Finally we saw the Market rally even if it was just for a day. That might give some hope or calm down the fears fueling the Correction. My perspective about the upward price movement is that it will just be a reaction rally caused by oversold Market conditions. Below I want to illustrate my reasoning about why I think the Correction isn't over yet.

Market Overview

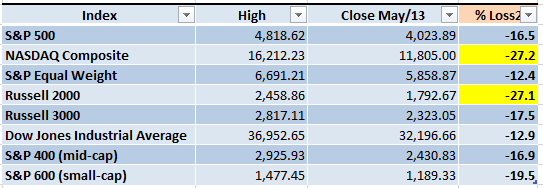

In order to gain a perspective about the percentage loss in each important USA index, below is a chart with the latest numbers. The ones in yellow are in a confirmed Bear Market territory (a loss of 20% or more from the previous highest level).

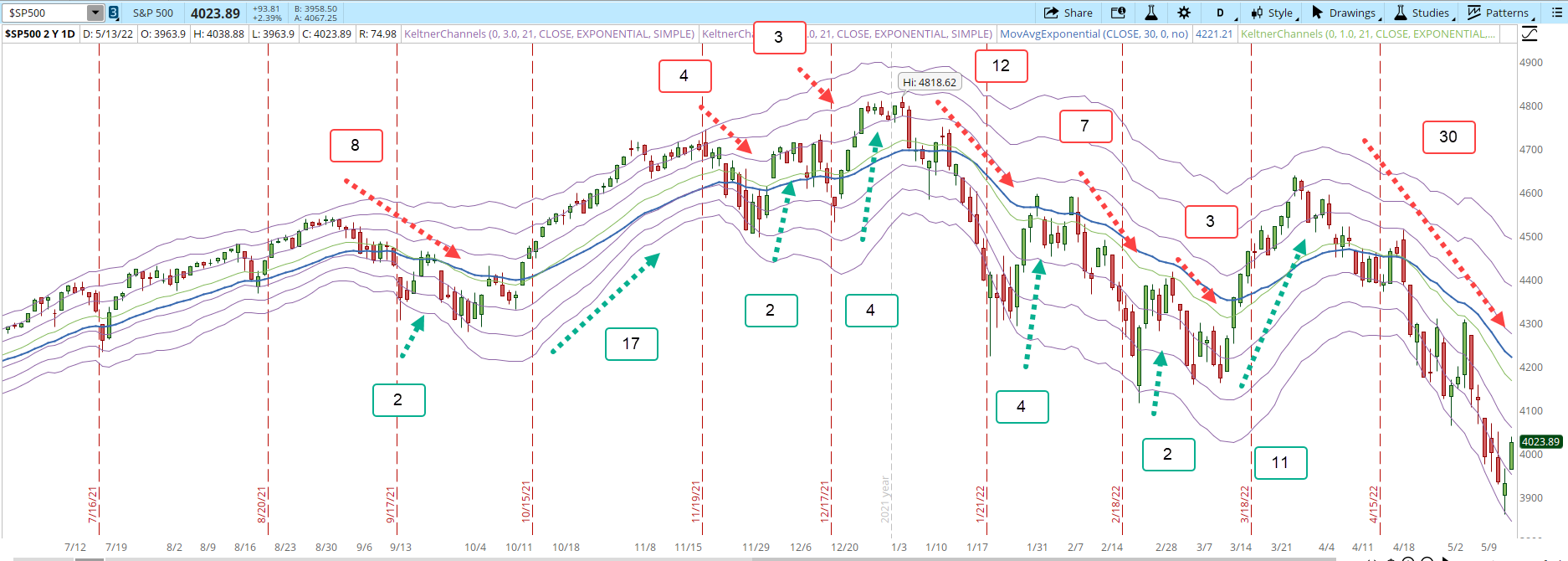

The first reason for which I think the Correction isn't over yet is that we have had this game of up and downs for a while now, lately more downs than ups. That is part of the game, just that in an uptrend the oscillations lead to higher highs and higher lows. What we see now is leading to lower highs and lower lows.

Reviewing the S&P 500 daily chart below I want to show that certainly there have been rallies since the uptrend started a consolidation period around Sept/2021, but most of them have been short lived. The green dotted arrows are the rallies and the red ones the pullbacks. The boxes show the number of days that the movement lasted. You might disagree with the number of bars I calculated, but even if you take a different bar as a reference for the beginning and ending of the rally/pullback, it cannot be argued that the index closed at 4,023. That's a loss of more than 16% compared to the level we saw in Jan/2022. At this point, a rally of a single day means nothing.

