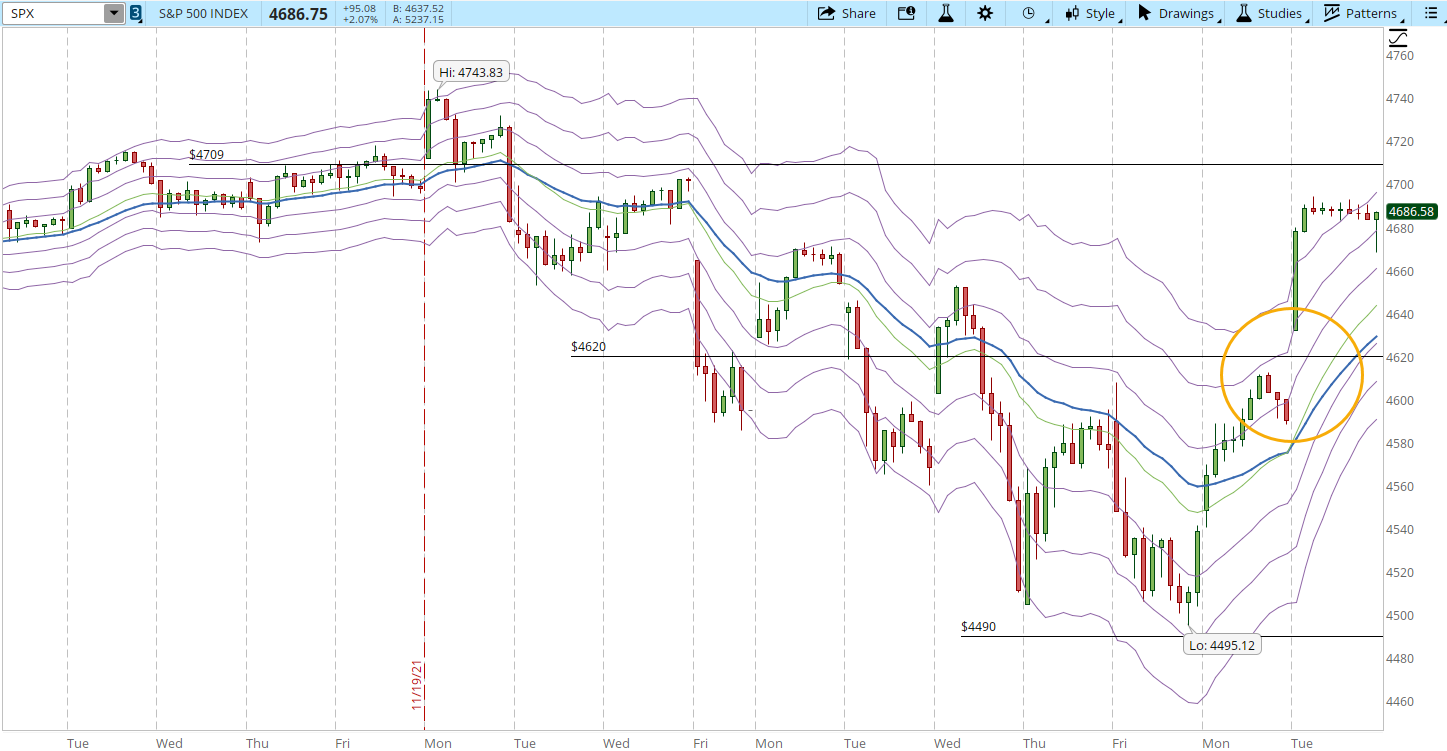

The battle between bulls and bears never ends. Monday and Tuesday the Bulls clearly demonstrated that there is still a chance for the weekly trend to continue its way up.

During today's Market open the S&P 500 gapped up, it skipped completely the short term resistance and never pulled back. The pattern on the 39-min chart where the S&P reached the +1 Keltner Channel (KC) and then collapsed to the -3 KC band was broken. Rather than pulling back the rally continued and with a lot of power.

