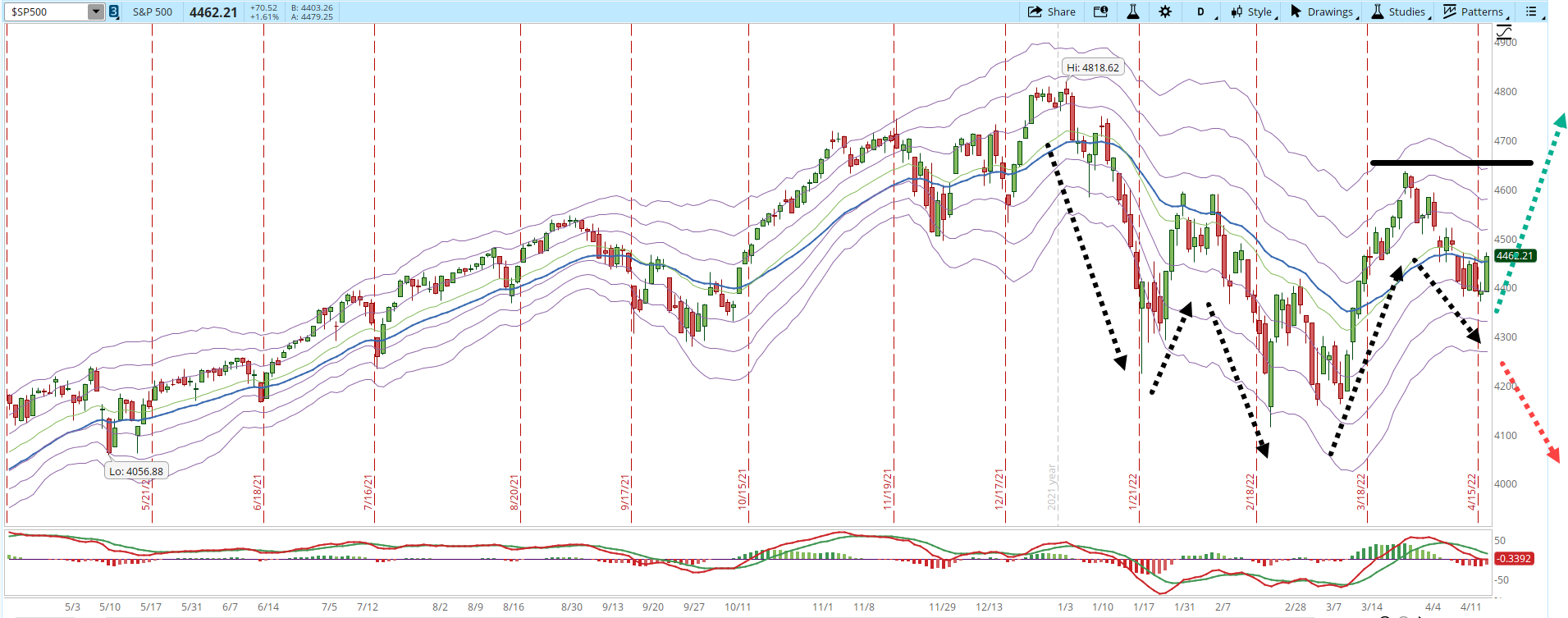

The First Higher Low pattern and the false breakout which I have mentioned several times in my latest articles, I learned about them in spiketrade.com, if you are interested they have a set of videos that explain in detail the pattern. On April/13 there was a false breakout that triggered a buy signal in the S&P 500 and S&P 400. However, on April 14 that signal failed and now on April/19 we are getting another buy signal with today's false breakout.

It won't be an easy task to turn the current scenario into an uptrend. If the Bulls really have force this time the First Higher Low pattern needs to rally above 4,637 (previous high). That's 175 points away from today's closing price (horizontal solid line). The possibility that the pattern fails is still there, with the New Monthly Lows elevated and the failed buy signal from April/13 we still need to see if there is enough demand to move the S&P 500 more than 175 points in the next few days.

The S&P 400 (mid-cap) had an even more powerful movement, the First Higher Low pattern also completed in its daily chart. In order for the S&P 400 to start forming an uptrend, it will have to break and hold above its weekly support at 2,750. That's something that the S&P 400 hasn't done for a while now, check the orange arrows, those are the times that the S&P 400 has failed at that level (you can click on the image in order to magnify it).

Today's move gives some hope that the current Market scenario could start to turn bullish. However it's best to follow a real plan that base your trades on hope. It takes more than one good day to change the Market situation. Strict risk management, maybe I keep repeating it in every article, but that's what will help with capital preservation. If you lose your money, you can't continue playing the game.