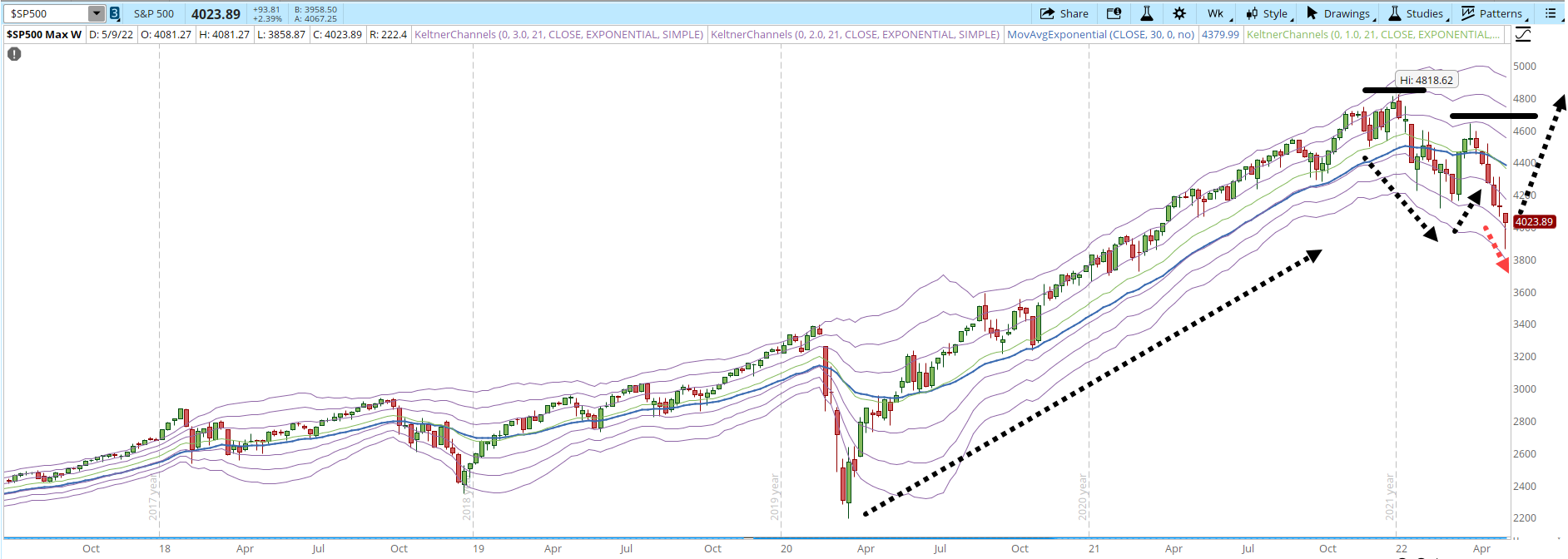

The second reason for which I think that the Correction isn't over yet is the pattern that the weekly S&P 500 chart is forming. After the impact that the Markets suffered caused by the Covid, there was a powerful recovery from March/2020 to Jan/2022. After that, the Market reached a new historic high and then started the decline.

On the weekly chart, the S&P 500 seems to be tracing the beginning of a downtrend. In order to break the pattern of lower highs and lower lows (horizontal black lines), the index needs to get to 4,650 and hold above that level. Otherwise, the rally will be short lived and the likely path of least resistance will be the red dotted arrow.