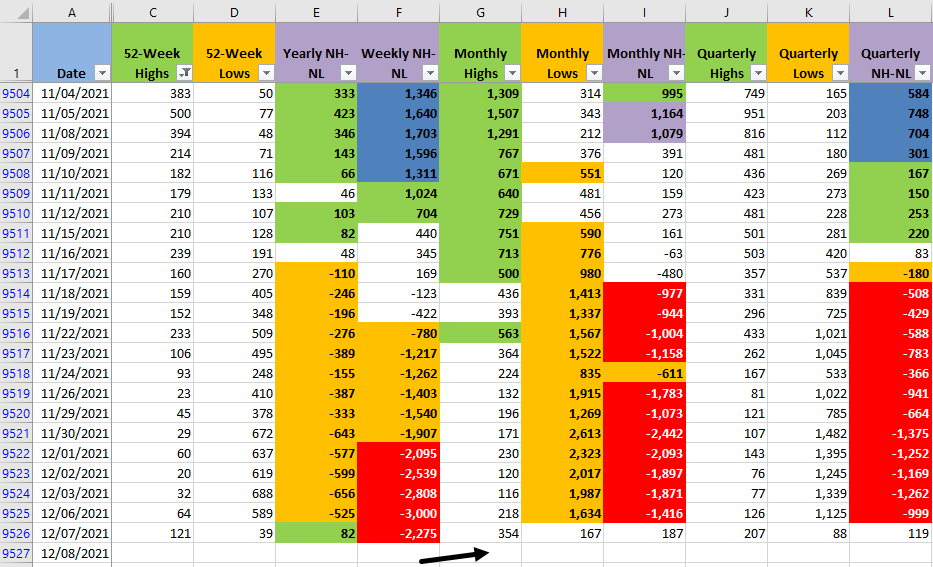

The balance between monthly New Highs and Lows shifted completely (columns G and H, you can click in the image below to zoom in).

Trading the weekly trend gives me the luxury of not having to jump right away into a trade. Four of the symbols I'm tracking as potential trades triggered today. Three of them in the 'Information Technology' Sector and the other one in 'Consumer Discretionary' (I use the GICS classification as described in the FAQ section of the blog.

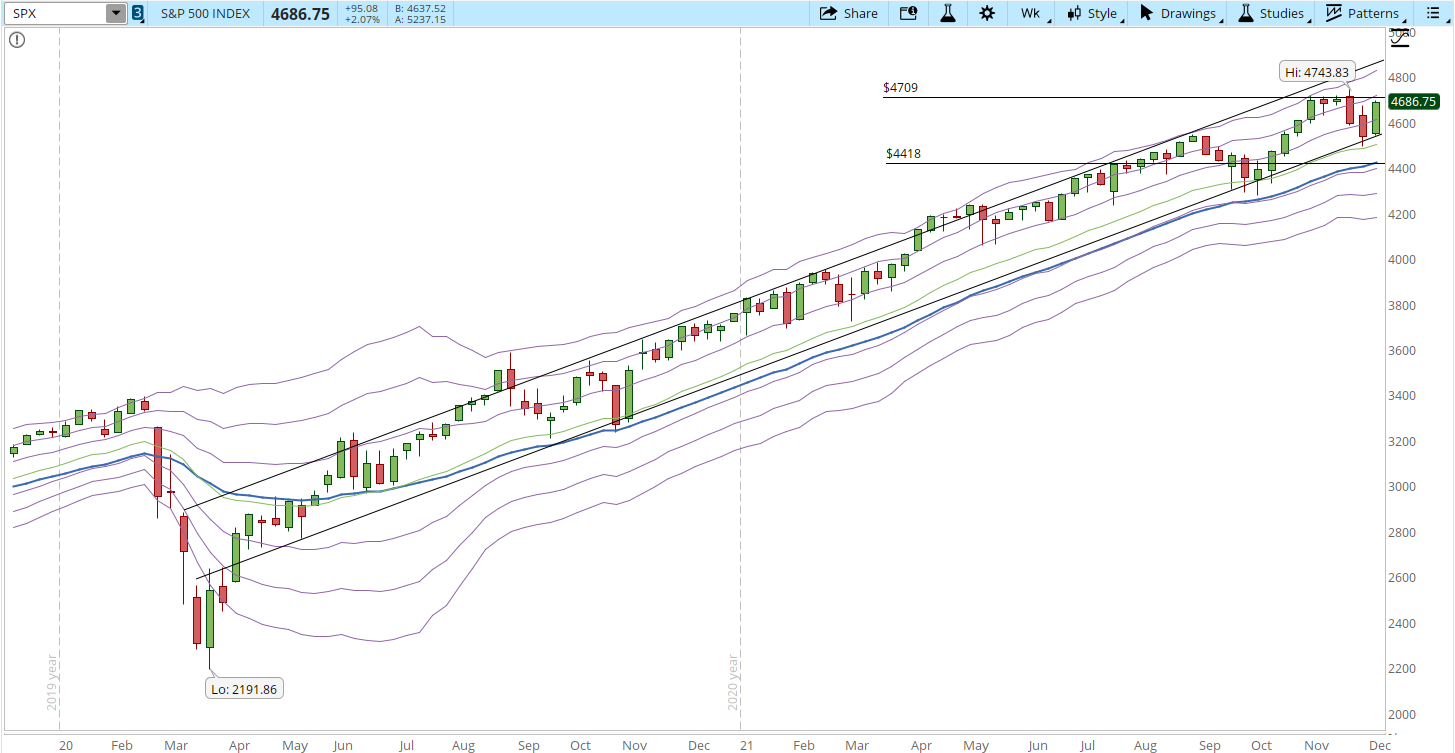

The reason I decided to wait is that the rally was very explosive and it might even continue for a few days. The interesting part will come when the price test the weekly resistance mentioned in my last Weekend post at 4,709. Will the rally have enough fuel to close past that line or not? If it does and starts reaching new historical highs then it will be time to see which stocks are still candidates for me to trade.

This is how the weekly trend is looking right now, still intact, still up.