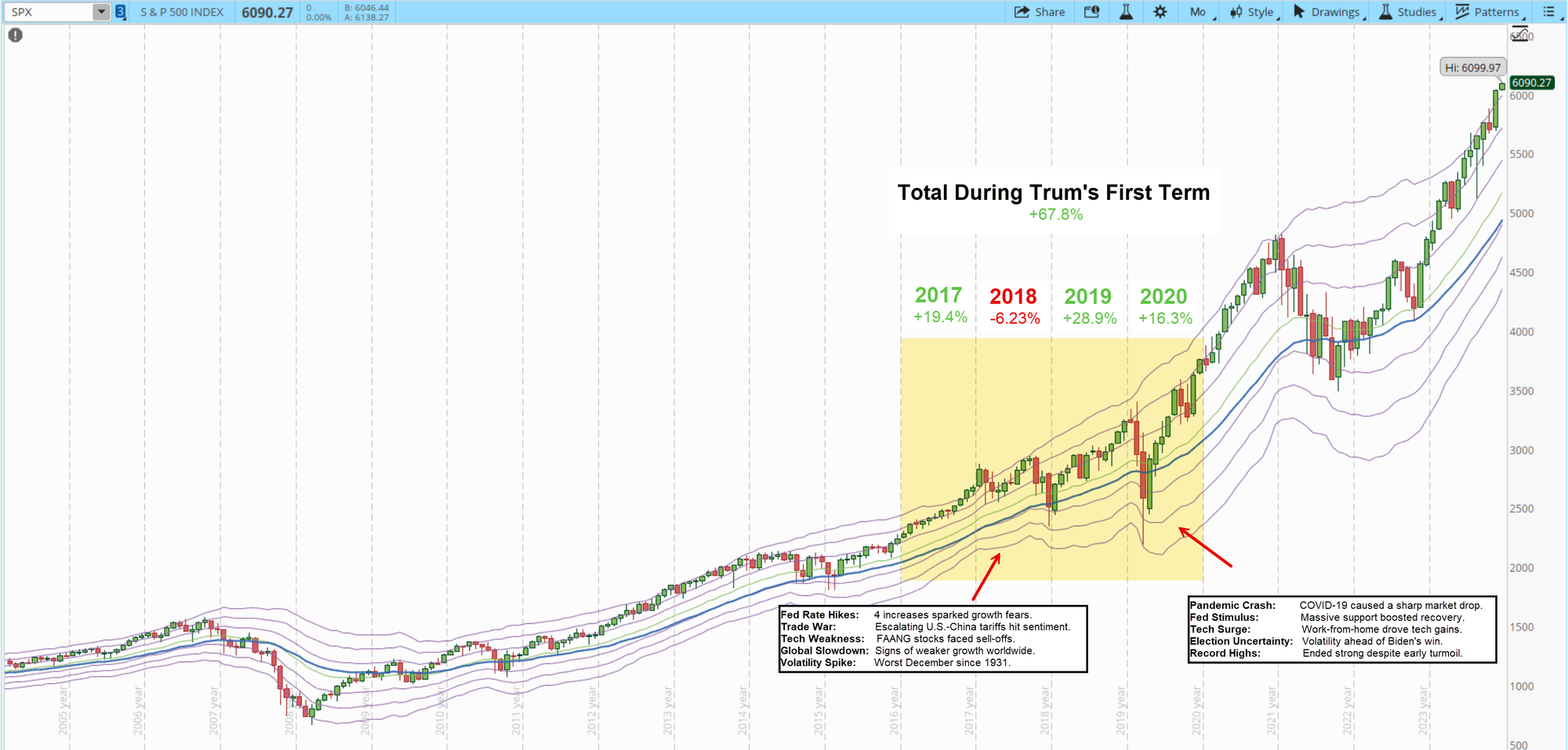

At the end of 2023, the S&P 500 closed at 4,769.83 points, still stuck below its January 2022 all-time high. But 2024 has turned into a breakout year. The index keeps hitting new records, with the latest peak at 6,099.97. As of December 6, 2024, it closed at 6,090.27—a solid 27.66% jump from last year’s finish. It’s been an incredible run for the markets, but how much longer can this momentum hold?

With Donald Trump about to step back into the White House in 2025, market volatility is likely to heat up. His previous presidency brought significant disruptions, like the U.S.-China trade war in 2018, which dented the S&P 500. The risks in 2025 could be even bigger: potential trade conflicts, immigration policies, geopolitical tensions in the Middle East and Ukraine, and even climate-related challenges. For traders, this means risk management will be more critical than ever.

This year has been all about taking advantage of the market’s strength. Of the 73 GICS (Global Industry Classification Standard) industries, 28 are in strong uptrends, leaving only one lagging. Shorting opportunities have been few and far between. I’ve tested some short trades, but the persistent uptrend has made them tough to execute successfully.

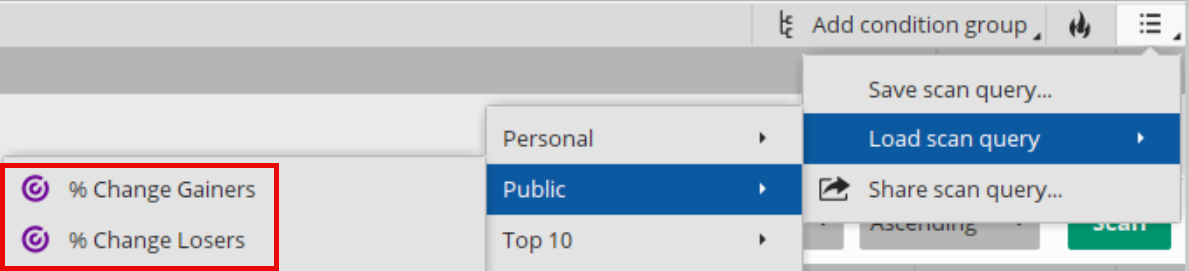

Every day, I monitor the biggest percentage movers—mostly gainers right now, but I also look for potential shorts. While tools like Finviz are great for spotting these moves, I prefer using ThinkorSwim’s scanner. It allows me to customize searches with criteria like price range and volume, which helps narrow down actionable opportunities.

I also keep tabs on a few specific stocks that fit my system. While nothing particularly exciting has popped up lately, there’s always the chance of a surprise. Take my recent trade on ASP Isotopes (ASPI), for example. It wasn’t a standout pick, but it met my parameters, so I entered the trade. Volatility spiked unexpectedly, my stop triggered, and I exited the next day with a 38.4% gain. Sometimes, luck plays a role!

As we approach 2025, I don’t expect the market to deliver the same spectacular gains we’ve seen this year. Whatever Trump decides to prioritize, his policies are likely to have ripple effects far beyond the U.S. However, with other global powers growing stronger, America’s dominance isn’t what it used to be. Volatility will undoubtedly create opportunities, but not all trading strategies will thrive in these conditions. As a trend trader, I’m cautiously watching how things develop, knowing that adaptability will be key.