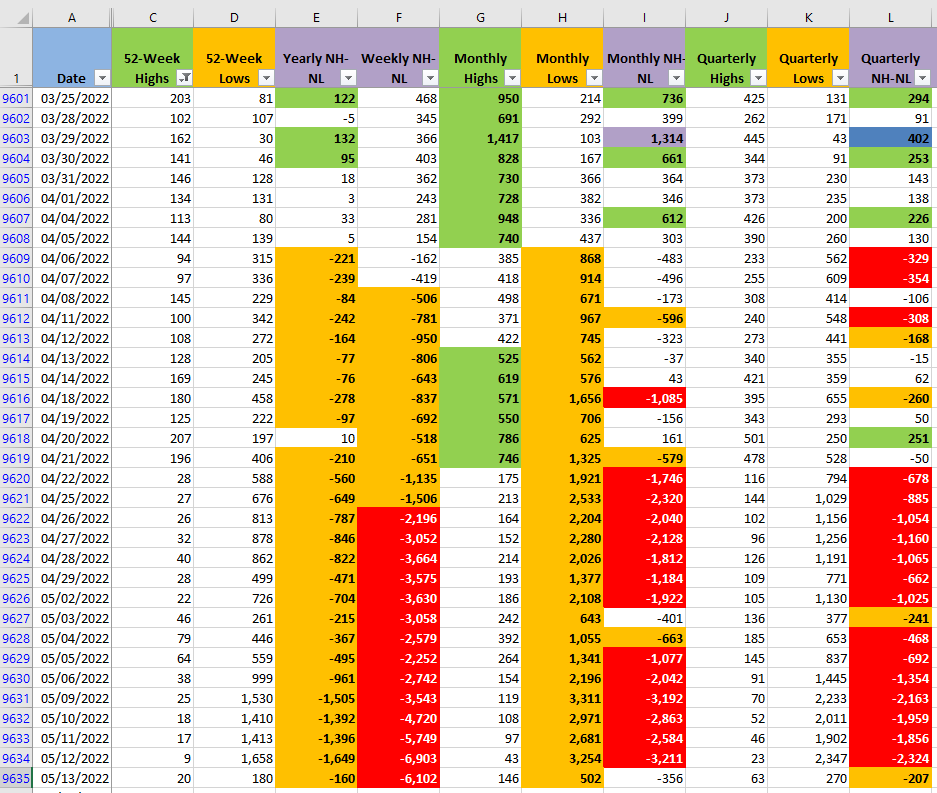

The third reason for which I think that the Correction will continue is the New Highs and New Lows indicator (NH-NL). There are great news since the number of New Lows decreased significantly in all the timeframes. However, the number of New Highs hasn't been significant for a while. The Monthly columns (G, H and I) are the ones that move faster in all the timeframes displayed in the screenshot below.

The highest amount displayed of New Highs is 1,417 and from the New Monthly Lows 3,211. If the index is going to have a multi-day or multi-week rally, the stocks need to start getting to higher highs. The numbers from last May/13 are that only 146 stocks reached a new high taking a period of a month. The target is very narrow when trying to pick a big winner from thousands of available stocks.

If the amount of New Monthly Highs doesn't increase significantly soon, any bad news could easily kill the rally. The selling pressure has been dominating the Market, the Bulls need to show that there's some real force and that is done by breaking some important resistances.

Industries

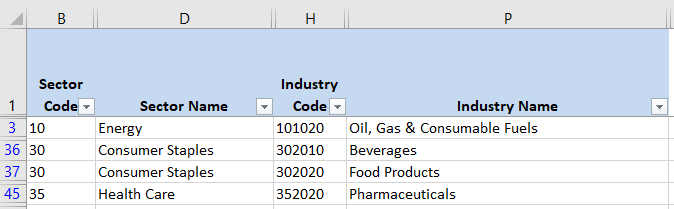

Every week I review the list of Industries that compose the Global Classification Standard (GICS), 68 in total. This week there are four Industries that from my point of view are still strong. Unfortunately, two of those Industries are in the defensive sector of 'Consumer Staples', not a very encouraging scenario for the investors with risk appetite. Less than 10% of the Industries are still strong, eventually that number has to increase and some of those 68 Industries will lead the beginning of a new Bull Market.

Scenarios

Scenario #1: The scenario that I see more likely for the trading week about to start is that the rally will stall. The NH-NL indicator hasn't displayed a significant increase in the New Highs for a while now. The rallies in the past year have been usually short-lived and the same negative old news keep impacting the Markets. I imagine that the rally might continue a couple of days before it stalls, waiting for a new catalyst to give a direction for the next few days.

Scenario #2: The second most likely scenario, from my point of view, is that the rally will get killed quickly and the Correction will resume. I see this scenario as less likely because, I think the selling pressure could decrease for a few days while people run to cover their shorts and people get greedy buying trying to pick the bottom of the Correction. In the second scenario, there is panic, the Correction kills immediately the rally and the path towards sending every index into Bear Market territory continues.

Scenario #3: The third scenario, which is highly unlikely, is that we see a V-shaped recovery. Something really surprising needs to happen, something really big and unexpected, like the end of the Ukraine war, in order to turn a single day rally into a multi-day rally. In order to catalog the rally as really powerful it needs to break the downtrend pattern that is forming, that means break and hold above the 4,650 level.

Summary

There was an improvement in the indicators and the charts last May/13. It's important to distinguish that rallies and pullbacks will be present in uptrends and downtrends, the Market never moves in a straight line. That makes it difficult to distinguish between a reaction rally and a change in the Market direction.

What I'm trying to illustrate with this article is that at this point I just see a simple and expected reaction rally that can be easily killed by the Bears. Everybody has an opinion, mine could be wrong but the important thing isn't trying to forecast the Market, what is essential is to be ready for whatever scenario the Market throws at us. I'm on the sidelines, not a single open position until I see a cluster of signals showing some real force from the Bulls. I'm a trend trader, a short rally in the middle of a Correction is useless to my trading style.

Analyze if the current Market situation is favorable or not for your Market strategies. In order to keep playing this game the most important part is to preserve the capital. Even before thinking how much money you can make, it's key to understand how much money you can lose.